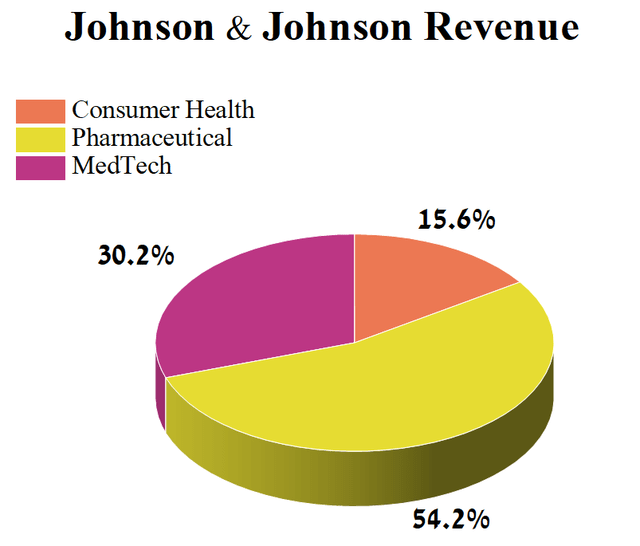

Johnson & Johnson (NYSE:JNJ) is one of the world’s largest multinational healthcare corporations, with operations in almost every corner of the world and whose products are used by millions worldwide. Johnson & Johnson’s Pharmaceuticals division develops and commercializes next-generation medicines, many of which are becoming gold standards in therapeutic areas such as immunology, oncology, and neuroscience.

Author’s elaboration, based on 10-Q

A previous article, “Talc Scandal Clouds Investment Attractiveness Of Johnson & Johnson’s Pharmaceutical Business,” provided an analysis of the impact of the talc crisis on the company’s future. More than six months have passed, but this problem continues to overshadow the company’s investment attractiveness, despite the improvement in sales of the company’s blockbusters and strong demand for over-the-counter medicines due to an increase in the incidence of respiratory infections in Europe.

On April 18, 2023, Johnson & Johnson released financial results for the first three months of 2023, which not only beat analysts’ expectations but were able to demonstrate that the revenues of the company’s three main business segments continue to grow year-on-year, despite unsuccessful sales of the COVID-19 vaccine and the impact of the Ukraine-Russia conflict, which has led to a stoppage in the supply of some products to this region.

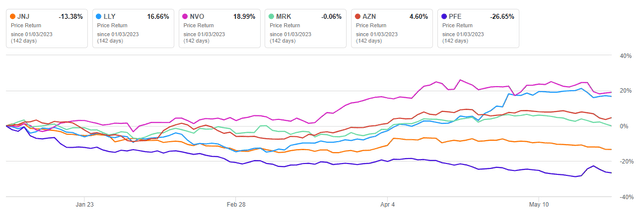

Since the beginning of 2023, Johnson & Johnson’s share price has declined by about 13.38%, significantly worse than primary competitors in the healthcare sector, such as Eli Lilly (LLY), Novo Nordisk (NVO), and AstraZeneca (AZN).

Author’s elaboration, based on Seeking Alpha

We continue our analytics coverage of Johnson & Johnson with a “hold” rating for the next 12 months.

Johnson & Johnson’s Financial Position

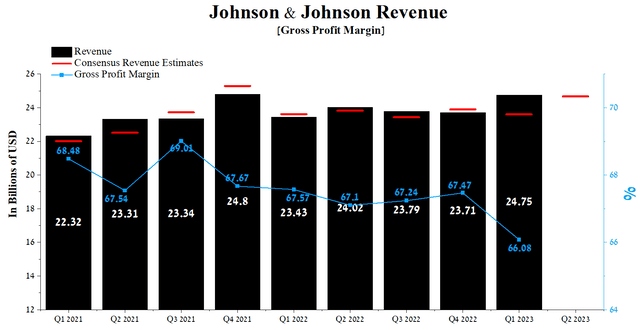

Johnson & Johnson’s revenue for the first three months of 2023 was $24.75 billion, up 4.4% from the previous quarter and 5.6% from the first quarter of 2022. But despite the positive momentum achieved in each of the three business segments, since 2021, when Johnson & Johnson became a key player in the fight against COVID-19, the company’s actual revenue has beaten analysts’ consensus estimates only five times out of nine.

Author’s elaboration, based on Seeking Alpha

Johnson & Johnson’s revenue for Q2 2023 is expected to be $24.3-25.22 billion, up 4.5% from analysts’ expectations for the first three months of 2023. We believe that most of the revenue growth will come from the interventional solutions franchise and the company’s division focused on developing and commercializing cancer-fighting drugs.

However, from 2024, the pressure on the pharmaceutical business unit will increase due to the company’s immunology division, which contributed about 16.6% of Johnson & Johnson’s total revenue in Q1 2023.

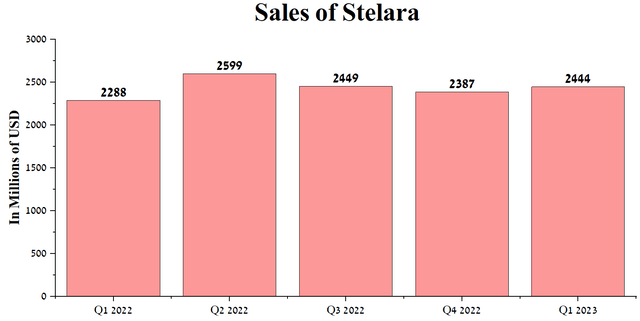

The primary headache for Joaquin Duato is the possible appearance of Stelara’s biosimilars in the next year and a half. Stelara (ustekinumab) is a medicine used to treat autoimmune diseases such as psoriatic arthritis, Crohn’s disease, plaque psoriasis, and ulcerative colitis, with sales of $2,444 million in Q1 2023, up 6.8% year-over-year. The share of ustekinumab in the company’s total revenue is about 9.9%, which makes this drug one of the weight products for Johnson & Johnson’s financial position.

Author’s elaboration, based on quarterly securities reports

According to Johnson & Johnson’s annual report, the last US patent for the composition of Stelara expires in 2023, while the European patent expires in 2024.

On May 23, 2023, news broke that Johnson & Johnson reached a settlement with Amgen over the Stelara’s biosimilar. Despite the confidentiality of most of the settlement terms, it is known that they will allow Amgen to sell their biosimilar “no later than January 1, 2025.” Alvotech/Teva Pharmaceuticals and Amgen’s ustekinumab biosimilars are currently under review by the FDA, and a decision on their approval will be announced in the second half of 2023.

In addition, on February 9, 2023, Alvotech and STADA Arzneimittel announced that the EMA had accepted an application for marketing authorization for AVT04, a biosimilar of Stelara. We expect the regulator’s final decision to be announced in late 2023/early 2024.

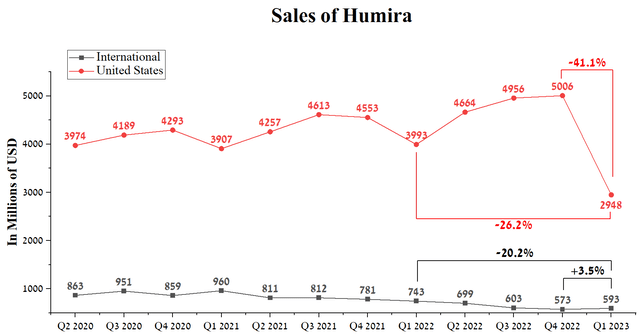

The launch of ustekinumab’s biosimilars will have a similar effect as the launch of the first biosimilar to Humira at the end of January 2023, causing significant damage to AbbVie’s net income and revenue. Humira’s U.S. sales for the first three months of 2023 were $2,948 million, down 41.1% quarter-on-quarter and down 26.2% year-over-year, despite Amgen’s product being on the market for only two months.

Author’s elaboration, based on quarterly securities reports

In addition, Remicade (infliximab), a former cash cow of Johnson & Johnson, continues to feel increased pressure from its biosimilars. Thus, sales of Remicade amounted to $487 million in the 1st quarter of 2023, having decreased by 26.5% compared to the previous year.

The only hope for the company’s management is Tremfya (guselkumab), used to treat adults with moderate to severe plaque psoriasis and active psoriatic arthritis. The mechanism of action of Tremfya is based on inhibiting the p19 subunit of interleukin-23 (IL-23), which ultimately helps reduce inflammation.

Although Johnson & Johnson’s drug is ahead of many of its competitors, a head-to-head study comparing its effectiveness with Eli Lilly’s medicine demonstrated that in 41.3% of patients with plaque psoriasis who took Taltz (ixekizumab), the skin was completely cleared. At the same time, only 24.9% of patients treated with Tremfya achieved PASI 100 at week 12. In addition, Eli Lilly’s product was able to achieve all of the major secondary endpoints, further indicating that it may provide higher levels of skin clearing in people with psoriasis.

Johnson & Johnson’s gross margin was 66.08% in Q1 2023, declining slightly quarter-on-quarter due to increased costs following the acquisition of Abiomed and higher prices for raw materials used to manufacture medicines. On the one hand, this financial indicator is higher than that of the healthcare sector, but at the same time, it lags significantly behind such main competitors as Bristol-Myers Squibb (BMY), Gilead Sciences (GILD), and AstraZeneca, which is also another factor that repels investors to choose Johnson & Johnson as a long-term investment.

We predict that Johnson & Johnson’s gross margin will reach 68.5% by 2023 and rise slightly to 70.5% by 2024, thanks to declining inflation and FDA and EMA approval of cancer drugs.

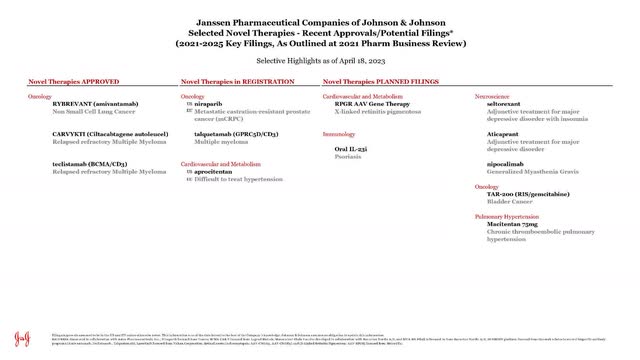

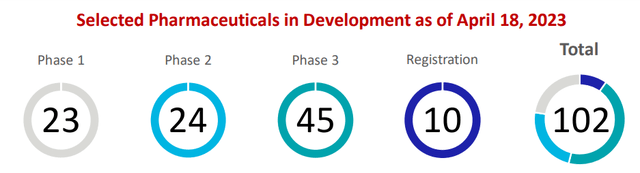

Johnson & Johnson Pharmaceutical Pipeline

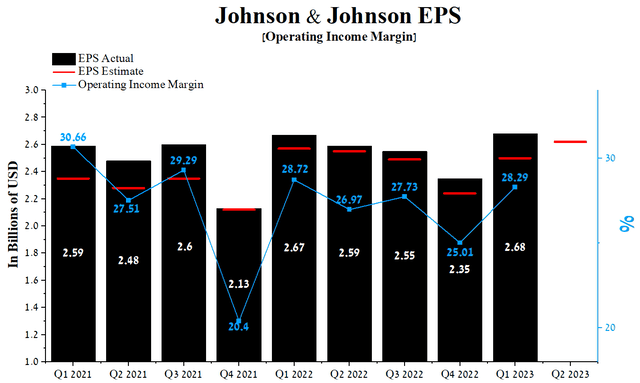

Johnson & Johnson’s Q1 2023 margin operating profit was 28.29%, down slightly from the prior year but approaching its median of 27.18% between January 1, 2021, and the end of March 2023. The company’s earnings per share (EPS) for the first three months of 2023 was $2.68, up 14% quarter-on-quarter, and just as importantly, it continued to beat analyst consensus estimates in recent quarters.

Moreover, Johnson & Johnson’s Q2 EPS is expected to be in the $2.56-$2.7 range, up 4.8% from the Q1 2023 consensus estimate. At the same time, Johnson & Johnson’s Non-GAAP P/E (TTM) is 15.18x, which is 14.75% less than the average for the sector and 12.75% less than the average over the past five years, which is one of the factors of slight undervaluation of the company in the current period of declining inflation.

Author’s elaboration, based on Seeking Alpha

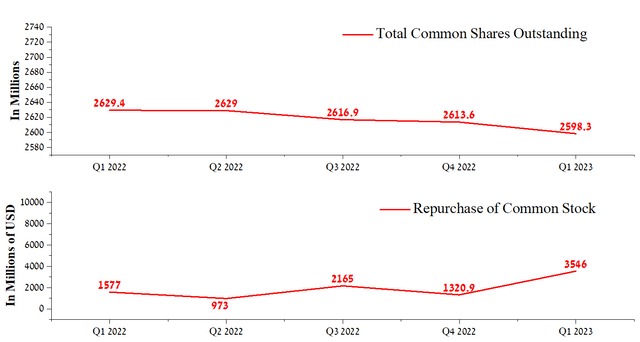

Nevertheless, we believe that the beating of EPS is due mainly to the share repurchase program. For the first quarter of 2023, Johnson & Johnson bought back its shares for about $3.55 billion, and at the same time, Joaquin Duato does not have the option to buy back the company’s shares at the moment. We estimate that this will negatively affect the ability of Johnson & Johnson’s management to maintain the company’s share price during declining sales of some of the blockbusters.

Author’s elaboration, based on Seeking Alpha

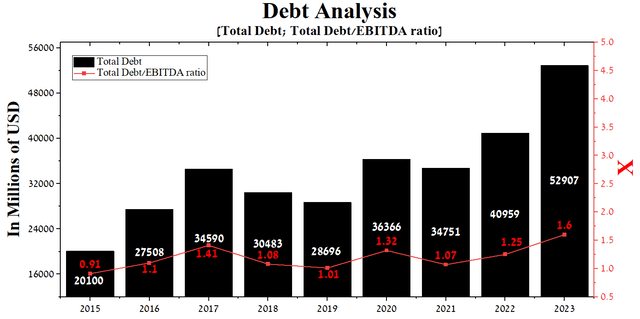

At the end of the first quarter of 2023, Johnson & Johnson’s total debt stood at about $52.91 billion, a significant increase from 2021 due to the acquisition of Abiomed and Kenvue’s placement of senior unsecured notes totaling $7.75 billion. However, despite a modest increase in EBITDA in recent years, the total debt/EBITDA ratio increased from 1.07x to a record 1.6x for Johnson & Johnson.

Author’s elaboration, based on Seeking Alpha

However, given the maturities of the debentures and senior bonds, we do not expect Johnson & Johnson to have any problems with their redemption and the company’s management to pursue an active R&D policy to maintain a leading position in the pharmaceutical industry.

Johnson & Johnson Pharmaceutical Pipeline

Conclusion

Despite the company’s rich drug portfolio, we continue to be skeptical of claims by Johnson & Johnson’s management that the pharmaceutical division could reach $60 billion in revenue by 2025. With increasing competition from manufacturers of Remicade’s biosimilars, declining demand for Imbruvica due to competitive pressures and withdrawals of accelerated approvals for certain types of cancer, the possible introduction of Stelara’s biosimilars to the market in 2024, and a decrease in the number of COVID-19 cases harming demand for a COVID-19 vaccine, this could ultimately lead to lower revenue growth rates.

Moreover, we are concerned about lawsuits related to allegations against Johnson & Johnson products containing talc. On April 4, 2023, the company announced that it was offering $8.9 billion to settle claims filed by tens of thousands of plaintiffs alleging that asbestos contamination of talc-containing products caused them to develop cancer. Currently, Johnson & Johnson and the plaintiffs have yet to reach a final resolution on all the talc issues in the LTL bankruptcy case.

Since the beginning of the year, Johnson & Johnson’s share price has continued to fall, offsetting the positive effect of the share buyback program that has affected Johnson & Johnson’s ability to beat analyst consensus estimates for years. Currently, Joaquin Duato does not have the option to buy back the company’s shares after the program has been completed. As a result, we expect the company’s share price to face increased downward pressure in the short term. Moreover, many of the strategies put in place by management to keep Johnson & Johnson attractive as an investment hasn’t had the desired effect, which also calls into question Joaquin Duato’s ability to effectively manage the dividend aristocrat in a looming period of macroeconomic instability.

As a result, we expect the company’s share price will drop to $144 per share in the next three months before reaching a strong support zone. We continue our analytics coverage of Johnson & Johnson with a “hold” rating for the next 12 months.

Read the full article here