Investment thesis

Our current investment thesis is that Newegg Commerce, Inc. (NASDAQ:NEGG) continues to deteriorate as loyal customers turn away from the business and new customers choose alternatives. Margin contraction now has the business making losses with no real scope to improve this. If things continue as they are, the business will quickly find itself in a crisis.

Company description

Newegg Commerce is an e-retailer specializing in electronics products in North America. It offers a wide range of products including computers and accessories.

Prior thesis

We first covered Newegg in Feb23, issuing a sell rating. Our thesis was:

- Newegg’s strategy of expanding its marketplace offering has contributed to its stagnation. It is turning away loyal customers and reducing its credibility.

- Economic conditions represent a short-term headwind that could lead to further declining growth.

- The lack of physical presence could hold the business from expanding into the mainstream, keeping Newegg niche.

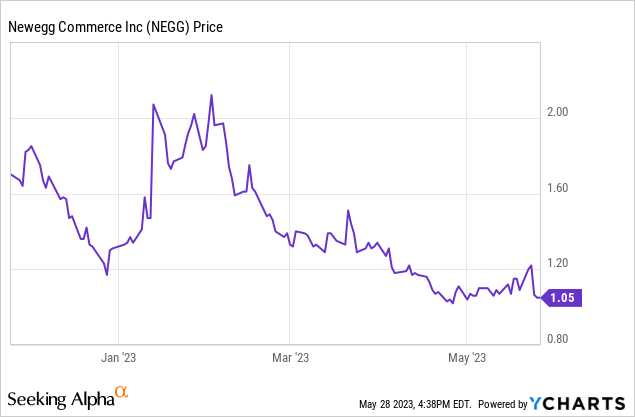

Share price

Since issuing a sell rating, the share price has continued to decline, falling a further 32%. Newegg continues to struggle both financially and commercially, further reducing investor sentiment.

Financial analysis (FY22)

Financial performance (Tikr Terminal)

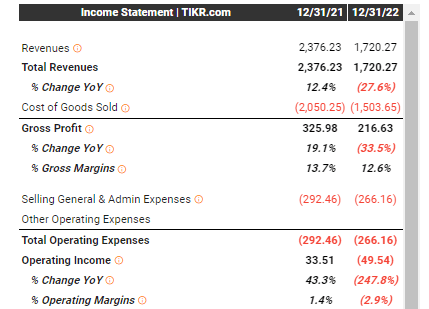

Newegg’s FY22 performance was terrible.

Revenue has declined (27.6)%, falling to below its FY18 level. This is on the back of a very poor Q4, reflecting a sustained decline in revenue QoQ.

Management attributes this to two primary factors. Firstly, current economic conditions are contributing to a material slowdown in consumer electronics. This is a reasonable assessment as Newegg is highly exposed to a change in demand for consumer electronics, given its primary market. Further, our view is that consumer electronics are overexposed, stating the following in our prior paper “declining disposable income will likely lead to decreased spending on electronics”. In the initial paper, we suspected the coming 12 months would be difficult for the business. We maintain this belief, given the lack of material change in economic conditions.

Secondly, the volume of technology purchases made during the Covid-19 period, combined with longer product lifespans, has contributed to an extension of the consumer upgrade cycle. As a result of this, Newegg likely benefited from a degree of brought-forward demand, much of which is now being unwound with understanding. Although we concur with this, there is no reason why sales are below FY18 levels.

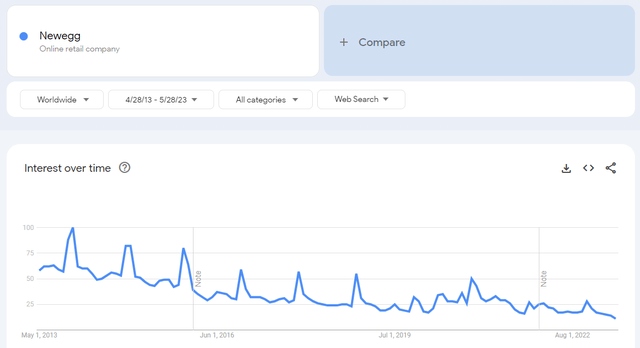

One of our key thesis arguments was that Newegg’s marketplace offering is turning away loyal customers. We believe this is continuing to impact the company, reducing traffic to the site. In order to assess this, we initially considered reddit reviews. We will now take a new data source. According to Google Trends, Newegg has reached a new low for interest in the site, having experienced a brief stabilization during Covid-19.

Newegg (Google Trends)

We understand the issue for Newegg here, as the company must find a way to continue its growth trajectory, as well as improve margins. Marketplace has the opportunity to offer this, but the execution has been poor. Consumers are not happy with the marketplace offering and it isn’t generating the growth desired.

There is a saying, “You can do a hundred things right, but it takes only one mistake to destroy everything”. This feels like the case here. Newegg has destroyed its goodwill with its core customers, making it incredibly difficult to win this back.

GPM has also declined, falling 1.1ppts. This is a reflection of continued inflationary pressures, as well as increased discounting activities as a means of maintaining revenue. Given that the decline is only 1.1ppts, it is likely worth the effort given the sales have still fallen c.28%. Further, inventory turnover has fallen by 2.1x, which is a substantial level. Although inventory levels have declined, the company faces the potential for additional discounting which will bring margins down further.

Newegg’s OPM was a key concern for the business when it was growing, due to heavy investment in S&A as a means of driving growth. Our concern is that these costs are seemingly sticky, as OPM has declined by 4.3ppts despite the 1.1ppt fall in GPM. A part of this is likely Management attempting to steady demand by maintaining a disproportionate degree of marketing spending. Management interestingly stated the following, “From a marketing perspective, we continued to reduce and shift spending to better yielding channels.“, suggesting our financial observations are correct. Newegg’s return on S&A spending is incredibly disappointing.

The only positive we see is that Management is clearly aware of the slowing demand and so is not quick to replace stock. This has allowed the business to end the year FCF positive, resulting in a negative net debt position. For this reason, liquidity and solvency is not an immediate issue despite the rapidly declining position.

Outlook

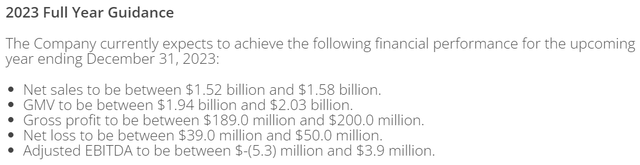

FY guidance (Newegg)

Management is guiding a continued decline in sales, with a full-year estimate of c.$1.5bn. This represents a fall of 12%, which is quite substantial given the decline already experienced.

Further, margins are forecast to remain flat. This is highly concerning as we think it suggests Management does not have a clear plan for returning to immediate profitability. Retailers generally struggle with winning back their margins due to the high level of competition. With a large degree of inventory expended, the company will likely use a degree of its cash balance in the coming year in order to support operations.

Overall, we are very concerned with this forecast. Management is likely being conservative on the topline but this is not what is worrying us. The lack of clear margin development intentions is an issue.

Valuation

Valuation (Tikr Terminal)

Newegg is trading at 0.21x its LTM Revenue, close to its all-time low. This suggests investors are placing little value on the company’s sales. It is difficult to argue against this given the continued decline both commercially and financially.

Final thoughts

We concur with the negative sentiment around the business due to several glaring issues. The company’s commercial position has deteriorated over several years which ironically is due to Management seeking to maintain its high-growth trajectory. Further, its financial performance is extremely poor and we only see scope for worsening.

We would only turn positive on the business if margin improvement occurs or fast growth returns through improving services. The business does not need both to get back on track but currently lacks either.

Read the full article here