Investment Thesis

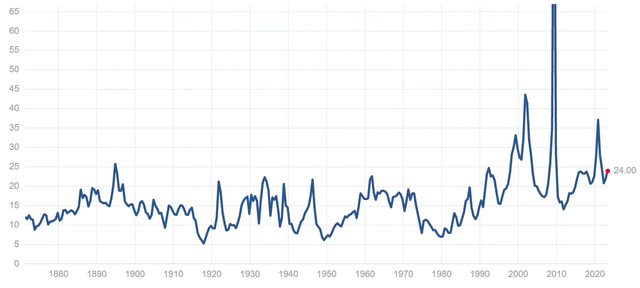

The S&P 500 (SP500) is currently trading at a P/E of about 24, which is significantly above long-term historical mean levels of around 16.

S&P 500 P/E ratio (Multpl.com)

In past years, authoritative voices like Warren Buffett rightly pointed to low-interest rates that prevailed for most of the last decade as a valid reason to expect stock market valuations to diverge from the long-term trend and trade higher as a result. Interestingly, even though we are now increasingly entrenched in a higher interest rate environment, which in my view is not likely to revert back to what we saw last decade, the S&P 500 still trades at very similar valuations that we saw last decade as a new normal within the low-interest rate environment.

There is also arguably a heightened risk to the market as well for individual stocks or industries emanating from a growing number of factors. The higher interest rate environment, after more than a decade of very low-interest rates, seems to have caught out financial institutions that are sitting on piles of low-interest debt obligations as assets on their books. It is at the root of the banking sector turbulence, and there is no telling how it might unfold in the future.

We also have growing geopolitical frictions, and despite some resistance to acknowledging it, individual companies are increasingly exposed to the dangers of getting caught up in the culture and ideological civil war that Western society seems caught in. A growing number of companies are becoming real-life examples of the kind of collateral damage these wars can inflict on companies and their investors.

Between higher interest rates that make the current valuation look increasingly out of place, as well as all the risk factors that are now affecting the market, which was mostly absent for most of the last decade, the logical conclusion is that stock markets need to pause and let valuations catch up, or correct lower. My thesis adds up to the S&P 500 mostly staying flat at current levels of around 4,200 for the rest of the year, as I forecast in my analysis at the end of last year. Furthermore, I am expecting 2024 to also be mostly flat. I also maintain my overall cautious approach to investing, focused on keeping exposure to any one particular stock limited, with a high percentage of cash as part of the overall portfolio, and an emphasis on avoiding buying stocks at or near their all-time or recent highs.

Interest rates now normalizing, making viable argument that market valuations need to normalize

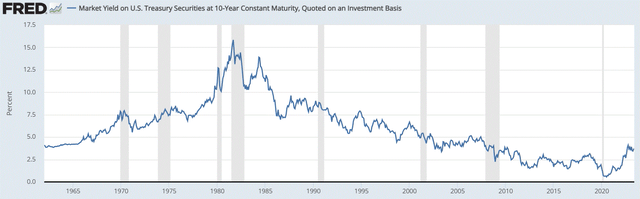

Based on the benchmark US 10-year bond yield, interest rates are now stabilizing at a rate that resembles something approaching normal economic times, which we arguably left behind after the 2008 crisis.

Federal Reserve Bank of St. Louis

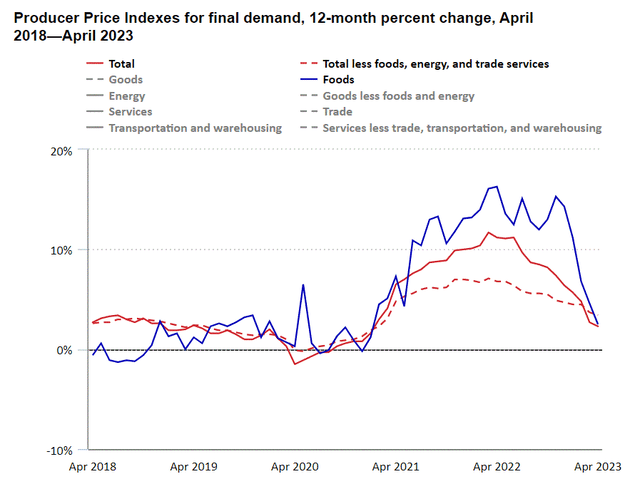

It should be noted that in real terms, in other words, adjusted for inflation, interest rates are still very low. It can therefore be argued that companies looking to borrow can do so with some confidence that they can see the face value of the issued debt inflated away in nominal terms. In reality, however, producer prices have been mostly outpacing actual consumer inflation and higher interest rates only exacerbate the situation as higher interest payments add significantly to those input costs.

U.S. Bureau of Labor Statistics

Even though producer price growth has trended sharply down recently, it should not be assumed that this is the end of the story. We have been in a downward price cycle for commodities prices in the past few quarters, which helps to push producer prices lower as well. Some early signs suggest that we may be looking at a reversal in the commodities price decline, with US shale producers cutting back their drilling activities sharply in response, meaning that energy prices cannot stay at current levels. If energy prices will rise sharply from current levels, so will producer prices with a slight lag.

Heightened risk factors

- The potential banking crisis:

Aside from the argument that stock valuations need to be reduced in order to account for the higher interest rate, there is the fallout related to the fast-paced rise in rates, which seemingly left many banking institutions as well as perhaps other entities in a vulnerable position. Just to recap, we are seeing a number of bank failures as well as worries about more to come, due to many banks being burdened with low-yield debt on their books that they piled throughout most of the last decade and the first two years of the current decade. Those bonds and other low-yielding assets are fine as long as the institutions sitting on them are willing to wait it out until maturity. If however, a liquidity squeeze pushes them to have to sell, they end up taking a loss, because the market is not willing to pay full face value price for bonds that have comparatively very low yields, given the fresh higher-yield debt being issued.

The magnitude of the potential danger as well as the odds of a banking calamity is unknown, simply because it is impossible to predict how it might all play out. So far, it does seem to be contained, with three bank failures, based on the FDIC. Contagion risk that there may have been, was probably contained. One important potential factor that could trigger a new wave of bank failures is the consumer’s financial situation and its evolution through a potential recession this year or worse, stagflation.

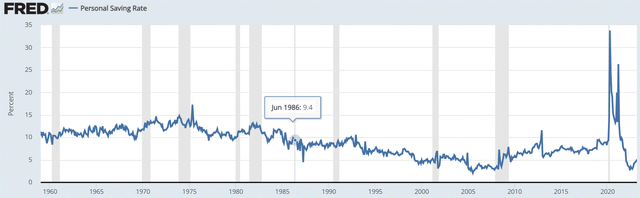

Federal Reserve Bank of St. Louis

As we can see, the average consumer personal saving rate is pretty low at this moment, currently sitting at levels not seen since 2009. Taking a step back and contemplating what this might mean for banks, it is probable that a large swathe of the consumer demographic is drawing down savings in order to make ends meet. Wealthier consumers might not be in that situation, but surplus savings are more likely to go into investment accounts, not into bank accounts. If personal bank accounts will see a steady net outflow of cash, it can potentially expose the entire banking system to having to liquidate some of that low-yielding long-term debt in order to raise cash.

It is impossible to quantify and it is often hard to pinpoint the net negative effects on any particular company or industry, but we are living in an era of geopolitical risk, where anything could happen at any time, with unforeseen consequences. For most S&P 500 companies, we are talking of secondary effects. For instance, I recently covered the planned lithium industry nationalization plan in Chile, where a company like Albermarle (ALB) has the potential to lose out. It still remains to be seen how that episode will play out.

We have the Russian situation, which has the potential to plunge the world into a severe resource scarcity situation at any moment since it is the world’s largest net exporter of commodities. The impact of such a crisis would span the entire economy, although it should be noted that some domestic energy companies in the shale patch for instance would probably benefit from it.

We have economic frictions with China, where for instance a company like Boeing (BA) might find itself targeted, by China for maximum economic pain, in retaliation for growing sanctions & restrictions being placed on Chinese companies. China could potentially cancel all contracts and refuse to sign any new ones thereafter, which would not only affect Boeing but indirectly the entire US economy. China could also retaliate by holding back on exports of certain raw materials like rare earth, or intermediary goods that go into our own supply chains, without which many of our own economic activities would be disrupted.

- A cultural civil war, with the corporate world caught in the middle:

There is arguably growing pressure for the corporate world to cater to ideological lobby groups or factions. With most such pressures coming from the left in the last few decades, companies adapted by simply giving in. However the rise of the boycott movement on the right, now has them exposed to being pushed from one side in a direction that risks the ire of the other side. The Anheuser-Busch (BUD) controversy did hammer the company’s stock, once the effect on sales became apparent, contrary to initial expectations that it will just fade away. Its stock price declined by about 14% since the controversy started. Target (TGT) saw its stock decline by about 14% in the past 10 days as well, with no other obvious factor but its ideological controversies being the main drivers. In the case of Target, it seems the market is not ready to wait to see the potential negative impact on sales after the market mostly misjudged the effects on Anheuser-Busch.

There is no telling how this emerging investment risk will evolve going forward. At the moment, it seems that the corporate world is finding itself tiptoeing on a minefield, and there is no telling who will be next. There seems no way out at the moment since both sides of the culture war are digging in.

- Commodities scarcity risk:

I saved the risk factor that I find to be the most dangerous for the longer term for last on this list. There are many skeptics out there on this one, which is partly justified by many false starts to a global commodities resource crisis, starting with Malthus in the 18th century. On many occasions since then, it seemed that the world or certain regions were about to run into trouble, but then, new resources emerged, and/or technological innovations came to the rescue. The latest such episode was the shale boom, which added about 10% to the world’s supply of oil & gas and probably prevented a commodities-driven inflationary crisis from taking shape about a decade ago.

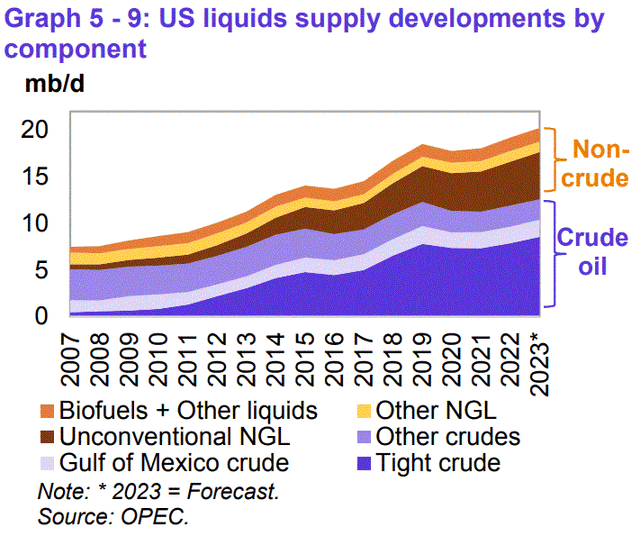

OPEC

As we can see, the tight oil component of America’s oil production helped to greatly boost America’s production, turning it from the world’s largest net importer of oil just over a decade ago, into a largely self-sufficient country in this regard, with net imports becoming minimal, helping to free up global exports for other markets, thus keeping the global economy from facing a massive energy availability shock.

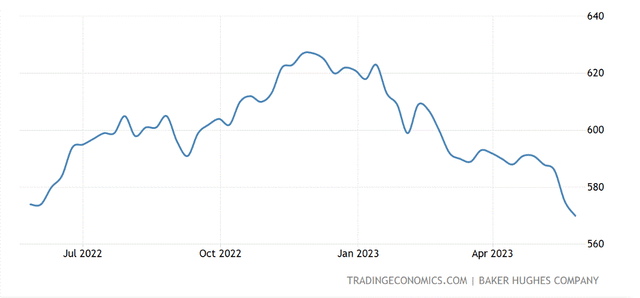

There are some signs that the shale boom is coming to an end, and may even stage a rapid reverse in production. Based on the latest Baker Hughes (BKR) data, US natural gas rigs in operation are currently down about 10% compared with the same period last year. Crude oil rigs are down about 1%. The decline in rig activity in the past month in particular has been spectacular. The natural gas rig activity slowdown can be explained at least in part due to low prices, but with crude oil trading at around $70/barrel in the past few months, it is harder to pin it on low prices, and crude oil rigs have been declining at a fast pace as well.

Trading Economics

If this trend continues in terms of US drilling activities, it is entirely possible that US oil & gas production will enter a sustained period of decline as soon as the end of this year, or perhaps early next year. A significant and sustained rise in oil & gas prices could in theory stem the decline in drilling. It is questionable however whether the economy can withstand an increase that will be high enough for shale drillers to feel comfortable with, as they will probably have to venture into second-tier acreage going forward to at least maintain production.

If the shale industry declines, perhaps within a year, I am personally hard-pressed to point to any viable alternatives on the horizon. Kerogen deposits to be an elusive resource from an economic standpoint. Gas Hydrates on the ocean floor have similarly proven to be challenging. Technological breakthroughs that might greatly enhance recovery from current resources, or help to reduce demand can never be ruled out. But at this point, any such breakthrough would come too late to prevent a potential energy price shock. New technological breakthroughs can take years and sometimes even decades to have a meaningful impact.

Investment implications

At the end of last year, I wrote an article predicting that the S&P 500 will reach a level of 4,200 by the end of 2023. I believe things are on track for that to be the case, and I am furthermore extending my forecast to the end of 2024. In other words, I expect the index to more or less be flat for the next year and a half, from current levels.

Summing up my analysis of the economy going forward, a stagflationary scenario seems to be the most likely outcome for the US economy. I expect producer prices to start rising again in a few months as commodities prices will increase in the second half of the year. That in turn will push inflation higher, leading to interest rates remaining high, and consumers being squeezed, leading to stagnated real consumer demand.

Companies will probably see their input costs pushed higher as higher commodity prices will work their way through the supply chains. A secondary squeeze will come from higher interest rates, as low-yield debt issued years ago will be retired and replaced with more and higher-yielding debt issued within the current environment. Within this overall situation, a gradual return to a historical average P/E level is a fundamentals-based expectation. Any growth in corporate profits should be considered to be a contributing factor towards that return to a fundamentally-sound P/E level, rather than a reason to be bullish.

Given the stagflationary and heightened risk environment, my own strategy of minimizing risk remains in place. I switched from a portfolio where I mostly held about seven or eight company stocks at any point in time, to one where I am hovering at around 25-30 individual company stocks or ETFs. I try to keep most of my new investment positions at under 3% of my total portfolio, with only a few legacy positions still taking up a larger share. Furthermore, I am keeping about 25% to 30% of my portfolio in cash. When I do deploy some cash as opportunities arise, I tend to avoid buying stocks that are flying at all-time highs or recent highs. I am more likely to sell when new all-time highs are reached. Some flexibility is of course warranted when there is a compelling reason to stray from these self-imposed guidelines. It is an adaptation to an investment environment that in my view is set to be the toughest going forward in perhaps a few generations, for the foreseeable future.

Read the full article here