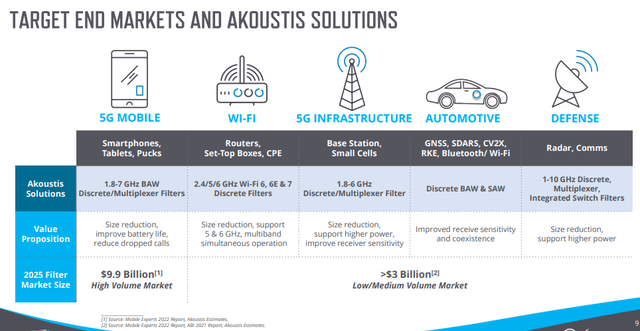

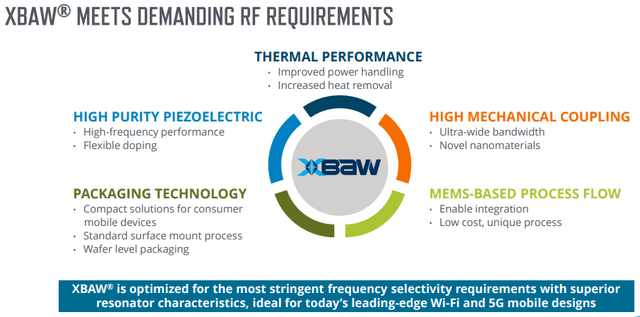

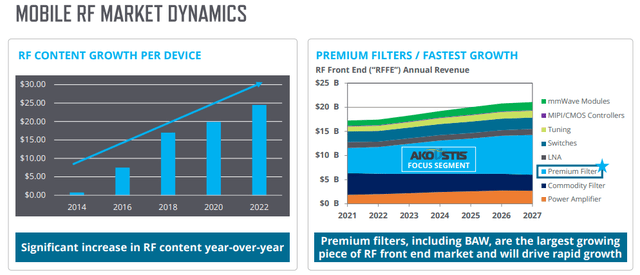

Akoustis Technologies (NASDAQ:AKTS) is a producer of RF filters, more especially ones based on its patented XBAW technology that are used in demanding situations like 5G, WiFi 6,6E and 7, 5G infrastructure, automotive and defense markets.

AKTS earnings deck

We have described the advantages of XBAW in previous articles (here, here, here and here).

AKTS earnings deck

The rapid customer uptake is validating these advantages and the company is set for further growth.

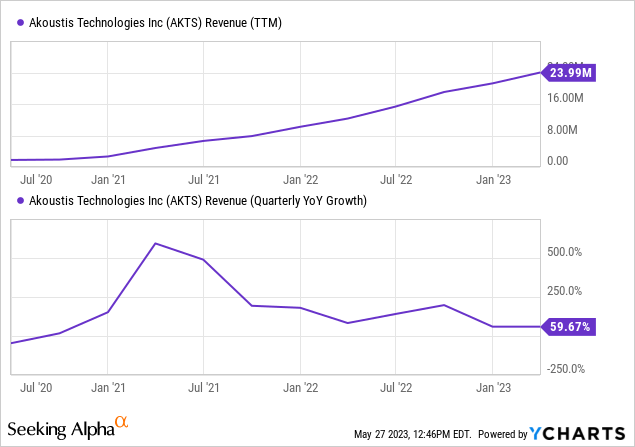

Growth

The good news is that the company is in the early innings of getting real traction and we can look forward to quarters producing considerable sequential growth (+25% in Q3, the April quarter for instance):

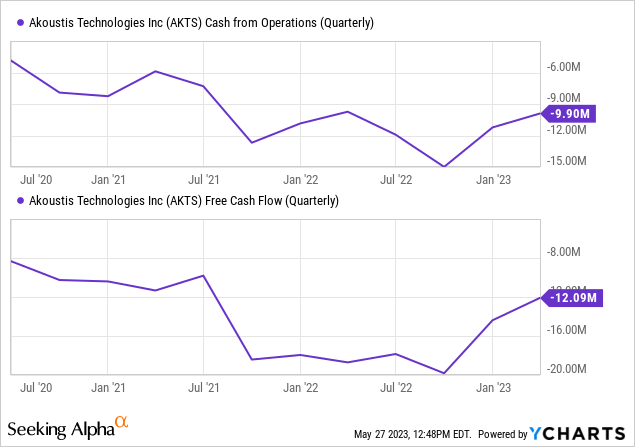

The revenue ramp is already starting to significantly dent the cash burn:

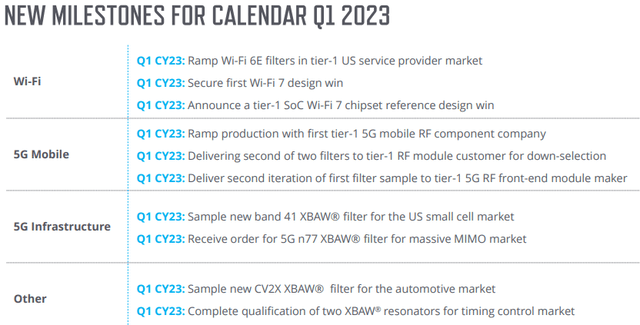

The company provided a nice overview of the progress made in Q3:

AKTS earnings deck

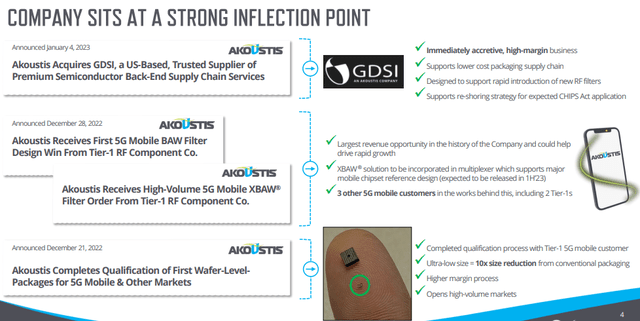

Management argues that the company is at an inflection point and they have reasons to back that up:

AKTS earnings deck

The three reasons are:

- The acquisition of GDSI

- The first high-volume order in the 5G mobile space

- The first qualification of wafer-level-packages

Acquisition of GDSI

AKTS earnings deck

The company acquired GDSI in January this year, they have a 60% margin service business that’s immediately accretive and produces cost savings and speeding up prototyping and boosting their package manufacturing capabilities (and chances of funding from the CHIPS Act).

The company has already begun integrating the systems of both companies, GDSI is cash flow positive so that helps although they did need to issue 14.1M shares at $2.75 to pay for the $13.9M acquisition.

The two biggest segments are 5G mobile and WiFi, so let’s check the progress there:

5G Mobile

5G is the biggest opportunity:

AKTS earnings deck

There is considerable progress:

- They began shipping the order for high-volume XBAW filters to a Tier 1 RF component customer who is incorporating it in a multiplexer on a reference design with a Tier 1 chipset maker. The multiplexer is being sampled with multiple Tier 1 and Tier 2 handset OEMs, management expects multiple design wins from these efforts in the next 3-6 months so the real ramp is yet to take off.

- They also delivered new samples

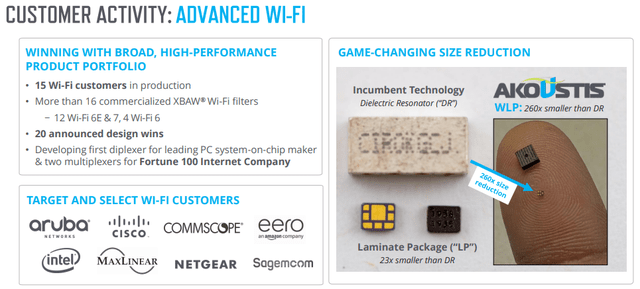

WiFi

AKTS earnings deck

Here too there is considerable progress with a

- A development order from a leading Asian RF front-end module maker

- Volume orders for Wi-Fi 6E filters for Wi-Fi 6E fixed infrastructure products

- First WiFi 7 design win

- Ramping initial production for a large US cable company (one of three carrier-focused WiFi design wins announced during the December 2022 quarter)

- The company has 20+ design wins and 15 customers in WiFi.

Management touted their competitive position in this segment (Q3CC):

So any of our all competitors that are approaching the WiFi market may be approaching it with 2 or 4 filters. We have greater than 12 filters targeting the WiFi market, supporting tri-band and upcoming quad-band and upcoming pentane design.

Other segments

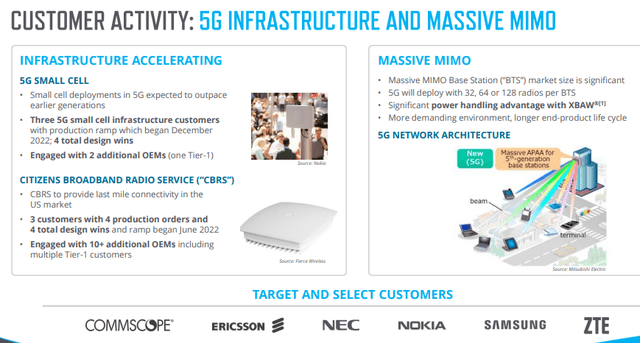

There is the 5G infrastructure market where the company already has 4 design wins in small cell and 4 in CBRS:

AKTS earnings deck

They are already shipping XBAW filters to some of these customers and management expects the market to strengthen in H2 and next year.

Management also announced a reference design wins with a leading 5G transceiver OEM, targeting Tier 2 small cell OEMs and it expects to receive a development order for a new 5G n77 filter from a Tier 1 European 5G network infrastructure OEM in the current quarter.

The company also has a new XBAW-based filter solution for the automotive market, the CV2X, expanding their legacy (SAW-based) TAM considerably. It’s already being sampled by Tier 1&2 automotive companies.

This isn’t going to move fast though, there is usually 2+ years between a design win and a significant production ramp in the automotive segment. Nevertheless, it’s their first XBAW based entry in this market, they do have existing business here though (Q3CC):

But we also have traction with TCU telematic control units that are looking at 5G and WiFi and then also with the GPS sector, we’re both promoting the SAW technology and the Vault technology.

The company also recently moved into the timing market and they have finished the qualification of one timing control resonator for their first timing customer, with another one coming up.

They have a multiyear contract with DARPA to scale their XBAW tech up to 18 GHz and achieved another milestone (Q3CC):

The milestone achieved was enabled by our patented single crystal piezoelectric nano materials, which are unique to Akoustis in the BAW filter industry.

There are other milestones for the June quarter (Q3CC):

For the June 2023 quarter, our expected milestones in our Defense and other business segment includes the completion and qualification of the second XBAW resonator for our timing control customer. Additionally, we plan to broaden the sampling of our new CV2X filter solution for the automotive market. And finally, we expect to secure $1 million-plus new development order from a Tier 1 defense customer for the development of a switch filter module using our XBAW filter technology.

The company has applied for a five-year $150M DoD program under the CHIPS Act where they are the lead company for a consortium and expect feedback in July. The goal is to increase their domestic production capacity (Q3CC):

we plan to propose a project contemplating spending up to approximately twice our current market cap to establish 200-millimeter silicon wafer manufacturing capability as well as a U.S. advanced packaging center.

The company also introduced new products which are sampling already like the 5.6GHz and 6.6GHz Wi-Fi 6 and 7 filters and the CV2X filter for the automotive market.

The company has 89 issued patents and 124 patents pending, but it has two litigation cases with a competitor Qorvo

Finances

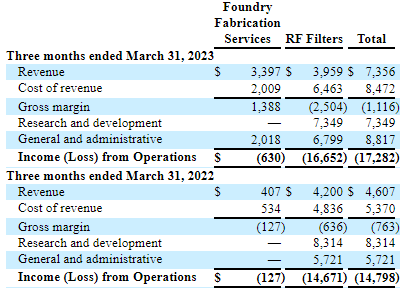

AKTS 10-Q

All the growth comes from foundry services, from the 10-Q:

Foundry fabrication services revenue includes XBAW® foundry services, Non-Recurring Engineering (“NRE”) and back-end supply chain services. Under these contracts, products are delivered to the customer at the completion of the service, which represents satisfaction of the performance obligation as well as transfer of title. Depending on language with regards to enforceable right to payment for performance completed to date, related revenue will either be recognized over time or at a point in time.

Basically, these services enable customers to design, fabricate and test their own RF filters based on XBAW technology. They exited MEMS foundry services in 2021.

The company had $52.7M in cash and equivalents left. Management expects 10%-20% sequential revenue growth in Q2, based on the production ramp of several customers.

Costs have come down, by 25% in Q2 and another 12% in Q3 so rising revenues and falling costs will reduce cash bleed every quarter and produce operating cash flow breakeven in the next 12 months at a level of revenue between $15M-$18M (we assume per quarter, a little over double where they are now).

Operational cash flow improved from -$15M in Q1 to -$11.2M in Q2 to -$9.9M in Q3 and is likely to decline further.

That leaves CapEx of course, they are as good as completing their New York fab with a 500M capacity, but as with all new fabs, they’ll have to manage cycle times and yields very carefully in the beginning.

Valuation

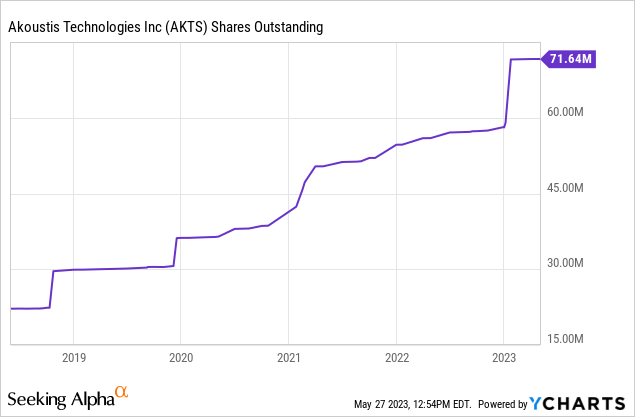

There was a $32M financing in January 2023, management participated for roughly $1M.

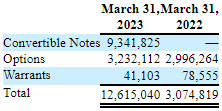

There is more to come:

AKTS 10-Q

So that’s 84M shares, at $2.8 per share is a market cap of $235M. There is every reason to assume the company can be worth a multiple of this in a few years if one extrapolates the revenue growth and traction they are getting with their XBAW technology.

But this isn’t a given, there are several hurdles and risks like the speed of the production ramp and the CapEx needs.

Conclusion

There is a lot to like:

- The company has a large and growing TAM (or several TAMs).

- Market acceptance of its multi-patented XBAW filter technology is increasing at a rapid pace, given the number of design wins and some production orders already in the bag.

- Based on the design wins alone, management expectation for continued significant sequential growth doesn’t seem to be unrealistic.

- A favorable industrial policy shift in general, and more in particular the CHIPS Act could very well relieve a lot of the financial burden of capacity expansion.

There are also some risks:

- The litigation cases with Qorvo

- The speed of the production ramp

- The CapEx needs

- The unit economics

With $52.7M of cash left, and operational cash flow set to decline further from the present $9.9M they are not in immediate need and could well reach that $15M-$18M revenue level where they become operational cash flow breakeven. But there are also CapEx plans, the CHIPS Act could come in very handy here.

Read the full article here