Boston Omaha (NYSE:BOC) is a small holding company that has made the most of familial ties between management and Warren Buffett. Some value investors have looked upon Boston Omaha as the second coming of Berkshire Hathaway (BRK.B) and gotten excited about BOC stock.

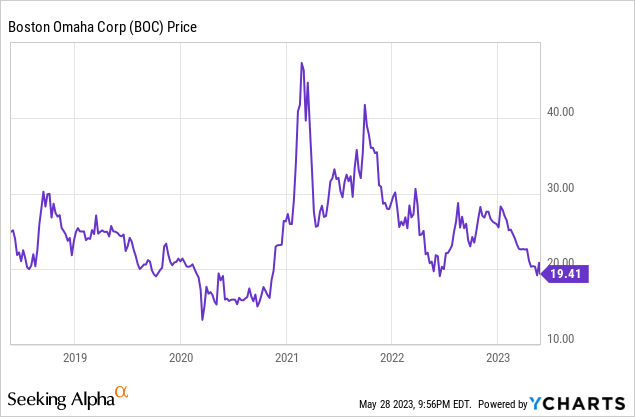

Despite that, BOC stock hasn’t really caught on. Shares are down a bit over the past five years, including a significant decline in 2023 year-to-date:

Some readers may be considering Boston Omaha shares here after the recent sell-off. However, I’d argue there is little appeal to the stock even at a sub-$20 price point.

Poor Shareholder Value Generation

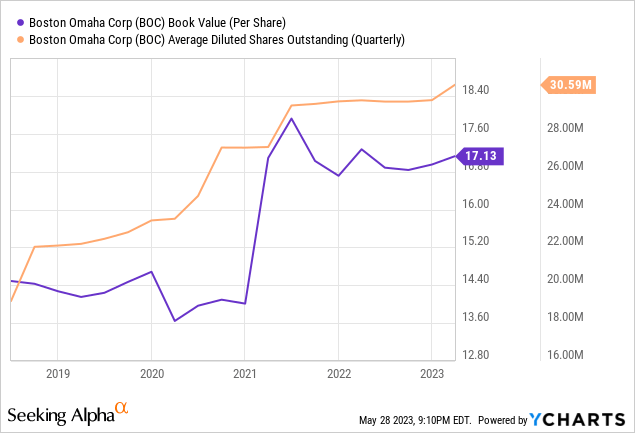

I believe the following chart sums up the issue with Boston Omaha. The company has been a serial issuer of stock, printing up new shares on an almost annual basis.

Despite issuing heaps of stock, often at a substantial premium to book value, the company’s book value per share has only modestly increased since 2018:

The share count is up from less than 20 million to 31 million today, and yet book value has only risen 20% over the past five years. Between issuing shares at a premium and operating the underlying businesses, we should hope for substantially faster book value growth.

Some people might complain that book value isn’t a great way to look at the company. But, I’d argue that for a holding company, it is a reasonable way of looking at the variety of disparate assets that have been assembled. Especially as bulls have made such of a point of highlighting Boston Omaha’s connections to Warren Buffett, it will be evaluated by book value per share growth, just as Berkshire Hathaway has been over the decades. And, so far, Boston Omaha’s performance on that metric has been underwhelming.

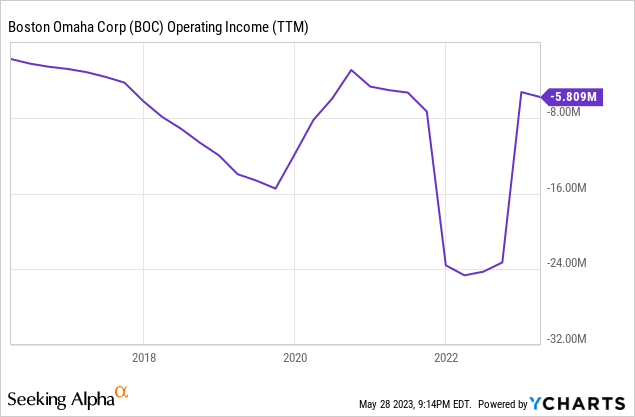

Let’s move away from book value though for a second. How is the business is faring on other fronts? On an operating income basis, not well. The company has never turned a profit on this count, and 2022 saw its worst stretch of profitability since the company went public:

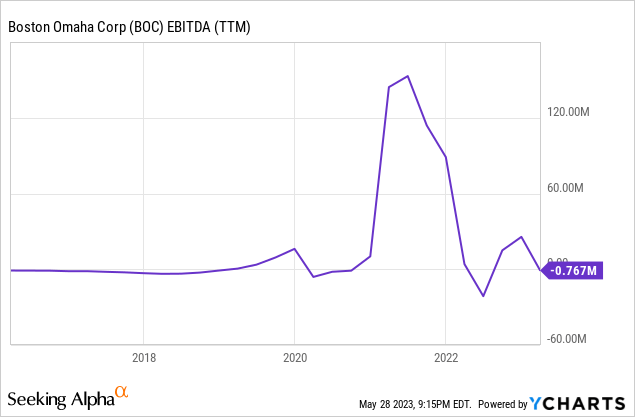

If you’d prefer EBITDA as your metric, there is slightly better news. Albeit, just barely. The company had one good year on the EBITDA front, but has returned to roughly zero, with an EBITDA loss of $767,000 over the past 12 months:

Are The Businesses Promising?

Boston Omaha is involved in a number of business lines including but not limited to insurance, billboards, asset management, and the cable industry.

I’d argue billboards are a marginal business at risk of technological disruption. There are two publicly-traded comps to look at. Lamar Advertising (LAMR) has meaningfully underperformed the S&P 500 over the past 20 years, with the gap widening in recent years. Meanwhile, Outfront Media (OUT) has produced an outright negative return (even including dividends) since going public in 2014.

The cable industry is under fire for a variety of reasons that are outside the scope of this article. I’d simply point out that joining the industry as a small scale player now seems like poor allocation in a time when even the giants like Charter Communications (CHTR) are seeing major declines in their valuations.

Boston Omaha’s insurance business may not have the scale to successfully compete against large internationally known rivals. I’m skeptical that the firm will be able to establish strong profitability against much more established peers.

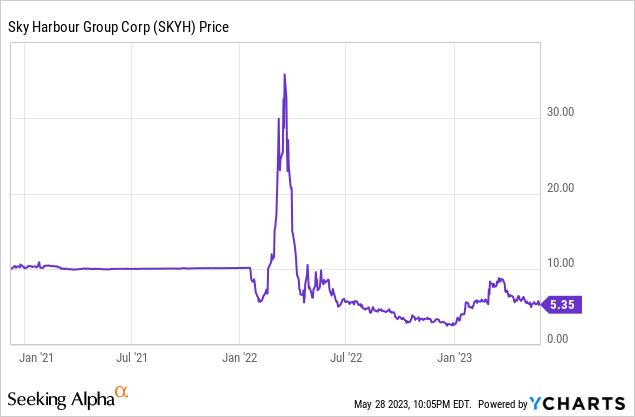

There is also the firm’s investment in Sky Harbour (SKYH), an aviation hangar company which went public via a SPAC. As you might expect, shares have declined (following an initial spike) since the SPAC deal concluded:

Boston Omaha owns 23% of Sky Harbour which is 13.1 million shares. As per the 10-Q, Boston Omaha is carrying this investment at a value of $7.73 per share, implying that a significant write-down to book value could be on the way given where SKYH stock is trading now.

Following up on that, I’d further note that Sky Harbour has a market cap of $320 million and generated $1.1 million of revenues last quarter. Many people, particularly value investors, might find that to be a surprisingly high price-to-sales ratio. Needless to say, I would not be surprised if the price of SKYH stock falls a lot more in coming months, which would further reduce the value of Boston Omaha’s investment.

To answer the original question, no I would not consider this assortment of businesses to be particularly promising. They are diversified, I’ll grant you that. But I haven’t seen much evidence that any of them are particularly special or demand a premium to book value. That’s especially true after considering how much of Boston Omaha’s revenues go to paying management.

Hefty Executive Compensation

While Boston Omaha’s operating results have been lackluster, executive compensation hasn’t reflected that. In fact, management is paid a most generous bonus incentive. As per the 10-K:

“The Bonus Plan is designed to encourage the growth in the Company’s “Adjusted Stockholders’ Equity,” as defined in the Bonus Plan, based upon the increase in the Company’s stockholders equity for such fiscal year less any increase arising from the sale of Company securities. Under the Bonus Plan, the total awards shall equal 20% of the amount by which Adjusted Stockholders’ Equity Per Share for the applicable fiscal year exceeds 106% of Adjusted Stockholders’ Equity Per Share for the preceding fiscal year […]

Based upon these and other factors, the Compensation Committee recommended a bonus for each of the co-chief executive officers of $7,500,000, for a total bonus payment under the Plan of $15,000,000, which was approved by the Board of Directors.”

I believe bonuses based on the growth on adjusted stockholder equity are not ideal since they incentivize the growth of the business’ total size, rather than its profitability. This, in my view, helps explain why the company is issuing so much stock to buy seemingly marginal assets in such a diverse range of industries with no apparent synergies.

Furthermore, it’s my opinion that given the company’s small size and lack of profitability that management is getting paid rather steeply with a $15 million annual bonus.

BOC Stock Verdict

I believe that if you stripped away the connections to Buffett and Omaha that this stock would trade at a large discount to book value. Between the unusual executive compensation structure, the hodgepodge and fairly unattractive collection of businesses, and the steady and repeated dilution, there’s simply not much to like here.

Things could turn around, to be certain. And with so many irons in the fire, it wouldn’t be surprising if at least one of Boston Omaha’s businesses eventually catches on. However, I think investors should be skeptical until there is much more evidence that the business plan is paying off. For now, this is an easy stock to avoid.

Read the full article here