Nvidia’s (NASDAQ:NVDA) stock price exploded higher last week after earnings beat expectations and guidance surged 50% above Wall Street expectations. Expectations of $11bn in revenue in Q2 saw the company’s market cap rise by $210bn, which as far as I am aware is the single largest one-day gain for any stock ever. Investors and analysts have taken the strong guidance and extrapolated it out impressively, with options markets now showing extreme fear of a further rally relative to a reversal and Wall Street analysts increasing their price targets by almost 50%.

With a market cap just shy of a trillion dollars, even if sales and earnings were to rise over the next decade to match those of Apple today, and the stock was to trade at similarly expensive valuations, investors would see annual returns of just 5% in excess of cash and bonds. Investors appear to be betting on continued AI-driven speculation driving the stock higher as we saw in the tech bubble in the late-1990s. This kind of optimism tends to occur towards the end of market rallies not the start, and while there is a possibility that Nvidia surges further from here as we saw with Cisco Systems in 1999, the risk-reward outlook is increasingly precarious.

Options Market Showing Extreme Fear Of Further Upside

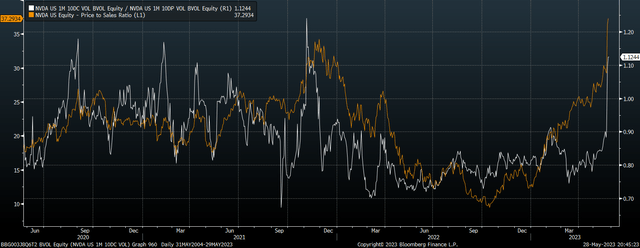

This surge in optimism towards the stock can be seen in options markets. The vast majority of the time it costs less to hedge against a stock price decline than to bet on a rally, and this has been the case with Nvidia. This makes sense as market declines tend to be more abrupt than market rallies in the short term. On Wednesday, however, the implied volatility of 1 month 10 delta call options rose above put options, meaning that after a huge gain in the stock investors are now willing to pay more to protect against a further rally than a correction.

This sudden surge in the stock price, while triggered by the strong earnings report, has also likely been exacerbated by forced buying. The strongest moves in financial markets are those that become self-reinforcing. When a stock price rises rapidly, short sellers are often forced to buy to cover their positions, which adds to upside momentum. As the stock rises, option sellers are often forced to buy the stock to hedge their exposure, which is known as a gamma squeeze. We have seen similar moves in option prices before and they tend to occur after significant rises and often shortly precede significant market tops as the chart below shows.

NDVA vs Call-Put Option Volatility Ratio (Bloomberg)

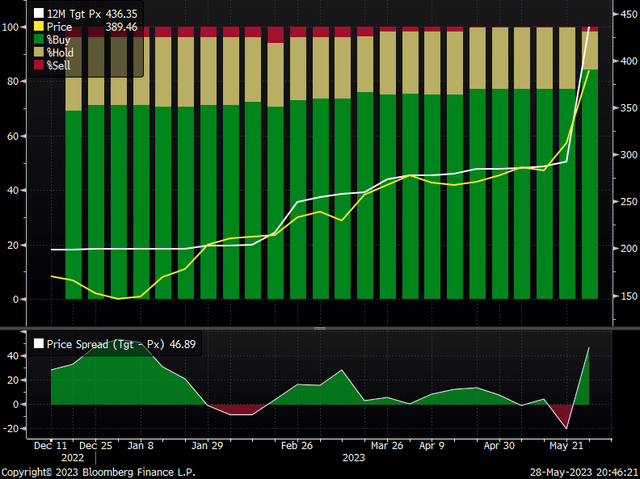

Analysts Have Risen Their Price Target 49% In One Week

The rise in Nvidia’s earnings outlook has also led to a surge in Wall Street buy rating for the stock and a rise in the target price. Prior to the earnings release 77% of Wall Street analysts had a buy recommendation on the stock, and the 12-month target price was $292. After the release, the buy rating percentage rose to 84%, while the 12-month price target soared to $436. This 49% rise in the target price based almost entirely off of one quarter’s guidance is extreme.

Analyst Ratings And Price Target (Bloomberg)

To put it another way, the 50% increase in expected Q2 revenues to $11bn reflects a $3.6bn increase in quarterly revenue expectations, which compares to a rise in the Wall Street price target equivalent to $356bn. Clearly analysts and investors are anticipating this rapid revenue and earnings growth to be sustained for years to come, and at current valuation multiples they absolutely need it to for the stock price to avoid a large drop.

Even A Decade Of 30% Revenue Growth Would Not Justify Current Valuations

As I argued in my previous article on Nvidia in March (see ‘Nvidia’s Stock Price Is Detached From Reality’), the combination of extreme valuations, the lengthy time period over which revenues and earnings will be received, and elevated bond yields, make the stock price overvalued based on any feasible growth expectations.

Since then, valuations have become more extreme, yet so has the risk that sales and earnings growth may be even stronger and arrive quicker, particularly with gross margins expected to rise to a record high of 70% next quarter. It is therefore worth revisiting the assumptions I put out in March.

If we raise the revenue growth assumption over the next decade from 20% to 30% and increase the profit margin assumption from 12% to 24%, we would see Nvidia’s revenues and earnings rise to size of Apple currently, with around $370bn in revenues generating $90bn of free cash flow. For context, this compares to free cash flows of $66bn for the entire MSCI World Semiconductor and Semiconductor Equipment Index.

If we assume that Nvidia trades at the same free cash flow yield as Apple, which is currently 3.5%, this would put the company’s market cap at around $2.6trn in 2033. While this may seem like a great investment, even under the rapid growth assumptions above and assuming valuations remain elevated, investors would still receive just 10% per year, which is on par with long-term equity market returns and just 5% above cash.

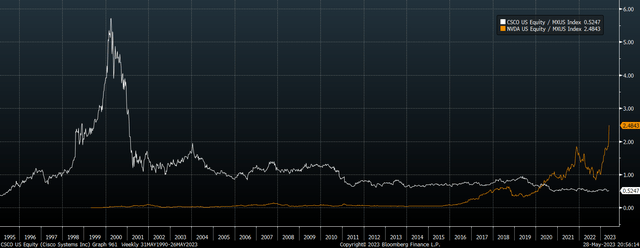

Echoes Of The Late-1990s Tech Mania

Clearly, the marginal NVDA investor is not buying the stock for the chance to generate 5% returns above bonds if all goes well and the company manages to replicate the success of Apple. There are much easier ways for investors to generate such returns without the risk of major interim capital losses even if they are correct. Rather, as shown by option volatility and price action, investors are responding to short-term factors, looking to benefit from the fever surrounding AI at any price. The surge in the price target by Wall Street analysts likely reflects the herd behavior of the industry and the career risk that comes from being the only bear on a popular hot stock, rather than the result of any meaningful fundamental analysis.

CSCO and NVDA Market Cap, % of MSCI USA (Bloomberg)

Whether they realize it or not, holders of Nvidia are betting on the continuation of a bubble, which is fraught with risks. That said, it is also true that the bulk of dollar gains for a stock can occur in the latter stages of a bubble. At the start of 1999 the market cap of Cisco Systems had risen to 2.5% of the entire US market, similar to Nvidia’s share of the total market today. While already extremely overvalued, the stock tripled over the next 12 months, reaching a staggering 5.7% of US equity market cap despite generating just 0.2% of total revenues.

Summary

There is no doubt that Nvidia is uniquely placed to benefit from the boom in AI-driven hardware demand, but this says very little about the outlook for the stock price, which is likely to perform poorly over the long term even if the growth story plays out as the bulls hope. The surge in call option implied volatility and the scramble among analysts to upgrade the stock suggest we are much closer to a peak than a sustainable rally. I am taking advantage of high implied option volatility to generate income while limiting losses in the event that the stock’s value follows the path of Cisco from extreme to absurd.

Read the full article here