It seems difficult to predict where the market will move in the second half or over the course of the next year, given the uncertainty surrounding the Fed’s pivot and the impending recession. In such a scenario, focusing on investments that have the potential to outperform in both bearish and bullish market conditions would be prudent. One possible investment in a volatile environment is the Fidelity High Dividend ETF (NYSEARCA:FDVV). The ETF outperformed the S&P 500 during the bull market of 2021 and remained largely stable during the bear market of 2022. Despite the fact that the ETF has fallen a little more than the overall market index so far in 2023, it is expected to recover over the next few months and seems like a reliable ETF to hold for the long term.

Why Is FDVV Likely to Perform Well in Bull and Bear Markets?

FDVV Price Change Since 2021 (Seeking Alpha)

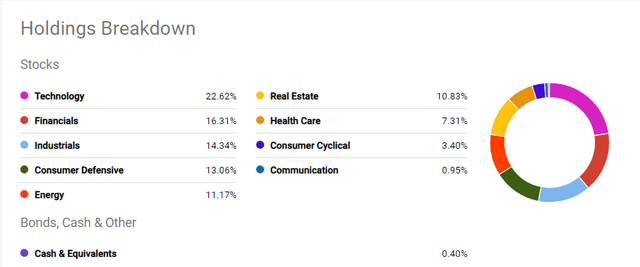

The key reason for FDVV’s ability to perform well in both bull and bear market conditions is its well-diversified portfolio, which is heavily weighted toward large-cap dividend stocks. Moreover, the combination of growth and value stocks enables FDVV to outperform in any market condition. The technology sector, which has been the best-performing sector so far in 2023, accounts for roughly 20% of the overall portfolio weightage. Indeed, large-cap stocks such as Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA) are FDVV’s top three holdings, accounting for 15% of the total weightage. If the current uptrend in tech stocks extends the momentum and forms a bull run in the second half, FDVV’s stakes in high-growth tech stocks would help the ETF to perform well in the bullish market condition.

FDVV Portfolio Breakdown (Seeking Alpha)

The financial sector, which has been a laggard in terms of price performance thus far, has the second-highest weightage in FDVV’s portfolio. It’s also worth noting that FDVV invests in large-cap financial stocks, with no exposure to struggling regional banks. JPMorgan Chase (JPM), Bank of America (BAC), and Wells Fargo (WFC) are among its top financial sector stock holdings. These three banks have benefited from higher interest rates. For instance, JPMorgan Chase reported a 24% increase in revenue in the first quarter, while its earnings per share of $4.10 exceeded expectations by $0.69 per share. Similarly, Bank of America’s earnings per share of $0.94 for the first quarter exceeded the average analyst estimate of $0.83, up from $0.85 in the fourth quarter of 2022 and $0.80 in the previous year.

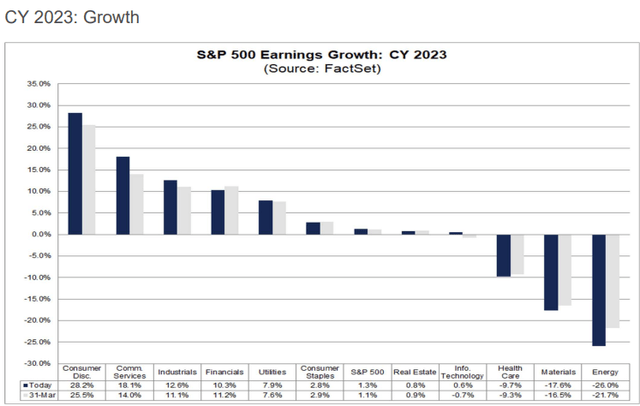

FY 2023 Earnings Projection (FactSet)

According to FactSet data, the financial sector is expected to be among the best performers in terms of earnings growth in 2023 and 2024. The stress in the financial sector is primarily caused by regional banks, which are not part of the FDVV’s portfolio and account for only a small portion of the total financial sector. As a result, I expect the sector to recover in the coming quarters.

Industrial and consumer defensive sectors account for 14% and 13% of portfolio weightage, respectively. Large-cap stocks in these two less capital-intensive sectors have a significant amount of cash to support growth activities. So far in 2023, the S&P 500 industrial sector has not gained any ground, but fundamentals indicate that earnings growth power will help shares recover in the coming quarters. Wall Street anticipates that the industrial sector will post double-digit percentage earnings growth in 2023, ranking it third among S&P 500 sectors. The consumer defensive sector, on the other hand, is typically adaptable to shifting economic conditions. For instance, Procter & Gamble (PG) experienced a 7% organic sales growth during the first quarter, and the company anticipates a 4% growth in full-year earnings per share. PepsiCo (PEP) expects 8% organic revenue growth and 9% earnings growth for the entire year. In general, it appears that FDVV’s well-diversified portfolio and exposure to the large caps growth and value category will continue to aid in producing long-term sustainable returns.

The Dividend Factor

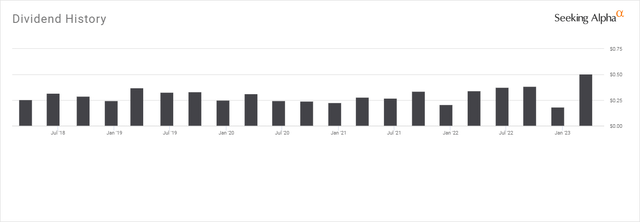

FDVV Dividend History (Seeking Alpha)

The dividend factor is always important in increasing total returns and persuading investors to hold the stock or ETF for an extended period of time. In the case of FDVV, the ETF offers an above-average dividend yield of around 3.8%, compared to 2.27% for all median ETFs. Its dividend payout increased by 17.9% in the previous year, following a 6% increase in 2021. Aside from 2020, the ETF has a strong track record of dividend increases. It also appears to be in a position to make another significant dividend increase in 2023. This is reflected in the first-quarter dividend of $0.50 per share, the highest quarterly dividend in its history, and represents a significant increase from $0.33 per share in the previous year.

Large-cap tech stocks like Apple, Microsoft, and NVIDIA have plenty of cash on their balance sheets to keep dividend growth going. Furthermore, despite difficult market conditions, their financial numbers continue to grow. For example, Microsoft, which has raised dividends for the past 18 years, earned $2.45 per share in the March quarter, up from $2.22 per share in the previous year. Similarly, Apple recently announced a 4.3% dividend increase as well as a massive $90 billion stock repurchase program. Furthermore, as large banks in the financial sector continue to generate robust earnings growth, there is a high likelihood of significant dividend increases from them. Consumer defensive stocks such as PepsiCo and Coca-Cola (KO) have also increased their dividends for 2023, while industrial companies are also poised to offer a solid dividend increase given double-digit earnings growth expectations. Overall, there is no risk to FDVV’s dividend growth in 2023.

Quant Ratings

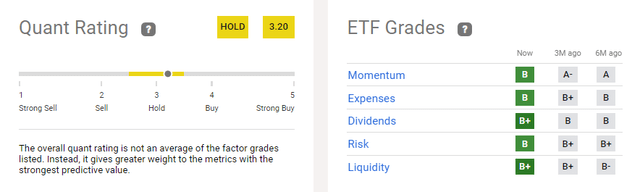

Quant ratings (Seeking Alpha)

Fidelity High Dividend ETF fell just short of the buy range based on SA’s quant score of 3.20. The hold rating is primarily due to a low momentum score. Given the strong financial performance of the majority of its holdings, I anticipate an increase in its momentum score in the upcoming months. In addition to momentum, the ETF scored B plus on liquidity, indicating strong inflows and rising trading volume. Furthermore, a low-risk rating and high dividend grade make it a good long-term investment.

In Conclusion

When it’s unclear where the market will go in the future, Fidelity High Dividend ETF seems like one of the best ETFs to own. It has the potential to perform well in both bullish and bearish market conditions thanks to its well-diversified portfolio, which consists primarily of large caps. The high dividend yield and low expense ratio also make it a good ETF to hold for the long term.

Read the full article here