The New Cannabis Ventures Global Cannabis Stock Index has dropped 21.4% thus far in 2023, while the NCV Canadian Cannabis LP Index is down just 4.6%. That index has currently 23 members, many of which are small. It is missing two of the larger licensed producers that trade only on the NASDAQ. Most of the large Canadian LPs have gone down a lot in 2023.

These Canadian LPs have been hammered and deserve it

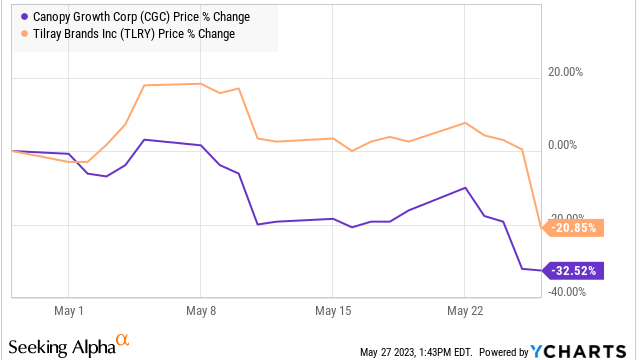

Two of the more popular Canadian licensed producers are Canopy Growth (CGC) and Tilray Brands (TLRY), and they are down a lot recently. Here are the returns for May:

YCharts

Year-to-date, Canopy Growth has dropped 62.0%, while Tilray Brands has declined by 30.9%. I have shared my negative views about the two companies recently.

Four months ago, I described how Canopy Growth is not a good stock for cannabis investors, and it has dropped by more than 66% since then. I noted how the debt is rising and big, and the cash is dwindling. The company burns a lot of cash and isn’t doing well. It is trying to hold on to its NASDAQ listing while buying three American cannabis operators. I don’t think that it will succeed. If it does, it would open the door to American operators mimicking it. The company has an accounting issue with its majority-owned BioSteel weighing on it and making it likely to file its year-end financials late.

A few days before the recent convertible note offering, I followed up on my April 10th article warning investors to stay away from Tilray with a prediction of more stock price declines ahead. I lowered my right-now target from $1.36 to $0.96 based on 1.5X tangible book value.

The large Canadian LP public company group has several players now

Beyond Canopy and Tilray, the Global Cannabis Stock Index has six other large Canadian LPs. HEXO Corp. (HEXO) is in the process of merging with Tilray. I highly recommend that holders sell the stock and buy Tilray if they like Tilray, as HEXO is trading well above the price implied by the pending acquisition. 0.4352 times the TLRY closing price of $1.86 would be $0.81, but HEXO closed at $1.02, a 26% premium. At the current price, the stock is up 1.0% year-to-date.

I used to follow Aurora Cannabis (ACB) closely, but I no longer do. The company is very focused on medical cannabis, a strategy that I don’t think will succeed in the near term or perhaps in the long term too. The stock, which is down 41.5% in 2023, trades below tangible book value.

SNDL (SNDL) is another one. I don’t follow it closely, though I did follow Alcanna and Valens, both of which it acquired. To me, the company, which trades only on the NASDAQ, is complex. It appears to be cheap, as it is trading at a big discount to its tangible book value. It is down 25.4% in 2023.

I discuss the other three below, Cronos Group (CRON), Organigram (OGI), and Village Farms (VFF).

Canadian adult-use cannabis is maturing

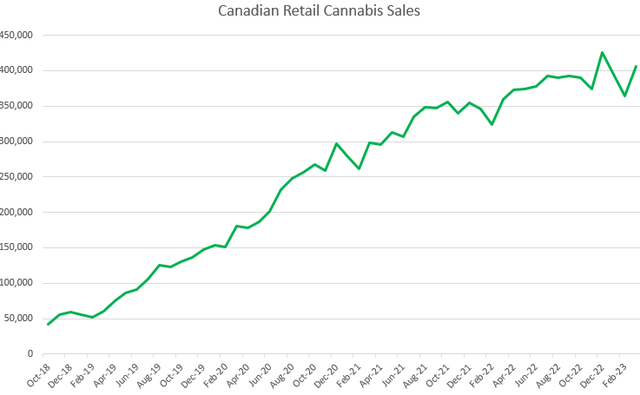

The Canadian adult-use market went live in late 2018. It soared initially, but it has plateaued near C$400 million for the past year or so:

Alan Brochstein using StatsCan data

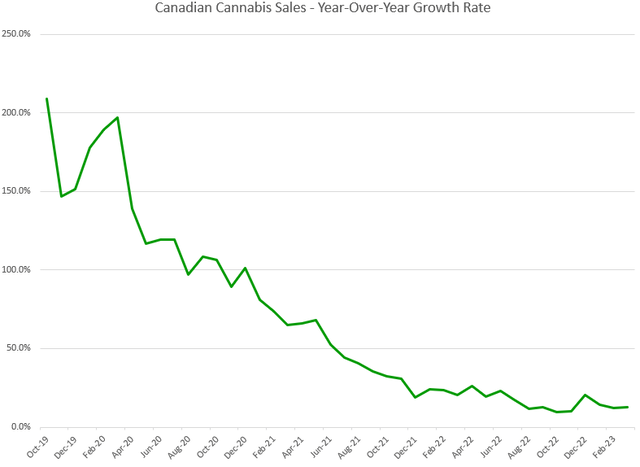

The growth has been slowing:

Alan Brochstein using StatsCan data

In March, growth was 12.9% from a year ago, above the record low of 9.8% in October.

How the marketplace could improve

Canada was one of the first countries in the world to create a federal medical cannabis program, and it is the only large country with legal adult use. The program has its challenges including too many licensed producers, too few provinces that don’t require the province to be the distributor and too high of taxation. Another problem has been the 10mg cap for THC in edibles by the package rather than the serving, which makes the edibles a very small part of the market.

Perhaps the country will improve things. Already a lot of LPs are returning their licenses back to the nation, and many have sold or are selling their assets. If the government were to take steps to reduce taxation or to allow private distributors into the market, it could change things for the better.

Here are the Canadian LPs that I like

I run the Beat the Global Cannabis Stock Index model portfolio at 420 Investor, and the New Cannabis Ventures Global Cannabis Stock Index has three names currently that total 45.7% of the portfolio. This far exceeds the current value of Canadian LPs in the index, which is at 25.9% currently. My positions in Cronos Group, Organigram, and Village Farms compare to their combined index exposure of just 10.2%, so it’s a massive over-exposure to these names.

In 2023, these stocks are all down a lot. Cronos has fallen 30.3%, Organigram is down 44.8%, and Village Farms has dropped 46.8%

I think that being federally legal in Canada is very valuable for all of these companies. They also are participating in some foreign markets, which could help them grow over time.

Each of the Canadian LPs that I like trades at a large discount to its tangible book value. It’s challenging to find an American cannabis companies with a similar characteristic. Cronos trades at just 0.63X tangible book value, while Organigram trades at the ridiculously low 0.43X. The cheapest is Village Farms at just 0.36X.

What’s nice about Cronos and Organigram is that they both have strategic investors that could buy them. Cronos is owned 41% by Altria (MO), while Organigram is owned 20% by British American Tobacco (BTI).

The balance sheets of these three companies range from decent for Village Farms to superb for Cronos and for Organigram. Village Farms, which I wrote about here after they raised capital in January, has a small amount of net debt. The stock plunged on that capital raise and then rallied sharply, but it never fully recovered and now is a lot lower. Both Cronos and Organigram have massive amounts of cash and no debt. Five weeks ago, I described Cronos as “dirt cheap,” and it has dropped just 4.8%. I called Organigram my favorite cannabis stock two weeks ago. It has dropped 6.0% since then.

I think that each of these companies has been making progress in their operations. For 2023 and 2024, analysts project Cronos Group will increase revenue 7% this year and 25% next year. 2024 estimated adjusted EBITDA is -$42 million, about half of the loss from 2022 and small relative to the cash position. Organigram is expected to see revenue increase 18% in the fiscal year ending in August 2023, and then to grow revenue 16% in FY24. Adjusted EBITDA is projected by the analysts to be C$28 million in FY24. Finally, Village Farms, which generates only a portion of its revenue from Canadian cannabis, is expected to see overall revenue fall 1% in 2023 and then increase 5% in 2024. The analysts project adjusted EBITDA will increase to $6 million in 2024.

Conclusion

I see extreme value in some of the Canadian LPs. I believe that the weakness at Canopy Growth and Tilray has been weighing on investor sentiment, but these companies aren’t struggling with debt issues and operational issues like the two more popular names. In fact, the whole industry is looking hard for cash, and Cronos Group and Organigram have a lot. I continue to think that their strategic investors could move to take them over. While Village Farms has no strategic investor, I think it learned a big lesson during that January capital raise and meltdown, and the company is looking to sell an asset in Texas. This is a lot smarter in my view than selling stock below tangible book value. I continue to think that the Pure Sunfarms operations in Canada are worth more than the entire market cap, which is just $78 million.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here