The dream is free, the hustle is sold separately ― Luis Cortes

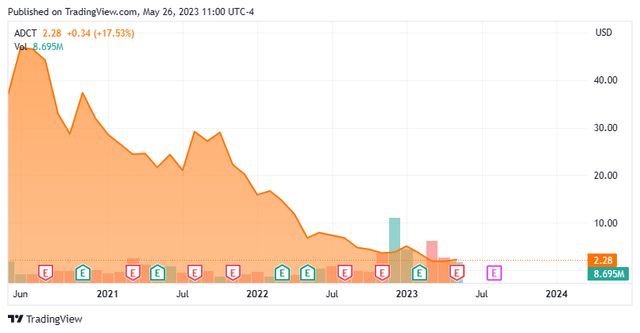

Today, we look at a small cap biotech concern whose stock has been through the ringer despite one approved product on the market and some potential catalysts on the horizon. Are the shares’ implosion overdone? A thorough analysis/recommendation follows below.

Seeking Alpha

Company Overview:

ADC Therapeutics SA (NYSE:ADCT) is an Épalinges, Switzerland domiciled early commercial-stage biotech focused on the development of antibody drug conjugates (ADCs) to address oncology indications. The company has one approved therapy, Zynlonta (loncastuximab tesirine-lpyl), for the treatment of diffuse large B-cell lymphoma (DLBCL) in a third line (3L) or later setting. It is also being evaluated in earlier treatment lines for DLBCL, as well as for non-Hodgkin lymphoma, while four other programs are pursuing multiple oncological targets. ADC was formed in 2011 and went public in 2020, raising net proceeds of $244.2 million at $19 per share. The stock trades around $2.25 a share, translating to an approximate market cap of $185 million.

March Company Presentation

Antibody Drug Conjugates

For those unfamiliar, ADCs are targeted therapies for treating cancer, as opposed to systemic drugs such as chemotherapy. They consist of a monoclonal antibody [MAB] to target the cancer cell, a cytotoxic payload (warhead) to kill it, and a linker that joins the two to ensure that the payload does not disengage from the antibody before reaching its target. ADCs have been around since Pfizer’s Mylotarg was approved for relapsed acute myelogenous leukemia (AML) in 2001. However, owing to challenges with linker technologies and payload resistance, only two more were approved over the subsequent 15 years. There are now 13 approved ADCs, including Zynlonta.

Company’s Approach

Management believes its programs’ differentiating feature is their use of pyrrolobenzodiazepine [PBD] dimer warheads – essentially potent chemotherapy – which once inside the target cell, bind irreversibly to DNA without distorting the double helix; thus, evading the DNA repair mechanisms that have degraded the effectiveness of other ADCs, allowing them to kill cancer cells. PBD warheads are 100 times more potent than warheads on other commercial ADCs, lending themselves to more durable responses. These next-generation PBD warheads are less hydrophobic, making them easier to excrete once outside the tumor microenvironment, translating into less off-target toxicity and easier manufacturability. The company originally licensed the PBD technology from Spirogen, which is now part of AstraZeneca (AZN). ADC has no outstanding potential financial obligation on that license.

Zynlonta

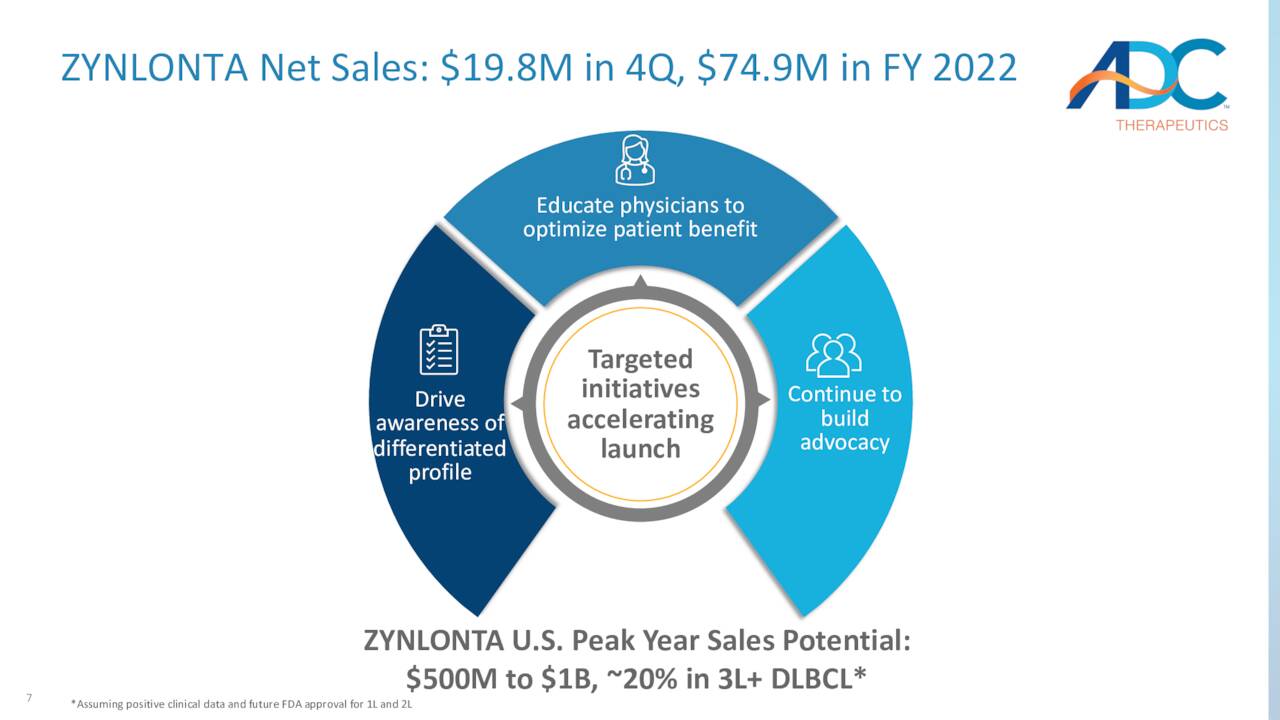

The PBD approach was validated by the FDA approval of CD19-targeting Zynlonta in 2021 (EU 2022). Requiring a 30-minute infusion once every three weeks, it produced complete responses [CRS] in 24.8% of third-line or later DLBCL (and other related) patients (n=145) and an overall response rate (ORR) of 48.3% in its pivotal trial. It generated FY22 revenue of $74.9 million, but that figure isn’t expected to climb meaningfully in FY23, as the potential entry of bispecific therapies – including AbbVie (ABBV) and Genmab’s (GMAB) recently approved epcoritamab – and a patient population of just greater than 6,000 in a third-line plus setting is somewhat limiting, meaning substantial additional contributions from Zynlonta will only occur if it can transition to earlier lines of care.

March Company Presentation

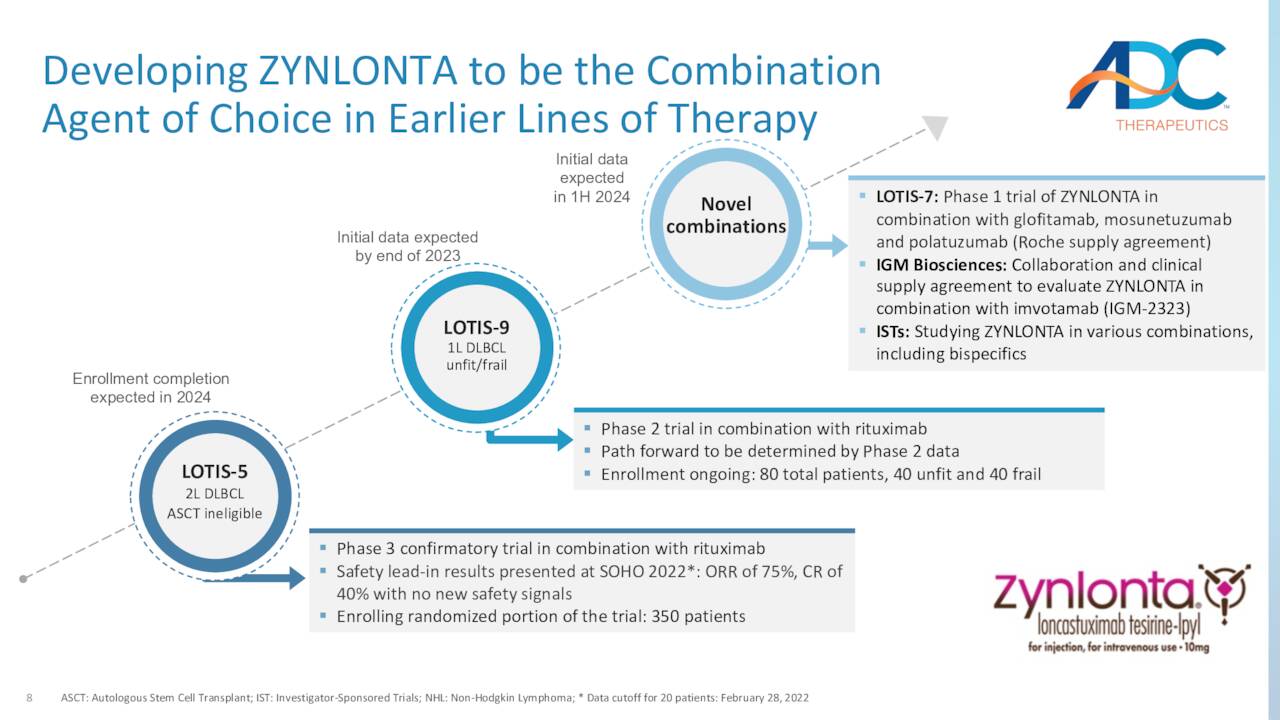

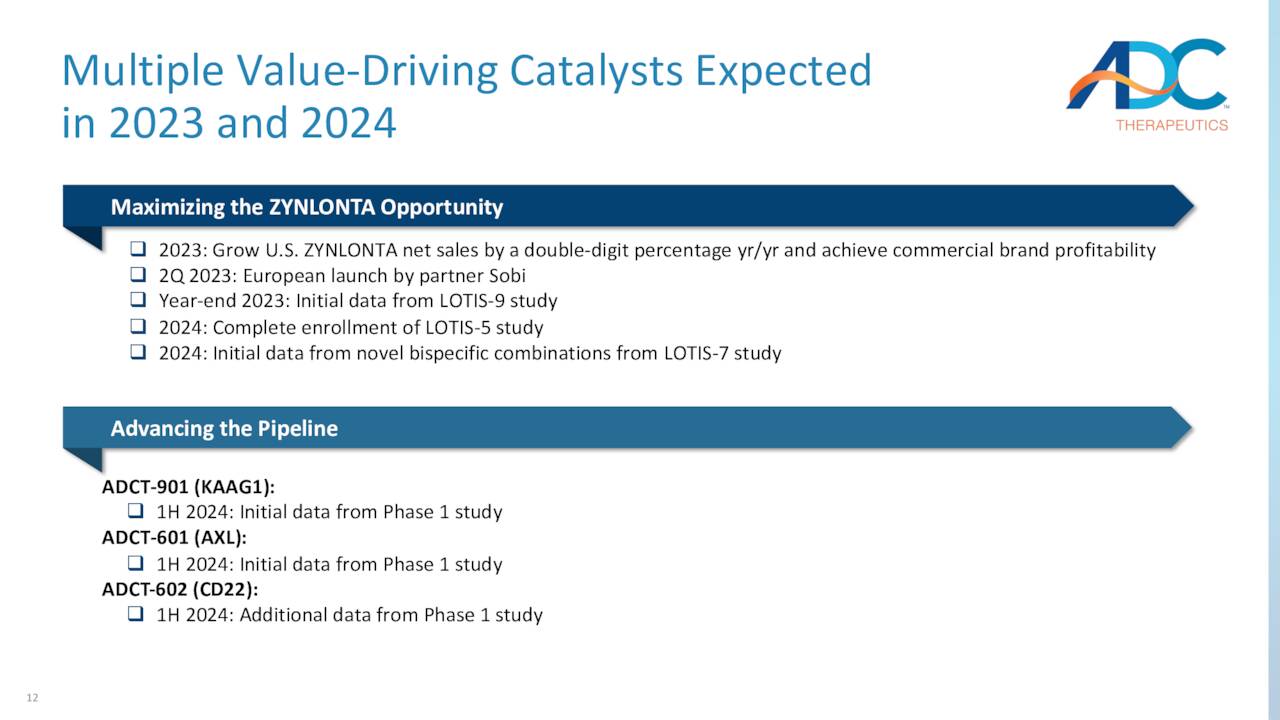

To that end, it is undergoing evaluation in three trials: a Phase 3 study in combination with anti-CD20 mAb rituximab in a 2L setting (LOTIS-5); a Phase 2 trial in combination with rituximab in a 1L setting of unfit or frail DLBCL patients (i.e., the 15% of the patient population that cannot handle standard-of-care R-CHOP chemotherapy) (LOTIS-9); and a Phase 1b study in combination with multiple therapies in patients with relapsed/refractory B-cell non-Hodgkin lymphoma (LOTIS-7). It is anticipated that LOTIS-5 will complete enrollment in 2024, while LOTIS-9 and LOTIS-7 are expected to produce preliminary data that same year. Management believes a move to the front lines of DLBCL care would increase Zynlonta’s market opportunity to $500 million to $1 billion.

May Company Presentation

Zynlonta has attracted two licensing deals. The first was inked in January 2022 with Mitsubishi Tanabe for Japan that included $30 million upfront and potential milestones totaling $205 million, as well as high-teen to low-twenties royalties. That agreement was followed by one with Swedish Orphan Biovitrum (Sobi) for all territories ex-Japan, Singapore, U.S., and greater China, which produced $55 million upfront in July 2022 and $50 million more when Zynlonta was approved for the EU in December 2022. ADC is eligible to receive an additional $332.5 million in milestones and mid-teens to mid-twenties royalties.

Camidanlumab Tesirine (Cami)

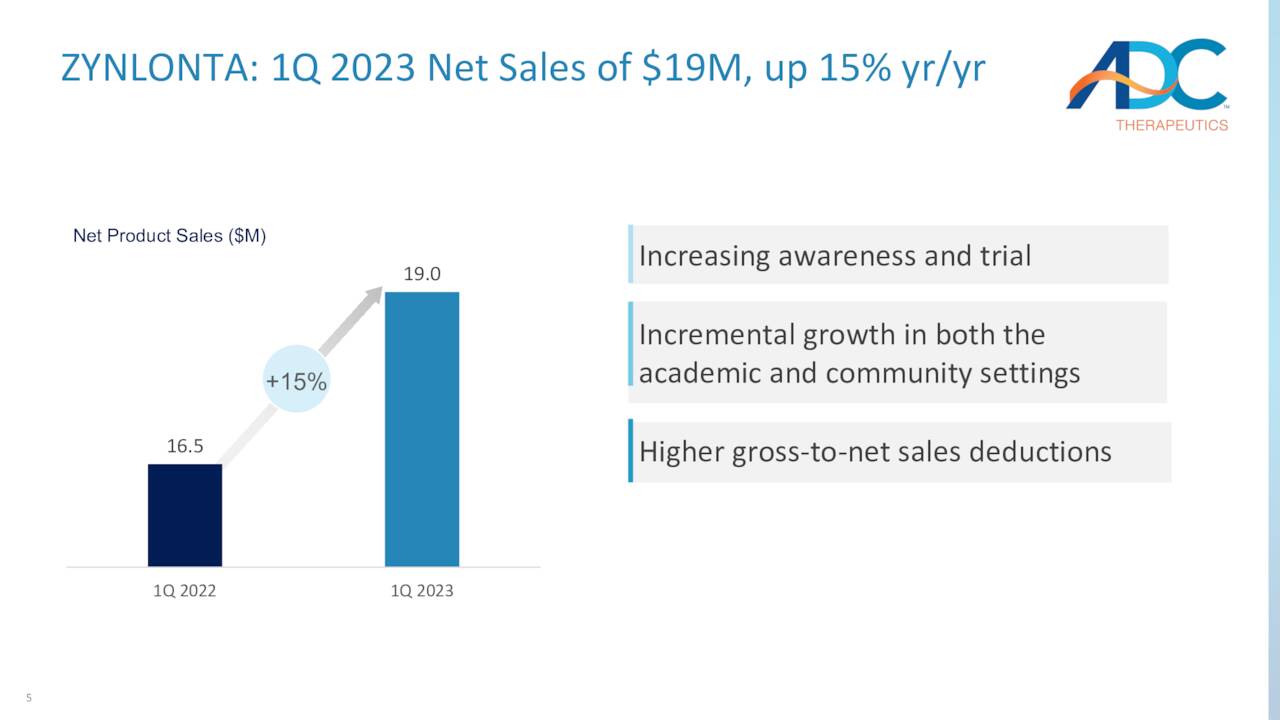

The reason why Zynlonta is expected to generate ~$80 to $90 million in FY23 revenue, (Zynlonta has net sales of $19 million in 1Q2023, up 15% Y/Y) yet its owner only commands a $185 million market cap is a function of two dynamics. One is Cami. It is a CD25-targeting ADC employing the same PBD technology that has successfully completed a Phase 2 trial in the treatment of relapsed/refractory Hodgkin Lymphoma [HL]. Annual new cases of HL are estimated at ~18,000, but fortunately the disease – a cancer of the lymph nodes that can travel to the liver, lungs, and bone marrow – is highly curable with an 87% five-year survival rate. That said, many patients don’t respond to treatment and require later line alternatives.

May Company Presentation

In a 117-patient Phase 2 trial in a 3L setting (or at least 2L if the patient was ineligible for hematopoietic stem cell transplant), Cami achieved a CR in 39 (33.3%) patients and a partial response [PR] in 43 (36.8%) patients, for an ORR of 70.1%. From an efficacy perspective, the trial was successful enough that management anticipated filing a BLA for accelerated approval of Cami for HL in a 3L setting.

However, two events derailed Cami off that pathway. First, its Phase 2 and Phase 1 studies were placed on partial clinical holds due to patients diagnosed with Guillain-Barré syndrome (GBS). Across the two trials, 12 patients were diagnosed with GBS, a disease with symptoms similar to polio. Owing to this adverse event profile, between the Phase 1 and Phase 2 studies, Cami’s progression through the clinic was delayed by at least a year. By that time, the accelerated approval pathway window was closing after considerable blowback following the FDA’s accelerated approval of Biogen’s (BIIB) Alzheimer drug aducanumab. As such, the FDA told ADC that in order to consider accelerated approval for Cami, a confirmatory Phase 3 trial must be well underway (and likely fully enrolled) at the time of BLA submission. Due to this decision, the company deprioritized Cami’s development and is now seeking a partner to advance it across the regulatory finish line.

Other Clinical Assets

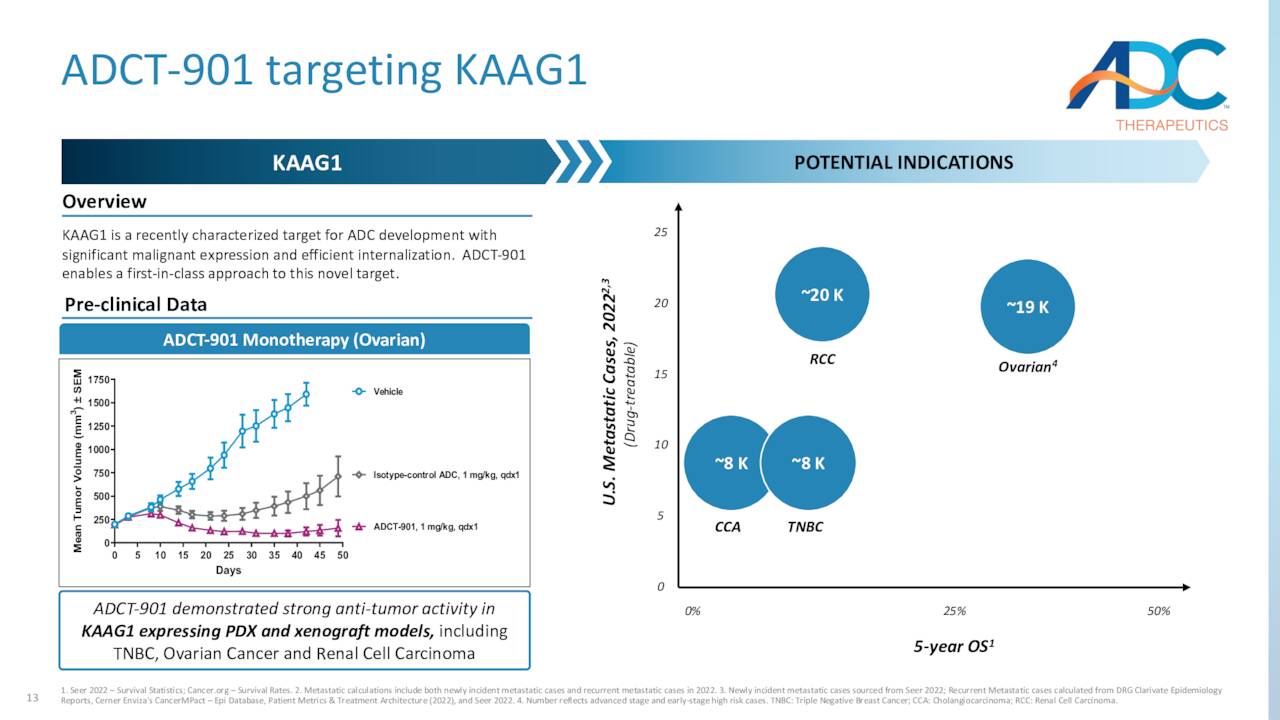

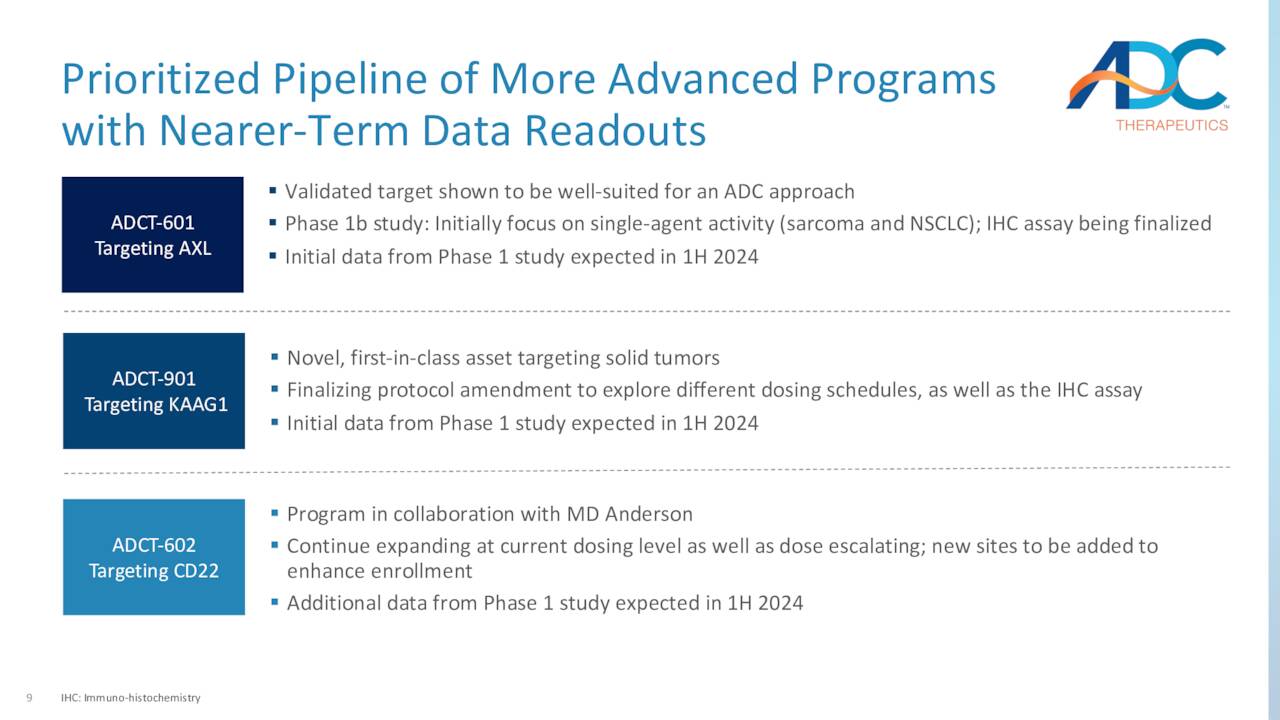

ADC elected to reprioritize its resources to expand the patient population for Zynlonta and advance other programs through the clinic. Those assets include KAAG1-targeting ADCT-901, which is undergoing a Phase 1 dose escalation study as a monotherapy in various solid tumors; AXL-targeting ADCT-601, which is being assessed in a Phase 1b dose escalation trial as a monotherapy in various solid cancer indications; and CD22-targeting ADCT-602, which is undergoing study in a Phase 1 dose escalation trial as a monotherapy in the treatment of acute lymphoblastic leukemia – initial clinical data were characterized as encouraging – with final results due in 1H24. The other two studies will provide preliminary data in 1H24. The company also recently laid off 17% of its workforce to reduce costs as well.

March Company Presentation

Balance Sheet & Analyst Commentary:

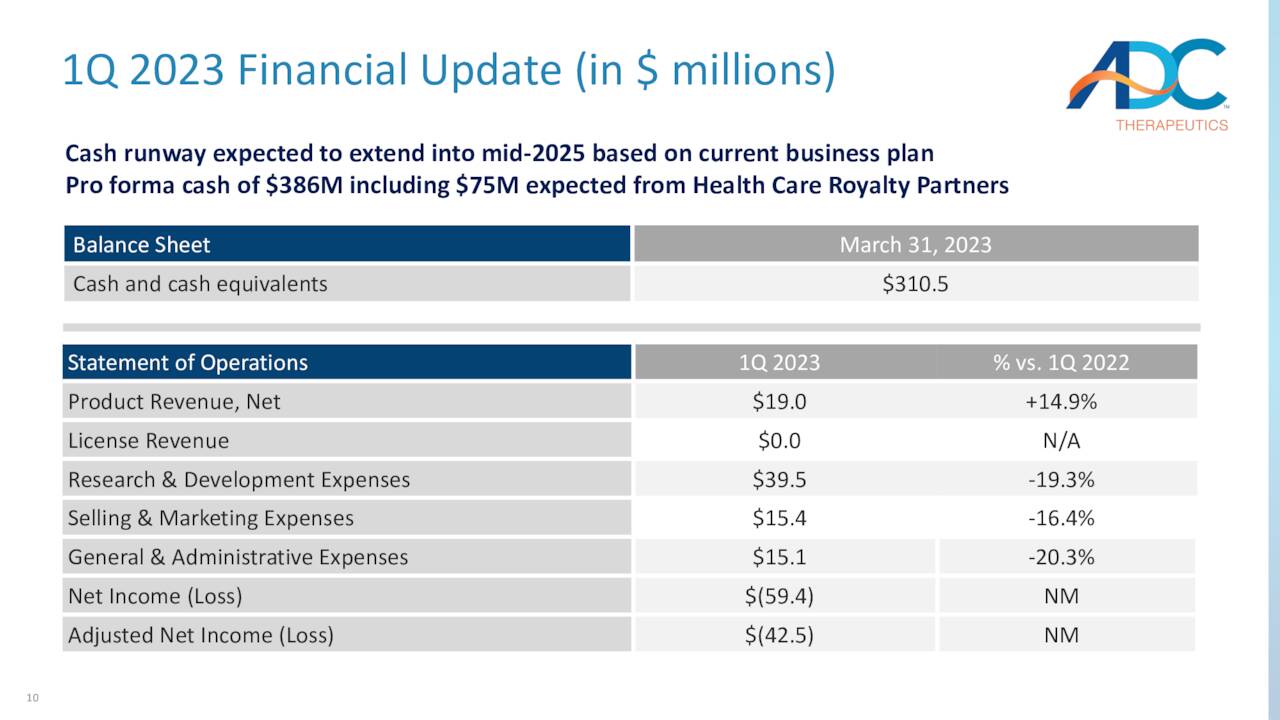

The other headwind to increasing its market cap is the company’s balance sheet. To fund its clinical endeavors, ADC held cash and equivalents of $326.4 million versus debt of $322.1 million, which includes ~$225 million outstanding on a royalty purchase agreement with HealthCare Royalty Partners (HCRX) – at YE22. That balance sheet snapshot did not reflect the $50 million milestone payment from Sofi or the anticipated $75 million milestone from HealthCare after effectuating its first EU commercial sale. These infusions will provide ADC with a cash runway into mid-2025. Assuming receipt of the $75 million, the total cap on the company’s 7% royalty obligation to HealthCare Royalty will increase to $750 million.

May Company Presentation

The Street leans is mixed on ADC, featuring one buy and two outperform ratings against three ratings of Hold/Neutral. Their average 12-month price target is $9.00. The underperform rating comes from Bank of America, whose downgrade of the stock (from a hold) on April 24, 2023 – citing Zynlonta headwinds – took the shares of ADCT down 15% in one day to $1.96. The stock has since recovered.

It also didn’t help that a suspiciously priced secondary of 12 million shares from selling shareholder Auven Therapeutics in early February 2023 seemed to place about half the shares in weak hands, adding to the downward pressure. The pejorative ‘suspicious’ is used as the $5 a share pricing was near the top tick in its stock since September 2022 without any market altering news preceding the transaction. Shortly thereafter, Fidelity exited its remaining 4.6 million share (6%) position through conventional means, which pressured shares of ADCT. Auven continues to own 8% of ADC. As a result of the secondary, Redmile Group became a beneficial owner at 16.8%, already down 61% on the six million shares it picked up in February.

Verdict:

Besides for Zynlonta sales – which are not expected to grow substantially – there isn’t much to motivate investment in 2023.

May Company Presentation

The one exception is a partnership that would advance Cami into a conformational Phase 3 study. Given the GBS issues and the relatively small Hodgkin lymphoma market size (estimated at $1.1 billion globally by Expert Market Research), the odds of a needle-moving deal is a longshot. The recommendation is to stay to sidelines while it forms a base around $2 and reevaluate near YE23.

May Company Presentation

Destinations are ordinary; Journeys are unique. ― Wrushank Sorte

Read the full article here