Thesis

ASML Holding N.V. (NASDAQ:ASML) is a leading player in the semiconductor industry, providing advanced technology for the production of integrated circuits or chips. With the increasing demand for semiconductors across various sectors, ASML is poised to benefit from this growing market. The company’s recent advancements in Extreme Ultraviolet (EUV) lithography technology position it well for future growth. Moreover, the company’s considerable Return on Invested Capital (ROIC), as well as consistent share buybacks, underscores its potential for yielding significant returns for its investors. Despite geopolitical tensions and reliance on a small number of customers, ASML’s strong financial position, innovative technology, and massive economic moats make it an attractive investment opportunity.

Introduction

ASML is a Dutch company and one of the world’s leading manufacturers of chip-making equipment. The company is a key supplier to the semiconductor industry, providing innovative technology solutions for the production of integrated circuits (chips). ASML’s products are used by major chipmakers like Intel, Samsung, and TSMC – which produce a wide range of semiconductor devices such as microprocessors, memory chips, and sensors.

EUV Domination

ASML has essentially established a monopoly in the global semiconductor industry, particularly in the realm of extreme ultraviolet lithography (EUV) technology. Most experts agree that it could take another decade and billions of dollars for another company to match the expertise of ASML.

This technology is crucial for the production of smaller, more powerful, and energy-efficient chips that are in high demand across various industry: computing, telecommunications, and automotive. ASML’s EUV machines, which cost approximately $200 million each, are the only ones capable of creating circuits small enough for the next generation of microchips.

The company’s dominance in this field is due to its significant investment in research and development of over 15% of revenue. ASML has spent billions of dollars to develop this technology and this spending has consistently increased YoY. It has also formed partnerships with key customers like Intel, Samsung, and TSMC, who have co-invested in ASML’s research and are now reaping the benefits of this advanced technology by being the main customers for ASML.

ASML is still continuously innovating – working on High-NA-EUV technology to allow chipmakers to produce 2nm processors. These chips will revolutionize processing speeds and could potentially quadruple phone battery life. Thus, ASML is the driving force behind future ground-breaking developments in the semiconductor industry.

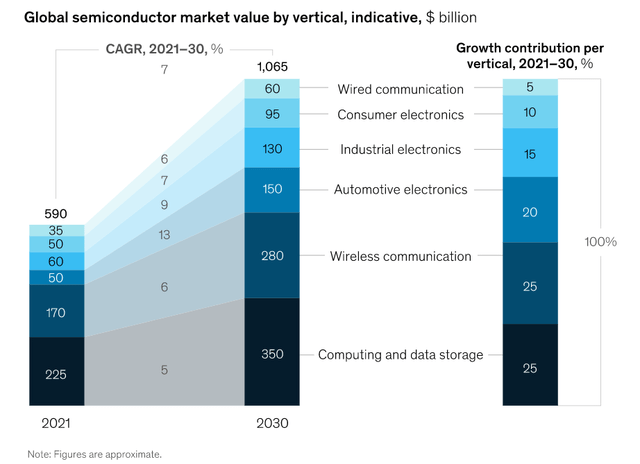

Surging Demand for Semiconductors

In recent years, ASML has seen a surge in demand for its EUV machines, driven by the growing need for advanced chips in various applications, from smartphones and data centers to cars and AI technology. This demand is expected to continue in the foreseeable future, given the ongoing digital transformation and the advent of technologies like 5G, AI, and the Internet of Things. In fact, the automotive industry seems to be the main driver for growth with the increasing advancements and developments being made with autonomous vehicles. This, in turn, could cause demand for automotive chips to potentially triple in the coming decade — benefiting ASML directly.

McKinsey & Company

Financials

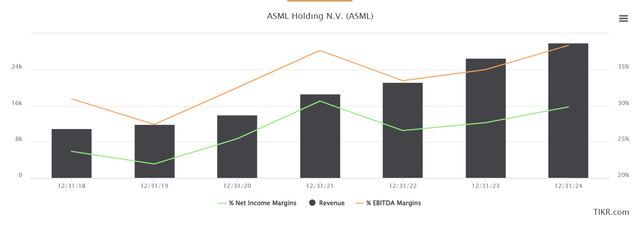

ASML’s market cap of over $260 billion indicates its position as a firmly cemented company that is still experiencing tremendous growth. Over the last 5 years, its revenue has grown at a CAGR of over 17% and is expected to grow at an average rate of over 18% over the next couple of years. These numbers certainly indicate high growth potential, however, ASML is also expected to increase its margins, driven by additional EUV and Deep UV immersion revenue.

TIKR Terminal

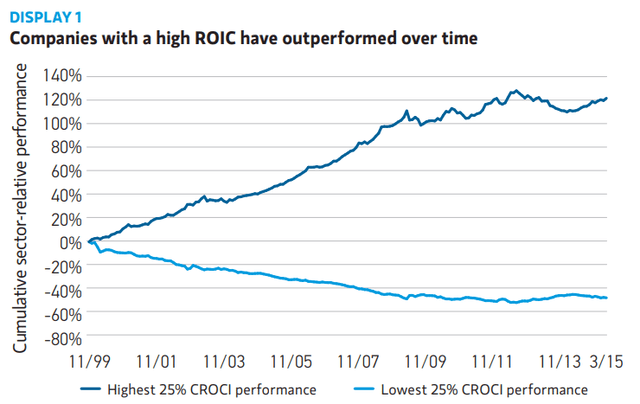

What truly stands out to me is ASML’s remarkable Return on Invested Capital of 39.1% in 2022. This figure underscores ASML’s efficiency in its expansion efforts, as it demonstrates the company’s ability to generate substantial returns on the capital it physically invests. This level of performance is comparable to great companies such as Apple, Google, and Microsoft. A high ROIC is often indicative of a company with high return potential for shareholders, as firms with high ROICs tend to significantly outperform the broader market due to their ability to generate elevated levels of free cash flow.

Morgan Stanley

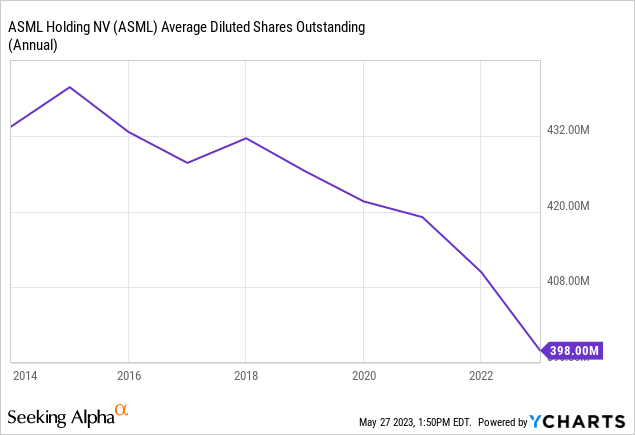

ASML has also consistently performed share buybacks, which should signal to investors the confidence management has in their own company. This allows them to return value to shareholders by enabling them to increase their stake in the company.

Valuation and Target Price

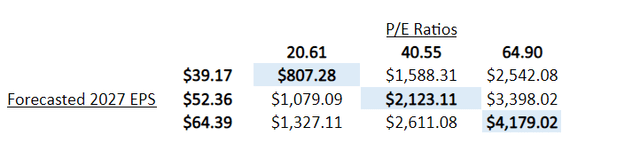

Since ASML has no real competitors, we can only really assess its valuation in comparison to its historical values. Its current P/E ratio of 39.12 is in line with its 5-year average of 40.64 meaning that it is trading at a relatively fair multiple to what the market usually gives it.

I like to think in the mid to long term. As such, I estimated a five-year target price for ASML by examining analysts’ projections for the company’s earnings per share in 2023 and 2024. By analyzing the low, average, and high estimates, I established conservative, base, and optimistic scenarios by growing each EPS forecast at rates of 21%, 29%, and 33% respectively per annum until 2027. These EPS growth rates may seem absurd, but seem perfectly logical when considering the potential for rapid revenue growth and high ROIC, combined with increasing margins. Moving on, to estimate the price-to-earnings (P/E) multiple at which ASML might trade in 2027, I used a value of 20.61 for the conservative scenario, since this was the lowest value from the last 5 years. Meanwhile, I utilized its five-year median of 40.55 as the base case. For the optimistic scenario, I chose the highest P/E ASML has traded at over the last 5 years of 64.90. Thus, it is very likely that its P/E in 2027 will fall in between this range. By combining the base case projected EPS and the projected P/E ratio, I arrived at a 5-year target price of around $2,100 for ASML. This calculation yields an average return of over 24%, which widely outperforms the S&P 500’s average yearly return of approximately 10%.

Excel

Risks

One significant concern with ASML is its dependency on a limited number of large customers, such as Intel, Samsung, and TSMC. This concentration could potentially impact ASML’s revenue if any of these key clients alter their strategy or face downturns in their business.

The geopolitical tensions surrounding ASML also pose another risk. The U.S. government has been pressuring the Dutch government to restrict the export of ASML’s advanced chip-making equipment to China. This is due to concerns over China’s increasing capabilities in chip manufacturing, which is seen as a critical technology for the development of artificial intelligence systems. If the Dutch government were to comply with these restrictions, it could potentially limit ASML’s market and impact its revenues.

Finally, there is the risk associated with the complexity and cost of ASML’s machinery. The machines are incredibly expensive to produce and require highly specialized knowledge to operate. This means that ASML is heavily reliant on a small pool of skilled workers and any disruptions to this workforce could potentially impact its ability to manufacture and service its machines.

ESG

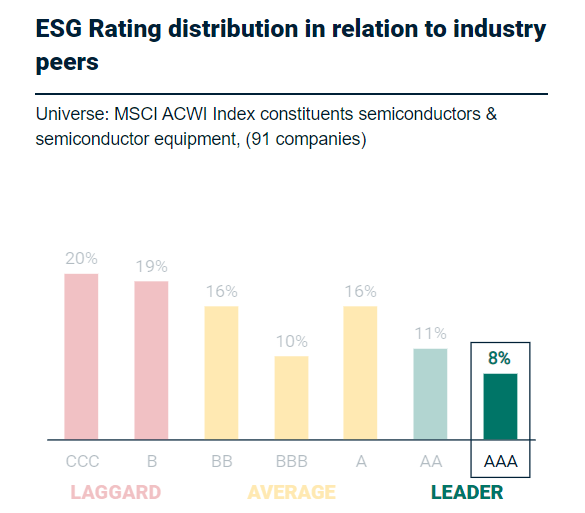

With an outstanding MSCI ESG rating of AAA, ASML is a leader in the semiconductor industry and receives the highest possible rating.

MSCI

They are virtually flawless in all aspects of ESG, being involved in no major controversies with respect to environmental, human rights, supply chain, or governance areas. They are also considered to be aligned with the UN Sustainable Development Goals in the categories of gender equality, clean water and sanitation, affordable and clean energy, reduced inequalities, responsible consumption and production, and climate action. This underscores how the company goes above and beyond to not only be highly profitable, but very socially responsible, indicating well-functioning management.

Conclusion

Though ASML is exposed to risks such as its dependency on a small number of key customers and geopolitical tensions, these potential challenges can be mitigated by the company’s innovative prowess. Its relentless drive for technological advancement, coupled with an excellent ESG rating, underscores ASML’s commitment to responsible and sustainable business practices. As such, ASML not only stands out as a highly profitable entity but also as a socially responsible one. With a projected 5-year target price that widely outperforms the S&P 500’s average yearly return, ASML offers a compelling investment case and thus is well deserving of a “Strong Buy” rating.

Analyst recommendation by: Vayun Chugh

Read the full article here