Amid skyrocketing interest rates and continued market volatility, it’s no big secret that investors’ risk appetite has sharply waned. The market is no longer willing to gobble up pie-in-the-sky growth stories and is particularly retreating on the social media stocks that were among the hottest trades of 2021.

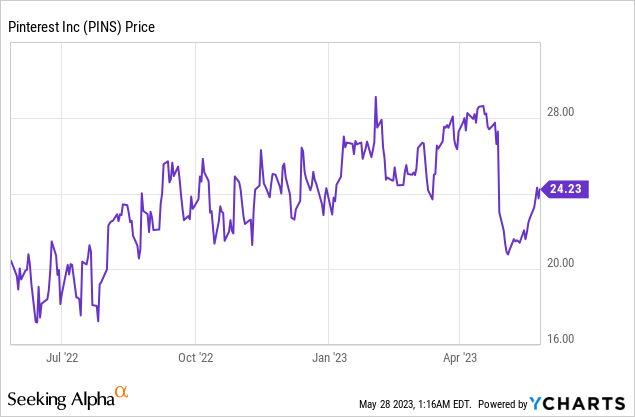

Look no further than Pinterest (NYSE:PINS) to ascertain the damage. The stock is down by nearly three-quarters versus 2021 peaks above $80. And so far this year, all we’ve seen is a crumbling of user trends alongside a persistent rising of costs.

The question for investors now is: does Pinterest have what it takes to stage a rebound? In my view, the answer is no, and I remain ardently bearish on this name.

Here, in my view, are the biggest red flags to watch out for with Pinterest:

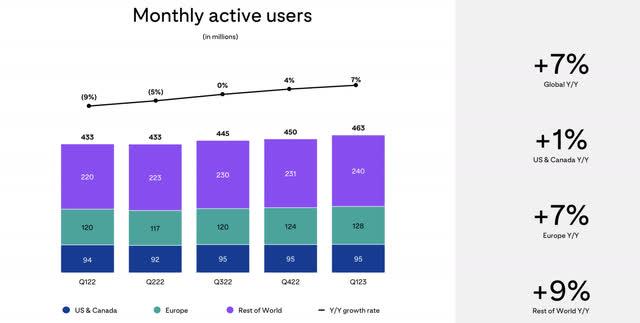

- Pinterest’s core user base is not seeing growth. Pinterest generates the majority of its revenue (just like any other social media company) in the U.S. Unfortunately, user growth domestically has been stagnant for several quarters, which is a reflection of Pinterest’s high penetration within its target audience plus the rampant competition among social media apps in the U.S.

- Competition is fierce. Needless to say, there are many social media applications competing for users’ time. And in particular, as Facebook/Instagram (META) hone in on their Marketplace functionalities, Pinterest’s niche as a shopping-oriented site may be threatened.

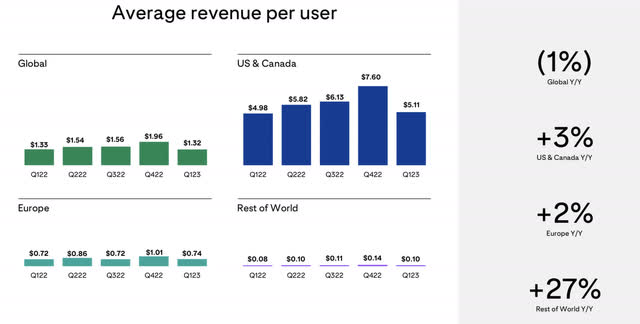

- ARPU is no longer a revenue tailwind. Social media companies that have run out of the user growth lever typically can lean on increased ad load to chase revenue growth. But in this climate, with advertisers pulling back, Pinterest’s chances of meaningfully resuscitating its ad revenue stream are also under fire.

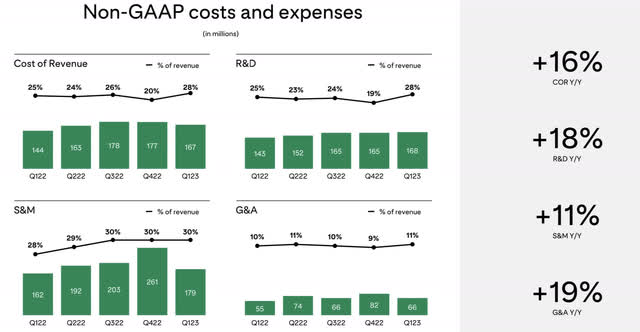

- Stubbornly high cost structure. In spite of just single-digit revenue growth, Pinterest is still seeing costs grow at a double-digit pace, which is sinking its adjusted EBITDA.

It’s worth noting as well that expectations remain lofty for Pinterest. Wall Street consensus is calling for Pinterest to generate 7% y/y revenue growth in FY23 (data from Yahoo Finance), despite hitting only 5% y/y growth in Q1. Unless you’re banking on a meaningful advertising demand rebound in the back half of the year, or a sudden surge of new U.S. users to the Pinterest app (both of which I find very unlikely), I think Pinterest will have a tough time not disappointing investors throughout the balance of this year.

The social media landscape is a graveyard of applications that were once popular and have long passed their heyday. Pinterest, in my view, is very much at risk of heading in this direction, which I find to be clearly spelled out by its stagnant domestic user base.

The bottom line here: this is not a stock to bank on in 2023. Stay on the sidelines here and invest elsewhere.

Q1 download

Let’s now go through Pinterest’s latest Q1 results in greater detail, starting with the company’s latest user trends.

Pinterest user trends (Pinterest Q1 earnings deck)

As shown in the chart below, global MAUs (monthly active users) grew 7% y/y. But in the U.S. and Canada, users stayed flat both sequentially and year over year at 95 million users.

Due to this mix change in users, Pinterest’s overall ARPU (average revenue per user) declined -1% y/y to $1.32. You can see in the chart below that users in the “Rest of World” (which contributed to 11 million of the company’s net 13 billion MAU adds in the quarter) generate substantially lower ARPU at $0.10 per user versus a U.S./Canada user at $5.11.

Pinterest ARPU (Pinterest Q1 earnings deck)

This is the very core of Pinterest’s problem: in the U.S., where Pinterest generates substantially all of its revenue, it has no more user growth levers to pull, while ad ARPU is under pressure due to the current macro climate. It’s good that Pinterest is adding users in the rest of the world, but monetization here is so low that even the slightest stumble in U.S. users would be enough to topple it.

Here’s some anecdotal commentary on user trends from CEO Bill Ready’s remarks on the Q1 earnings call:

We continue to make good headway in adding new users, especially Gen Z users who grew double digits and continue to be our fastest growing demographic on the platform. Gen Z users are finding value in our positive and inspirational platform and are engaging with the full breadth of content including video.

During the quarter, our video content on the platform grew nearly 40% quarter-over-quarter on top of the 30% sequential growth we drove in Q4. Furthermore, in March, we announced a new publisher deal with Dotdash Meredith, one of the largest publishers in America to bring video content to the platform across lifestyle, fashion, and food categories with brands including better homes and gardens, brides, food and wine, and all recipes.“

In spite of these top-line challenges that produced only 5% y/y revenue growth, Pinterest still grew each category of its expenses by double digits – particularly 19% y/y growth in G&A spend, which I consider to be the “least productive” category of corporate opex and something that most other companies are trying to slim down at the moment.

Pinterest cost trends (Pinterest Q1 earnings deck)

Earlier this year, Pinterest did announce 150 layoffs, representing 4% of its workforce. It’s unclear, however, if the magnitude of this action will be enough to offset the company’s natural cost growth.

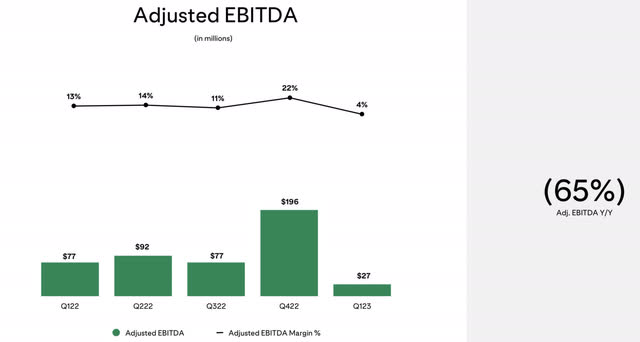

As a result of cost growth far outstripping revenue growth, note that Pinterest’s adjusted EBITDA declined -65% y/y to $27 million, representing just a 4% margin less than a third of the year-ago Q4’s margin of 13%.

Pinterest adjusted EBITDA (Pinterest Q1 earnings deck)

Key takeaways

To me, Pinterest remains a land mine of potential risks: slowdown in user growth, ARPU contraction driven by both macro headwinds as well as a more unfavorable user mix, and EBITDA contraction driven by an explosion of cost. Stay on the sidelines here; this is not a rebound play worth banking on.

Read the full article here