Although I have a really solid track record in the market, I do sometimes misjudge an opportunity. One really good example of this can be seen by looking at Rayonier (NYSE:RYN), a REIT that manages timberland. In general, I have found that I am sometimes too optimistic about the pricing of REITs because of their track record for consistent and growing cash flows. But when market conditions are changing, these companies can sometimes be impacted just as much as any other firm. Recently, financial performance achieved by Rayonier has been rather disappointing. Revenue and cash flows are all declining because of weakness that seems to have been driven largely by construction markets. More likely than not, this picture will actually worsen from here. And with shares of the company still looking anything but cheap, and in spite of the stock already falling materially in recent months, I do think that further downside is probably on the table. As such, I have decided to decrease my rating on the company from a ‘hold’ to a soft ‘sell’.

Difficult times

In August of last year, I wrote an article that took a rather neutral stance on Rayonier. In that article, I talked about how well the company had outperformed the broader market in the months leading up to that point. This outperformance came even as fundamental data came in rather mixed for the company. Higher costs, as well as changing market conditions, negatively impacted the business. But even so, I ended up rating the company a ‘hold’ to reflect my view that shares should generate performance that would be more or less in line with the broader market moving forward. Since then, things have not gone exactly as planned. While the S&P 500 is up 5.1% since the publication of that article, shares of the company have seen a decline of 16.4%.

Author – SEC EDGAR Data

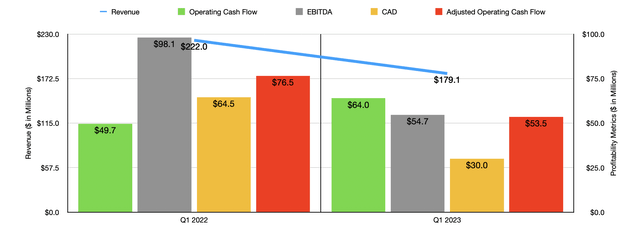

You would think that I would consider upgrading the company after such a substantial decline. Normally, this would be the case. However, Recent fundamental weakness has me worried. Consider how the company performed during the first quarter of its 2023 fiscal year. Revenue for that time came in at $179.1 million. That’s down 19.3% compared to the $222 million reported one year earlier. Management reported weakness almost entirely across the board.

Even though the company saw sales volume for the wood from the Southern Timber segment dip down only slightly from just under 1.90 million tons to 1.89 million tons, a fall in pricing negatively affected the company. The weighted average total of pricing dropped from $27.94 per ton to $24.03 per ton. Under the much smaller Pacific Northwest Timber segment, sales volume plummeted 24% from 505,000 tons to 384,000 tons, while pricing fell 7.5% from $95.35 per ton to $88.17 per ton. And under its New Zealand Timber segment, volume fell 6.6% from 515,000 tons to 481,000 tons, while pricing dropped 5.8% from $96.59 per ton to $90.99 per ton.

Even more painful than these operations was the Real Estate portion of the company, with revenue plummeting from $34.2 million to $16.3 million. This drop, according to management, largely resulted from a sizable decline In rural land sales from $16.9 million to $6.5 million as the number of acres sold dropped 67.8%. And when it came to timberland and non-strategic sales, revenue plunged from $11.4 million to $1.6 million thanks to an 86.7% decline in acres sold.

Author – SEC EDGAR Data

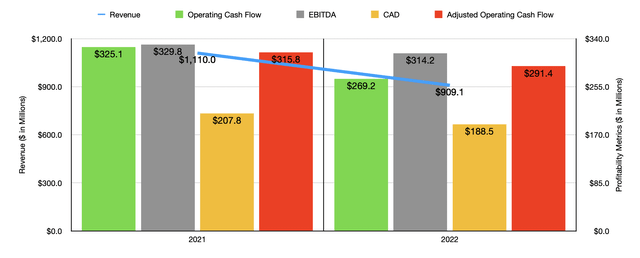

On the bottom line, the picture for the company was definitely mixed. As an example, operating cash flow managed to increase from $49.7 million to $64 million. But all other profitability metrics for the company worsened during this time. For instance, if we adjust for changes in working capital, we would have seen cash flow fall from $76.5 million to $53.5 million. Cash available for distribution, also known as CAD, fell from $64.5 million to $30 million. And finally, EBITDA for the business dropped from $98.1 million to $54.7 million. As you can see in the chart above, the first quarter of 2023 was not the only time of pain that the company experienced. For 2022 as a whole, the picture ended up being worse than 2021 was.

I don’t mind buying stock of companies that are being hit fundamentally when the company in question is trading at a level that’s cheap enough to justify the pain. But that is not the case here in my opinion. For the current fiscal year, management expects EBITDA to be between $280 million and $320 million. Taking the midpoint here and making some adjustments, we could expect adjusted operating cash flow of around $278.2 million. These numbers compare unfavorably to the $314.2 million and the $291.4 million, respectively, that we get from 2022. A similar approach would give us CAD of $179.7 million compared to the $188.5 million that the company got last year.

Author – SEC EDGAR Data

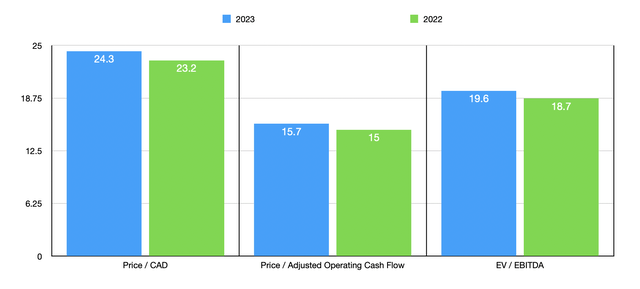

As you can see in the chart above, shares of the business are trading at a forward price to CAD multiple of 24.3. The forward price to adjusted operating cash flow multiple would be 15.7, while the forward EV to EBITDA multiple would come in at 19.6. As the chart above illustrates, the numbers are higher than what we would get using data from 2022. In the table below, I compared the company to two similar firms. On a price to operating cash flow basis and on an EV to EBITDA basis, Rayonier ended up being the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Rayonier | 15.7 | 19.6 |

| Weyerhaeuser (WY) | 10.4 | 11.2 |

| PotlatchDeltic Corporation (PCH) | 11.5 | 12.4 |

Takeaway

In another article that I wrote not too long ago, I discussed the problems facing the residential construction market. I do believe that situation will worsen before it gets better. As such, I think that additional pain is likely around the corner for Rayonier and companies like it. If shares of the company were trading on the cheap, I would consider taking a more bullish stance. But with how pricey the stock is and when factoring in what is around the corner, I do think a bearish approach is not unwarranted. So for now, I’ve decided to downgrade the business from a ‘hold’ to a ‘sell’ even though RYN stock has already fallen quite significantly.

Read the full article here