ATRenew (NYSE:RERE) stock is a great buy for growth-oriented investors – the company’s sales are rising fast, whilst the stock price has not risen by much. The net results have also improved, whilst the management has cut some of the costs. The outlook is also good, whilst ATRenew is not just expanding its consumer electronics division, it is also improving its product mix, especially its second-hand luxury goods range.

ATRenew’s quarterly earnings

ATRenew has just reported its 1Q 2023 earnings results and there was a substantial improvement compared to the same period a year ago. Earlier on I wrote an article about ATRenew and its 2022 financial report where the company reported a sound sales improvement. In the 1Q 2023, there are many more positive highlights. But let me talk about them in some more detail in this article.

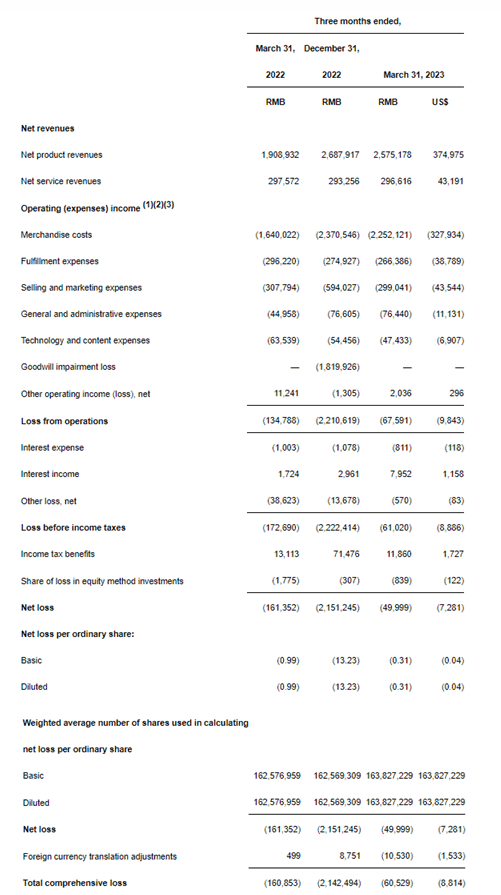

In short, ATRenew reported the following results. Here is an excerpt from the company’s earnings press release. I have highlighted the key figures.

- Total net revenues grew by 30.2% to RMB2,871.8 million (US$418.2 million) from RMB2,206.5 million in the first quarter of 2022.

- Operating costs and expenses were RMB2,941.4 million (US$428.3 million), compared to RMB2,352.5 million in the same period of 2022, representing an increase of 25.0%.

- Loss from operations was RMB67.6 million (US$9.8 million), compared to RMB134.8 million in the first quarter of 2022. Adjusted income from operations (non-GAAP) was RMB44.4 million (US$6.5 million), compared to RMB3.9 million in the first quarter of 2022.

The only negative piece of news I see here is the fact the operating costs and expenses increased somewhat compared to the same period a year ago. That is mainly because of the rise in sales. This made the merchandise costs rise by 37.3%, thus pushing the total operating costs upwards. Still, there were some improvements in the company’s efficiency. For example, the fulfillment expenses dropped by 10.1% to RMB266.4 million, the selling and marketing expenses fell by 2.9% to RMB299.0 million, whilst the non-GAAP technology and content expenses dropped by 26.3% totaling RMB42.3 million. So, in some respects, the company even cut its costs. Of particular importance to the company’s cost-cutting program are its automation technologies and the use of artificial intelligence.

On an even more positive side, the total net revenues figure surged by over 30%. Such a substantial rise was due to an increase in the sales of pre-owned consumer electronics through the company’s online and offline channels.

The loss from operations decreased by about 50%, whilst the non-GAAP operating income jumped more than 10 times compared to 1Q 2022. The reason why ATRenew’s operating loss decreased by so much is because of the scale effects facilitated by automation inspection upgrades and improved cost efficiencies in sales and marketing.

(Amounts in thousands, except share and per share and otherwise noted)

ATRenew

The net loss reported for the March 2023 quarter was substantially below the figures reported for December 2022 and the March 2022 quarters respectively. Some investors might indeed wonder why a successful company reported a net loss. The reason why ATRenew reported a net loss for 1Q 2023 was because of the higher merchandise expenses. These totaled RMB2,252 million compared to RMB1,640 million for the same period a year ago. That is an RMB612 million rise. Without that rise, ATRenew’s net income would have totaled a whopping RMB562 million. And the company is working hard to further optimize its cost structure.

But let us see the earnings and sales trend considering the last set of results.

|

RERE quarterly earnings (in million RMB) |

|||||||||

|

Time period |

Q1 21 |

Q2 21 |

Q3 21 |

Q4 21 |

1Q 22 |

2Q 22 |

3Q 22 |

4Q 22 |

1Q 23 |

|

Revenue |

1514 |

1868 |

1962 |

2436 |

2207 |

2146 |

2536 |

2981 |

2872 |

|

GAAP net profit |

-95 |

-506 |

-122 |

-104 |

-161 |

-125 |

-30 |

-2151 |

-50 |

|

Non-GAAP net profit |

-36 |

-60 |

-23 |

-50 |

-36 |

-13 |

77 |

22 |

50 |

Source: Prepared by the author based on ATRenew’s data

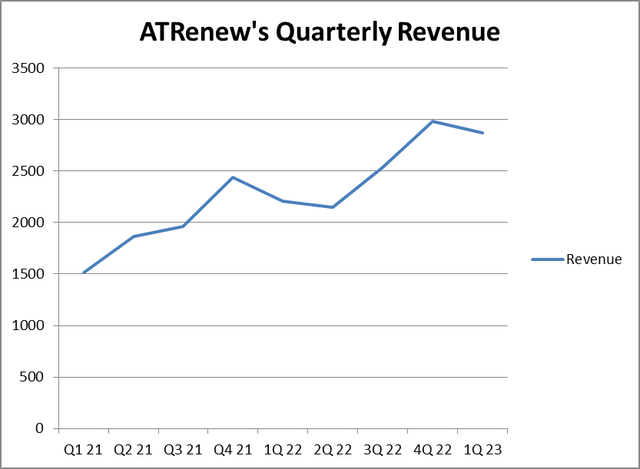

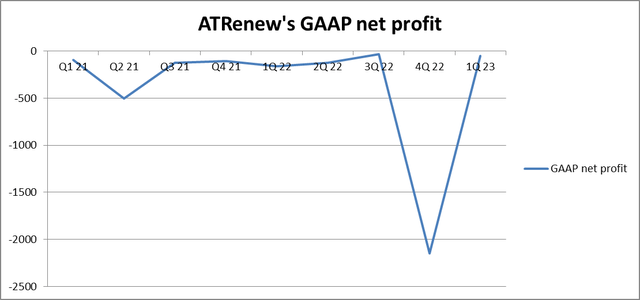

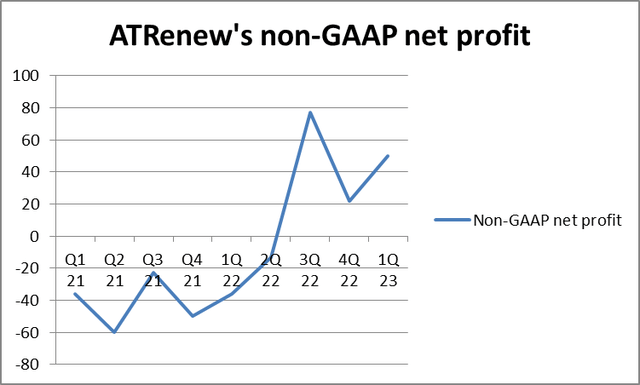

If we see the data above, we can clearly notice that ATRenew’s results are improving overall. As I have mentioned in my previous article, the high 4Q 2022 net loss was due to a large impairment in intangible assets. This did not affect ATRenew’s business operations. But overall ATRenew’s sales are rising, whilst its income figures are improving. This can be well illustrated by the diagrams below.

Prepared by the author based on ATRenew’s data

The quarterly revenue trend is the most promising, in my view.

Prepared by the author based on ATRenew’s data

The company’s GAAP net profit trend is not so obvious. But I have already explained the reasons for the 4Q2022 plunge above.

Prepared by the author based on ATRenew’s data

But ATRenew’s non-GAAP net profit history suggests the non-GAAP profits are rapidly improving.

Other developments and the management’s outlook

Now a couple of words about the management’s 2Q 2023 outlook and some of ATRenew’s business highlights.

ATRenew’s store expansion is rising. As of 1Q 2023, the company’s 1935 offline stores are based in 269 cities. These stores are the company’s main priority. The company is expanding in other segments, not just electronics. Gold recycling, for example, has achieved good growth.

Further store expansion will be a big plus for ATRenew as it will mean further sales growth. But the most important factor for ATRenew is its ability to cut costs. If the management further automates its working processes, including recycling and quality inspection, it will be an even bigger plus for its financials.

ATRenew is improving its product mix, which includes luxury goods, gold, and prestige liquor. The company’s partnership with JD.com will also enhance ATRenew’s online-offline capabilities. The company’s monthly GMV for non-electronics new category recycling has now exceeded RMB70 million. It might not sound like much, given ATRenew’s scale. But it is the company’s non-core division that has only been recently launched.

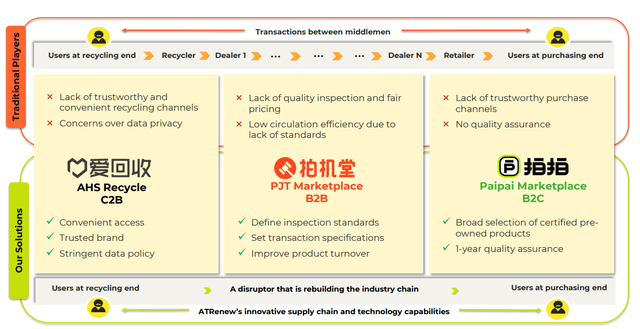

ATRenew competes with traditional sellers of second-hand goods. But ATRenew has an advantage over them thanks to the fact it is a high-tech company. Due to this fact, ATRenew offers better recycling opportunities, better quality inspection, and trustworthy purchase channels.

ATRenew’s earnings presentation

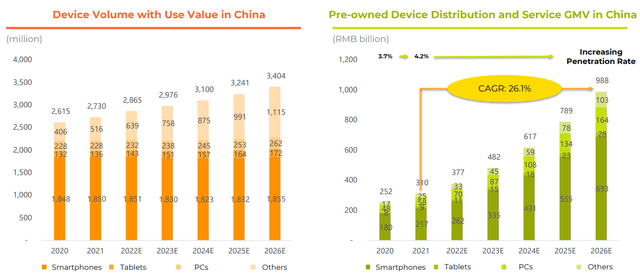

The company also has plenty of growth potential thanks to the fact the demand for consumer electronics in China is growing. But the demand for pre-owned electronics is growing even faster. This can be seen from the diagram below.

ATRenew’s earnings presentation

For 2Q 2023, ATRenew expects its total revenues to total between RMB2,850.0 million and RMB2,950.0 million. Of course, this depends on the operational conditions, which are subject to change.

The company confirmed its intent to continue to repurchase its stock. Just a quick reminder that in December 2022, ATRenew announced an extension of its stock buyback program under which the company may repurchase up to US$100 million in shares over one year’s time. This means the company has plenty of cash so it can afford to do so.

Risks

Overall, ATRenew is doing well, whilst its recent earnings results show the company is enjoying many improvements. However, RERE stock is not a classical buy for a conservative value investor simply because the company is not recording GAAP net profits just yet and does not pay dividends. Still, it has stable cash flows. Its financial position is quite stable, whilst the stock is cheap.

So, many risks are quite general. Namely, the company is based in China but listed in the US. Some investors might worry about the delisting threat as the US-China relations are getting more tense. However, ATRenew is not currently on the list of Chinese companies to be delisted. Moreover, the company’s operations and also its customers are based in China. So, the US-China relations are not much of a problem.

In my view, the company is also quite resistant to economic downturns since it sells inferior goods. Yes, the post-Covid reopening in China was a big positive for ATRenew. However, the company is reselling second-hand goods, not luxurious items. That is why the next recession might not be a big risk to ATRenew.

Valuations

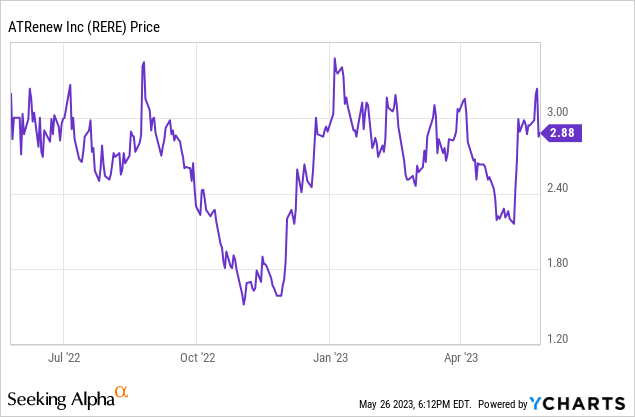

Although ATRenew’s stock is trading near its 52-week highs, RERE is well below its IPO price of around $15 per share. But it is not enough to say the stock is undervalued. Other indicators also suggest the stock’s undervaluation.

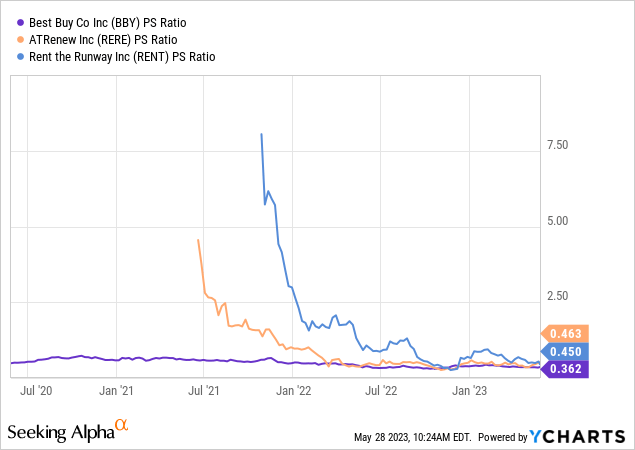

ATRenew’s price-to-sales (P/S) ratio is also quite low, currently lingering at less than 0.50. It used to be much higher 1 or 2 years ago. I decided to compare this indicator to two of ATRenew’s competitors, namely Best Buy (BBY), specializing in reselling consumer electronics, and Rent the Runway (RENT), reselling clothes. ATRenew’s P/S is only slightly above these two.

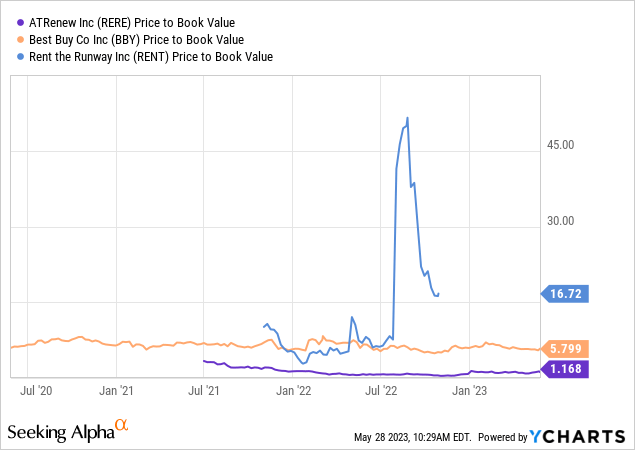

ATRenew’s price-to-book (P/B) ratio is just over 1. Generally, it is considered to be reasonable for a company to have a P/B of 1 to 3. But RERE’s P/B is substantially lower than these of its competitors. This can be seen from the diagram below.

So, we can say RERE stock is good value for money.

Conclusion

Overall, the ATRenew reported an excellent set of results. The stock is still quite cheap. The risks are general although I believe RERE stock is a better buy for growth investors. The business ATRenew operates in is growing, whilst the management is putting in some real effort to further improve the company’s financial performance.

Read the full article here