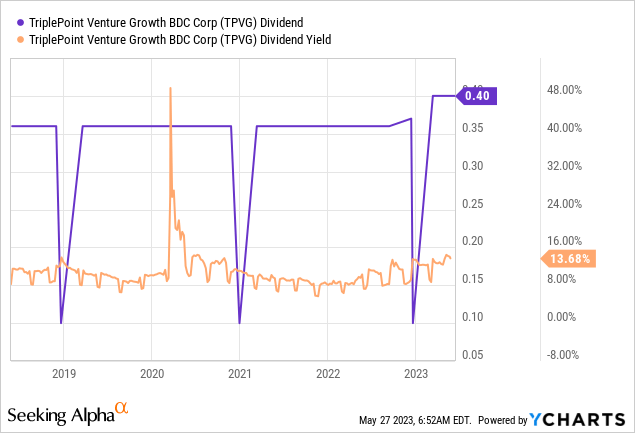

TriplePoint Venture Growth (NYSE:TPVG) last declared a quarterly cash dividend of $0.40 per share, in line with the prior payout and for a 14.7% forward yield. The prior payout had previously been raised a huge 8% with the venture-focused BDC retaining spillover income of $27 million, $0.70 per share, as at the end of its fiscal 2023 first quarter. Are the commons a buy? Yes. TriplePoint is now down 25% over the last year, currently trades on a price-to-forward GAAP earnings ratio of 5.64x, and fully covers its dividends in spite of some recent non-accruals.

TriplePoint’s dividend trendline chart looks disrupted due to the occasional supplemental dividends paid out, the regular quarterly pay-outs have been stable and on an upward trend since the externally managed BDC went public in 2014 with a $0.30 per share quarterly payout. The growth of this payout and an expansion of net asset value from the core drivers of positive return and the 8% early 2023 dividend raise was a positive signal that the underlying venture loan portfolio has benefited from the current rising interest rate environment. Critically, the forward dividend yield at 14.7% now forms a multi-year high and would represent a rare abnormally high yield on a tech-focused venture loan portfolio.

Net Asset Value And Non-Accruals

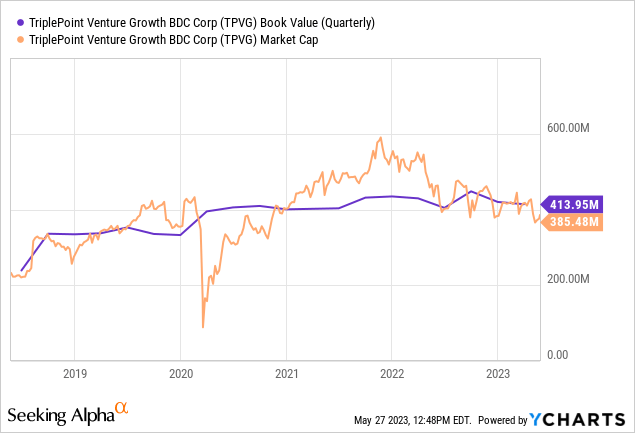

The $385 million market cap BDC targets returns of 10% to 18% on its debt investments from interest and fees. It targets loans to technology and high-growth companies backed by venture capital firms. The BDC is managed for a 1.75% base fee charged on average adjusted gross assets and an income incentive fee equal to 20% of TriplePoint’s pre-incentive fee net investment income above an 8% annualized hurdle rate. The portfolio at fair value was $983 million as of the end of the first quarter and consisted of 59 funded borrowers, warrants in 107 portfolio companies, and equity investments in another 48 portfolio companies at a total cost of $1.004 billion.

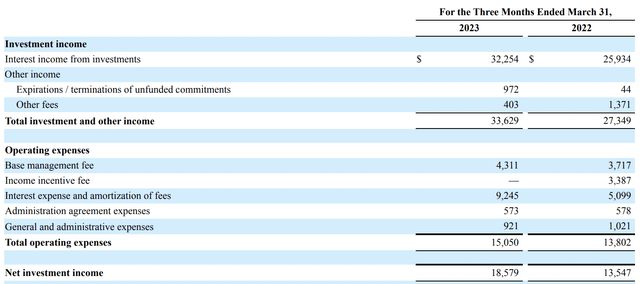

TriplePoint Venture Growth 10-Q

Total investment and other income came in at $33.6 million, up by 22.96% from the year-ago comp but a small miss by $810,000 on consensus estimates. The BDC funded $57.6 million in debt investments to 11 portfolio companies during the first quarter. This was at a weighted average annualized yield of 14.1% and with around half of the funded portfolio companies during the quarter generating annual revenues in excess of $100 million. The BDC did not pay an income incentive fee during the quarter, reflecting a management clause where incentive fees are capped at 20% of its cumulative net increase in net assets resulting from operations since its IPO date.

Non-accrual investments as of the end of the first quarter were $77.1 million at total cost and $45.7 million at fair value. This was 5.1% of debt at fair value and was set against a net investment income of $18.6 million as of the end of the quarter. This was around $0.53 per share, up $0.09 from $0.44 in the year-ago comp. The BDC’s net asset value was $414 million, around $11.69 per share but down 15.5% from $13.84 per share in the year-ago quarter. Whilst NAV has been trending down over the last year, it is not far removed from its long-term trendline. Indeed, NAV is still broadly up versus the pre-2022 figures.

The Dividend Is Safe

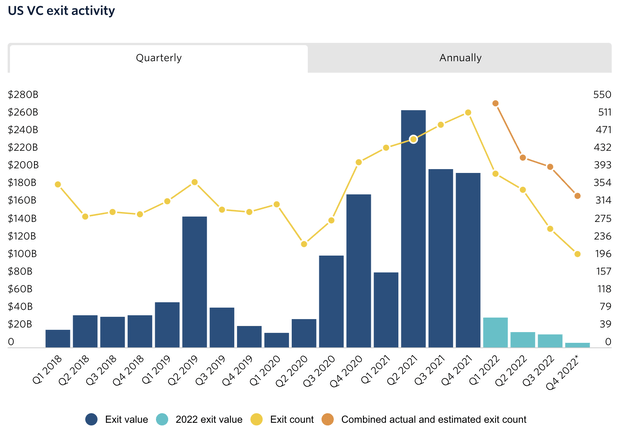

TriplePoint’s payout ratio against first-quarter net investment income per share stands at 75.5%, a level that not only infers a strong level of safety but opens up the possibility of another dividend raise before the end of the year. This comes as VC exit activity has fully dried up against the current macroeconomic backdrop of rapidly rising interest rates, high inflation, and the specter of a recession. Exits fell to their lowest level in more than 5 years as of the fourth quarter of 2022. Crucially, this restricts the overall amount of funding going into the venture companies and VCs will be less able to reinvest into follow-on offerings of their portfolio companies.

PitchBook Data

The current environment increases the likelihood of non-accruals and has forced BDCs like TriplePoint to be more selective with their underwriting. Funded debt investments for the first quarter fell sequentially from $95 million in the fourth quarter and was also down from its year-ago comp. The dividend is safe at its current level and the marked decline in the commons has opened up a 6.8% discount to book value. However, this discount runs the risk of being a premium at some point in 2023 against a book value still declining and against the current stock price. I’m a fan of the fully covered yield here though and would rate the commons as a buy.

Read the full article here