DTE Energy Company (NYSE:DTE) has demonstrated sustained growth and prosperity over numerous decades, making it a compelling investment opportunity. With a strong dividend, strategic implementation of grid modernization to enhance margins, and a slight undervaluation based on my DCF analysis, I believe the company presents a favorable buying prospect.

Business Overview

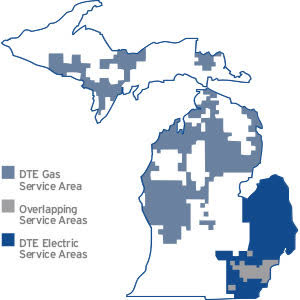

DTE Energy is a utility company involved in electricity generation, distribution, and sales. Its Electric segment serves approximately 2.3 million customers in southeastern Michigan, utilizing various energy sources such as fossil fuels, hydroelectricity, nuclear power, and renewable assets like wind and solar. The segment operates numerous distribution substations and line transformers.

The company’s Gas segment purchases, stores, transports and sells natural gas to around 1.3 million customers throughout Michigan. It maintains an extensive network of distribution mains, service pipelines, meters, and transmission pipelines.

DTE Energy’s DTE Vantage segment provides metallurgical and petroleum coke to industries, along with power, steam, chilled water production, wastewater treatment services, and compressed air supply to industrial customers.

In addition, the company’s Energy Trading segment engages in marketing and trading of power, natural gas, and environmental products, including structured transactions and optimization of natural gas pipeline transportation and storage positions.

DTE Service Map (Company Website)

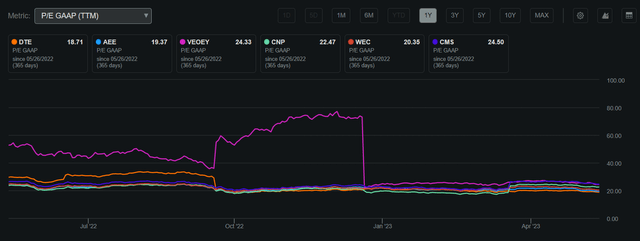

DTE Energy, with a market capitalization of $21.953 billion, has experienced a 52-week high of $136.77 and a low of $100.64. Currently trading at $106.51, the stock is approaching its annual lows. The price-to-earnings ratio of 18.71 suggests a relatively lower valuation compared to similar peers, indicating potential value.

DTE P/E GAAP Compared to Peers (Seeking Alpha)

DTE currently offers a dividend yield of 3.56%, with a payout ratio of 65.16%. This dividend not only serves as a reward for shareholders but also provides DTE with the means to invest in the expansion and improvement of its grid infrastructure with remaining FCF.

Seeking Alpha

In the first quarter of 2023, DTE delivered mixed performance, with earnings per share beating expectations by $0.03 at $1.33, while revenues missed projections by $1.12 billion, at $3.78 billion, a notable decrease of 17.4% compared to the previous year. With such declines in revenues, it demonstrates that DTE must create a strategy that limits cyclicality while maintaining profitability.

DTE Energy also reaffirmed the 2023 operating EPS guidance of $6.09 – $6.40. With 2022 EPS at $5.52, this increase demonstrates the company’s ability to expand profitability and hedge against headwinds even while losing revenues due to cyclical downturns.

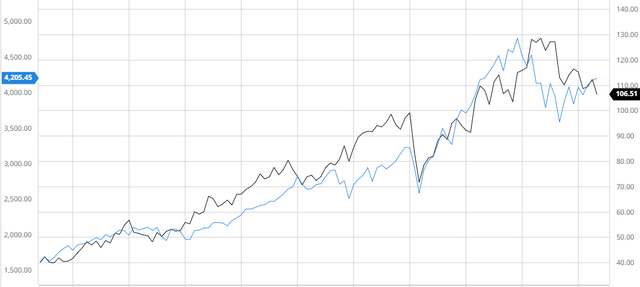

Performance in Comparison to the Broader Market

DTE has shown consistent performance on par with the broader market over the past decade, even when considering dividends. This highlights the company’s capacity to grow and deliver value to shareholders, affirming the enduring nature of investing in DTE.

DTE Compared to the Broader Market 10Y (Created by Author Using Bar Charts)

Grid Modernization Fostering Growth

DTE Energy is reaping numerous benefits from grid modernization and infrastructure investment, notably in terms of improving the dependability, efficiency, and sustainability of its energy distribution system. DTE Energy can satisfy its customers’ changing energy needs, incorporate renewable energy sources, and enhance grid performance by updating and modernizing the grid infrastructure.

DTE Energy’s commitment to the southern Michigan region serves as one specific illustration of its grid upgrading initiatives. To improve the capacities of the grid and offer improved services to its customers in this area, DTE Energy is actively undertaking infrastructure modifications and installing cutting-edge technologies.

DTE Energy has been spending money in Southeast Michigan to construct smart meters, which is referred to as advanced metering infrastructure. These meters allow for two-way communication between the utility and the consumer, facilitating the exchange of data in real time and enhancing the monitoring of energy consumption. Smart meters give users access to extensive data about their energy usage, which enables DTE to compete well with its rivals. DTE Energy is also able to remotely monitor energy flows thanks to this technology, promptly identify disruptions, and react more quickly to consumer needs.

Additionally, DTE Energy has been vigorously implementing grid automation and control technologies in the Southeast Michigan region. These technologies track the grid’s performance in real-time using cutting-edge sensors, communication networks, and analytics. DTE Energy can prevent power outages, minimize downtime, and raise the overall dependability of the electrical power supply by anticipating problems and enhancing grid operations.

The infrastructure in the area is also being strengthened as part of DTE Energy’s grid modernization initiatives in the area to allow for the incorporation of renewable energy sources. Managing the increased power from renewable energy systems like wind and solar power includes updating the distribution and transmission lines, adding additional substations, and increasing the total grid capacity.

I am confident that DTE’s strategic investments in infrastructure will enhance the reliability of the grid, resulting in more stable cash flows and increased free cash flow. Moreover, the reduced outage durations will contribute to margin expansion, positively impacting DTE’s overall business performance and the generation of free cash flow. As a result, the company will be well-positioned to achieve accelerated growth by reinvesting the newfound free cash flow into its core business or alternatively, provide greater value to shareholders by increasing dividends. This approach will create long-term value for shareholders and enable the company to thrive at an accelerated pace.

DTE Energy

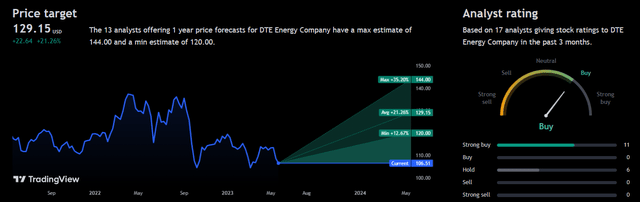

Analyst Consensus

DTE Energy has received a “buy” rating from analysts, aligning with my own perspective on its long-term growth potential. The average 1-year price target of $129.15 suggests a potential upside of 21.26%, further supporting the positive outlook for DTE Energy.

Trading View

Valuation

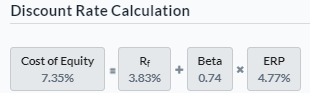

Before formulating my assumptions, I calculated a suitable discount rate for DTE using the Capital Asset Pricing Model approach. By incorporating a risk-free rate of 3.83% based on 10Y treasury yields, I arrived at a Cost of Equity of 7.35%.

Created by author using Alpha Spread

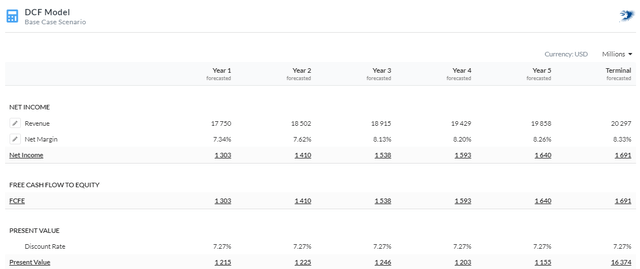

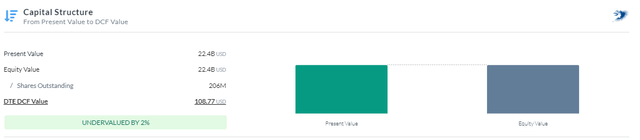

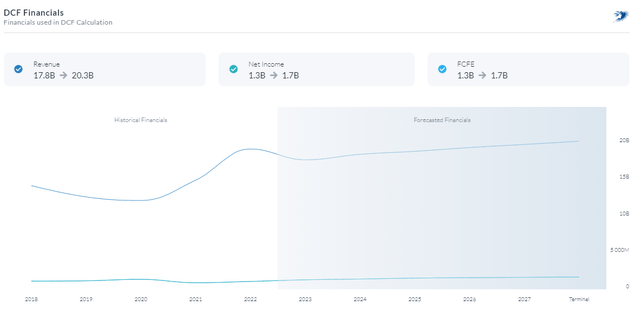

After conducting an Equity Model DCF analysis using net income, it has been determined that DTE is presently undervalued by approximately 2%. This indicates a fair value estimation of around $108.77. The valuation was derived by applying a discount rate of 7.27% over a span of 5 years. Moreover, the analysis took into account the company’s projected revenue growth rate in the low to mid-single digits beyond 2023, which aligns with their own forecasts. Additionally, the anticipated enhancement in margins resulting from grid improvements was also factored into the valuation.

5Y Equity Model DCF Using Net Income (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Risks

Regulatory and Legislative Changes: The business in which DTE Energy works is highly regulated. Changes in federal, state, or municipal energy laws, regulations, or policies may have an effect on business operations, expenses, and profitability.

Volatility in Energy Markets: Energy price fluctuations, particularly those for electricity and natural gas, can have an effect on DTE Energy’s bottom line. The company’s revenue and profitability may be impacted by variables like shifts in supply and demand dynamics, geopolitical developments, and volatility in commodity prices.

Conclusion

To summarize, I believe that DTE Energy is currently a buy due to its solid dividend, grid modernization initiatives creating margin expansion, and slight undervaluation assuming my DCF figures.

Read the full article here