The oncology landscape is evolving at an astonishing pace, offering groundbreaking therapies and hope for patients diagnosed with cancer. In the midst of this innovation-driven market, Exelixis (NASDAQ:EXEL) stands out as an investment gem with the potential to revolutionize cancer treatments. This article aims to provide a unique and original analysis of Exelixis as an actionable and direct investment opportunity, taking into consideration the company’s robust financial growth, innovative product portfolio, and promising pipeline for the future.

Our conviction in Exelixis as an investment opportunity is strengthened by its outstanding financial performance, continually expanding revenues and meticulous cost management that contributes to its profitability. As the company continues to invest in research and development (R&D), alongside sales and marketing efforts, we expect Exelixis to thrive in the years to come.

Financials Facilitate Growth

Exelixis is on an outstanding growth path, as demonstrated by its Q1 2023 financial results. The company’s total revenues for the quarter reached $408.8 million, a notable increase from $356.0 million during the same period in 2022. This is a solid sign that Exelixis is consistently broadening its business activities, a fact that should appeal to investors.

Looking further into the figures, net product revenues paint a picture of a company that is effectively boosting its sales volume and raising its average net selling price. With $363.4 million in net product revenues for Q1 2023, compared to $310.3 million in the same period in 2022, the company showcases effective distribution and marketing approaches.

While collaboration revenues saw a minor dip from $45.7 million in 2022 to $45.4 million in Q1 2023, higher royalty revenues from Exelixis’ collaboration partners, Ipsen Pharma SAS (OTCPK:IPSEY) and Takeda Pharmaceutical (TAK) Company Limited, reveal that the company’s international partnerships are yielding results.

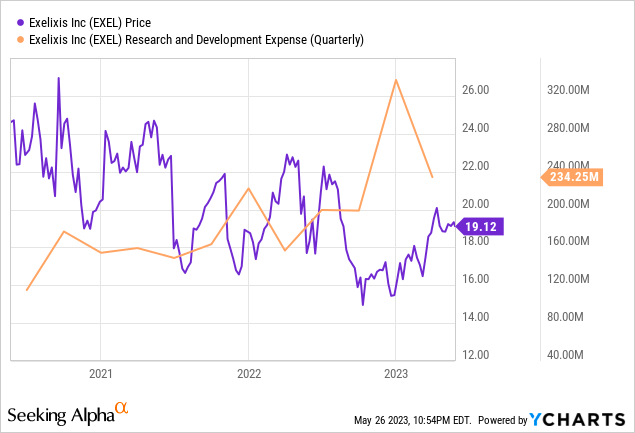

Exelixis is making substantial investments in its future, with research and development costs of $234.2 million, a considerable climb from $156.7 million during the same timeframe in 2022. This indicates the company’s dedication to its mission and innovation, ultimately aiming to supply valuable products to its customers and stimulate growth.

A rise in selling, general, and administrative expenses, at $131.4 million compared to $102.9 million in the same period in 2022, is the result of an increase in personnel costs, highlighting the company’s investment in its workforce to guarantee quality.

ycharts.com

The company’s assurance to maintain its financial projections for the fiscal year 2023, with total revenues ranging from $1.775 to $1.875 billion and net product revenues between $1.575 and $1.675 billion, demonstrates Exelixis’ steadfast confidence in its growth prospects.

A Leader in Oncology Products

In 2023, Exelixis is flourishing with a collection of three products on the market, such as Cabometyx (cabozantinib), which is primarily used to treat advanced renal cell carcinoma and hepatocellular carcinoma. It functions as an inhibitor for various receptor tyrosine kinases. Cometriq (cabozantinib) shares the same active component as Cabometyx, but is intended for different cancer types. Together with Genentech, a Roche Group (OTCQX:RHHBY) affiliate, Exelixis promotes Cotellic , a cobimetinib formulation.

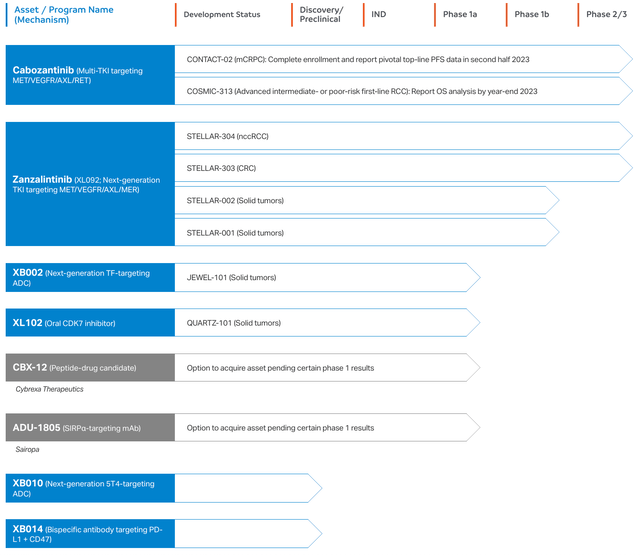

ir.exelixis.com

Besides its available products, Exelixis possesses a range of potential offerings, including Zanzalintinib, a powerful and highly selective KRAS G12C mutant protein inhibitor. This has demonstrated considerable anti-proliferative effects in cell-based assays and in vivo experiments. XB002 serves as another product—an antibody-drug conjugate (ADC) aimed at tissue factors present on cancer cells, leading to the targeted destruction of these cells. This is under evaluation as a solitary treatment in multiple solid tumor indications through an ongoing phase 1 clinical trial.

Also among Exelixis’ pipeline is XL102, which acts as a covalent inhibitor of CDK7, a vital cell cycle progression and transcription controller. CDK7 overexpression has been noted in cancers such as breast, prostate, and ovarian cancers. XL102 is currently in a phase 1 trial examining its effectiveness as a standalone treatment and in two combination regimens for multiple solid tumors.

The company is also advancing XB010, an ADC that targets the oncofetal antigen 5T4, overexpressed in various solid tumors, utilizing Catalent’s SMARTag site-specific conjugation technology. This creates a uniform ADC with a fixed drug-antibody ratio. In addition, Exelixis is developing XB014, a bispecific antibody targeting PDL1 and CD47 to activate T-cells and adaptive immunity while involving innate immune cells. This was designated as a development candidate in 2022.

Unfortunate Phase III Study Results

Exelixis recently revealed that the phase 3 CONTACT-03 study failed to reach its primary target of progression-free survival (PFS). This trial evaluated the combination of Cabometyx with atezolizumab against Cabometyx alone in individuals with advanced or metastatic clear cell or non-clear cell renal cell carcinoma (RCC) who had previously shown progression on immune checkpoint inhibitor therapy.

Despite the study’s outcome, the safety profile of the Cabometyx and atezolizumab combination aligned with the known safety records of each individual agent, and there were no new safety concerns found. The complete results will be presented at a future medical conference.

CONTACT-03 was an international, multicenter, randomized, phase 3, open-label trial that involved 522 participants. The subjects were evenly distributed between the experimental group, which received the Cabometyx and atezolizumab combination, and the control group, which received Cabometyx alone. The study’s objective was to determine the clinical advantages of combining a multi-tyrosine kinase inhibitor and an immune checkpoint inhibitor after progression. Sponsored by Roche and financially supported by Exelixis, CONTACT-03’s primary endpoints were PFS per Response Evaluation Criteria in Solid Tumors, as determined by independent radiology review, and overall survival.

RCC is one of the top ten most commonly diagnosed cancers for both men and women in the United States. In 2023, around 81,800 Americans will be diagnosed with kidney cancer. Clear cell RCC is the most prevalent kidney cancer in adults. Patients with advanced or late-stage metastatic RCC have a five-year survival rate of only 14%. In 2022, approximately 32,200 patients with advanced kidney cancer in the US required systemic therapy, with over 20,000 patients undergoing first-line treatment.

Cabometyx is approved in the US for advanced RCC treatment, hepatocellular carcinoma treatment in patients previously treated with sorafenib, first-line treatment for advanced RCC in combination with nivolumab, and treatment for adults and children aged 12 and older diagnosed with locally advanced or metastatic differentiated thyroid cancer that has progressed after prior VEGFR-targeted therapy and are radioactive iodine-refractory or ineligible. Cabometyx also has regulatory approval in the European Union and other countries and regions worldwide.

Even though the CONTACT-03 study did not achieve its primary objective, the trial’s safety findings confirm the value of Cabometyx as a viable cancer therapy. This offers the potential for ongoing revenue generation in a competitive and dynamic sector. Additionally, the commitment to investigating new combination treatments highlights the company’s dedication to innovation and developing new therapeutic options for cancer patients.

Risks of Resistance, Mutations, and Toxicity

A potential concern with the use of tyrosine kinase inhibitors, such as Exelixis’ Cabometyx and Cometriq, is the development of drug resistance in cancer cells. Various mechanisms, including genetic mutations, activation of alternative signaling pathways, or upregulation of compensatory mechanisms, can lead to treatment failure. Close monitoring of patients and combination therapies may be necessary to address this challenge. In collaboration with Genentech, Exelixis also markets Cotellic, a selective inhibitor of MEK1 and MEK2 enzymes involved in the MAPK signaling pathway. By targeting these enzymes, Cotellic aims to hinder the proliferation of cancer cells with BRAF gene mutations. One potential danger with MEK inhibitors is their potential to cause adverse effects on normal cells, leading to toxicity, and, like other targeted therapies, the development of drug resistance can limit their long-term effectiveness.

Zanzalintinib is a promising candidate in Exelixis’ pipeline. Mutations in the KRAS gene, particularly the G12C mutation, are prevalent in several types of cancers and contribute to tumor growth and survival. Zanzalintinib has demonstrated significant anti-proliferative activity against tumor cell lines dependent on mutant KRAS in preclinical studies. However, potential challenges for KRAS inhibitors include secondary mutations in the KRAS gene causing treatment failure and the complexity of KRAS signaling pathways affecting broad efficacy.

Exelixis is also developing targeted therapies, such as antibody-drug conjugates. XB002, one candidate, targets tissue factor on tumor cells and delivers a cytotoxic agent to induce targeted tumor cell death. ADCs show promise in enhancing chemotherapy specificity by selectively delivering cytotoxic agents to cancer cells. A potential concern with ADCs is the risk of off-target toxicity or insufficient targeting specificity, as unintended binding to healthy cells with similar antigens could lead to adverse effects and limit the therapeutic window of ADCs. Addressing these concerns requires careful optimization of the antibody component and thorough preclinical and clinical evaluations.

Competitor Shortcomings

In the field of receptor tyrosine kinase inhibitors, several competitors offer alternative options to Exelixis’ Cabometyx . Some of these competitors include Pfizer’s (PFE) Inlyta , a selective inhibitor of VEGFR, and Novartis’ (NVS) Afinitor , an mTOR inhibitor. Compared to these other inhibitors, Cabometyx not only boasts action on VEGFR but also targets multiple other receptor tyrosine kinases such as MET and AXL, broadening its anti-cancer activity by simultaneously blocking multiple pathways directly involved in tumor growth and metastasis. This multipronged approach may grant Cabometyx greater potency, leading to significant improvements in overall survival and progression-free survival in clinical trials compared to its competitors.

When exploring KRAS G12C inhibitors, the primary competitor to Exelixis’ Zanzalintinib is Amgen’s (AMGN) Lumakras , which has already been granted accelerated approval by the FDA for treating KRAS G12C-mutated non–small cell lung cancer (NSCLC). The highly selective nature of Zanzalintinib may give it competitive advantages; by demonstrating robust anti-proliferative activity in preclinical studies targeting multiple mutant KRAS-dependent tumor cell lines, the treatment has the potential to excel in the KRAS G12C inhibitor space by expanding its application to various cancer types harboring this mutation, as opposed to being limited to only NSCLC.

When it comes to ADCs, Exelixis’ XB002 and XB010 face competition from various marketed ADCs such as AstraZeneca’s (AZN) Enhertu and Seagen’s (SGEN) Adcetris . While the existing ADCs are successful in specific cancer types, XB002 and XB010 target more broadly expressed antigens on the tumor surface: tissue factor and oncofetal antigen 5T4, respectively. This allows for a wider applicability to multiple solid tumors. Furthermore, the use of Catalent’s SMARTag platform for XB010 allows for controlled drug-antibody ratios, which can optimize efficacy and safety profiles compared to other ADCs on the market.

As for Exelixis’ CDK7 inhibitor XL102 and bispecific antibody XB014, their unique mechanisms offer promising therapeutic effects for patients who may not benefit from existing therapies. These additions to Exelixis’ pipeline provide competitive advantages in the oncology market, strengthening the company’s position as a leader in innovative cancer treatment development.

Conclusion

Exelixis is backed by a dynamic and thriving financial stance that promises to deliver rewarding returns. The company’s remarkable growth trajectory, demonstrated by consistent revenue increases and efficient cost management, indicate a financially-sound and reliable business poised for long-term prosperity.

Exelixis’ strategic alliances with industry-leading partners, such as Genentech, exemplify the company’s ability to form mutually-beneficial collaborations that enhance its market position, revenue streams, and overall impact on the sector. These partnerships, in our view, are vital in further establishing Exelixis as a frontrunner in cancer treatment development.

Read the full article here