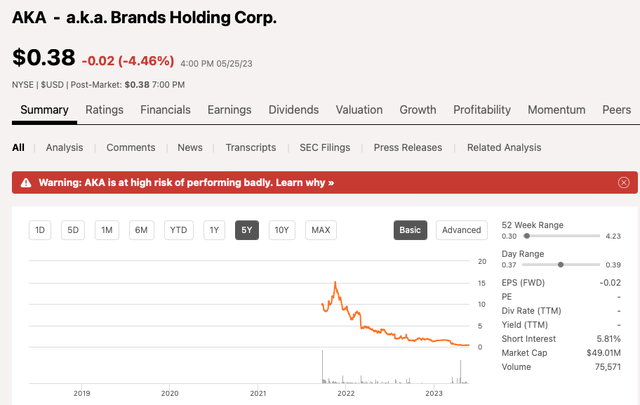

In September 2021, a.k.a. Brands Holding Corp. (NYSE:AKA) went public, by selling 10 million shares, at $11 per share, raising $95.7 million, net of banking fees and underwriters discounts. Notwithstanding a short-lived pop, in November 2021, with AKA shares hitting a high water-mark of $15, it has been all downhill since.

However, despite the double black diamond ski slope of a stock chart, as a small cap value and special situation investor, on nearly a weekly basis, I set out off on a quest searching for mis-priced and undervalued securities. On these adventures, sometimes I encounter, battle, and slay dragons in order to discover and rescue princesses (undervalued stocks) locked up in towers. Other times, these quests are just quixotic.

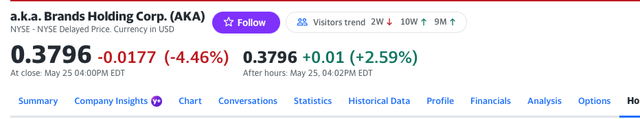

On a recent adventure, I discovered a.k.a. Brands. Fascinated by the valuation, I invested the time to do some work and get up to speed here. From what I can tell, the stock looks super mis-priced and appears to be a situation where the baby has been thrown out with the bathwater. This is a company with very healthy gross margins, has a direct to consumer business model, owns strong and growing brands, and has a balance sheet that is better than feared. In today’s piece, I will walk readers through why I think AKA shares are very mis-priced, at $0.38 per share.

Seeking Alpha

The Company

a.k.a. Brands (“a.k.a.”) is an accelerator of fashion brands for the next generation. The company is mostly digital (or direct to consumer) and through its portfolio of four global brands, the company targets the Millennial and Gen Z demographic. The company is really strong on the social media and digital marketing fronts. As of March 31, 2023, the company had nearly 10 million social media followers and 3.6 million active customers.

As of April 2023, the company owns the following brands:

Women’s Brands: (Princess Polly and Petal & Pup)

Both Princess Polly (established in 2010) and Petal & Pup (established in 2015) were founded in Australia. Princess Polly is mostly online and targets female customers ages 15 to 25. Petal & Pup targets female customers are mostly ages 25 to 34.

Two streetwear brands: (Culture Kings and mnml)

Culture Kings was founded in 2008, in Australia. Culture Kings sells streetwear apparel, footwear, headwear and accessories. They offer an assortment of products from over one hundred third-party vendors and have a large and growing in-house roster of designer brands. More than 50% of its products are exclusive and 76% of sales are online.

mnml was found in Los Angeles, in 2016. They sell men’s streetwear that is designed for fashion forward apparel, with an emphasis on bottoms, and at affordable price points.

(They Sold Rebdolls, in February 2023)

The company owned Rebdolls brand, a brand they purchased in December 2019, but it was sold back to its founder, in February 2023. Per the company’s March 9, 2023 Q4 FY 2022 earnings call, the Rebdolls brands had an annual revenue run-rate of roughly $10 million and most likely wasn’t making any EBITDA.

Why The Stock Has Gotten Dinged:

Among the biggest drivers of the share price weakness are macro factors. Specifically, the consumer discretionary sector is deeply out of favor driven by weak operating results, fears of a recession, poor consumer sentiment, and persistent inflation headwinds.

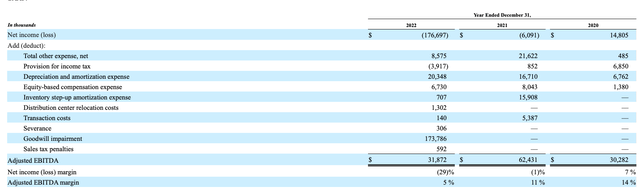

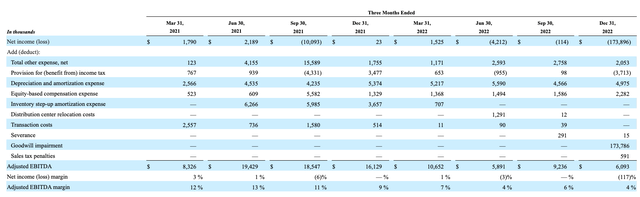

Specifically, AKA FY 2022 Adj. EBITDA was down nearly 50%, to $31.9 million (5.2% of sales), compared to $62.4 million (11.1% of sales) in FY 2021.

AKA’s FY 2022 10-K

From a cadence perspective, AKA’s Adj. EBITDA trajectory decelerated in Q2 FY 2022. Therefore, as of this quarter, they are lapping easier comparisons.

AKA’s FY 2022 10-K

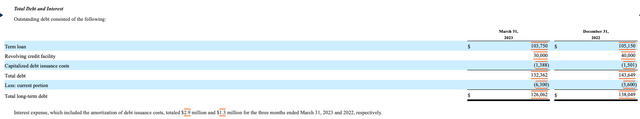

The decline in Adj. EBITDA combined with some debt on the balance sheet are other factors. As of Q1 FY 2023, AKA had $132 million of debt (there was $6.3 million of current long-term debt) and $32 million of cash. On the May 13, 2023 Q1 FY 2023 conference call, we learned that management paid down an additional $10 million of debt, thus far during Q2 FY 2023. Therefore, on a pro-rated basis, we’re talking about only $122 million of debt and perhaps $25 million of cash.

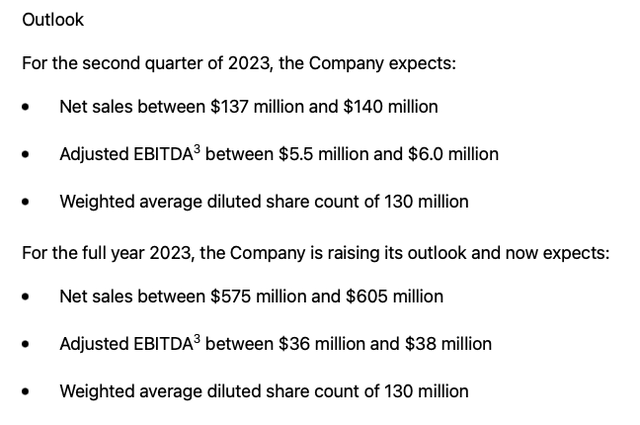

Turning to FY 2023, as of May 13, 2023, let’s take a peek at AKA’s updated guidance:

FY 2023 Updated Guidance

a.k.a.’s Q1 FY 2023 Earning Press Release

Valuation:

$0.38 per share x 130 million shares equals a market capitalization of only $49.4 million. Let’s assume May 2023 pro-forma net debt is about $100 million. If you believe AKA can hit its FY 2023 Adj. EBITDA guidance then this stock is only trading a 4X EV/ FY 2023 Adj. EBITDA guidance. That is ridiculously cheap for a DTC company that owns good brands!

Also, as of March 31, 2023, AKA had positive net working capital of $93 million.

The Debt

As of March 31, 2023, AKA’s term loan had a balance of $104 million and $30 million outstanding on its revolver.

AKA’s Q1 FY 2023 10-Q

Per the 10-Q, the all-in cost of its debt was 7.92% based on the terms of it credit agreement and the spread to SOFR.

So, with $122 million of pro-forma debt, we talking about $9.8 million of going forward annual interest expense. Please note the debt doesn’t mature until 2026!

Q4 FY 2023 and Q1 FY 2023 Conference Call Highlights:

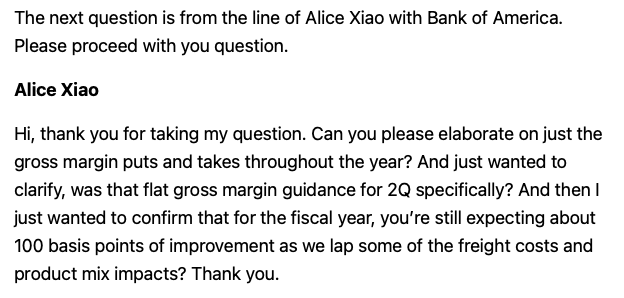

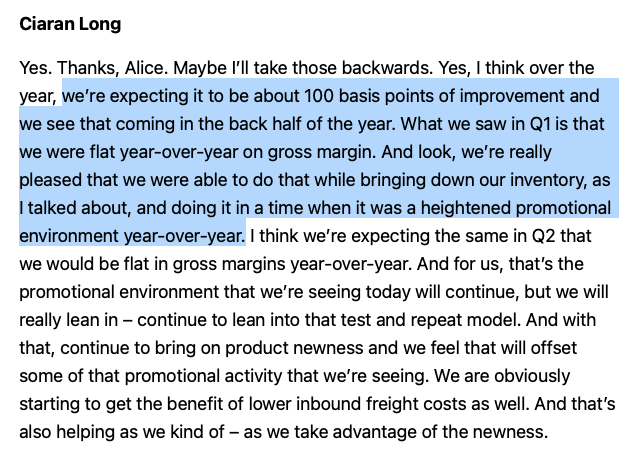

1) Strong gross margins despite the heightened promotional environment and AKA intentionally reducing inventories to free up working capital dollars to pay down debt.

AKA’s Q1 FY 2023 Conference Call

AKA Q1 FY 2023 Conference Call

2) Management is playing the long game and balancing growth with profitability.

I want to give you some color on the factors that impacted our business in the fourth quarter. A key anchor of our strategy is balancing growth and profitability across our brands. We’re proud to run a profitable and durable business, and we’re committed to building great brands for the long-term. We entered the fourth quarter knowing it was going to be promotional due to the inventory [indiscernible] across the fashion sector. But as we went through the holiday season, particularly in the second half of the quarter, the promotions and discounts were abundant and much more intense than we anticipated.

As part of our efforts to balance growth and profitability, we made the strategic decision not to compete in our peers promotional levels, and we held our discounts and promotions relatively flat to last year. Furthermore, because of the heightened promotional environment, we also saw that the returns on marketing investments were lower than previous levels and incremental marketing spend was hitting diminishing returns and was not profitable. In an effort to maximize profitability, we held our marketing spend at the same 10% of net sales on a rate basis, which also impacted our top line.

(Source: Q4 FY 2022 Conference Call)

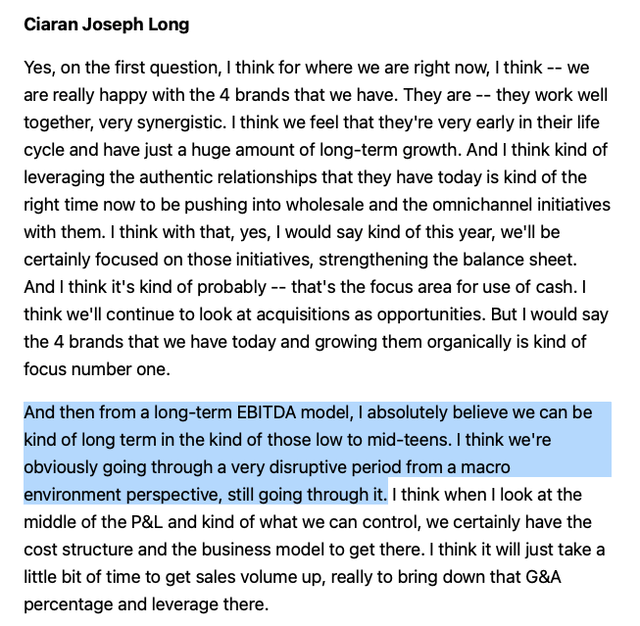

3) In A More Normalized Environment, Management Believes They Can Get Back To Low to Mid Double Digits Adj. EBITDA Margins

AKA’s Q4 FY 2022 Conference Call

AKA’s Q4 FY 2022 Conference Call

The Cost Of Acquiring The Brands:

If you dig through AKA’s 10-K, in 2021, you can find three major purchases. The total cash outlay was $276 million of cash and 23.86 million shares of stock issued.

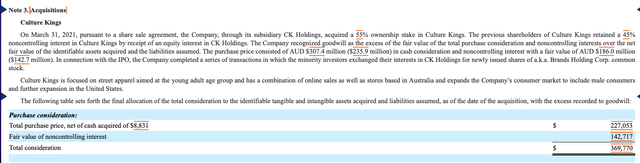

1) Culture Kings: $370 million ($227 million was in cash)

They bought Culture Kings, in March 2021, for $370 million. $227 million of cash and $142.7 million of stock, as the sellers agreed to receive 21.8 million shares, prior to the IPO.

AKA Brands’ 10-K

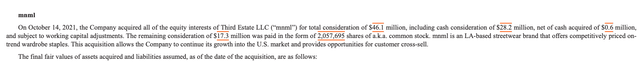

2) mnml was purchased on October 14, 2021, for $45.5 million. This consisted of $28.2 million, in cash, and the issuance of 2,057,695 shares of AKA.

AKA Brands’ 10-K

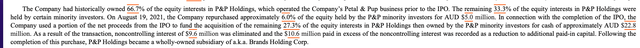

3) In August 2021 and then post the September 2021 IPO, they bought the remaining non-owned 33.3% piece Petal & Pup, for $27.8 million in AUD (roughly $21 million in USD).

AKA Brands’ 10-K

If you looked at AKA’s S-1, they acquired the controlling interest in Princess Polly, in July 2018 and the 67% interest in Petal & Pup, in August 2019.

AKA Brands’ S-1

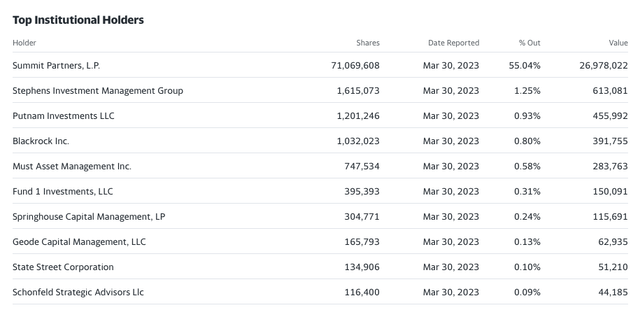

Summit Partners, L.P. Owns 55% Of The Equity

If you look at the holders, long-time private equity firm, Summit Partners, L.P., out of Boston, owns the 55% of the equity. There are no other material holders.

See here:

Yahoo Finance

Yahoo Finance

Putting It All Together

Notwithstanding January 2023, it has been tough sledding in the small cap patch. 2023 returns and market interest is exclusive focused on big cap technology stocks and A.I. Mr. Market is super pessimistic on so many micro-caps and consumer discretionary stock are deeply out of favor.

When it comes to a.k.a. Brands, I would argue of parts (or sum of the brands) being worth well in excess of its current enterprise value. This is a DTC company that has solid gross margins and that owns good brands. The intense macro headlines and industry-wide overcapacity will course correct, it always does. With AKA’s debt termed out (to 2026) and manageable interest expense, the equity is just too cheap here, from multiple vantage points.

If you believe management can deliver $37 million of FY 2023 Adj. EBITDA, we could be talking about $15 million of free cash flow here. Here’s the math ($37 million of Adj. EBITDA, less $11 million of interest expense, less $11 million of CAPEX).

Frankly, I’m kind of surprised Summit Partners, L.P. hasn’t tried to just buyout the rest of the publicly traded AKA equity (the other 45%), given this valuation disconnect and the strength of AKA’s brands.

Simply stated, I would argue that AKA shares are just too cheap to ignore, at $0.38.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here