StealthGas (NASDAQ:GASS) may have one of the strongest net asset backings of any stock available to investors on Wall Street. The company provides seaborne transportation services to liquefied petroleum gas [LPG] producers and users globally. It carries/moves various petroleum gas products in liquefied form, including propane, butane, butadiene, isopropane, propylene, vinyl chloride monomer, and ammonia. In addition, shipping services for refined petroleum items like gasoline, diesel, fuel oil, jet fuel, plus edible oils/chemicals generate revenue. As of April 2023, StealthGas ran a fleet of 36 LPG carriers and is based in Athens, Greece.

The name has been showing up on some of my daily screens of low trading volume buy ideas in May. And, considering the need for Europe and Asia to increase trade in liquified gas and fossil fuel supplies, the outlook for its operating business is quite bright for 2023-24. Income levels reflect this fact, with the maritime oil/gas shipping industry churning out robust levels of income since the Russian invasion of Ukraine in February 2022.

Terrific Underlying Valuation

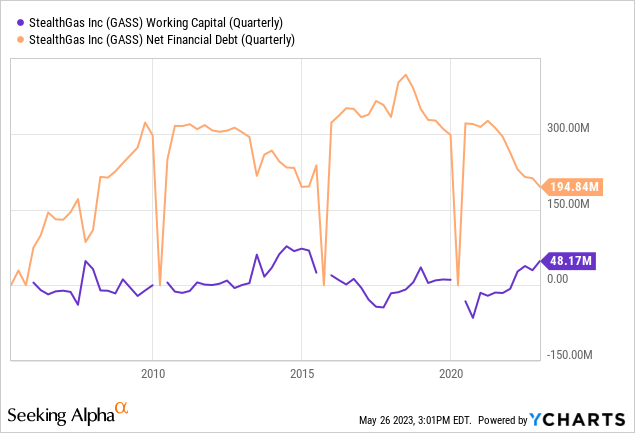

When you dig deeper into the investment story, you will find an extraordinary hard asset foundation, with tanker accounting values and cash holdings far outstripping all liabilities. In fact, total cash of nearly $90 million compares quite favorably with an equity capitalization of less than $120 million at $3 per share. Working capital of almost $50 million and new cash generation of $40+ million over the trailing 12-month period are also huge positives. The net liability vs. working capital situation is the most flexible since at least 2014, drawn below.

YCharts – StealthGas, Working Capital & Net Debt, Since 2005

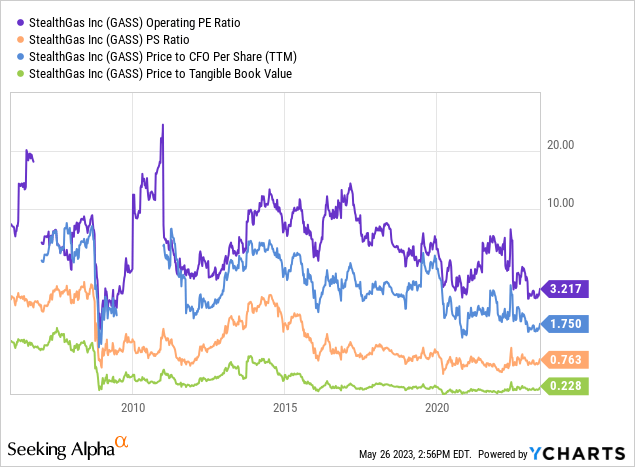

Stated book value of $13.50 per share (including vessels of debatable resale value vs. held/depreciated accounting cost) creates a price to tangible book value multiple of less than 0.23x! Other fundamental ratios also point to an incredible bargain today. Using basic ratio analysis, I can argue the company is the cheapest overall since 2008.

YCharts – StealthGas, Fundamental Valuation Ratios, Since 2005

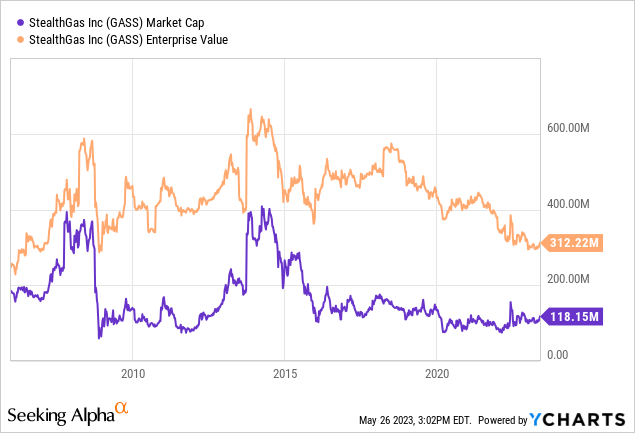

In the end, today’s equity market capitalization plus total debt, minus a growing cash position is bringing the lowest “enterprise value” [EV] since early 2009.

YCharts – StealthGas, Equity Market Capitalization vs. Enterprise Value, Since 2005

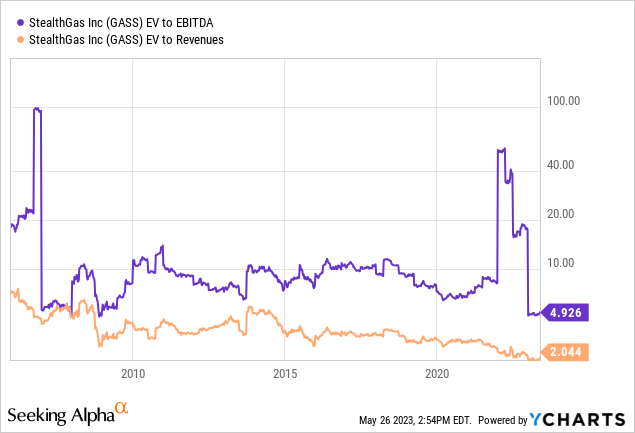

Then, when we compare cash EBITDA and raw revenue numbers to EV, StealthGas may be less expensive for new investors now than at any other time since the company was formed in 2004.

YCharts – StealthGas, Enterprise Value vs. EBITDA & Revenues, Since 2005

Bullish Technical Chart

So, if the fundamental valuation story is rated “A” for what you are receiving in net hard assets and earnings on your investment dollar, what does the technical trading picture look like?

The answer is the StealthGas equity quote broke out of a triangle pattern drawn from last June (green trendlines on the 18-month chart below). A much stronger-than-expected earnings report was the catalyst last week, pushing price above $3.30 initially, from a low trade of $2.65 in early May. In terms of momentum, price is now comfortably above the important 50-day and 200-day moving averages, which are both trending higher.

In many respects, the breakout is mimicking the late May 2022 situation, with price spiking +60% over three weeks a year ago. Almost non-existent volume trading (with few sellers boxed in gold on the chart) was the status quo in April-May of this year, until a few days ago. Low-volatility readings under 10 in the 21-day Average Directional Index (circled in blue) helped to put in a base-like structure.

On Balance Volume trends have been exceptional since the February 2022 Russian invasion of Ukraine, highlighting regular buying. And, the 14-day Money Flow Index spiked above 80 (circled in red) with intense accumulation out of the slow-trading base pattern. My read of the technical situation is a move to $4 or even $5 a share is possible in coming months.

StockCharts.com – StealthGas, 18 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

StealthGas management will have to do something with the cash piling up on its balance sheet. Everything from initiating a quarterly dividend to buying back inexpensive shares vs. net assets, paying down debt, and/or acquiring new vessels are decisions to make in 2023.

The company is in a unique position to repurchase shares in an “accretive” fashion. StealthGas could take $30 million in cash on hand to buy back a meaningful 20% to 25% of outstanding shares. Such a move would shoot tangible book value HIGHER by $2 or $3 per share, while bumping EPS 20-30 cents annually, assuming operating business results remain the same.

What are the risks on investment? The maritime transportation business is very capital intensive and economically cyclical. A deep recession in demand for energy, the end of the Russia/Ukraine war, and other scenarios could encourage ship lease rates to decline, negatively affecting income at StealthGas.

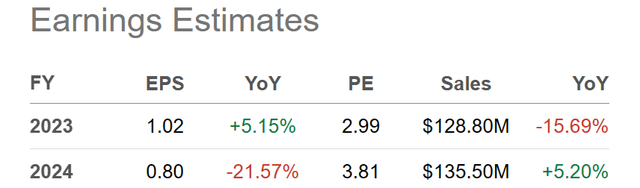

Already, Wall Street analysts are projecting a peak in profitability during 2023, which may or may not play out. However, a major share repurchase plan and still elevated demand for shipping LPG product could increase results into 2024 vs. 2022.

Seeking Alpha Table – StealthGas, Analysts Estimates for 2023-24, Made on May 25th, 2023

Outside of a prolonged and severe global recession, I doubt shares will trade under $2.50 anytime soon. With a low-$3 stock price, downside may be limited to -15% to -20%, meaning upside to $5 or higher (+65% or better for price appreciation) over the next 6-12 months is worth contemplating for your portfolio.

I rate shares a Buy. If we use the 10-year averages of price to operating earnings, sales, cash flow and tangible book value, a quote above $6 per share is well within reach. Such would create a double (+100% gain) on your investment around $3.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here