Nestle (OTCPK:NSRGY) (OTCPK:NSRGF) published its Q1-23 revenue numbers that beat analysts’ consensus, reporting 9.6% organic growth from the prior year period. The consumer staples giant demonstrated the strength of its pricing power, as a 9.8% increase in prices resulted in just a -0.5% price and mix decline.

I reiterate a Buy rating, with a price target of CHF 124.4 per share or $137.7 per ADR, reflecting a 12% upside.

Introduction

In February, I published an article covering Nestle with a Buy rating, as I found the company’s pricing power much stronger than what the analysts’ consensus reflected at that time.

I urge you to read that article, in which I described my investment thesis in detail, as well as the group’s amazing portfolio of brands, long-term strategy, risks, competitors, and the major growth prospects I project for 2023 and beyond.

In short, my investment thesis in Nestle is based upon the immense pricing power it possesses with its portfolio of stale brands, as the steady demand for the group’s products is resilient and isn’t as sensitive to the economic environment.

Regarding valuation, I showed that Nestle trades at a small premium compared to its peers, however, I found the premium justified due to Nestle’s better growth prospects. Additionally, I covered the strength of Nestle’s production chain and explained why my model assumes a significant recovery in EBITDA margins.

Since the article was published, Nestle has beaten the S&P 500 by 3.5 percentage points, as it provided investors with a 10.8% total return. Now, let’s focus on the company’s results, see how my projections fared compared to the consensus, and provide an updated model.

Q1-23 Highlights

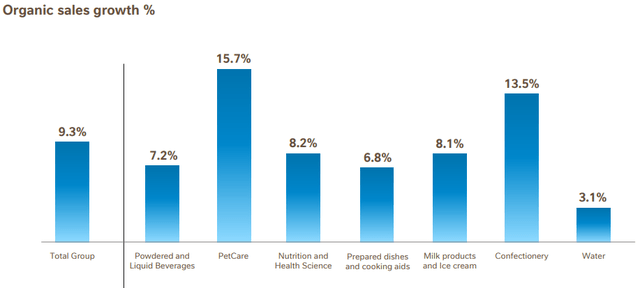

Nestle reported consolidated revenues of CHF 23.5B, a 5.5% increase from the prior year, 1.0% above expectations. On a constant currency basis, Nestle’s revenues grew by 9.5%. Based on its historical seasonality, the Swiss conglomerate is on pace to deliver 5.1% growth for the entire year, assuming constant currency will remain the same. Organic growth came in at 9.3%, as a 9.8% price contribution was slightly offset by negative mix and volume.

Nestle Q1-23 Investor Presentation

As we can see, growth was broad-based across categories, with PetCare and Confectionary leading the way, and water lagging due to supply chain constraints.

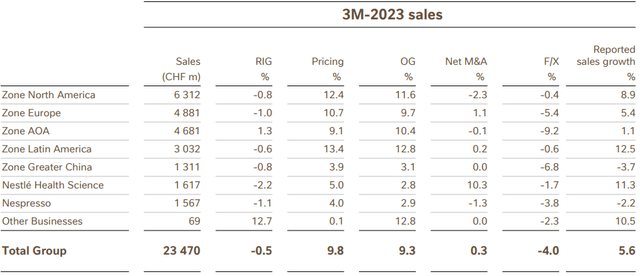

Nestle Q1-23 Investor Presentation

Looking at segments, we see Latin America has led organic growth, while Other Businesses and Zone Asia, Oceania, and Africa (AOA) were the only segments with positive RIG (real-internal-growth), reflecting a weaker consumer, with lower volumes and trade downs.

Nestle Q1-23 Investor Presentation

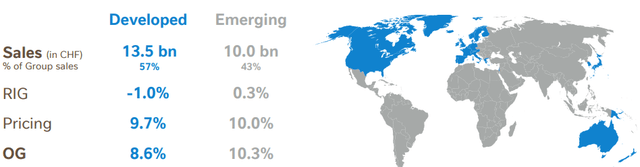

Emerging markets are becoming increasingly significant for Nestle, as it continues to gain market share, specifically with its more than 30 “billionaire brands” like Nespresso, Kit Kat, and Nesquik.

Another interesting announcement was the creation of a frozen pizza joint venture with private equity firm PAI Partners after the two sides had great success with the Froneri ice cream partnership.

Overall, Nestle’s strong sales results signal the company is on track with its optimization strategy, focusing on a smaller number of products, with higher growth and higher margins. According to the management, most of the negative RIG is a result of capacity constraints and optimization, as opposed to weakening demand.

Important Notes From The Call

We are still having some capacity constraints that are impacting our Real Internal Growth, in particular for PetCare, Coffee Creamers as well as Perrier.

— Mark Schneider, Chief Executive Officer, Q1-23 Earnings Call

As we saw above, PetCare is the fastest-growing category despite those capacity constraints, and continuing from what I wrote in the previous article, I expect capacity enhancements in that category to be a significant growth driver for the company.

We continued to work on our portfolio optimization program and can confirm our earlier estimate that this program will have a net negative impact for the first half of this year and a slightly positive impact for the Full Year 2023. We are seeing the first expected benefits come in as planned, in particular higher service levels for the company overall and for our highrotation items in particular.

— Mark Schneider, Chief Executive Officer, Q1-23 Earnings Call

As expected, this fiscal year’s results will lean more towards the second half of the year, in addition to historical seasonality. Historically, Nestle’s second-half revenues are approximately 52.0% of the full year. This supports my projection that Nestle will surpass CHF 100B in 2023, which is 2.2% above the current consensus.

We have started to see our gross margin improving in Q1 over the second half of 2022, as we expected. We may still land H1 gross margin, possibly at a lower level than the same period of last year, but we do expect indeed to see an increase in H1 as well over H2 last year.

— François-Xavier Roger, Chief Financial Officer, Q1-23 Earnings Call

H1-22 gross margins were 46.0%, and H2-22 came in at 44.5%. My current projection is in line with the consensus at 45.8% gross margins for H1-23, which seems to be reasonable according to the management’s comment.

[Regarding slower growth in Nespresso] I think as COVID came and went, clearly, of course, there was a strong tailwind as there was more at-home consumption. And now we’re essentially going through some quarters where we have a headwind and hence, that European situation becomes more visible. Timing-wise, we believe that starting from this summer, you should see the situation turn again. And then I think we have some of the strong lapping quarters behind us and then the true underlying growth of Nespresso should be showing through more strongly.— Mark Schneider, Chief Executive Officer, Q1-23 Earnings Call

So Nespresso, one of Nestle’s strongest brands, should see growth accelerate in H2 as well, with a normalization of out-of-home and at-home consumption. It’s important to note that Nespresso is just one coffee brand sold by Nestle, with brands like Starbucks by Nespresso and Nescafe Farmers Origins that are growing mid-single-digits not included in the Nespresso segment.

On private label, so indeed they gained market share in 2022 in the Food and Beverage industry, for us and against us as well. However, so far, private label levels have essentially regained the market share that they lost during the pandemic. And more recently, we have seen the rate of private label share gains slowing down. Inflationary pressure, by the way, impact all players in the industry, including private label. The pressure is typically more pronounced for private label since input costs typically represent a higher proportion of their sales. And as a consequence, we have seen that private label had to implement significantly higher percentage increases than branded products like ours, while, obviously, their price points remain at a lower level than branded products.

— François-Xavier Roger, Chief Financial Officer, Q1-23 Earnings Call

One major concern for Nestle is that Private Labels, which are typically cheaper, will take its market share, especially at times when the consumer’s budget is pressured by inflation and higher interest rates. However, I find Nestle’s brands less exposed to that risk, as a food and beverage company with renowned brands. Private labels are typically more focused on basic items, which are easier to manufacture and don’t require substantial investments. Personally, I don’t mind buying private-label toilet paper, but I would probably refrain from a private-label chocolate snack.

Valuation

In the February article, I provided my H1-23 projections for Nestle:

For the first half of 2023 I forecast Nestle will report CHF 48.4B in sales which is at the mid-point of the organic growth guidance, CHF 22.5B in gross profit, and CHF 6.1B in net income. The consensus numbers are sales of CHF 47.2B, gross profit of CHF 21.9B and CHF 6.3B in net income.

Based on the Q1 results, I need to slightly lower my near-term projections, however, my full-year estimates are higher. I now project H1-23 sales of CHF 48.0B, CHF 22.0B in gross profit, and CHF 6.1B in net income, all slightly higher than the consensus. Another important note for the near term is regarding cash flows. After knowingly increasing inventories in 2022 to prepare against possible constraints arising from the Russia-Ukraine war, Nestle should see elevated cash flows in 2023 as working capital decreases.

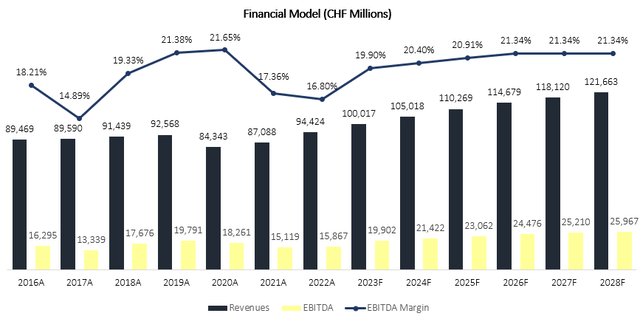

For the long term, I now project Nestle will grow at a 4.0% CAGR between 2023-2028, which is at the low end of the company’s long-term guidance for organic growth. I believe revenues will grow at this above-industry pace due to Nestle’s significant investments in capacity enhancements, and shift in focus to faster-growing brands.

I project EBITDA margins to increase incrementally up to 21.3%, which is slightly below its 2019 level. This results in an EBITDA CAGR of 5.5% between 2023-2028, reflecting operational leverage, better mix, and easing cost inflation.

Created and calculated by the author based on Nestle financial reports and the author’s projections

Taking a WACC of 6.9%, I estimate Nestle’s fair value at CHF 124.4 per share or $138.2 per ADR. This represents a 12.0% upside compared to the market price at the time of writing.

Dividends & Buybacks

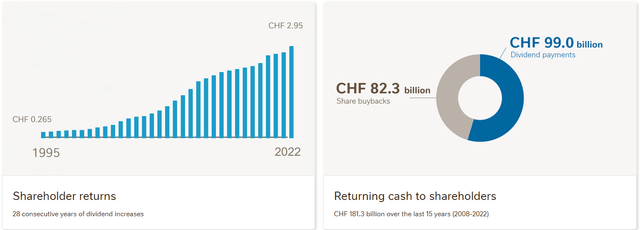

Nestle is a natural constituent in dividend growth portfolios. The company has raised its dividend for 28 consecutive years and has bought back 15.2% of its shares outstanding since 2013.

Nestle Investor Relations

Overall, Nestle returned CHF 181.3B to shareholders over 15 years between 2008-2022. In essence, if you bought Nestle shares at the beginning of 2008, you would have gotten more than a 100% return on your investment via cash returns alone.

Leverage

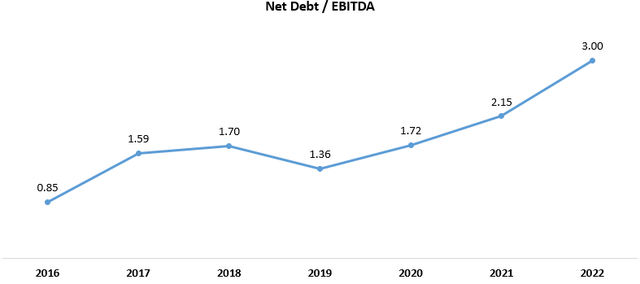

One point to address with Nestle is the growing size of its financial debt. As of the end of 2022, Nestle’s net debt amounted to CHF 47.6B, more than 3 times as high as it was back in 2016. While net debt kept increasing, EBITDA fluctuated, and in 2022, EBITDA amounted to CHF 15.9B, which is below the levels of 2016. Consequently, the Net Debt to EBITDA has risen sharply.

Created and calculated by the author based on Nestle financial reports

A significant portion of the debt issued was used to finance buybacks, which made sense at a time of low interest rates. However, as interest rates are rising, it seems less reasonable. Nestle still borrows at extremely low rates, yet I believe the company should put emphasis on deleveraging in the following years.

Conclusion

If you’re looking for an exciting investment, then you came to the wrong place. Nestle is the definition of a stalwart. What you can expect from Nestle is steady growth, limited volatility, and consecutive dividend payments that will probably continue as long as humankind continues to eat and drink. Even with stalwarts, there are more attractive times to buy. As Nestle is in the midst of a turnaround, which should lead to a material increase in margins and accelerated growth in the near term, I believe now is a great time to increase exposure to the staple giant. Thus, I reiterate Nestle stock as a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here