By Andrew Ang, PhD

I have been fortunate to have had the opportunity to work and live across the globe. I was born in Malaysia, before my family migrated to Perth, Australia. I was a foreign exchange student in high school in Canada. After completing university in Sydney, I moved to the US where I spent the formative years of my career. I earned my PhD at Stanford and then worked as a business school professor at Colombia University. During my time as an academic, I was fortunate to work with many institutions around the world, including 10 years as an advisor to the Norwegian sovereign wealth fund. I joined BlackRock as an investor in the New York office in 2015. The one constant, across geographies and jobs, was a focus on factors.

The growth of factors

Investors have always loved a bargain – lower relative priced securities (value), more profitable companies (quality), stocks with upward-trending prices (momentum), and less volatile firms (min vol). Factor investing has been around for decades and is supported by a wide body of academic literature, including six Nobel prizes. While these investing concepts have been studied in tens of thousands of papers and confirmed with decades of empirical evidence, it is not surprising that more and more investors have adopted the ability to invest in factor-based strategies in convenient vehicles via the ETF wrapper.

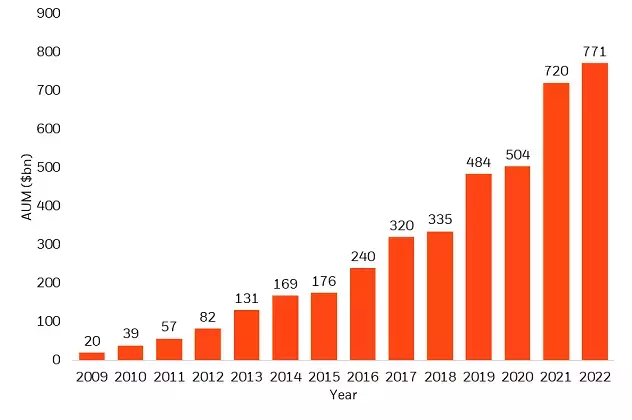

Exhibit 1: US Factor ETF AUM over time

Source: BlackRock GBI as of 12/31/22 Includes US domiciled ETFs classified as smart beta by BlackRock Global Business Intelligence.

As of the end of Q1 2023, there was $800bn in Factor ETF assets in the US.1 Approximately 80% of the $800bn was targeting factors in US equities. Only $135bn, or about 17% of those assets, targeted factors internationally. (For the astute reader, the remaining ~3% of factor ETF assets are in fixed income factors).

While factor popularity has certainly grown with equity factor ETFs, there is still an opportunity for investors to gain exposure to these well-known drivers of return in international markets.

Moving abroad

The first question is whether factors are applicable in international markets. Yes! Academics have shown that the same factors that are documented in the US also have exhibited positive excess returns or reduced volatility in international markets.2 In some cases, their premiums are even stronger than in the US.

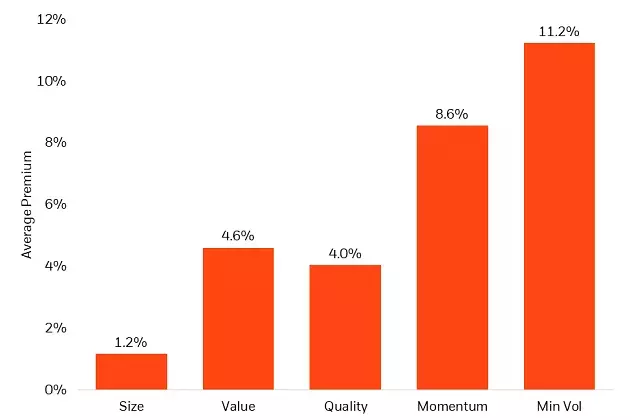

Exhibit 2: Average 1-year International Premiums (Long/Short)

Source: Analysis by BlackRock using Ken French data library (https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html) and AQR data set (https://www.aqr.com/Insights/Datasets/Betting-Against-Beta-Equity-Factors-Monthly) as of 1/31/23. Data from November 1990 through January 2023. Premiums are calculated as long/short. International stocks for size, value, quality, and momentum represented by Developed ex US stocks as classified by Ken French Data Library. Minimum volatility represented by Global ex USA stocks as classified by AQR data set. Low size represented by SMB (small minus big). Value represented by HML (high book-to-market minus low book-to-market). Quality represented by RMW (robust minus weak). Momentum represented by WML (winners minus losers). Low Vol represented by BAB (betting against beta). Counterparts for size, value, quality, momentum, and min vol are larger firms, higher priced stocks, less profitable stocks, downward trending stocks, and higher beta securities.

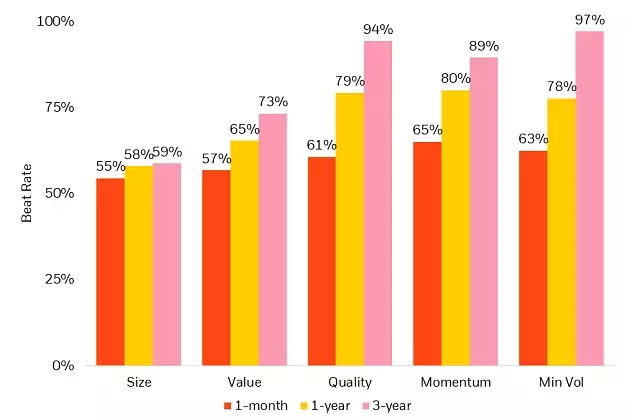

Similar to the US, small size, value, quality, momentum, and minimum volatility in international developed markets have historically outperformed their counterparts. Also similar to the US, the persistence of outperformance has increased the longer the underlying factors have been targeted.

Exhibit 3: Percentage of periods factors have outperformed their counterparts

Source: Analysis by BlackRock using Ken French data library (https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html) and AQR data set (https://www.aqr.com/Insights/Datasets/Betting-Against-Beta-Equity-Factors-Monthly) as of 1/31/23. Data from November 1990 through January 2023. Premiums are calculated as long/short. International stocks for size, value, quality, and momentum represented by Developed ex US stocks as classified by Ken French Data Library. Minimum volatility represented by Global ex USA stocks as classified by AQR data set. Low size represented by SMB (small minus big). Value represented by HML (high book-to-market minus low book-to-market). Quality represented by RMW (robust minus weak). Momentum represented by WML (winners minus losers). Low Vol represented by BAB (betting against beta). Beta measures volatility of a stock compared to the market as a whole. Counterparts for size, value, quality, momentum, and min vol are larger firms, higher priced stocks, less profitable stocks, downward trending stocks, and higher beta securities. 1-year and 3-year periods are calculated by using rolling 1-year and 3-year periods using monthly returns. Beat rate shows the historical percentage of periods that the factor outperformed (“beat”) its counterpart.

Just as many investors have used factors for their US portfolios – to express views, to help provide diversification by adding factors that their current portfolios don’t contain or are underweight, or to reduce risk in portfolios – investors can likewise attempt to improve their international portfolios by considering expanding their opportunity set to include strategic factor exposure.

Diversification

Value and momentum in the US have been negatively correlated, is that also true for international markets? The data shows even more negative correlations between US value and international momentum.

Exhibit 4: Correlations3 between US and International Factors

Source: Analysis by BlackRock using Ken French data library (https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html) and AQR data set (https://www.aqr.com/Insights/Datasets/Betting-Against-Beta-Equity-Factors-Monthly) as of 1/31/23. Data from November 1990 through January 2023. Premiums are calculated as long/short. International stocks for size, value, quality, and momentum represented by Developed ex US stocks as classified by Ken French Data Library. Minimum volatility represented by Global ex USA stocks as classified by AQR data set. Low size represented by SMB (small minus big). Value represented by HML (high book-to-market minus low book-to-market). Quality represented by RMW (robust minus weak). Momentum represented by WML (winners minus losers). Low Vol represented by BAB (betting against beta). Counterparts for size, value, quality, momentum, and min vol are larger firms, higher priced stocks, less profitable stocks, downward trending stocks, and higher beta securities.

How can an investor use this information in building optimal portfolios? If the investor has a value bias in their US allocation, then adding targeted exposure to US momentum and international momentum may be beneficial, especially during extended periods of value underperformance. Both value and momentum have positive expected returns,4 but they may outperform at different times—one strategy can zig while another strategy zags. Thus, combining lowly correlated sources of returns can potentially reduce portfolio risk. The potential risk reduction and increases in expected return by including international factors may make a compelling case to add them to US centric portfolios.

Putting it all together

Many financial professionals have started to use factor ETFs to help improve expected returns and lower risk in their portfolios as evidenced by the exponential growth in factor assets over the past decade. But it’s also important to remember that factors have not only been persistent over time but pervasive across markets – including internationally. Investors may want to consider expanding their factor toolkit abroad to capture additional sources of returns in their portfolios. Just as my career has spanned multiple countries and continents, factors can be found around the world.

This post originally appeared on the iShares Market Insights.

Read the full article here