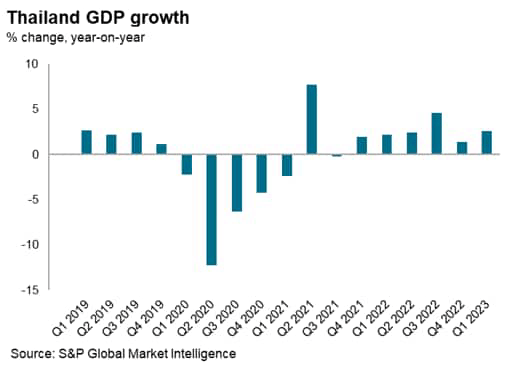

Thailand has shown a gradual economic recovery from the COVID-19 pandemic during 2022, helped by rising international tourism arrivals. Real GDP growth rose from 1.5% in 2021 to 2.6% in 2022, with growth momentum expected to improve further in 2023.

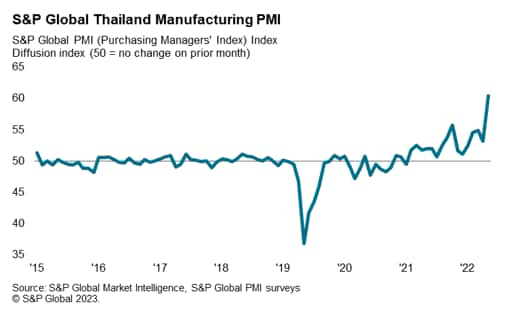

The latest S&P Global Thailand Manufacturing PMI survey results for April 2023 showed a strong upturn in manufacturing output and new orders. Due to the importance of international tourism for the Thai economy, the strong rebound in international tourism inflows evident in early 2023 signals that the tourism economy will be a key growth driver in 2023.

Thailand’s economic recovery from the pandemic

The Thai economy has shown an upturn in economic growth momentum in early 2023, with first-quarter GDP growth up by 2.7% year-on-year (y/y), compared with 1.4% y/y growth in the fourth quarter of 2022.

The strong first-quarter growth rate was underpinned by rapid growth in private consumption, which rose by 5.4% y/y, helped by surging international tourism arrivals. Expenditure on services rose by 11.1% y/y due to buoyant spending in hotels and restaurants. However, private investment grew at a modest pace of just 2.6% y/y, while public investment grew by 4.7% y/y.

Thailand’s growth rate in 2022 was quite moderate in comparison with other large ASEAN economies such as Malaysia, Vietnam, and the Philippines, which posted very high growth rates as they rebounded from the pandemic. Thailand recorded real GDP growth of 2.6% in 2022, representing a relatively modest pace of economic recovery from the recessionary conditions caused by the COVID-19 pandemic.

A key driver for improving economic growth in 2022 was the recovery of private consumption, which grew by 6.3% compared with just 0.6% y/y growth in 2021. Private investment growth also improved from a pace of 3.0% in 2021 to 5.1% in 2022. However, public investment contracted by 4.9% in 2022, while government consumption was flat.

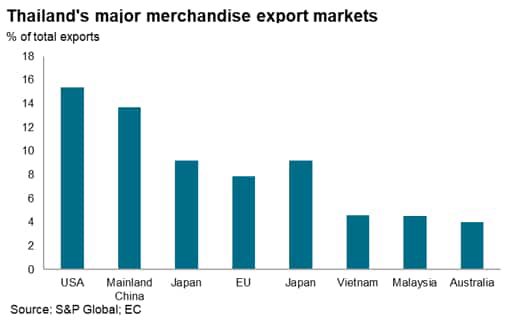

Strong growth in private consumption and investment as well as rising energy import prices helped to boost import growth, which rose by 15.3% in 2022, while exports rose by just 5.5%, measured in USD terms. Consequently, the trade balance narrowed from USD 32.4 billion in 2021 to USD 10.8 billion in 2022.

S&P Global Market Intelligence

Due to the important contribution of international tourism to Thailand’s GDP, a key factor that constrained the rate of recovery of the Thai economy in 2022 was the slow pace of reopening of international tourism, although this gathered momentum in the second half of 2022.

S&P Global Market Intelligence, S&P Global PMI surveys @ S&P Global 2023

The S&P Global Thailand Manufacturing PMI surged to 60.4 in April from 53.1 in March, signalling a rapid improvement in overall business conditions and the strongest performance in any month since the survey started in December 2015. The month-on-month increase in the headline PMI, at 7.3 points, was also by far the biggest on record (the next-largest upward movement was 4.8 points in May 2020).

S&P Global Market Intelligence, S&P Global PMI surveys @ S&P Global 2023.

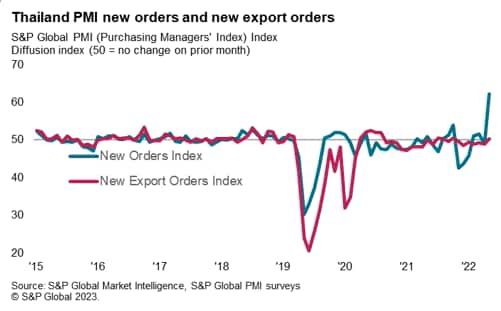

A key factor driving the improvement in manufacturing operating conditions was a marked expansion in new orders during April. The rate of growth was the fastest on record and largely driven by domestic demand.

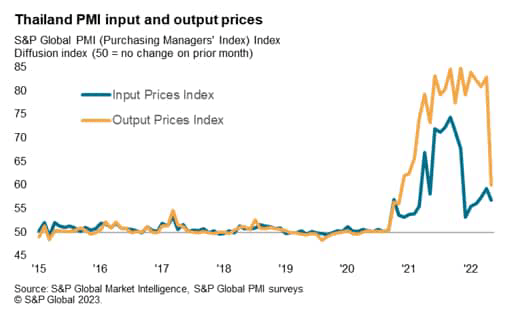

Despite rising demand for raw materials and components in April, manufacturers reported shorter suppliers’ delivery times for the first time since April 2022. This reflected a wider recovery in regional and global supply chains. Price pressures eased in April, with input prices having increased at the slowest rate in three months.

S&P Global Market Intelligence, S&P Global PMI surveys @ S&P Global 2023.

Thailand’s headline CPI inflation rate eased to 2.7% y/y in April 2023 compared with 5.0% y/y in January 2023 and 7.9% y/y in August 2022. The Monetary Policy Committee (MPC) of the Bank of Thailand decided to raise the policy rate by 0.25% from 1.25% to 1.50% at their Monetary Policy meeting on 25 January 2023, with a further 0.25% rate hike implemented on 29 March 2023. This follows three 25bp rate hikes by the MPC in 2022, In 2022, the Monetary Policy Committee (MPC) decided to increase the policy rate three times by 25 basis points each in August, September and November. The MPC assessed that headline inflation will likely return to the target range by mid-2023, with average CPI inflation projected to decline to 2.9% in 2023 and 2.4% in 2024.

Recovery of international tourism sector

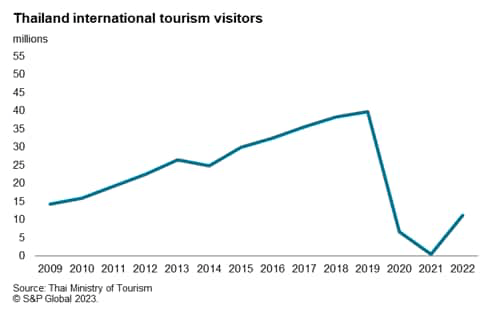

International tourism was a key part of Thailand’s GDP prior to the COVID-19 pandemic, contributing an estimated 11.5% of GDP in 2019. However, foreign tourism visits collapsed after April 2020 as many international borders worldwide were closed, including Thailand’s own restrictions on foreign visitors.

As COVID-19 border restrictions were gradually relaxed in Thailand and also in many of Thailand’s largest tourism source countries during 2022, international tourism showed a significant improvement during the second half of the year. The number of international tourist arrivals reached 11.15 million in 2022, compared with just 430,000 in 2021. However, the total number of visits was still far below the 2019 peak of 39.8 million, indicating considerable scope for further rapid growth in the tourism sector during 2023.

International tourism arrivals in the first quarter of 2023 surged to 6.5 million visitors, which was more than half the total number of international tourist visits in 2022. Total tourism receipts in the first quarter for both domestic and international tourism spending were estimated at 499 billion baht, up by 127% y/y. The Tourism Authority of Thailand has increased its estimated target for international tourism visits in 2023 to 25 million, which is more than double the total number of international tourism arrivals in 2022.

Thai Ministry of Tourism @ S&P Global 2023.

Thailand economic outlook

Despite the upturn in private consumption and international tourism arrivals in 2022, the overall pace of economic expansion was relatively moderate, at just 2.6%. Easing of pandemic-related travel restrictions during 2022 has also allowed a gradual reopening of domestic and international tourism travel, which gathered momentum in the second half of 2022.

With more normal conditions expected for international tourism travel in 2023, this should provide a significant boost to the economy. Due to the importance of tourism inflows from mainland China prior to the pandemic, the reopening of mainland China’s international borders will be an important factor contributing to the further recovery of Thailand’s tourism market.

Helped by the continued recovery of the international tourism sector, some upturn in GDP growth to a pace of around 3.4% is expected in 2023.

Over the next decade, Thailand’s economy is forecast to continue to grow at a steady pace, with total GDP increasing from USD 500 billion in 2022 to USD 860 billion in 2032. A key driver will be rapid growth in private consumption spending, buoyed by rapidly rising urban household incomes.

The international tourism sector will continue to be a dynamic part of Thailand’s economy, buoyed by rapidly rising tourism arrivals in the populous Asian emerging markets, notably mainland China, India and Indonesia.

S&P Global: EC

By 2036, Thailand is forecast to become one of the Asia-Pacific region’s one trillion-dollar economies, joining mainland China, Japan, India, South Korea, Australia, Taiwan, Philippines, and Indonesia in this grouping of the largest economies in APAC. The substantial expansion in the size of Thailand’s economy is also expected to drive rapidly rising per capita GDP, from USD 6,900 in 2022 to USD 11,900 by 2032. This will help to underpin the growth of Thailand’s domestic consumer market, supporting the expansion of the manufacturing and service sector industries.

However, rising per capita GDP levels will also put pressure on Thailand’s competitiveness in certain segments of its manufacturing export industry. Therefore, an important policy priority for the nation will be to continue to transform manufacturing export industries towards higher value-added processing in advanced manufacturing industries.

One of the key economic and social challenges facing Thailand is its rapidly ageing population, which will result in a rising burden of health care and social welfare costs over the next two decades. This will be a drag on Thailand’s long-term potential growth rate, making an investment in technology and innovation increasingly important to mitigate the economic impact of demographic ageing.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here