Welcome to the May 2023 edition of the ‘junior’ lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2024 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020’s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

May saw another very busy month of news from the lithium juniors.

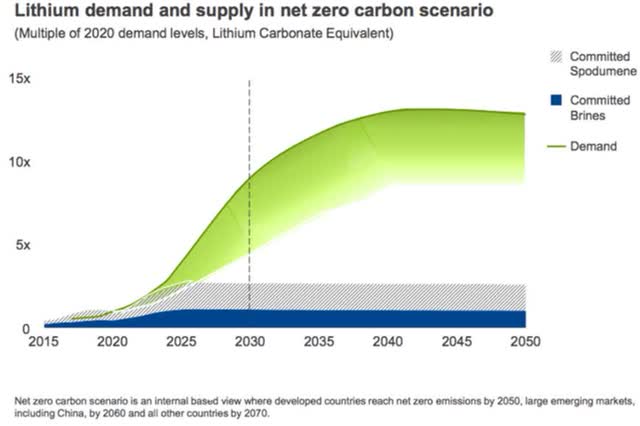

It is good to remember the Benchmark Minerals Intelligence forecast that the world will need 78 new lithium mines from 2022 to 2035. Or Trend Investing’s forecast that lithium demand will increase 35x from 2020 to 2037. At Tesla 2023 Shareholder Meeting Elon Musk said the world needs to increase battery production by 29X/year from now to reach a 100% renewable energy world.

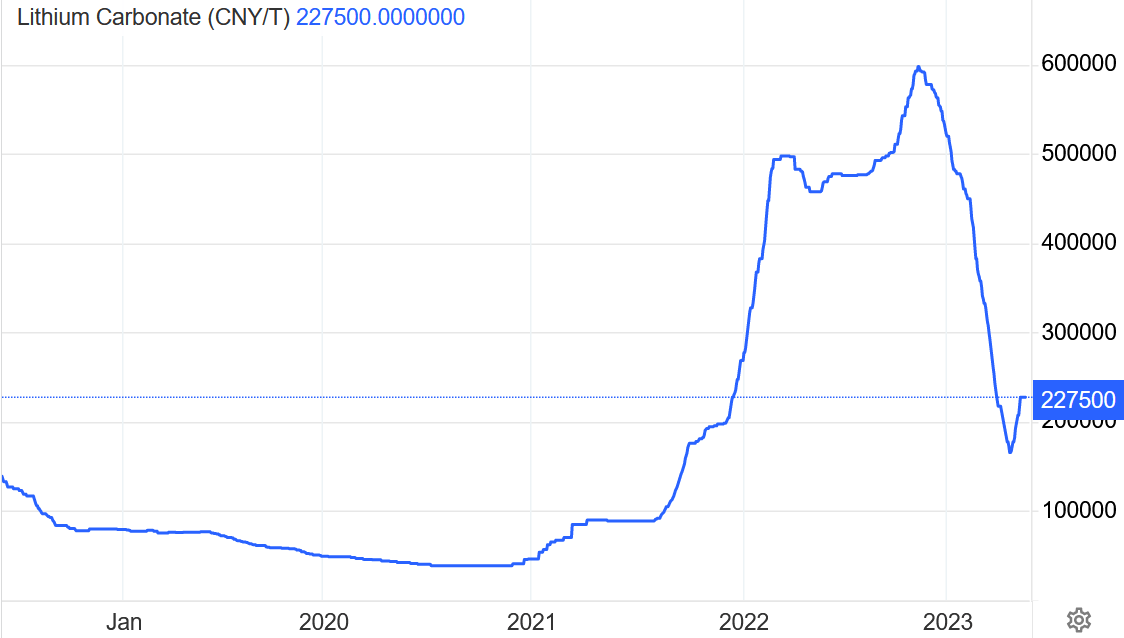

Lithium price news

Asian Metal reported during the past 30 days, the 99.5% China delivered lithium carbonate spot price was up 44% and the China lithium hydroxide price was up 14.7%. The Lithium Iron Phosphate (Li 3.9% min) price was up 8.96%. The Spodumene (6% min) price was down 0.57% over the past 30 days.

Metal.com reported lithium spodumene concentrate (6%, CIF China) average price of USD 4,120/t, as of May 24, 2023.

China lithium carbonate spot price 5 year chart – CNY 227,500 (~USD 32,197) (source)

Trading Economics

Rio Tinto forecasts lithium emerging supply gap (chart from 2021) – 60 new mines the size of Jadar needed

Rio Tinto

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of May 2023” article. Highlights include:

- Samsung SDI, GM to build $3 bln joint EV battery plant in US.

- Hyundai Motor Group and SK On to establish EV battery cell production JV in US.

- Argentina’s lithium pipeline promises ‘white gold’ boom as Chile tightens.

- Germany to dedicate $2.2 billion to secure supply of critical commodities – report.

- Reuters: BMI – Lithium prices bounce after big plunge, but surpluses loom.

- Tesla lithium refinery groundbreaking in Texas.

- Tesla Master Plan 3 says we will need a massive 240 TWh of energy storage for a 100% renewable energy economy. Tesla 2023 shareholder meeting – Solar & wind production needs to increase by 3x/yr, battery production by 29x/yr, BEV production by 11x/yr.

- Macron Flags $7.3 billion in battery investments in France.

- Japan to subsidize half of costs for lithium and key mineral projects.

- Argentina gets “nod” from US to increase lithium trade fivefold. Emerging lithium supplier Argentina says it’s close to US deal under IRA.

- Korea’s battery makers embrace LFP cells as China strides ahead.

- LG Chem to expand battery materials business more than six-fold by 2030.

- Sodium batteries need to grow up more before dethroning lithium, CPCA says.

- Albemarle OK’s up to $1.5B lithium hydroxide plant expansion in Australia. Albemarle establishes Strategic supply Agreement with Ford Motor Company to deliver battery-grade lithium hydroxide.

- SQM announces long-term lithium supply agreement with Ford.

- Ganfeng Lithium has announced mass production of solid-state batteries.

- Allkem and Livent to merge and create a leading Global Integrated Lithium Chemicals Producer.

Junior lithium miners company news

Wesfarmers [ASX:WES] (OTCPK:WFAFY) (took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. More details here at: Progress at the Mt Holland lithium project where Wesfarmers state: “Construction of the mine, concentrator and refinery is underway with first production expected in 2024.”

On May 2 The West Australian reported:

Wesfarmers seeks high value acquisitions in lithium for group renewal. Wesfarmers is open to further deals in the lithium space and healthcare as it flags it is seeking high value “bolt-on acquisitions” to grow its portfolio…

You can view the latest company presentation here.

Upcoming catalysts include:

- Late 2023 – Mt Holland spodumene production.

- H1, 2025 – Kwinana LiOH refinery planned to begin and ramp to 45-50ktpa LiOH.

Liontown Resources [ASX:LTR] (OTCPK:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. Mostly funded to production.

On April 28 Liontown Resources announced: “Quarterly activities report for the period ended 31 March 2023.” Highlights include:

- “…Mining activity commenced with first blast and 771,000 BCM of Total Material Movement on site.

- Construction at Kathleen Valley continued at pace with a focus on earthworks, processing infrastructure foundations and delivery of pre-ordered critical path equipment progressing to site.

- Rapid expansion of the Accommodation Village with 444 rooms now on site and dining hall commissioned.

- Underground mining tender issued to market for award in the second half of 2023.

- Ongoing optimisation identified opportunity to expand initial plant capacity and updated capital estimate reflecting scope changes and industry-wide cost escalation.

- Large focus on detailed design completion and incorporation of throughput increase to 3 Mtpa.

- DSO opportunity progressed with ore already being stockpiled, samples sent to potential customers and commercial discussions advancing.

- Continuation of Buldania exploration program and Olympio farm-in executed.

- Cash at bank of $305.1 million and first draw down of Ford funding facility subsequent to the end of the quarter.

- Liontown Board rejects unsolicited non-binding indicative proposal from Albemarle.“

On May 10 Liontown Resources announced: “Liontown awards Open Pit Mining Services Contract.”

You can view the company’s latest presentation here.

Upcoming catalysts include:

- 2023-24: Kathleen Valley Project construction

- Q1, 2024: Commissioning with production set to begin mid 2024

Leo Lithium Limited [ASX:LLL] (OTCPK:LLLAF)

Leo Lithium is developing the Goulamina Lithium Project (50/50 JV with Ganfeng Lithium) in Mali with a total Resource of 142.3 Mt @ 1.38% Li2O targeting a production start in mid 2024.

On April 27 Leo Lithium Limited announced: “Goulamina Project mid-term status update. Mid-term review demonstrates project on track to deliver first spodumene by Q2, 2024. Ongoing optimisation work and improved cost visibility has resulted in an updated capital estimate reflecting DFS scope changes, which includes an accelerated mining ramp up, and industry-wide cost escalation to a lesser extent. Despite minor revisions, Leo Lithium remains a top tier, low-cost producer.” Highlights include:

- “Detailed engineering of Stage 1, design optimisation, additional scope and industry wide inflationary pressures have resulted in a US$30 million increase in the 2021 DFS capital cost estimate from US$255 million to US$285 million (a 12% increase).

- The costs for the Operational Readiness Phase are estimated at US$33 million and cover the accelerated ramp up of mining and plant commissioning activities.

- The combined impact of the revised capital cost estimate and the inclusion of costs for the Operational Readiness Phase brings total capital expenditure from FID to first production to US$318 million.

- Project schedule review completed, and mine plan for the first two years of operations finalised. 90% of contracts awarded or under negotiation, securing much of the supply and construction costs.

- Project remains on track for first spodumene production in Q2 2024, and early revenue opportunity from Direct Shipped Ore (DSO) confirmed at an expanded 185,000 tonnes, providing significant additional early funding: first DSO shipments are planned for Q4 2023.

- The Goulamina Project is one of the largest and lowest capital intensity lithium spodumene projects globally with a Stage 1 capacity of 506,000 dry tonnes per annum at a capital intensity of US$580/tonne SC6 capacity based on the revised capital cost estimate of US$285 million which confirms Goulamina as a globally competitive, emerging spodumene producer.“

On April 28 Leo Lithium Limited announced: “Quarterly report for the quarter ended 31 March 2023. Goulamina Lithium Project: Construction on track, Resource set to grow, and DSO swiftly materialising.”

On May 24 Leo Lithium Limited announced: “Drilling delivers thick high-grade mineralisation outside of current resource.” Highlights include:

- “More strong assay results received from Danaya and the Northeast Domains at the Goulamina Lithium Project.

- Significant down-hole pegmatite intercepts include: 92 metres at 2.01 % Li2O, from 132 m including 36 metres at 3.00 % Li2O, from 132 m (GMRC689). 112.7 metres at 1.43 % Li2O, from 83.2 m (GMDD013). 60.35 metres at 1.72 % Li2O, from 205.3 m and 14m at 2.17 % Li2O from 271 m (GMRC597D). 76.4 metres at 1.73 % Li2O, from 90 m and 70.65 metres at 2.24 % Li2O, from 175.6 m (GMRC533D).

- Mineralisation remains open at depth and along strike.

- Update of Mineral Resource Estimate anticipated in June 2023.”

You can view the company presentation here.

Upcoming catalysts include:

- H2, 2023: DSO targeted to begin.

- Q2, 2024: Commissioning targeted to begin for Goulamina.

Investors can read the recent Trend Investing article on Leo Lithium here.

Eramet [FR:ERA] (OTCPK:ERMAY) (OTCPK:ERMAF) – ‘Targets DLE production by early 2024’

Eramet is in a JV ‘Eramine Sudamerica’ (50.1% Eramet, 49.9% Tsingshan) which owns the Centenario-Ratones Lithium Project in Argentina. Eramet targets to start DLE production by early 2024.

On April 27 Eramet announced: “Eramet: Q1 2023 turnover of €775m.” Highlights include:

- “…Significant decline in selling prices compared to Q1 2022 particularly for manganese alloys, of which prices were exceptionally at that time, but also for Class II nickel (NPI and ferronickel).

- Input costs remain high, albeit with a trend reversal in freight and reducing agent prices.

- Strength of Eramet’s financial profile: first financial ratings obtained from Fitch (BB+) and Moody’s (Ba2).

- Liquidity remains at a high level contributing to secure the Group’s financing plan.

- The outlook for 2023 is, as expected, set against the background of a less buoyant macroeconomic context.

- Adjusted EBITDA is revised slightly downwards to around €1.1bn in 2023…

- The Group continues to focus on cost control, productivity actions and cash generation, while preparing its growth projects in the energy transition.“

On May 11 Eramet announced: “Eramet accelerates its CSR commitment with the launch of its first audit within the Initiative for Responsible Mining Assurance system.”

Investors can read the recent Trend Investing article on Eramet here.

POSCO [KRX:005490] (PKX)

POSCO owns the northern Sal de Vida (Hombre Muerto salar, Argentina) tenements bought from Galaxy Resources (now Allkem). POSCO targets to start DLE production by H1, 2024.

On May 2 KED Global reported:

POSCO to spend $900 mn to expand lithium, cathode output in Korea. The S.Korean steel giant plans to produce total 150,000 tons of cathodes and run 3 lithium refining plants in Gwangyang by 2025.

On May 10 Fastmarkets reported:

POSCO teams up with China’s Huayou to build battery material plant in S Korea. POSCO has signed a preliminary agreement with Chinese battery material company Huayou Cobalt to build a nickel sulfate refining and precursor plant in South Korea…The joint venture project is expected to go into commercial operations in 2027, according to domestic media in South Korea.

On May 22 The West Australian reported:

Pilbara Minerals partner POSCO lauds South Korea as cheaper option for lithium hydroxide plant…POSCO has partnered with several WA mining companies, including Gina Rinehart’s Hancock Prospecting — through which it holds a 12.5 per cent stake in the Roy Hill iron ore mine — and Pilbara Minerals on a lithium hydroxide plant in the South Korean city of Gwangyang.

Upcoming catalysts include:

- Late 2023 – Plan to commission production of POSCO/Pilbara Minerals JV LiOH facility in Korea.

- H1, 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Atlantic Lithium Limited [LSE:ALL] [ASX:A11] (OTCQX:ALLIF)

Atlantic Lithium is progressing its Ewoyaa Project in Ghana towards production. Piedmont Lithium has a 50% project earn-in share.

On April 28 Atlantic Lithium Limited announced: “Corporate update. Quarterly activities and cash flow report for the quarter ended 31 March 2023…”

On May 16 Atlantic Lithium Limited announced:

Appointment of Chief Executive Officer. Changes aligned with strategy to strengthen mine operating skills. Atlantic Lithium…is pleased to announce the appointments of Keith Muller as Chief Executive Officer (“CEO”) and Len Kolff as Head of Business Development & Chief Geologist, both effective immediately.

Upcoming catalysts include:

- End Q2, 2023 – Definitive Feasibility Study to be completed.

- 2024 – Production targeted to begin.

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On April 27 Vulcan Energy Resources announced:

Agreement for proposed strategic partnership for Central Lithium Plant including equity financing. Vulcan Energy Resources Ltd. (Vulcan, the Company; ASX: VUL) has signed a Term Sheet agreement with Nobian GmbH (Nobian) for the formation of a 50/50 joint venture over, and equity financing of, Vulcan’s Central Lithium Plant (CLP), which forms part of Vulcan’s Zero Carbon Lithium™ Project (Transaction)…Nobian shall contribute EUR 161 million (approximately A$265m) in cash as equity to fund CAPEX for the CLP, to acquire 50% of the SPV2 Joint Venture, on the basis of an agreed pre-money valuation of EUR 322 million for the CLP SPV2…It is expected that Nobian’s equity contribution, alongside expected project debt finance to be obtained by the Company, which BNP Paribas, Vulcan’s financial advisor, is assisting Vulcan on arranging, will fully cover the funding requirement for the CLP…

On April 28 Vulcan Energy Resources announced: “Quarterly activities report March 2023.” Highlights include:

- “…Successful completion of two years’ lithium extraction pilot plant operation on site, proving Vulcan’s Zero Carbon Lithium™ Project process to produce lithium with zero fossils and net zero carbon footprint.

- After two years of sorbent testwork, Vulcan’s internally developed VULSORB™ selected for Phase One commercial development as most optimal sorbent choice for lithium extraction, onshoring IP and supply chain in Europe.

- Successful completion of Phase One DFS for the Zero Carbon Lithium™ Project…

- Focus for the year ahead is now on execution and operational readiness, for the full Phase One commercial development to produce lithium for electric vehicles, as well as renewable energy, from Europe, for Europe.

- Launch of financing process for Phase One commercial development, with initial market sounding for debt financing providing positive feedback.

- Overall increase in the Upper Rhine Valley Brine Field (URVBF) lithium Resource to 26.6Mt LCE.

- Significant progress on optimisation plant construction, and significant growth in operations and execution teams, led by new VP Production.

- Bridging engineering phase commenced, towards planned start of ordering of commercial long lead items for Phase One in Q2. Discussions commenced with key suppliers and EPCM contractors.

- Significant cash position of EUR 112m being deployed towards initial CAPEX items for Phase One, including land acquisition, to maintain project momentum.“

On May 17 Vulcan Energy Resources announced:

Zero Carbon Lithium™ Project update…Crystallizer developed by Novopro has been successfully installed in the Vulcan Lithium Extraction Optimisation Plant (LEOP) in Landau…

Upcoming catalysts include:

- Q1 2023 – DFS, potential permitting and project funding.

- End 2026 – Target to commence commercial production, then ramp to 40,000tpa.

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

On May 16 Critical Elements Lithium Corp. announced: “Critical Elements Lithium: Rose drilling results and corporate update.” Highlights include:

- “LR-22-188A: 1.33% Li2O and 66.41ppm Ta2O5 over 13.20 m.

- LR-22-189: 1.79% Li2O and 220.39 ppm Ta2O5 over 4.10 m and 1.66% Li2O and 85.91 ppm Ta2O5 over 5.20 m.

- LR-22-190: 1.78% Li2O and 205.62 ppm Ta2O5 over 7.60 m…

- LR-22-197: 1.10% Li2O and 63.64 ppm Ta2O5 over 21.70 m.”

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2023 – Possible off-take or project financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

Standard Lithium [TSXV:SLI] (SLI)

On May 9 Standard Lithium announced:

Standard Lithium signs Joint Development Agreement with Koch Technology Solutions…to share data and jointly develop and commercialize integrated lithium brine processing flowsheets for Standard Lithium’s exclusive use in the Smackover Formation…

On May 11 Standard Lithium announced:

Standard Lithium reports fiscal third quarter 2023 results. Expands Project Portfolio to include Resource-Rich Texas Opportunity. Advances Work Supporting Flagship Arkansas Projects Feasibility Studies…

On May 23 Standard Lithium announced:

Standard Lithium drills and samples highest confirmed grade lithium brine in Arkansas…This recent infill drilling work to further define the lithium resource has resulted in a marked upside to the in-situ lithium grade. In our experience, the grade of lithium in brine used for Direct Lithium Extraction (DLE) has a meaningful impact on both capital expenditures and operating costs in connection with the extraction process, so a higher grade typically results in lower overall costs…

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF) (IONR)

ioneer ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

On April 26 ioneer Ltd announced: “Mineral Resource increases by 168% to 3.4 Mt lithium carbonate underscores growth potential for U.S. supply chain.”

On April 27 ioneer Ltd announced: “Quarterly activities report for the period ending 31 March, 2023.” Highlights include:

- “…U.S. Department of Energy offers conditional commitment for a loan of up to US$700 million for the Rhyolite Ridge Project.

- NEPA permitting process advances with formal closure of the Public Scoping Period.

- Detailed engineering and procurement activities advancing.”

On May 10 ioneer Ltd announced: “Ioneer and Dragonfly Energy Partnership to strengthen U.S. Lithium Battery and Storage Supply Chain.”

Upcoming catalysts include:

- 2023 – Possible permitting approval.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On April 28 AVZ Minerals announced: “Activities report for the quarter ending 31 March 2023.” Highlights include:

- “AVZ’s securities remained in Voluntary Suspension during the March 2023 Quarter pending a resolution and clarity of the mining and exploration rights for the Manono Lithium and Tin Project (“Manono Project”).

- AVZ continued its high-level discussions with the DRC Government with respect to the award of the Manono Project Mining Licence (PE) to Dathcom Mining SA (“Dathcom”) and other permits required for the Manono Project.

- AVZ continued to affirm its legal rights to a 75% interest in Dathcom and its pre-emptive rights over 15% of the 25% interest held by La Congolaise D’Exploitation Miniere (“Cominiere”) in the Manono Project, which is the subject of arbitration proceedings before the International Chamber of Commerce (“ICC”) in Paris…

- Essential construction works for the construction team camp facilities at site continued.”

On May 8 AVZ Minerals announced:

Favourable ruling in ICC Emergency Arbitration proceedings against Cominière…Cominière is prevented from taking any action or taking any steps, that would result from the implementation of the termination of the Dathcom JVA and/or the consequences of such termination, until the final award on the merits of the broader Cominière Arbitration Proceedings is made…

On May 15 AVZ Minerals announced:

Receipt of request for ICC Arbitration proceedings from Cominière and Jin Cheng…

Upcoming catalysts include:

- 2023 – Any further arbitration news in the Manono Project dispute with Zijin Mining Group.

Note: July 2022 – AVZ Minerals ‘confident’ despite Manono dispute remaining unresolved

Global Lithium Resources [ASX:GL1]

On April 26 Global Lithium Resources announced: “Mining lease application lodged for Manna Lithium Project. Technical De-Risking Workstreams Commenced.”

On April 28 Global Lithium Resources announced: “Quarterly report for the period ending 31 March 2023.” Highlights include:

- “Majority of assay results have now been received from the 2022 Manna drilling program with results indicating a large, high grade lithium bearing pegmatite extension of the existing deposit suggesting exploration upside.

- 2023 drilling program at Manna will comprise at least 35,000m and target extensions of lithium bearing pegmatites along strike and at depth.

- The Manna Project progresses to Definitive Feasibility Study (DFS) following completion of Scoping Study. A number of opportunities have been identified to improve mining costs and plant capacity. Exploration program is being finalised with a focus on extending mine life. Environmental baseline studies underway with the Company well positioned to submit Works Approvals early in CY24…“

On May 3 Global Lithium Resources announced: “Large scale exploration programs underway.”

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On April 28 Lake Resources NL announced:

Quarterly report for the quarter ended 31 March 2023…Definitive Feasibility Study [DFS] and Environmental Social Impact Assessment (ESIA) studies continue with demonstration plant validation required prior to completion of the DFS. Completion of DFS is expected in mid-2023. Lake is well funded with a cash balance of $A113 million and no debt at 31 March 2023.

European Lithium Ltd [ASX:EUR] (OTCQB:EULIF)

On April 28 European Lithium Ltd. announced: “European Lithium and Obeikan update.” Highlights include:

- “EUR finalising JV plans to build and operate the hydroxide plant in Saudi Arabia.

- Obeikan Investment Group complete due diligence.

- The Company aims to finalise the JV agreement before 31 May 2023.“

On May 10 European Lithium Ltd. announced: “Update on NASDAQ Listing.” Highlights include:

- “F-4 amendment lodged with the Securities and Exchange Commission (SEC).

- NASDAQ listing on track to complete in 2nd quarter 2023.”

Upcoming catalysts include:

- Q2, 2023 – Merger transaction and NASDAQ listing expected to complete.

- August 8, 2023 – Deadline to complete business combination to form Critical Metals Corp.

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

No news for the month.

Upcoming catalysts include:

- May 31, 2023 – Declaration of Environmental Impact (‘DIA’) decision due.

- 2024 – DFS due.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCQX:EMHLF)(OTCQX:EMHXY)

On April 28 European Metals Holdings announced:

Quarterly activities report March 2023. During the reporting period, the Company made two very significant announcements with respect to the delivery of the Cinovec Project. Firstly, European Metals was pleased to announce that the Cinovec Project had been declared a Strategic Project…Secondly, European Metals announced the appointment of DRA Global Limited (“DRA”) to complete the Definitive Feasibility Study (“DFS”) for the Cinovec Project in the Czech Republic…

On May 18 European Metals Holdings announced: “Czech PM visits Cinovec, signs key MoC with PM of Saxony.” Highlights include:

- “Czech Republic Prime Minister, Petr Fiala, visits the globally significant Cinovec Lithium Project.

- PM Fiala signs Memorandum of Cooperation (MoC) with Prime Minister Kretschmer of the German state of Saxony to enhance cooperation on strategic projects, including Cinovec.”

On May 25 European Metals Holdings announced: “Testwork realises continued outstanding lithium recoveries.” Highlights include:

- “…Flotation testwork repeatedly reached >95% lithium recovery to flotation concentrates at target Li–grades and mass yield.

- DFS remains on track for completion in Q4 2023.”

Upcoming catalysts include:

You can read a recent Trend Investing update article on EMH here.

Galan Lithium [ASX:GLN] (OTCPK:GLNLF)

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina.

On April 28 Galan Lithium announced: “Quarterly activities report March 2023.” Highlights include:

Hombre Muerto West (HMW) DFS:

- “Long-term production development plan, including Candelas, updated; Total production increase from 34ktpa to 60ktpa LCE over 4 stages.

- DFS optimisation across two phases; 1st phase end May’23 and 2nd phase Aug’23.

- Updated HMW Resource imminent; HMW Reserve model to follow with DFS…“

Candelas

- “100% ownership of Candelas completed.”

Greenbushes South:

- “Drilling commenced at Galan’s 100% owned Greenbushes South Lithium Project, located only 3km from the world-class Greenbushes Lithium Mine.”

Corporate:

- “Cash and investments at the end of quarter ≈A$28 million.”

On May 1 Galan Lithium announced: “Galan’s 100% owned HMW Project resource increases to 6.6Mt LCE @ 880 mg/l Li (72% in measured category).”

On May 5 Galan Lithium announced:

Addendum to announcement Galan’s 100% owned HMW Project resource increases to 6.6Mt LCE @ 880 mg/l Li (72% in measured category)…

On May 22 Galan Lithium announced:

Galan completes strongly supported A$31.5 million Institutional Placement to accelerate development of its Strategic Lithium Projects…Galan well-funded with pro-forma cash position of approximately A$50 million on completion of the Placement.

Century Lithium Corp. (TSXV:LCE) (OTCQX:CYDVF)(Formerly Cypress Development Corp.)

Century Lithium Corp. owns tenements in the Clayton Valley, Nevada, USA.

No news for the month.

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

May 9 Frontier Lithium announced: “Frontier Lithium announces filing of technical report on the Spark Lithium resource and provides initial results on the 2023 Exploration Program.” Highlights include:

- “The Company commenced drilling at Bolt on March 31st, 2023, and has, to date, completed 2,629m in 11 drill holes…Results from these first two diamond drill holes have been received and highlights are included below: DDH PL-103-23 beneath the northernmost channel on the Bolt pegmatite showing, intersected a total of 60.5m of pegmatite averaging 1.33% Li2O…DDH PL-104-23 intersected 67.2m of pegmatite averaging 1.33% Li2O on the Bolt pegmatite showing…

- The report titled “Mineral Resource Estimate (MRE) for the PAK Lithium Project” outlines the upgraded Spark Deposit total resource at 18.8 Mt, with an average grade of 1.52% Li2O in the Indicated category and 29.7 Mt, with an average grade of 1.34% Li2O in the Inferred category.

- A hydrogeological and geomechanical program was conducted with 2,033m in 11 holes eleven drill holes at the PAK deposit in February and March, 2023.”

Investors can read the recent Trend Investing article here and the recent CEO interview here.

Patriot Battery Metals [TSXV:PMET][ASX:PMT] (OTCQX:PMETF)

Patriot Battery Metals own the Corvette Lithium Project in James Bay, Quebec. No resource yet but some great long length drill results.

On May 1 Patriot Battery Metals announced: “Patriot extends strike length of the CV5 pegmatite to 3.7 km, Corvette Property, Quebec, Canada.”

On May 16 Patriot Battery Metals announced: “Patriot drills 122.6 m at 1.89% Li2O, including 8.1 m at 5.01% Li2O, and Extends High-Grade Nova Zone, at the CV5 Pegmatite, Corvette Property, Quebec, Canada.” Highlights include:

- “Additional high-grade Zone discovered, marking interpreted western extension of the Nova Zone – drill holes CV23-130, 132, 134, and 138:

- 122.6 m at 1.89% Li2O (126.0 m to 248.5 m), including 8.1 m at 5.01% Li2O (CV23-138).

- 130.3 m at 1.56% Li2O (164.0 m to 294.3 m), including 52.7 m at 2.45% Li2O (CV23-132).

- 101.3 m at 1.44% Li2O (123.3 m to 224.6 m), including 28.1 m at 3.00% Li2O (CV23-134).

- 101.2 m at 1.08% Li2O (145.5 m to 246.7 m), including 10.1 m at 2.42% Li2O and 4.0 m at 4.13% Li2O (CV23-130).

- Other significant intercepts:

- 101.2 m at 1.59% Li2O (240.3 m to 341.5 m), including 28.5 m at 4.14% Li2O or 8.8 m of 5.20% Li2O (CV23-141).

- 56.3 m at 2.34% Li2O (251.4 m to 307.6 m), including 11.1 m at 4.06% Li2O (CV23-114).

- 57.7 m at 1.46% Li2O (182.0 m to 239.7 m), including 13.3 m at 2.65% Li2O (CV23-168A).

- 43.5 m at 1.80% Li2O (239.5 m to 283.0 m), and 24.0 m at 2.04% Li2O (372.9 m to 396.9 m) (CV23-127).

- A continuous 93 m interval of dominantly spodumene-bearing pegmatite in most westerly drill hole completed to date at the CV5 Pegmatite – CV23-184 (assays pending).

- A continuous 139 m interval of dominantly spodumene-bearing pegmatite in final drill hole of the 2023 winter program at the CV5 Pegmatite – CV23-190 (assays pending).

- Core sample assay results for 27 drill holes completed during the 2023 winter drill program remain to be reported.”

Investors can read the Trend Investing article here.

Latin Resources Ltd [ASX:LRS] (OTCPK:LRSRF)

LRS’ flagship is the 100% owned Salinas Lithium Project in the pro-mining district of Minas Gerais, Brazil. The Salinas Project has a maiden Indicated & Inferred JORC Mineral Resource estimate of 13.3Mt @ 1.2% Li2O at the Colina deposit.

On April 28 Latin Resources Ltd announced: “Quarterly activities report for the period ending 31 March 2023.” Highlights include:

Salinas Lithium Project, Brazil

- “Commencement of 65,000m mineral resource infill and expansion program focused on fast-tracking the growth of the Colina Deposit Mineral Resource.

- Mineral Resource growth potential confirmed at Colina, with latest assay results confirming the presence of multiple thick high-grade pegmatites.

- Significant results include: SADD055: 13.73m @ 1.38% Li 2O from 200.19m and: 16.08m @ 1.07% Li 2O from 306.69m and: 10.85m @ 1.96% Li 2O from 322.15m and: 11.16m @ 1.61% Li 2O from 360.17m and: 16.00m @ 1.61% Li 2O from 393.60m. SADD061: 20.70m @ 1.51% Li 2O from 159.00m. SADD070: 16.43m @ 1.69% Li 2O from 323.57m and: 18.89m @ 1.56% Li 2O from 356.91m. SADD072: 26.87m @ 1.62% Li 2O from 333.82m including: 23.00m @ 1.78% Li 2O from 335.00m. SADD074: 28.87m @ 1.29% Li 2O from 283.13m. SADD077: 14.66m @ 1.52% Li 2O from 158.05m and: 33.07m @ 1.83% Li 2O from 319.53m.

- Resource definition drilling focused on the Colina and Colina West (“Colina”) areas is on track for the planned JORC Mineral Resource Estimate (“MRE”) upgrade scheduled for June 2023.

- Salinas Lithium Project tenure expanded by approximately 367% over the Company’s previous holdings, to a total of over 38,000 hectares now under Latin’s control.

- Latin Resources has signed a non-binding Memorandum of Understanding (“MoU”) with the State Economic Department of Minas Gerais (“Invest Minas”) to collaborate on building the battery materials sector and supply chain investment in the region.“

Corporate

- “Subsequent to the end of the quarter, the Company received firm commitments for a A$37.1 million placement.

- Latin held $21.0 million in cash and investments as at 31 March 2023.”

On May 2 Latin Resources Ltd announced:

Colina continues to impress. Diamond drilling on-track for june resource update. SADD087: 9.02m @ 2.06% Li 2O from 221.39m. SADD089: 18.21m @ 1.90% Li 2O from 212.72m. SADD091: 15.92m @ 1.64% Li 2O from 290.29m.

On May 18 Latin Resources Ltd announced:

New drilling confirms Colina lithium pegmatites extend to over 2.0 kms. Diamond drilling for June resource update completed.

You can read the very recent Trend Investing article that discusses Latin Resources here.

Lithium Power International [ASX:LPI] (OTC:LTHHF)

LPI owns 100% of the Maricunga Lithium Brine Project in Chile, plus plans to demerge its Australian assets into a new company called Western Lithium Ltd.

On April 28 Lithium Power International announced: “Activity report for the quarter ended March 2023.” Highlights include:

- “Completion of the MSB ownership consolidation enabled LPI to increase its presence in Chile.

- The Chilean Government recently announced the long awaited National Lithium Policy for the country…

- LPI commenced and completed its inaugural drilling program at its East Kirup lithium prospect, located in the Greenbushes region of Western Australia.

- The WA demerger process continues to be advanced and will be continually accessed in relation to capital market conditions.“

Upcoming catalysts:

- 2023 – Possible spin-out of Western Australian Greenbushes and Pilgangoora lithium assets.

American Lithium Corp. [TSXV: LI] (AMLI) (acquired Plateau Energy Metals Inc.)

On May 8 American Lithium Corp. announced:

American Lithium receives first of 3 drill permits to commence additional development and discovery drilling at and around Falchani Peru.

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

On May 16 Wealth Minerals announced: “Wealth Minerals engages Francisco Lepeley as CEO Wealth Minerals Chile SpA…”

Investors can view the company’s latest presentation here.

E3 Lithium Ltd. [TSXV:ETL] [FSE:OW3] (OTCQX:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an Inferred Resource of 24.3mt LCE.

On May 16 E3 Lithium Ltd. announced: “E3 Lithium begins Field Pilot Plant Site Construction…”

You can read the company’s latest presentation here.

Nevada Lithium Resources Inc. [CSE:NVLH] (OTCQB:NVLHF)

Nevada Lithium has an arrangement to own 100% of the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

No news for the month.

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

On May 5 Bloomberg reported: “Rio Tinto cautions against takeover fever after lithium’s dramatic price slump.” Highlights include:

- “High premiums for smaller players risky, CEO Stausholm says

- Prices of battery material have plunged from November peak.”

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

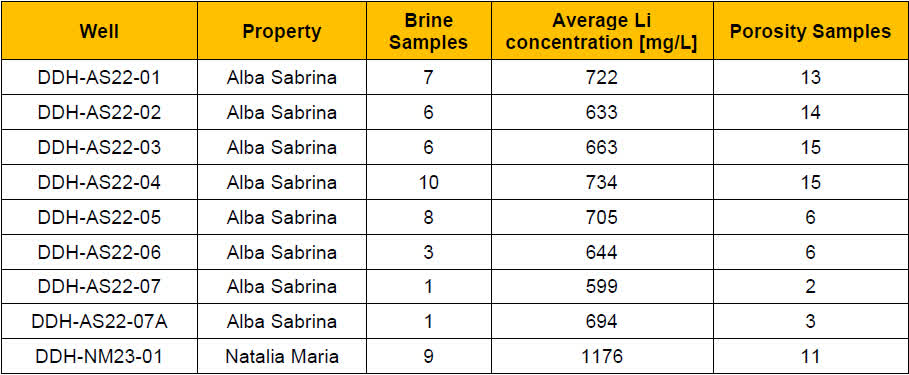

On May 16 Lithium South Development Corp. announced:

Lithium South drills monitoring wells on Tramo Property – A major milestone toward reserve estimation…Lithium South is providing final results for the recently completed resource expansion drilling program at the 5,687-hectare HMN Li Project in Salta Province, Argentina. The program was comprised of eight core holes, seven located on the Alba Sabrina claim block (2089 hectares) and one on the Natalia Maria claim block (115 hectares). Combined with the previously drilled Tramo claim block (383 hectares) the Company has now evaluated 70% of the owned salar surface area.

Final hole averages are reported in Table 1 below (source)

Lithium South Development Corp.

You can view a recent Trend Investing Lithium South CEO interview here.

Alpha Lithium [NEO: ALLI] (formerly TSXV: ALLI) [GR:2P62] (OTCPK:APHLF)

On May 2 Alpha Lithium announced:

Alpha Lithium nears completion of Pilot Plant at Tolillar Salar, Argentina.

On May 23 Alpha Lithium announced:

Alpha Lithium comments on unsolicited and non-binding acquisition proposal. Alpha Lithium Corporation (NEO: ALLI) (OTC: APHLF) (German WKN: A3CUW1) (“Alpha” or the “Company”), wishes to comment on the announcement by Tecpetrol Investments S.L. (“Tecpetrol”) of its unsolicited and non-binding offer to acquire the issued and outstanding common shares of the Company for cash consideration of $1.24 per share (the “Offer”)…Alpha’s board of directors has conducted a review and assessment of the Offer and determined it to be opportunistic, and not in the best interests of Alpha or its shareholders.

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Petalite Zone Resource of 6.28mt grading 1.37% Li2O, plus an Inferred Resource of 0.94mt at 1.3%. Avalon also has a Partnership JV Agreement with Indian conglomerate Essar to establish Ontario’s first regional lithium battery materials refinery in Thunder Bay.

On May 4 Avalon Advanced Materials announced:

Avalon expands resource potential at Separation Rapids Lithium Project, Kenora ON…Thirteen holes totalling 4179 metres were drilled on the central main mass depth extensions of the resource. Of note, the final hole totalled 570 metres vertically through the deposit and confirmed visual petalite mineralization to a depth of 565 metres. This increases the potential depth of the deposit by 80% from the previously tested 315 metres deepest intercept…In summary, drilling tested the deposit to depth, over a 300 metre strike length in the main part of the deposit (“The Big Whopper”) with mineralization exceeding the 0.5% Li2O cutoff grade encountered in all but one of the holes. Notable mineralized intervals (all widths estimated true width unless otherwise stated) include 1.67% Li2O over 19.6 metres (SR-22-81), 1.20% Li2O over 27.5 metres (SR-23-83) and 1.8% Li2O over 9.63 metres contained within 0.96% Li 2O over 45 metres (SR-23-86)…

On May 15 Avalon Advanced Materials announced: “Avalon outlines strategic direction and provides update on 2023 activities.” Highlights include:

- “Completion of 2022-2023 drill program at Separation Rapids, with recently announced drill results highlights (assays from four holes are still pending)

- Preparation of further exploration plans in 2023, which will include drilling the Snowbank target (6km northwest of flagship Separation Rapids), continue drilling at Separation Rapids and Lilypad.

- Additional baseline environmental study work underway.

- Ongoing lithium hydroxide conversion test work being conducted by a major technology group using innovative process technology.

- Discussions with various engineering firms in preparation of a definitive feasibility study on Separation Rapids.“

On May 19 Avalon Advanced Materials announced:

Avalon announces CEO retirement…Don Bubar. Don will continue to serve on Avalon’s Board of Directors. Scott Monteith, who was appointed to Avalon’s Board of Directors in May 2023, will assume the role of Interim CEO.

Snow Lake Resources (LITM)

No news for the month.

Essential Metals [ASX:ESS] (OTCPK:PIONF) – Acquisition offer @ A$0.50 from Tianqi Lithium Energy Australia effectively blocked by MinRes

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.16% Li2O.

On May 11 Essential Metals announced:

Pioneer Dome Lithium Project & corporate update. Lithium-focused exploration and feasibility study activities are ramping up as Essential re-engages with potential off-take and funding partners.

Green Technology Metals [ASX: GT1] (OTCPK:GTMLF)

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada.

On April 28 Green Technology Metals announced: “Quarterly activities report for the quarter ended 31 March 2023.” Highlights include:

Root

- “Significant drilling and exploration work across the 20km wide Root Project at the three primary locations of McCombe, Morrison and Root Bay.

- Maiden Mineral Resource Estimate at the McCombe Deposit of 4.5 Mt at 1.01% Li20 and 110 ppm Ta2O5 (inferred) over the first 1.5km strike…“

On May 1 Green Technology Metals announced: “High-grade lithium results in stacked pegmatites up to 18m thick at Root Bay.” Highlights include:

Root Bay Prospect

- “…Highlights from a further 13 diamond holes have been received, significant results include: RB-23-088: 17.8m @ 1.73% Li2O from 99.4m. RB-23-085: 16.0m @ 1.58% Li2O from 181.4m. RB-23-091: 14.3m @ 1.52% Li2O from 33.1m. RB-23-014: 13.3m @ 1.37% Li2O from 8.5m including 11.7m @ 1.50% Li2O from 9.4m. RB-23-016: 11.3m @ 1.52% Li2O from 57.8m. RB-23-007: 6.6m @ 1.57% Li2O from 170.8m. RB-23-083: 6.5m @ 1.55% Li2O from 54.8m.

- 13 stacked lithium bearing pegmatites along an initial 1.3km strike have been drilled to over 200m deep along the Root Bay trend, situated 8km east of Morrison.

- Expanded phase 1 program of 35 diamond drill holes at Root Bay now complete, with assays from 15 holes pending.”

Morrison Prospect

- “Phase 2 diamond drilling at Morrison now complete with assays from a further 15 diamond holes returned with highlights including: RB-23-347: 7.63m @ 1.64% Li2O from 81m. RB-23-362: 5.46m @ 1.21% Li2O from 44m. RB-23-366: 7.58m @ 0.72% Li2O from 94m including 3.0m @ 1.64% Li2O from 95m…“

On May 19 Green Technology Metals announced: “A$20m Strategic Investment and Offtake Term Sheet with LG Energy Solution.”

Winsome Resources Limited [ASX:WR1] [FSE:4XJ] (OTCQB:WRSLF)

On April 26 Winsome Resources announced: “Quarterly report period ending 31 March 2023.” Highlights include:

Drilling & Exploration

- “Drilling at Adina extends potential strike length of the mineralised pegmatite target to 3.1km.

- Mineralisation at Adina remains open to both the east and west of the Main Zone.

- Further assay results confirm Adina as a robust high-grade lithium project.

- Assays from Main Zone at Adina included several +50m intersections at high grades of Li2O.

- Resource development drilling ramps up at Adina with additional drilling rigs being mobilised…“

On May 10 Winsome Resources announced: “Discovery of new lithium bearing pegmatite dyke swarm at Adina.” Highlights include:

- “Drilling has identified a new lithium-bearing pegmatite dyke swarm at Adina, located in the footwall of the deposit below previous drilling.

- First results have been received as detailed in Table 1:2.44% Li2O over 10.1m from 219.9m and 1.10% Li2O over 21.0m from 260.6m (AD-23-051),1.57% Li2O over 15.4m from 221.5m (AD-23-073),1.29% Li2O over 14.0m from 200.8m (AD-23-054), and 1.02% Li2O over 23.2m from 253.0m (AD-23-028).

- The discovery of a new zone of lithium mineralisation significantly changes the potential endowment at Adina and is anticipated to enhance the potential to develop a viable lithium operation.

- Strong high-grade lithium intersections continue from the Main Zone of lithium mineralisation at Adina, with new results presented in this release including: 2.25% Li2O over 18.7m from 43.3m (AD-23-072), 2.09% Li2O over 10.0m from 35.2m (AD-23-028),1.71% Li2O over 42.8m from 49.9m (AD-23-040),1.68% Li2O over 34.0m from 126.0m (AD-23-060),1.38% Li2O over 44.1m from 49.9m (AD-23-073); and1.34% Li2O over 32.6m from 65.5m (AD-23-057).

- A fourth drill rig is being mobilised to Adina for resource definition drilling.

- Continued flow of results ensures Winsome on track for maiden Adina Mineral Resource Estimate later in 2023.“

You can view the Aug. 2022 Trend Investing article on Winsome Resources here, when it was at A$0.26.

International Lithium Corp. [TSXV:ILC] [FSE: IAH] (OTCQB:ILHMF)

On May 1 Market Screener reported: “International Lithium Corp. reports earnings results for the full year ended December 31, 2022.”

Lithium Energy Limited [ASX:LEL]

On May 1 Lithium Energy Limited announced: “Massive intersections of Lithium rich brine confirm World Class Potential of Solaroz Lithium Project.” Highlights include:

- “Initial assay results received for Holes 4 (SOZDD004) and 5 (SOZDD005) at the Solaroz Lithium Brine Project show outstanding lithium brine concentrations of up to 508 mg/L across massive intersections of up to ~400m, with final brine depth yet to be reached in both holes…

- Hole 4 highlights to date include a massive total of 401.5 metres of conductive brines across the upper and lower aquifer with assays returning up to 508 mg/l Lithium.

- Hole 5 highlights to date include a significant total of 369.5 metres of conductive brines across the upper and lower aquifers with assays returning up to 479 mg/l Lithium…

- The outstanding intervals and grades of lithium mineralisation encountered across the holes drilled to date support the world class potential of the Solaroz Project.”

On May 12 Lithium Energy Limited announced: “Massive intersections of brine continue at Solaroz at up to ~780 Metre Depth.”

On May 15 Lithium Energy Limited announced: “Further assays confirm significant lithium brine concentrations accross massive intersections at Solaroz.”

On May 19 Lithium Energy Limited announced:

Hole 6 commences at Solaroz Lithium Brine Project with Third Drilling Rig… Lithium Energy has commenced drilling the sixth diamond drill hole (SOZDD006) of its initial 10 hole, 5,000 metre resource definition drilling programme at Solaroz…

Argentina Lithium & Energy Corp. [TSXV: LIT] (OTCQB:PNXLF)

On May 3 Argentina Lithium and Energy Corp. announced:

Argentina Lithium announces corporate update. Argentina Lithium & Energy Corp… is pleased to announce that it has retained Zoppa Media Group (“Zoppa”) to act as an investor relations consultant to the Company, to assist with corporate finance and investor relations programs…

You can read a Trend Investing CEO interview here.

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On May 15 Rock Tech Lithium announced:

Final engineering study and Deutsche Bank mandated for Guben Converter…Estimated post-tax NPV (8% discount rate) of EUR 1,194m (USD 1,246m). Estimated post-tax IRR of 22.3%. Estimated annual EBITDA of EUR 293m (USD 305m); after-tax annual cash flow of EUR 188m (USD 199m). Estimated average battery-grade lithium hydroxide (LHM) prices of 31,771 USD/t, and average. SC6 prices of 1,966 USD/t. Estimated initial capital costs of EUR 730m (USD 762m); payback of 3.6 years after start of production. Preparation for construction has commenced, start of battery-grade LHM production planned for Q1’2026. Deutsche Bank mandated as placement agent for Converter equity financing.

Neometals (OTC:RRSSF) (OTCPK:RDRUY) [ASX:NMT]

On April 26 Neometals reported: “Portugal lithium refinery study confirms step-change Opex of ELi™ technology.”

On April 28 Neometals reported: “Quarterly activities report for the quarter ended 31 March 2023.” Highlights include:

Corporate

- “Cash balance A$32.4 million, investments of A$30.1 million and no debt.“

Core Battery Materials Business Units

Lithium-ion Battery (“LIB”) Recycling (50% NMT via Primobius GmbH, an incorporated JV with SMS group GmbH)

- “Successful completion of demonstration trial for refinery ‘Hub’ engineering cost study (“Hub ECS”)…

- Hub ECS activities advanced for 50 tpd (18,250tpa) plant due for completion end June 2023.

- Hilchenbach 10tpd commercial ‘Spoke’ ramping up – targeting permitted capacity end September 2023.”

Lithium Chemicals (earning into potential 50:50 JV with Bondalti Chemicals SA via Reed Advanced Materials Pty Ltd (“RAM”) (70% NMT, 30% Mineral Resources Ltd)

- “Advanced test work and engineering cost study for planned 25,000tpa lithium hydroxide operation using RAM’s ELi™ process at Bondalti’s operations in Portugal. Study results announced post quarter-end.

- Salar brine concentrate sample secured for Canadian pilot testing in JunQ/SepQ 2023.

- Advancing design of planned demonstration plant at Bondalti’s Estarreja chlor-alkali operation. Procurement planned for SepQ 2023 and construction in MarQ 2024.”

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

On May 11 Nano one Materials announced: “Nano One provides quarterly progress update and reports Q1 2023 results.” Highlights include:

- “Working capital of ~$35.7 million; cash of ~$40.1 million.

- Completion of Cathode Evaluation Project & Expansion of Collaboration with Automotive OEM.

- New program funding from SDTC.

- Three new patents issued and allowed in Taiwan, Korea, and US…

- Advancement of Commercial Plans for LFP and Other Cathode Materials.”

On May 17 Nano one Materials announced: “Successful completion of phase two of co-development agreement with leading niobium producer CBMM.”

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), ACME Lithium Inc. [CSE:ACME] (OTCQX:ACLHF), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (OTCQB:AZLAF), Atlantic Lithium [LON:ALL] (OTCQX:ALLIF), Atlas Lithium Corp. (ATLX), Azimut Exploration [TSXV:AZM] (OTCQX:OTCQX:AZMTF), Azure Minerals Limited [ASX:AZS], Bastion Minerals [ASX:BMO], Battery Age Minerals [ASX:BM8], Bradda Head Lithium Limited [LON:BHL] (OTCQB:BHLIF) (OTCPK:CDCZF), Brunswick Exploration [TSXV:BRW] (OTCQB:BRWXF), Bryah Resources Ltd [ASX:BYH], Carnaby Resources Ltd [ASX:CNB], Champion Electric Metals Inc. [CSE:LTHM] [FSE:1QB1] (GLDRF), Charger Metals [ASX:CHR], Compass Minerals International (CMP), Cosmos Exploration [ASX:C1X], Critical Resources [ASX:CRR], Cygnus Metals [ASX:CY5], Delta Lithium [ASX:DLI](formerly Red Dirt Metals), Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), Foremost Lithium Resources & Technology [CSE:FAT] (OTCPK:FRRSF), Future Battery Minerals [ASX:FBM] (OTCPK:AOUMF), Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), Grounded Lithium [TSXV:GRD] (OTCQB:GRDAF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formely Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], Infinity Stone Ventures (CSE:GEMS) (OTCQB:GEMSF), International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Jindalee Resources [ASX:JRL] (OTCQX:JNDAF), Jourdan Resources [TSXV:JOR] (OTCQB:JORFF), Kodal Minerals (LSE-AIM:KOD), Larvotto Resources [ASX:LRV], Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (LRTTF), Li-FT Power [CSE:LIFT] [FSE:WS0] (OTCPK:LFTPF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Ionic Corp. [TSXV:LTH] (OTCQB:LTHCF), Lithium Plus Minerals [ASX:LPM], Lithium Springs Limited [ASX:LS1], Loyal Lithium [ASX:LLI], Megado Minerals [ASX:MEG], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], Midland Exploration [TSXV:MD] (OTCPK:OTCPK:MIDLF), MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), Oceana Lithium [ASX:OCN], Omnia Metals Group [ASX:OM1], One World Lithium [CSE:OWLI] (OTC:OWRDF), Patriot Lithium [ASX:PAT], Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCQB:PWRMF), Power Minerals [ASX:PNN], Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Pure Resources Limited [ASX:PR1], Q2 Metals [TSXV:QTWO], Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Spod Lithium Corp. [CSE:SPOD] (EEEXF), Stria Lithium [TSXV:SRA] (OTCPK:SRCAF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Tantalex Lithium Resources [CSE:TTX], [FSE:1T0], Tearlach Resources [TSXV:TEA] (OTCPK:TELHF), Tyranna Resources [ASX:TYX], Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Xantippe Resources [ASX:XTC], X-Terra Resources [TSXV:XTT] (OTCPK:XTRRF), Zinnwald Lithium [LN:ZNWD].

Conclusion

May saw lithium chemicals spot prices surge higher and spodumene spot prices flat.

Highlights for the month were:

- Wesfarmers seeks high value acquisitions in lithium.

- Liontown Resources mining activity commenced with first blast

- Leo Lithium first DSO shipments are planned for Q4 2023. Drills 92 metres at 2.01 % Li2O, from 132 m including 36 metres at 3.00 % Li2O.

- POSCO to spend $900m to expand lithium, cathode output in Korea.

- Vulcan Energy Agreement with Nobian GmbH for proposed strategic partnership for Central Lithium Plant including equity financing.

- ioneer Mineral Resource increases by 168% to 3.4 Mt lithium carbonate.

- European Metals Holdings – Czech PM visits Cinovec, signs key MoC with PM of Saxony.

- Galan Lithium 100% owned HMW Project resource increases to 6.6Mt LCE @ 880 mg/l Li.

- Patriot Battery Metals drills 122.6 m at 1.89% Li2O (126.0 m to 248.5 m).

- Alpha Lithium rejects takeover offer from Tecpetrol Investments S.L.

- Green Technology Metals (“GT1”) Maiden Mineral Resource Estimate at the McCombe Deposit of 4.5 Mt at 1.01% Li20. GT1 signs A$20m Strategic Investment and Offtake Term Sheet with LG Energy Solution.

- Winsome Resources discovers new lithium bearing pegmatite dyke swarm at Adina. Drills 2.25% Li2O over 18.7m from 43.3m at Adina Main Zone.

- Lithium Energy Limited drills concentrations of up to 508 mg/L across massive intersections of up to ~400m.

- Neometals Portugal lithium refinery study confirms step-change Opex of ELi™ technology.

As usual all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here