Daiwa Industries (OTCPK:DAWIF) has been the Value Lab’s crowning idea, gaining around 20% since purchase despite still pretty low levels of discovery, driven by unbelievable earnings growth. The valuation is still a joke, and corporate governance reforms spurred by the TSE may be a catalyst going forward to see greater capital payouts. Most importantly, earnings growth is now reflected thanks to comparability across accounting periods, with no understating forces. We nailed the economic predictions for Daiwa in our Top Idea article a few months ago, but actually understated the effect caused by the tax assets and also some unexpected fixed cost control, as well as a more dramatic recovery in some of Daiwa’s products aimed at more traffic-based and discretionary markets in the food industry. Overall, we believe that general food industry support, including from renewed tourism, but also a total COVID-19 return to normal will continue to benefit the company, a well as a tax asset that likely still accounts for about 5% of market cap. Definite buy.

Discussing the Results: Q1 2023

Daiwa doesn’t provide English reporting, so Google Translate will have to do as we look to see management comments on the results. In typical Japanese fashion, the comments are modest, acknowledging vague risks on the horizons around Ukraine and raw material prices that other companies for the most part expect to be increasingly in the rearview mirror, at least in terms of the delta effects on things like inflation which remains structurally lower in Japan despite Yen depreciation and imported inflation effects.

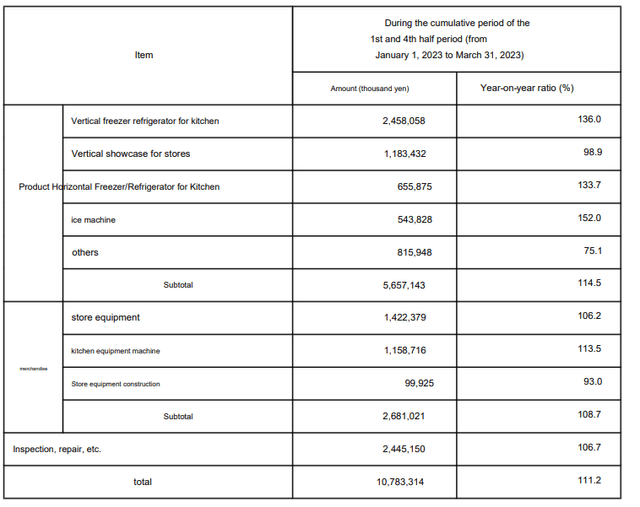

What is key is that the food industry is nearing pre-COVID levels in terms of activity, and it is certainly showing in the most traffic-levered categories. Things like ice machines have shown a sharp recovery, as well as konbini kitchen equipment, which is one of the merchandise products that they manufacture but don’t sell.

Sales Growth by Category (Q1 2023 Results)

But also their flagship refrigeration products are seeing much higher demand in terms of units, where slower unit sales in FY 2022 shifted more of the customer engagements into servicing rather than new units.

This would usually have a slightly negative mix effect, but good fixed cost control (SG&A flat YoY) on top of the gross profit growth (7%) meant pretty substantial increases in operating profit, up 28% YoY, now not confounded by the accounting changes that they didn’t do restatements for between the FY 2021 and FY 2022, discussed extensively in our Top Idea article.

Net income rocketed up almost 70% YoY, mainly because the tax bill was lower this year compared to last year despite substantially higher pre-tax profit thanks to a large tax asset created by the aforementioned accounting changes around lease sales – tax bill of 537 million Yen this quarter compared to 609 million Yen in Q1 2022.

Bottom Line

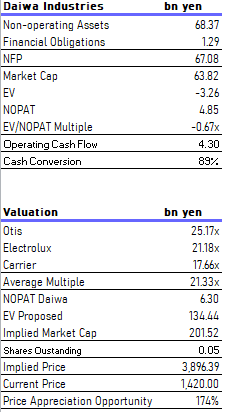

The stock is up around 20% since we first established our position. Still the upside has grown because of the operating profit growth.

Valuation (VTS)

We remain confident in the growth thanks to tourism tailwinds that have a disproportionate effect on the food industry. Moreover, Japanese foreign tourism remains a very small part of GDP compared to other countries, as well as small relative to domestic tourism, with substantial scope for growth (domestic tourism is still 80% of Japanese tourism industry). Furthermore, nothing will stop the return to pre-COVID levels, since COVID is no longer a talking point.

With the TSE beginning to crack down on caretaker managements in Japanese companies, incentivising shareholder payouts, we may see more energy in Japanese stock markets. While this concerns larger, low P/B companies more than Daiwa, where Daiwa is not really in the crosshairs for the TSE also because it is substantially family-owned, it is a less pronounced catalyst. But superb earnings growth makes us confident that this will continue to generate shareholder returns, and Daiwa is increasingly looking like a buy and hold forever stock. Obvious buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here