Investment Summary

Baker Hughes Company (NASDAQ:BKR) is a well-known global energy technology company operating in the oil and gas industry. The company’s diverse portfolio includes oilfield services, digital solutions, turbomachinery and process solutions, and measurement and control solutions. In the oilfield services segment, Baker Hughes specializes in drilling services, formation evaluation, well completion, and production optimization solutions.

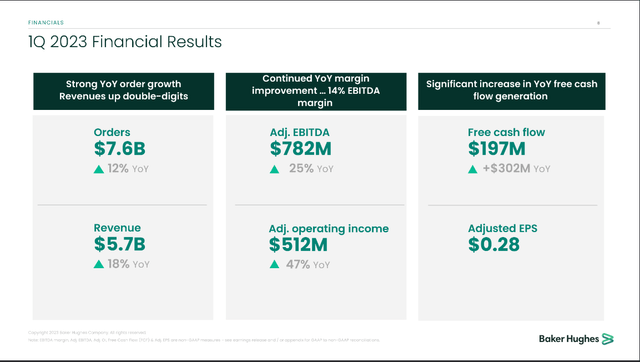

Q1 Results (Investor Presentation)

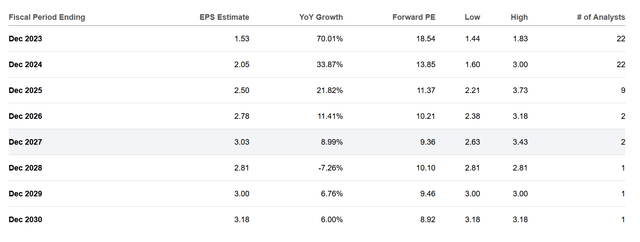

The company came out with a great last report for investors as they were navigating a quite difficult macro environment. Orders are up 12% YoY and revenues are 18% YoY is comforting to see. Looking ahead the company is aware of the special environment we are in but also mentions they have a strong diversification that should help weather volatility and uncertainty. Where I am worried about BKR is the dilution they have been performing. Shares down 20% over the last 5 years and quite close to the top they had in April 2022 doesn’t create a strong entry point right now. Paying 18x forward earnings for a company in the oil and gas industry is quite rich. Going by the estimates the current price could be at a fair multiple in 2027 if they grow the EPS accordingly. During that time I would much rather be in a company that is buying back shares and has a realistic valuation. BKR is a hold for me.

Oil And Gas Will Stay With Us

Despite the negative comments I had at the beginning of the article I am confident that BKR will continue seeing both growth and demand. The oil and gas industry won’t leave us for a very long time. There is still way too much of a dependency on it in our society. Where BKR benefits from this is that companies are still eager to start setting up drilling projects and of course need equipment to do so, equipment that BKR helps provide.

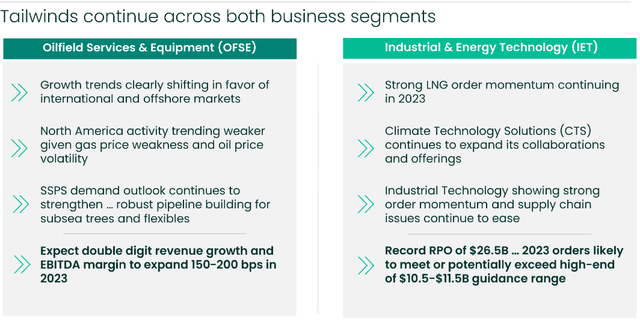

Company Segments (Investor Presentation)

Looking at what BKR recognizes as reasons for growth, the US market is weakening and other regions are presenting more growth potential instead. Present in 120+ countries, BKR has the position to start investing more in offshore and international markets instead to help fuel further growth.

Looking ahead, BKR has a strong conviction about growing revenues despite oil prices falling and not nearly at the same prices as 12 months ago. Margins aren’t fantastic, but they seem to stabilize somewhat at least. The growth the company is anticipating would be a major improvement from 2022 numbers, with around 20% top-line growth using the higher end of the estimates. The company generates a massive amount of levered FCF, if they maintain the same margins as in 2022 they could reach $2 billion in 2023.

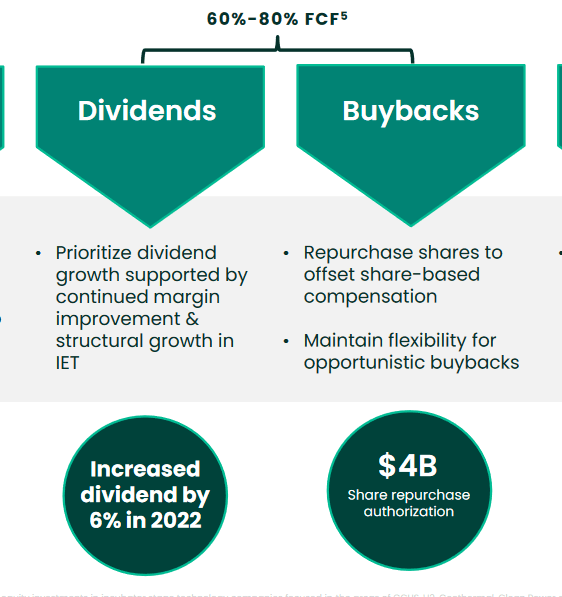

Dividend & Buybacks (Investor Presentation)

Diverting 60 – 80% of FCF to shareholders would be a major benefit to owning shares in the company. The company already has $4 billion in capital authorized to buy back shares, but it hasn’t seen any use as shares are still increasing. A stop in dilution and a start of the buyback program could be a catalyst for the share price and actually justify the current valuation. But until then I think there is still some valid concern to be had about the actual effect of the program.

The growth prospects are there for the company, but it’s still left to see about the actual impact we might see from the plan the management has set up. As mentioned, until then I will stay fast with my hold rating.

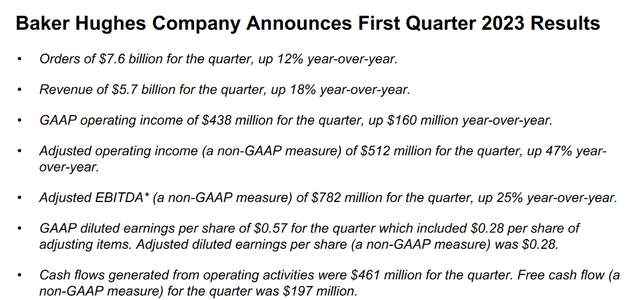

Quarterly Result

Looking at the first quarter to the start of the year, BKR had a fantastic start in my opinion. The company was able to grow both orders and revenues in the double digits. But perhaps one of the main attractions for investors with BKR is the cash flows they are generating. This quarter was no disappointment, $197 million was generated in the quarter.

Earnings Highlights (Earnings Report)

CEO Lorenzo Simonelli had an interesting remark about the market and the quarter, “Another notable characteristic of this cycle is the continued shift towards the development of natural gas and LNG. As the world increasingly recognizes the crucial role natural gas will play in the energy transition”. This take is interesting and important to keep in mind as it highlights some of the trends seen in the US natural gas market. Even though more electricity is being generated through renewable means, natural gas consumption is still trending upwards as a necessity to help support the need for housing in the US.

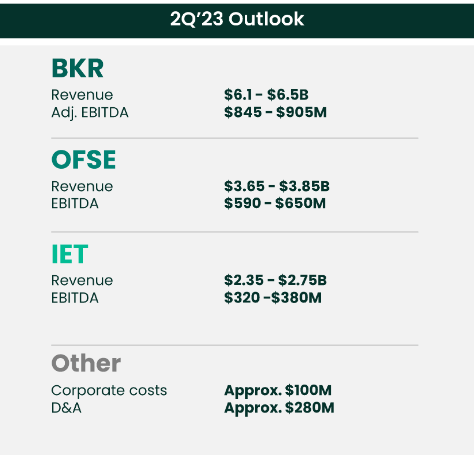

Company Outlook (Investor Presentation)

Looking at the coming quarter, revenues are expected to take a QoQ decline, but on a yearly basis, it would be an impressive 23% YoY growth using the higher end of the estimates. This goes in line with the plan the company has to deliver double-digit revenue growth for 2023. The risk for a drop in the share price I think will mainly come from a failure to execute the plan the company has for 2023. Estimates are optimistic that BKR can be a sort of growth company. Setbacks or lack of improvements in the margin I think would highlight why the current 18x forward earnings might be too rich to pay.

Earnings Estimates (Seeking Alpha)

As mentioned before, the company is dedicating a large amount of FCF to dividends and buybacks, if the margins aren’t improving and revenues don’t meet expectations I think the long-term value investors are getting here is greatly lowered. For me, investing in BKR is a bet that you will get some appreciation from the shares and the company’s ability to grow the bottom line efficiently, but also strong buybacks and dividends, despite a volatile market environment. I hope to see BKR invest heavily in foreign markets and offshore sites to benefit from the trend they noticed in the last quarter.

Valuation & Wrap Up

I think that BKR is a very exciting opportunity in the oil and gas market. But paying 18x forward earnings even if the company is estimated to have strong growth is just not viable given the industry they are in. They might be distinguished a bit given the product they offer, but I think there is ample risk here that a strong correction could happen if there is a slowdown in the growth or a miss in an earnings report.

Stock Chart (Seeking Alpha)

That’s a risk I am not comfortable taking on and would rather wait on the sidelines until the valuation either comes down, or the company is truly able to justify the valuation. Given the quality of the business and the strong balance sheet, I will still be rating them a hold.

Read the full article here