ATRenew Inc. (NYSE:RERE) operates a leading technology-driven pre-owned consumer electronics transactions and services platform in China. As a leader in the ESG sector, RERE’s mission is to provide a second life to all idle goods by facilitating recycling and trade-in services and distributing the devices to prolong their lifecycle.

ATRenew leverages its C2B, B2B, and B2C capabilities and proprietary technology to scale its omnichannel supply chain and set the standard for China’s pre-owned consumer electronics industry. To learn more details about RERE stock, please refer to my previous articles, ATRenew: Strong Revenue Growth And Positive Profits In Q4 ’22, and ATRenew: Continues To Drive Business Scale And Efficiency Through Automation.

RERE Company Website

Q1 2023 Financials

RERE reported its Q1 2023 financials on 5/23. Key highlights included high revenue growth rate outpacing the industry growth, and profitability improvement driven by efficiency gains through automation. As of Q1 2023, there were 1,935 AHS offline stores across 269 cities. The number of multi-category recycling stores exceeded 150, mainly in top-tier cities such as Shanghai, Beijing, Guangzhou, Hangzhou, and Chongqing. Monthly GMV of the multi-category products (except 3C products) exceeded RMB70 million.

Revenue: $418MM, +30% YoY driven by an increase in the sales of pre-owned consumer electronics across all channels benefiting from the overall economy recovery and AHS brand awareness in recycling.

Op Loss: -$9.8MM, and Adj. Op Income (non-GAAP): +$6.5MM (+1.5% Adj. Op margin) due to efficiency gains powered by its automated quality inspection system integrated with industry-leading AI and big data algorithms.

How Big Will RERE’s Total Addressable Market Be

ATRenew Inc. operates direct sales plus franchise stores, and it has established its strong presence in 269 cities. There are three ways to understand RERE’s total addressable market.

First, there are nearly 700 cities in China, 2x of RERE’s current footprint. Considering China’s smartphone penetration rate of ~70%, I see significant growth opportunities in most of those yet penetrated cities.

Second, China’s current total penetration of consumer electronics recycling only at 4- 5% per CIC. A 10% penetration will double RERE’s topline. The company is targeting 15%+ in top-tier cities through city-level integration, which implies 3x of its current revenue.

Finally, apart from 3C products, RERE’s multi-category recycling strategy will enable the company to gain incremental growth in the long run. For instance, according to scmp.com, “China’s second-hand luxury market is tipped to grow to US$30 billion in 2025 from US$8 billion in 2020.”

In Q1 2023, RERE’s 1P recycling transaction volume grew by +42% YoY, and +13% QoQ. As it continues the expansion efforts, I believe its growth can be further accelerated.

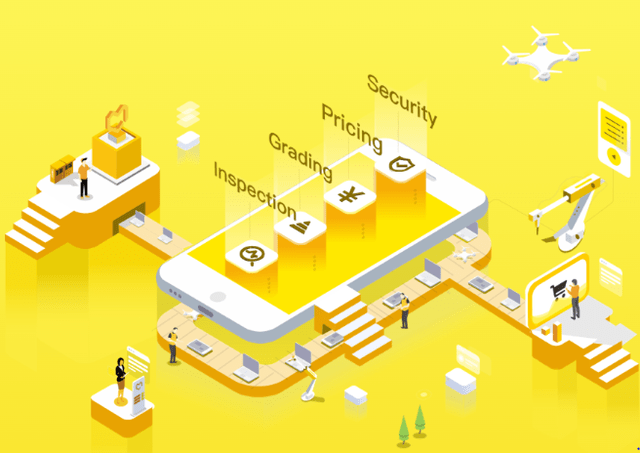

RERE’s Compliant Refurbished Devices 2C Business

Since last year, RERE has been doubling down its effort in compliant refurbished devices business. In Q1-23, this business generated RMB145 million in revenue ((RMB 140 million for the 2C business)). This allowed RERE to target high-end customers, and effectively expanded its gross margin.

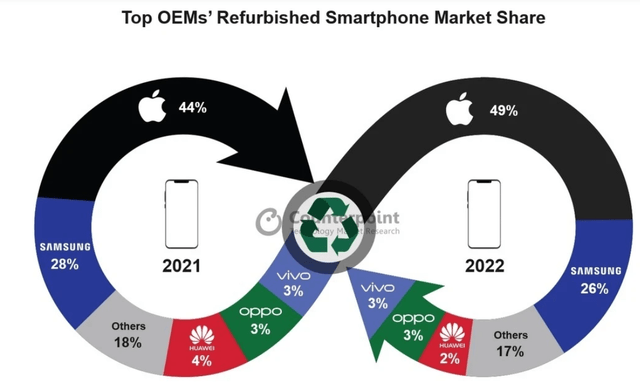

This is an attractive market. For smartphone along, according to Counterpoint Research, the iPhone has 49% market share of the global refurbished smartphone market followed by Samsung’s 26%.

www.phonearena.com/news/apple-samsung-lead-refurbished-phone-market_id147125

ATRenew Inc. has expanded its refurbishing capabilities into broad 3C categories. In Q1-23, RERE completed ~70,000 refurbished units, and aims to achieve ~160,000 units in the first half of 2023. According to the company, as of now, two out of its eight operation centers have established their refurbishment capabilities. This suggests RERE will be able to significantly grow its scale by replicating the capabilities to all remainder operation centers.

Investment Risks and Conclusion

As for investment risks, I have two callouts:

- Stock value: Similar to other U.S.-listed China stocks, their value may not be fully unlocked on the market as it will take time for investors to build confidence in these stocks.

- Fierce competition in China’s pre-owned electronics market: Overall, this space has a high barrier to entry. That said, there are a few major players on the market, and RERE has to maintain its strengths in order to grew its market shares.

Finally, ATRenew Inc. as an ESG leader has built a massively strong omnichannel foundation in pre-owned electronics market. RERE’s city expansion, category expansion, and automation operation will continue to drive its future growth in revenue and margin expansion.

Read the full article here