A Quick Take On Alarm.com

Alarm.com Holdings, Inc. (NASDAQ:ALRM) reported its Q1 2023 financial results on May 10, 2023, beating both revenue and EPS consensus estimates.

The company provides cloud-based security systems and intelligent automation functions to residential and commercial customers.

I previously wrote about Alarm.com Holdings, Inc. with a Hold rating here.

Given the macroeconomic risks the company faces, my near-term outlook on Alarm.com Holdings, Inc. stock continues to be Neutral [Hold] until we see a higher revenue growth rate.

Alarm.com Overview And Market

Tysons, Virginia-based Alarm.com was founded in 2000 to offer a range of security and other intelligent building services in the U.S. and internationally.

The firm is headed by Chief Executive Officer Stephen Trundle, who was previously Chief Technical Officer at MicroStrategy and MDI at Bath Iron Works.

The company’s primary offerings include:

-

Security & Safety

-

Video Monitoring

-

Home Management

-

Wellness

-

Access Control

-

Energy Management & Temperature Monitoring

-

Multi-location Management.

The firm acquires customers via direct sales for large accounts, through partners and resellers and via its website.

According to a 2021 market research report by Verified Market Research, the global market for alarm monitoring was an estimated $48.9 billion in 2019 and is forecast to reach $68.6 billion by 2027.

This represents a forecast CAGR of 5.0% from 2020 to 2027.

The main drivers for this expected growth are an increase in adoption of security systems in residential and commercial facilities due to insurance rate reductions and more capable system offerings at lower prices.

Also, the market for monitoring is increasingly fragmented, with new service providers such as Google and Amazon entering the market for various types of consumer-oriented monitoring solutions.

Alarm.com Recent Financial Trends

-

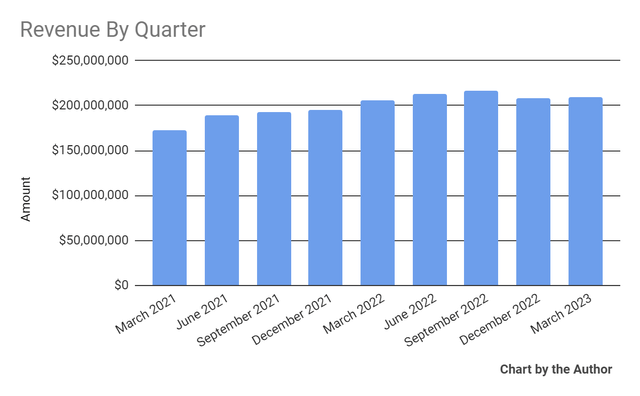

Total revenue by quarter has plateaued recently:

Total Revenue (Seeking Alpha)

-

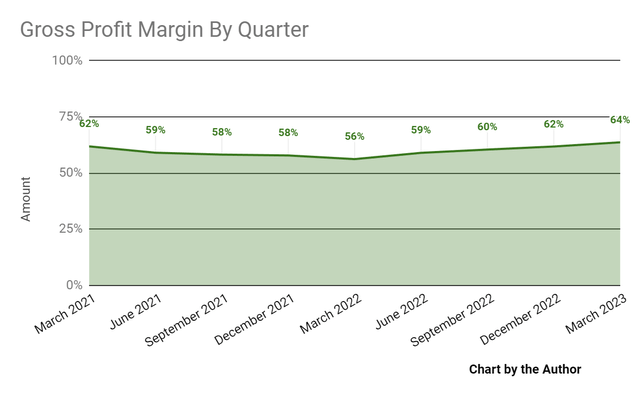

Gross profit margin by quarter has trended higher in recent quarters:

Gross Profit Margin (Seeking Alpha)

-

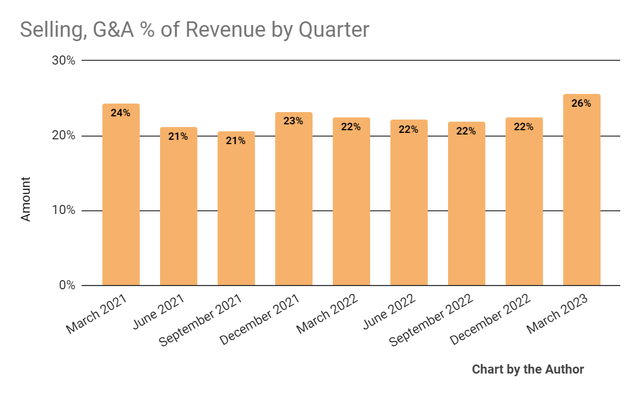

Selling, G&A expenses as a percentage of total revenue by quarter rose materially in Q1 2023:

Selling, G&A % Of Revenue (Seeking Alpha)

-

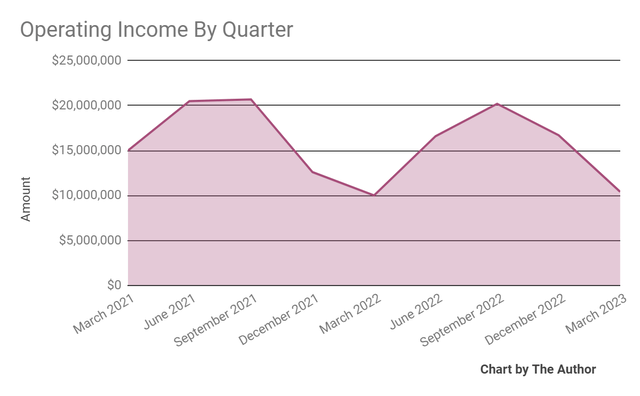

Operating income by quarter has fluctuated as follows:

Operating Income (Seeking Alpha)

-

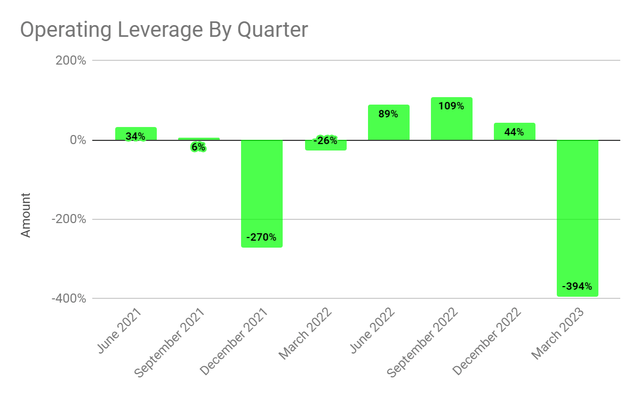

Operating leverage by quarter dropped sharply in Q1 2023:

Operating Leverage (Seeking Alpha)

-

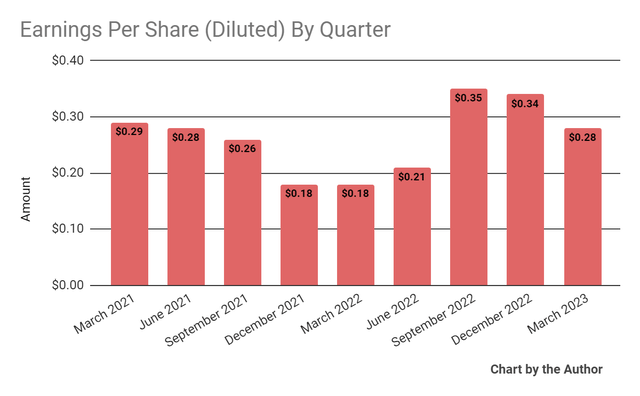

Earnings per share (Diluted) have produced the following results:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

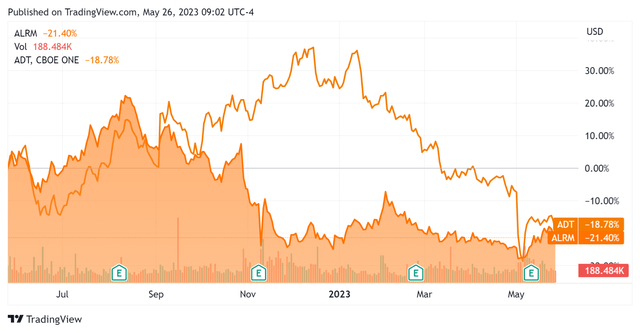

In the past 12 months, ALRM’s stock price has fallen 21.4% vs. the ADT, Inc. (ADT) drop of 18.78%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $606.4 million in cash and equivalents and $492 million in total debt, none of which was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $38.4 million, of which capital expenditures accounted for $28.9 million. The company paid $53.2 million in stock-based compensation (“SBC”) in the last four quarters, the highest trailing twelve-month result in the past eleven quarters.

Valuation And Other Metrics For Alarm.com

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.9 |

|

Enterprise Value / EBITDA |

28.0 |

|

Price / Sales |

3.0 |

|

Revenue Growth Rate |

8.3% |

|

Net Income Margin |

7.3% |

|

EBITDA % |

10.4% |

|

Net Debt To Annual EBITDA |

-1.3 |

|

Market Capitalization |

$2,500,000,000 |

|

Enterprise Value |

$2,460,000,000 |

|

Operating Cash Flow |

$67,340,000 |

|

Earnings Per Share (Fully Diluted) |

$1.18 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be ADT; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

ADT |

Alarm.com |

Variance |

|

Enterprise Value / Sales |

2.3 |

2.9 |

24.5% |

|

Enterprise Value / EBITDA |

6.0 |

28.0 |

367.8% |

|

Revenue Growth Rate |

16.5% |

8.3% |

-49.7% |

|

Net Income Margin |

0.48 |

7.3% |

-84.8% |

|

Operating Cash Flow |

$1,890,000,000 |

$67,340,000 |

-96.4% |

(Source – Seeking Alpha.)

Commentary On Alarm.com

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the resilient nature of the security industry during times of economic downturn.

Also, the firm has seen increased partner usage of its commercial service offerings.

The company has worked to expand the range of third-party camera support, making it easier for partners to use its platform.

Alarm.com Holdings, Inc. continues to expand its relationships in the residential home builder sector.

Notably, the company’s OpenEye system now offers Sales Connect, a system that is able to integrate with point-of-sale transactions to trigger ‘real-time alerts for point-of-sales exceptions such as voids, refunds and overrides, and retrieves the corresponding video of the transaction.’

However, Alarm.com Holdings, Inc. management did not disclose any company or customer retention metrics.

Total revenue for Q1 2023 rose 2.1% year-over-year and gross profit margin increased an impressive 7.5 percentage points.

Selling, G&A expenses as a percentage of revenue increased 3.1 percentage points, indicating reduced efficiency in this regard, while operating profit grew 4% year-over-year.

Looking ahead, Alarm.com Holdings, Inc. management guided full-year 2023 revenue to $868.7 million at the midpoint of the range, or approximately only 3.12% growth rate.

Adjusted EBITDA is forecasted to be approximately $122.5 million at the midpoint.

The company’s financial position is reasonably good, with ample liquidity, a moderate amount of long-term debt for its size and EBITDA and acceptable positive free cash flow.

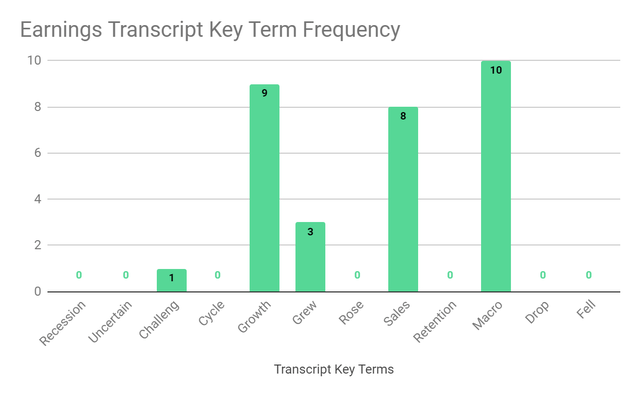

From Alarm.com Holdings, Inc. management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management cited “Challeng[es][ing]” once and “Macro” ten times.

The negative terms refer to the ongoing questions about the deteriorating macro environment the firm and its customers are facing.

In the past twelve months, the firm’s EV/EBITDA valuation multiple has dropped 13.3%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

While Alarm.com Holdings, Inc. management touts the security industry’s resilience, the company’s focus on growing its commercial business presents challenges as businesses reduce spending initiatives due to falling demand or lowered credit availability from smaller and regional banks.

Also, leadership has guided to a significantly reduced topline revenue growth rate in 2023 compared to 2022’s year-over-year growth rate.

Given the macroeconomic risks the company faces, my near-term outlook on Alarm.com Holdings, Inc. continues to be Neutral [Hold] until we see a higher revenue growth rate.

Read the full article here