The economic environment has changed significantly in the last three years. While growth rates were stable prior to the pandemic hitting in late 2019, the economy entered into a recession in early 2020. While growth rates stabilized coming out of a recession in 2021, prices also increased significantly out of the pandemic, with inflation levels coming in at historic highs for nearly three years now.

One company that has performed well even in the recent inflationary environment is the Coca-Cola Company (NYSE:KO).

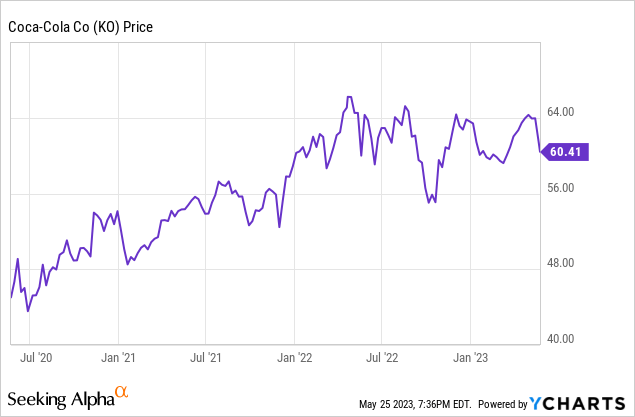

Coke is up 31.05% in the last three years. The S&P has risen 38.76% in this time frame.

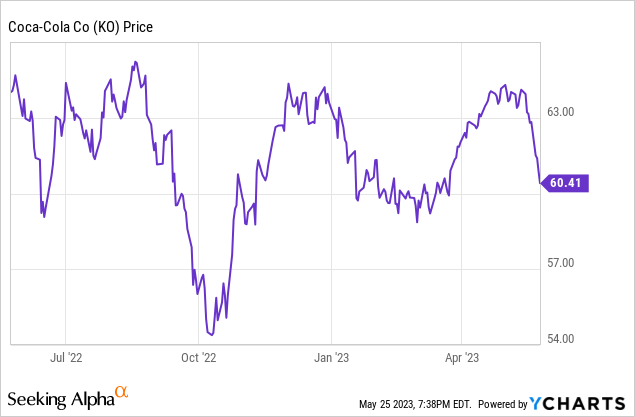

Still, while the company has performed well since late 2020, the stock has still gone nowhere over the last year.

Coke is down 5.71% in the last year, while the S&P 500 is up 4.34% in the same timeframe.

Today, I am changing my rating of the Coca-Cola Company from hold to sell. I wrote in my March article that the company was a hold because the sales volumes were flat and the valuation was unreasonable given the modest growth estimates. With a recession looking more likely today, I am changing my rating of Coke because of the unique risks that forex moves pose to the company’s current business model and the likely limit of Coke’s pricing power if incomes are declining. An extended economic slowdown should lead to a significant rise in the dollar against most major currencies, and a fall in income levels as well. The stock is also trading at a growth multiple despite analyst estimates for only mid-single-digit growth over the next four years, even a small negative revision in earnings projections should lead the stock to sell off from current levels.

Coke’s recent first-quarter earnings report shows how reliant this company is on pricing power.

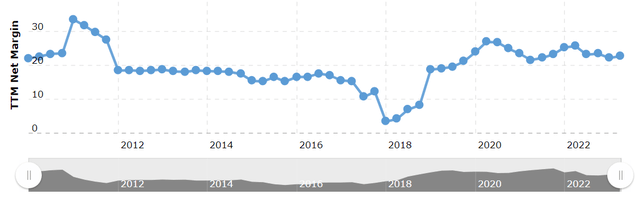

A Chart of Coke’s Net Margins (macrotrends)

Coke recently reported net revenues in the first quarter grew by 5% to $11 billion. Earnings per share increased by 12% to $.72 cents a share. The company’s first quarter margins of 22.69% were also close a 10-year high. While these headline numbers looked strong, 11% of Coke’s organic revenue growth for the quarter came from price increases, and just 1% was because of sales growth. The company also faced a 7-point headwind from currencies, showing how vulnerable Coke’s business model still is to forex moves.

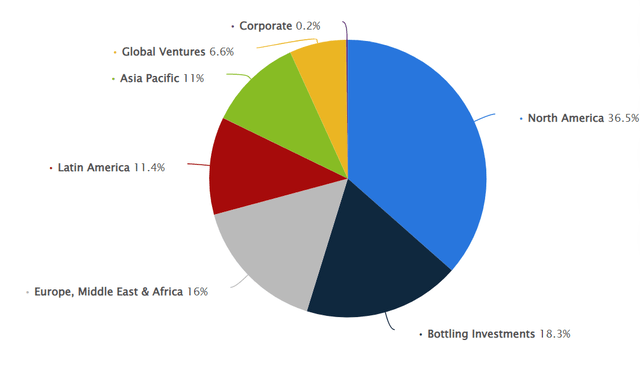

Coke increased prices by 22% on the net in Europe, the Middle East, and Africa, 12% in Latin America, and 11% in North America. While this kind of pricing power is impressive, these kinds of actions are also likely unsustainable. Coke’s recent price increases also make the company more vulnerable to a recession in emerging markets where income levels are lower, and demand is likely to be more elastic.

The company remains very vulnerable to currency movements as well. Even though management recently reported that operating income grew by 15% in constant currency, operating income still declined by 1% in the first quarter overall.

A Chart of Coke’s Revenue (statista)

In 2022, just 36% of Coke’s revenues come from North America, the company’s earnings can be significantly impacted by even small forex moves. The dollar has usually increased just over 3% in just the first three months of a recession during the last six recessions since 1979. With Europe and China both currently already seeing slower growth rates, the dollar is likely to increase significantly more than 3% against most major currencies if there is even a moderate recession this year. The consensus amongst economists remains that the US economy is likely to see at least two consecutive quarters of negative growth this year. There are growing signs of a slowdown, with first quarter growth in the US coming in at just 1.1%. Experts are forecasting the US has a 64% chance to enter a recession this year. The Fed also continues to remain committed to raising interest rates with recent inflation data in April coming in at 4.9%, which is above Powell’s stated goal of 2%.

Risks To My Thesis

There is a scenario where Coke could outperform market expectations. If the Fed were to reverse course on raising rates, inflation levels ease, or the economy avoided recession, Coke could see earnings growth accelerate overseas where the company gets nearly 65% of revenues. If prices were to fall this would also likely provide a particularly significant impact to consumers in emerging markets where income levels are lower. The company’s strong balance sheet also gives management some flexibility.

Conclusion

Here is why Coke looks overvalued at the current share price. The company currently trades at 23.4x likely forward earnings, 20.2x projected forward EBITDA, and 22.47x projected forward cash flow. The industry average is 20.03x forecasted forward earnings, 11.90x projected forward EBITDA, and 13.19x likely forward cash flow. Coke is obviously a top brand that commands a premium valuation, but analysts are still only forecasting this company to grow earnings per share at a mid-single-digit rate of 5-7% annually over the next four years despite the growth multiple the stock currently trades at. The company’s current business model is also likely to be more cyclical in my view, and signs of an extended recession this year continue to increase.

Coke was able to raise prices to successfully offset rising costs and currency moves over the last three years. Still, a recession would likely limit management’s pricing power and cause the dollar to increase significantly against more major currencies. While Coke has performed well during past recessions, the company’s current business model is likely to be much more vulnerable to an economic slowdown. With increasing signs that the economy should see two consecutive quarters of negative growth this year, investors should be able to find better value in alternative investments right now.

Read the full article here