What is the Goal of this Article?

In the high-octane, fast-paced world of technology, fortunes rise and fall. Few companies, however, display the kind of resilience, fortitude, and adaptability exhibited by Nvidia Corporation (NASDAQ:NVDA). At first glance, NVDA stock’s high valuation, with a market cap nearing $939B and a P/E ratio of 197, might deter some investors. But taking a deeper look into the company’s technology moat, financial health, business model, and innovation, it becomes evident that Nvidia Corporation’s stock price has the potential to surge even higher over the next decade.

I can’t predict or guarantee if Nvidia Corporation will be a large multi-bagger by 2033, but I believe even with its’ large market cap it can still run much higher than where it is today. The goal of this article is to explain why I believe Nvidia Corporation will be one of the most important companies of our future and due to its’ innovation will always have a high valuation. Investors who are looking to invest in Nvidia Corporation for the first time must ask themselves how long they are willing to hold shares so the company can grow into its’ valuation? and what kind of returns are they expecting. I believe there is a level of reliability, optionality, and growth that provides investors still good returns that can be earned by dollar cost averaging into this stock. So, let’s investigate the Nvidia Corporation business model and innovation that allows it to defy the rules of valuation.

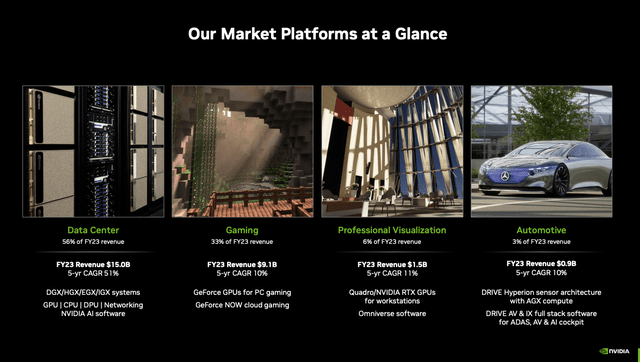

NVIDIA’s Four Market Platforms (NVIDIA Investor Presentation Q4 FY23)

Technology Moat: The Powerhouse of Accelerated Computing and AI

In my opinion, NVIDIA, is a vanguard in the technology sector and boasts a robust technology moat that firmly places it as a frontrunner in accelerated computing and Artificial Intelligence (“AI”). This edge has largely been driven by CEO Jensen Huang’s vision and execution. This company is a great example of why I prefer to invest in founder-led companies, because of their visionary leadership, innovation, and drive to create something never done before.

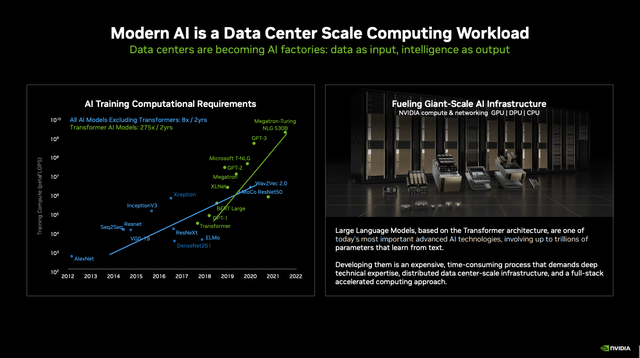

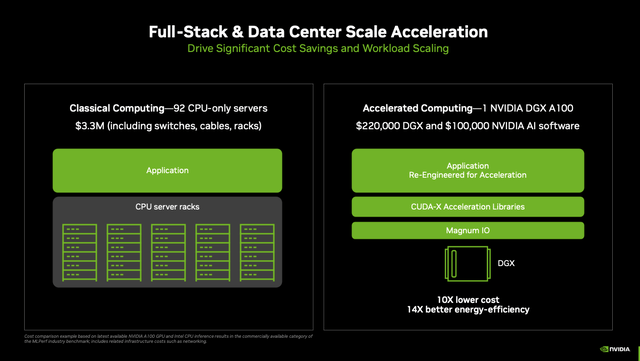

Nvidia Corporation has pioneered accelerated computing, which, as Huang explained in the Q1 FY24 earnings call, is a full-stack and data-center scale approach ideally suited for the current technology landscape. With CPU scaling slowing in the datacenter and demand for computing power ballooning, accelerated computing emerges as an optimal path forward.

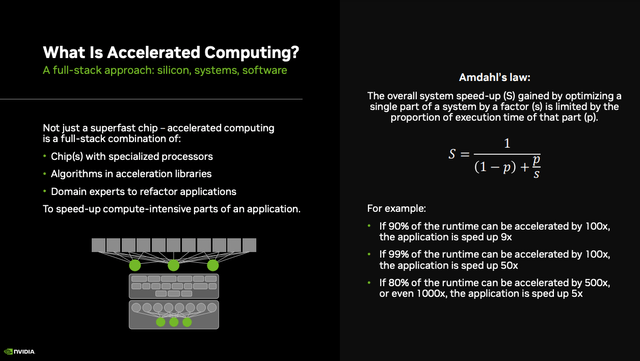

NVIDIA Defining Accelerated Computing (NVIDIA Investor Presentation 2023)

I highly encourage all current Nvidia Corporation and new potential investors to listen to this past earnings call and the GTC 2023 conference that Nvidia hosted. In this article, I will share a few very impactful excerpts and quotes from Jensen that were said in the earnings call. During the call Jensen doubled down on how difficult it truly was to create the Accelerated Compute Platform that Nvidia Corporation offers to provide exponential performance results for compute. He focused during the call on how the computer industry is going through two simultaneous transitions, accelerated computing and generative AI. Jensen explained how the full-stack and data-center scale approach is the best path to creating Accelerated Computing and it took over 15 years in the making for Nvidia Corporation to develop.

Investors, let that information simmer for a second, Jensen and Nvidia had the forward thinking and visionary prowess to start trying to build this full-stack compute platform 15 years ago. This is very similar to how two of my other favorite company investments, Palantir Technologies Inc. (PLTR) and Tesla, Inc. (TSLA), have had visionary leaders that built products that would lead their perspective industries years in advanced. If you are an investor in either of those other companies, I believe you would heavily be interested in investing in Nvidia Corporation stock.

Jensen said in the recent Q1 earnings call:

“Remember, we were in full production of both Ampere and Hopper when the ChatGPT moment came. And it helped everybody crystallize how to transition from the technology of large language models to a product and service based on a chatbot. The integration of guardrails and alignment systems were through reinforcement learning human feedback, knowledge vector data bases for proprietary knowledge, connection to search, all of that came together in a really wonderful way and it’s the reason why I call it the iPhone moment, all the technology came together and helped everybody realize what an amazing product that can be and what capabilities it can have. And so we were already in full production”

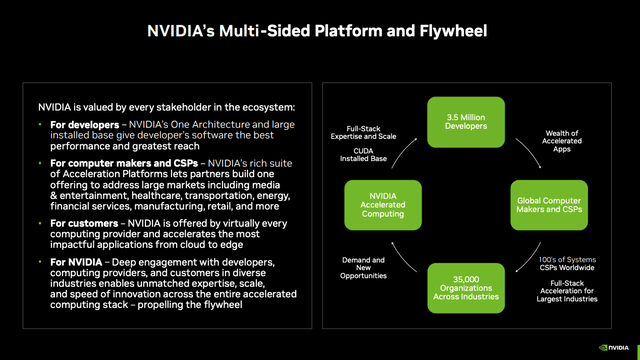

NVIDIA’s Flywheel of Technology Driving Business (NVIDIA Investor Presentation 2023)

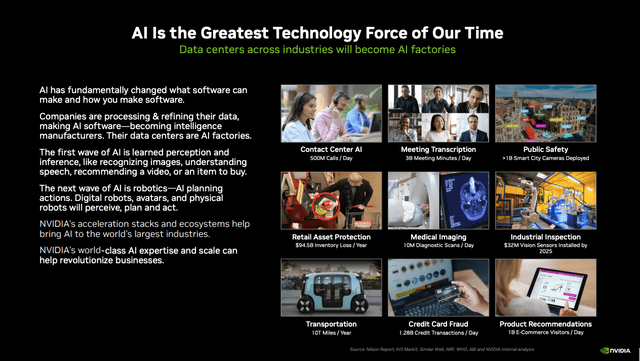

The paradigm shift toward AI, specifically generative AI, is another cornerstone of Nvidia’s technology moat. Generative AI models have the potential to generate impressive, nuanced content under the guidance of large language models to generate alpha and return on investment. Huang anticipates that these currently lab-bound technologies will soon transition to industrial applications, radically reshaping multiple sectors and driving demand for Nvidia’s AI solutions.

Financial Health & Business Model: Nvidia Corporation Has Sturdy Pillars

The financial stability and adaptable business model of Nvidia Corporation are further compelling factors investors can feel confident in the company. Despite GAAP expenses expected to rise by 12.2% year-over-year at $2.71B, Nvidia projects GAAP profits to surge by 159% to a whopping $7.5B in Q2 FY2024. The growth difference in profits vs. expenses illustrates the healthiness of Nvidia Corporation’s business. Nvidia’s commitment to demonstrating consistent free cashflow and shareholder value is also evident by the small dividend Nvidia Corporation pays and, in its plan, to repurchase shares totaling $7 billion by the end of 2023.

The adaptability of the Nvidia Corporation business model is demonstrated in its proactive response to surging demand. Nvidia Corporation was able to keep its’ operating expenses near flat for the last four quarters while dealing with the inventory complexities of the market. In anticipation of the continuing demand influx, Nvidia Corporation is significantly boosting its supply chain, ramping up production of several newer products, including the H100, Grace and Grace Hopper superchips, and the BlueField-3 and Spectrum 4 networking platforms. I would expect all of these new products to be growth catalysts for the business, as they allow customers to reach new compute capabilities in the datacenter.

NVIDIA AI Infrastructure Redefining the Datacenter (NVIDIA Investor Presentation 2023)

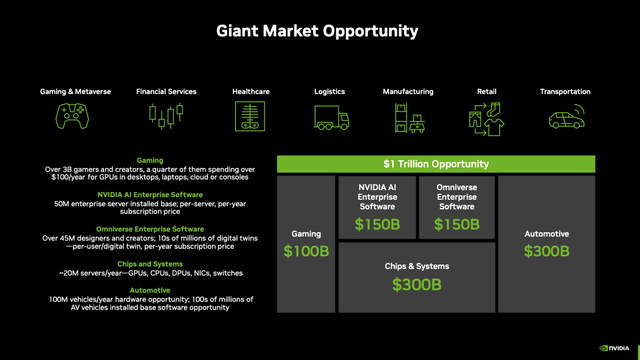

Innovation and Optionality: Nvidia’s Growth Engine

Jensen Huang and Nvidia Corporation’s steadfast commitment to innovation is another cornerstone that sets it apart. The company’s ongoing efforts to drive architectural improvements, develop new applications, and expand its product portfolio demonstrate its ability to stay ahead of the technological curve. It is precisely this relentless innovation that has put Nvidia Corporation at the forefront of what Jensen stated in the Q1 earnings call, that there is a $1 trillion global data center infrastructure transformation on the horizon. Over the next decade, most data centers worldwide are anticipated to adopt accelerated computing, promising a vast potential market for Nvidia Corporation.

NVIDIA’s $1T Market Opportunity (NVIDIA Investor Presentation 2023)

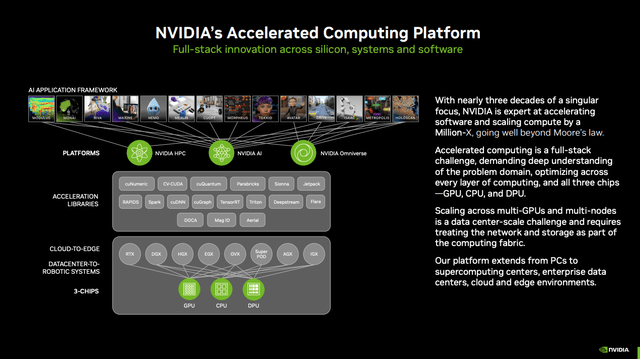

The full-stack architecture platform that Nvidia Corporation has created over these last 15 years, has allowed Nvidia to be able to provide the best value proposition for customers at the lowest total cost of ownership. I would like you to see what exactly Jensen said in the earnings call around this specific topic of value and competition. I believe these few comments from the earnings call may help you realize why Nvidia will continue to have the opportunities for innovation and staying ahead of the competition, because they are the only company with a holistic accelerated compute platform. Let’s review what Jensen has to say on this.

“Regarding competition, we have competition from every direction. Start-ups really-really well-funded and innovative startups, countless of them all over the world. We have competitions from existing semiconductor companies. We have competition from CSPs with internal projects. And many of you know about most of these. And so, we’re mindful of competition all the time, and we get competition all the time. But NVIDIA’s value proposition at the core is, we are the lowest cost solution. We’re the lowest TCO solution.

And the reason for that is, because accelerated computing is two things that I talk about often, which is it’s a full stack problem, it’s a full stack challenge, you have to engineer all of the software and all the libraries and all the algorithms, integrated them into and optimize the frameworks and optimize it for the architecture of not just one ship but the architecture of an entire data center, all the way into the frameworks, all the way into the models. And the amount of engineering and distributed computing, fundamental computer science work is really quite extraordinary. It is the hardest computing as we know.”

NVIDIA’s Accelerated Computing Platform (NVIDIA Investor Presentation 2023)

“And so, number one, it’s a full stack challenge and you have to optimize it across the whole thing and across just the mind blowing number of stacks. We have 400 acceleration libraries. As you know, the amount of libraries and frameworks that we accelerate is pretty mind blowing.

The second part is that generative AI is a large scale problem, and it’s a data center scale problem, it’s another way of thinking that the computer is the data center or to data center is the computer, it’s not the chip, it’s the data center and it’s never happened like this before. And in this particular environment, your networking operating system, your distributed computing engines, your understanding of the architecture of the networking gear, the switches and the computing systems, the computing fabric, that entire system is your computer and that’s what you’re trying to operate. And so in order to get the best performance, you have to understand full stack and you have to understand data center scale, and that’s what accelerated computing is.

The second thing is that — utilization, which talks about the amount of the types of applications that you can accelerate and diversity of our architecture keeps that utilization high. If you can do one thing and do one thing only and incredibly fast, then your data center is largely underutilized and it’s hard to scale that up. And the thing is, universal GPU in fact that we accelerate so many stacks, makes our utilization incredibly high, and so number one is throughput, and that’s software — that’s a software-intensive problems and data center architecture problems. The second is utilization versatility problem and the third is just data center expertise. We’ve built five data centers of our own and we’ve helped companies all over the world build data centers and we integrate our architecture into all the world’s clouds.

From the moment of delivery of the product to do standing up in the deployment, the time to operations of the data center is measured not — if you’re not good at it and not – not proficient at it, it could take months. Standing up a supercomputer, let’s see, some of the largest supercomputers in the world were installed about a year and a half ago and now they’re coming online, and so it’s not – it unheard of to see a delivery to operations of about a year.

Our delivery to operation is measured in weeks. And we’ve taken data centers and supercomputers and we’ve turned it into products, and the expertise of the team in doing that is incredible, and so. So, our value proposition is in the final analysis, all of this technology translates in the infrastructure, the highest throughput in the lowest possible cost. And so I think — our market is of course very, very competitive, very large. But the challenge is really-really great.”

NVIDIA TCO Savings vs. Traditional Computing (Nvidia Investor Presentation 2023)

Demand and Partnerships: The Fuel for The Nvidia Corporation Rocket

A key driving factor for Nvidia’s continued growth will be the rising demand for its products and solutions. The transformation of global data center infrastructure, the shift towards accelerated computing, and the advent of generative AI all represent a tremendous market opportunity for Nvidia.

All organizations, large or small, profit or non-profit, private, or public sector, etc. are looking to always make better decisions to generate higher revenues, profit, alpha against the competition and a better customer experience. Generative AI and large language models are the technology transformation that will enable this for more people in the world than ever before.

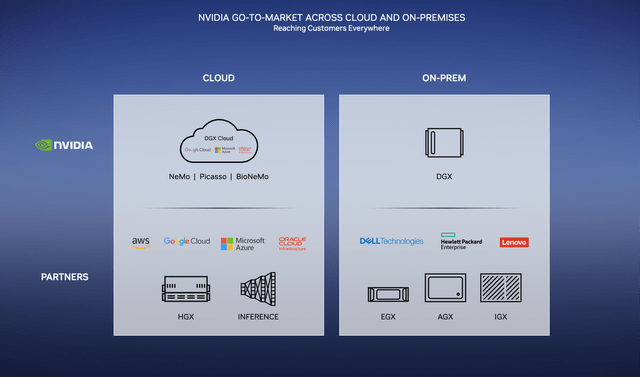

NVIDIA GTM Across Cloud and On-Premises (NVIDIA GTC 2023 Investor Presentation)

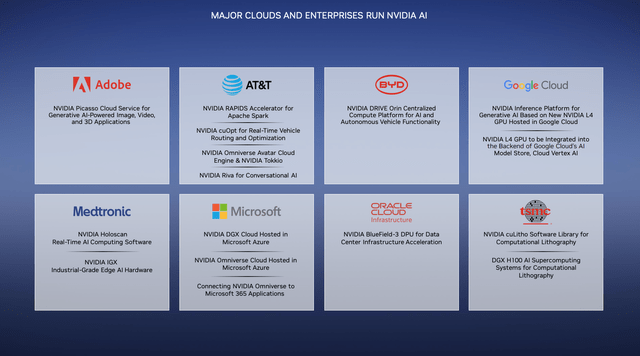

The partnerships and platforms NVIDIA is fostering also promise to fuel demand. The company is collaborating closely with all of the large cloud and internet service providers such as Amazon.com, Inc. (AMZN) AWS, Microsoft Corporation (MSFT) Azure, GCP, Oracle Corporation (ORCL) Cloud, Meta Platforms, Inc. (META), and creating platforms for large enterprises. Partnerships with major players such as Microsoft, Dell Technologies Inc. (DELL), ServiceNow, Inc. (NOW), and Adobe Inc. (ADBE) further underscore NVIDIA’s commitment to helping organizations leverage generative AI securely and effectively.

NVIDIA outlined several Enterprise customer examples of demand for different use cases of Generative AI in the Q1 earnings call. Specific industries that are seeing high demand were automotive, financial services, healthcare, and telecom. CFO Colette Kress shared on the earnings call:

“Bloomberg announced its’ BloombergGPT product, to help with processing tasks such as sentiment analysis, named entity recognition, news classification, and question answering. Auto Insurance company, CCC Intelligent Solutions is using AI for estimating repairs. And AT&T is working with us on AI to improve fleet dispatches so their field technicians can better serve customers. Among other enterprise customers using NVIDIA AI are Deloitte for logistics and customer service and Amgen for drug discovery and protein engineering.”

NVIDIA Enterprise Partnership Examples (NVIDIA GTC 2023 Investor Presentation)

The Final Verdict

Yes, Nvidia Corporation valuation is high, but it’s essential to look beyond the figures. The company’s formidable technology moat, solid financial health, adaptable business model, ceaseless innovation are what make it very difficult to predict a future valuation. Historically, Nvidia Corporation has always held a high valuation but has also pushed its technology to new boundaries and went from a graphics card company in the 90’s with 30% gross margins to the leader in GPUs in the 2010’s and 50% gross margins, and evolving to the world’s first ever accelerated compute platform that is generating near 70% gross margins.

NVIDIA’s Stance on AI and the Future (NVIDIA Investor Presentation 2023)

For me, the investment thesis on Nvidia Corporation is simple: I believe we are at the beginning stages of the fourth industrial revolution and Nvidia will be one of the most important companies of our time to propel industry, enterprise, and innovation forward. As many of my readers and friends know, a large portion of my money is on Jensen, Elon, and Karp to transform how data is used and the outstanding business results they will enable for their customers. It will be a fun rollercoaster ride to watch over the next few decades. If you would like to know more about my analysis on Nvidia Corporation, Tesla, and Palantir, you can read more of my articles here.

Read the full article here