Macroeconomic volatility intensifies as interest rate hikes persist. Recession fears are evident as the aggregate demand remains relatively weaker. With that, the banking industry faces more risks in its loan and investment portfolio. Deposits and borrowings become costlier. These make it more difficult for banks to remain afloat. But amidst all these, TFS Financial Corporation (NASDAQ:TFSL) remains a durable company. Its prudent management of its interest-sensitive Balance Sheet allows it to sustain revenue growth and generate adequate returns. Its well-capitalized operations show it can cover its operating capacity and raise capital returns. We can see it in the consistent dividend payments with attractive yields. Meanwhile, the stock price appears divorced from the fundamentals. It may be logical, given the negative market sentiments and contracting margins. Yet, it stays way lower than the intrinsic value of the company. Valuation also shows decent upside potential.

Company Performance

It’s been quite a while since I last covered TFS Financial Corporation. It has captured my attention ever since I focused on banking stocks. Although it did not avert inflationary blows, its prudent asset management remained one of its cornerstones. It operates in a highly cyclical market, but its performance remains robust. And even now, it maintains a sturdy FY 2023 despite the unfavorable impact of interest rate hikes.

The first half of FY 2023 was surrounded by headwinds as the Fed tried to stabilize and lower inflation. As a consumer banking and residential mortgage product and service provider, its risk exposure is higher. Despite this, its core operations continued to expand as it diversified its portfolio. Its operating revenue growth was driven by its interest and dividend income on loans and investments. It amounted to $147.55 million, a 57% year-over-year growth. If we combine it with the 1Q revenue, TFSL has already generated $286.52 million, 54% higher than in the first half of 2022. Indeed, revenue growth sped up this fiscal year. It could show the direct relationship between its earning assets and interest rate hikes. We can confirm it in its asset turnover ratio, which increased from 0.6% to 0.9%.

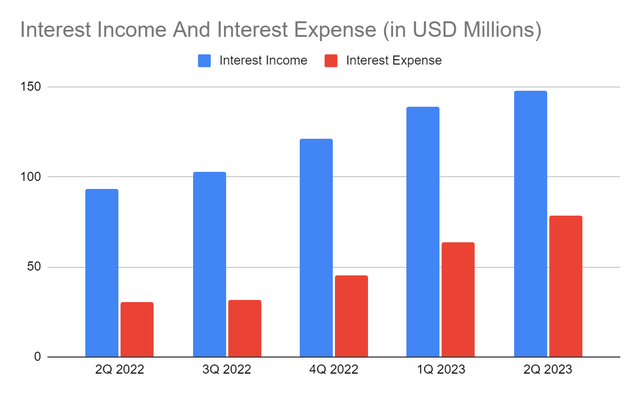

Interest Income And Interest Expense (MarketWatch)

Loan yields remained the largest component of its operating revenue. It comprised 93% of the total value and rose by 50%. Again, investors can attribute it to the sustained increase in interest rates. Also, thanks to its interest-sensitive loan portfolio, realizing higher yields. We can compare it to the interest income on loans, which rose from 0.7% to 1%. In addition, the company maintained its active loan repricing, allowing it to set favorable rates and offset the decrease in loan volume. Lastly, its loan composition was strategic for the company. Mortgage loans comprised 99% of the total loans. Despite the higher risk, it allowed the company to focus on what it does best. Home sales cooled down in 4Q 2022 and 1Q 2023 due to skyrocketing prices. Yet, residential houses remained a macroeconomic staple as shortages remained high. Also, US housing sales and loan demand rebounded in the first three months of the year. It was essential for the expansion of companies offering residential mortgage loans like TFSL. We will discuss more of the residential property market in the next section. Meanwhile, investment securities accounted for the remaining 7% of the total revenues. While it could be nothing compared to loans, their yields were massive. The amount of $10.72 million was more than thrice as much as it was in 2Q 2022. We can also identify prudent diversification as the primary driving force. Its investment securities are mortgage-backed loans from the government and GSEs. In essence, these types of securities fit the high-interest environment. These have higher yields and better hedges against valuation decreases.

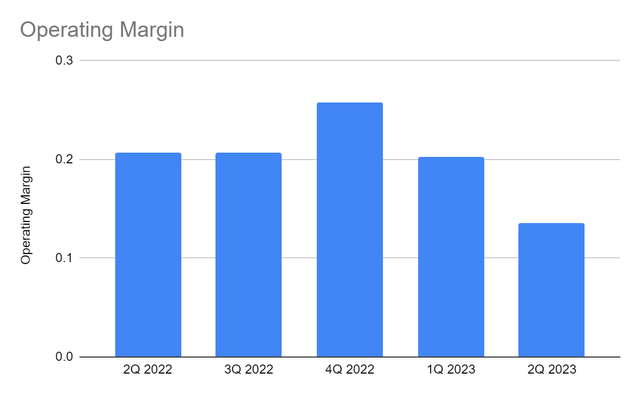

Despite its impressive revenue growth, expenses remained a concern. Interest rate hikes also affected deposit and borrowing costs. Their direct relationship led to the massive increase in interest expense. At 154%, it offset the increase in interest income. To be more specific, interest expense was equivalent to 33% of interest income in 2Q 2022. But in 2Q 2023, it rose to 53%. We can attribute it to the massive increase in borrowings. The only consolation was that its non-interest income and expense remained relatively flatter. It showed efficiency in managing its customers, staff, and other business expenses. It was impressive, given the higher prices and wages. Indeed, the bank demonstrated its adequate capacity to sustain its capacity amidst market headwinds. The operating margin was 14% versus 21% in 2Q 2022. It was also the lowest in five quarters. Even so, the actual operating income was higher at $20.02 million versus $19.36 million in 2Q 2022. The company also had stable returns, increasing its cash levels.

Operating Margin (MarketWatch)

In the second half of FY 2023, TFS Financial Corporation faces the same challenges. Interest rates stay elevated, which can affect its loan and investment portfolio. With that, recession fears are evident across the country. But with its effective strategies and adequate resources, TFSL can get through it. We will discuss more of its risks, opportunities, and core competencies in the next section.

How TFS Financial Corporation May Stay Solid This Year

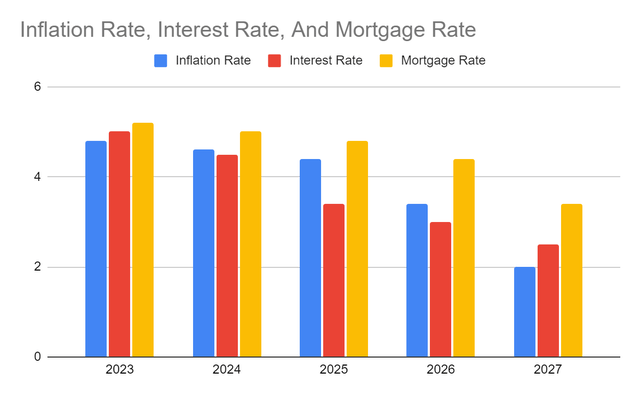

TFS Financial Corporation handled market headwinds very well. Despite the higher expenses, the operating income still increased. The thing is, it stabilized returns with its prudent portfolio diversification and operational efficiency. However, the fight is far from over as interest rate hikes persist. After setting interest rates flat at near-zero levels, the Fed made a haste move to combat inflation. In only a year, inflation has already more than quadrupled. In 2022, interest rates moved by 75 bps for four consecutive quarters. Thankfully, hikes appeared to have cooled down recently. In the first two meetings for this fiscal year, The Fed reduced the increase to 75 bps. But one should be on the watch since interest rates have already risen further than expected. It may discourage borrowings and investors, which can decrease loan volume and hurt the loan and investment yields of the company. It can also lead to higher interest expense, decreasing returns.

On the flip side, hope is on the horizon as inflation keeps decreasing. From there, the tighter monetary policy was fruitful. It is only 4.9%, a 46% reduction from the peak in 2022. It may take more time for its positive spillovers to materialize. Yet, it can increase economic confidence in the US, which may entice investments and purchases. It may become easier for the company to diversify its investment securities and generate higher yields. TFSL may set more strategic pricing for its services and manage non-interest expenses better. Concerning its mortgage loans, TFSL must watch out for changes in the property market. Nevertheless, I disagree with many analysts expecting a massive crash in the market. After all, the increase in property prices and mortgages was driven by the demand influx. It was not driven by cost-push factors like labor and raw materials in the first place. And while residential house prices have cooled down in recent quarters, they may be manageable. We can attribute it to the fact that residential houses remain a market staple. In 1Q 2023, the US was short of 6.5 million houses. House completions climbed, but house starts decreased by 10%. It showed the conservative approach of property builders, which proved effective in stabilizing prices. As of this writing, US housing shortages are already 7.3 million. We can attribute it to the cooling prices and increasing loan demand in 1Q 2023. With that, the residential mortgage loans of the company may remain high. Given the decreasing inflation, interest rate hikes may continue to cool down. These may help lower the risk of loan defaults and delinquencies.

Inflation Rate, Interest Rate, And Mortgage Rate (Author Estimation)

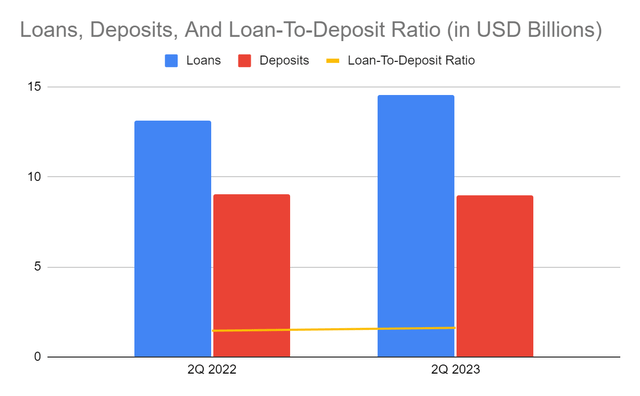

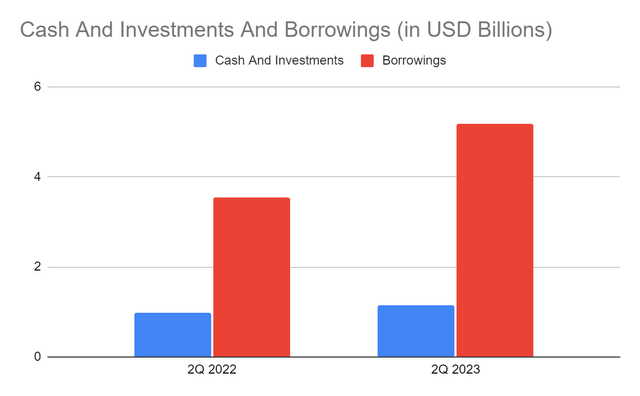

But what makes TFSL a secure company is its decent financial positioning. Its loans and deposits are the lifeblood of the company. At first glance, it appears risky, given the increasing loan-to-deposit ratio. I understand the skepticism about the company since it may affect liquidity. But the thing is, loan yields are still increasing despite the lower volume. It generates higher revenues and operating income, showing prudent loan portfolio diversification. Also, it maintains deposit yields at a relatively lower rate. Its decision remains strategic since deposits have already incurred massive expenses. Despite this, it can increase deposit interest anytime to attract customers and maintain liquidity. Most importantly, the company has no non-performing loans, making it a secure company. Even better, cash levels are increasing and consistent with the increasing operating income. Investments are also increasing, so liquid assets are adequate to cover its operating capacity and capital returns. My concern is the amount of borrowings, which increased by 44%. On a lighter note, only $1 billion have current maturities. It is also lower than in 2Q 2022 with $2.67 billion. Its liquid assets can cover all current borrowings in a single payment. TFSL balances viability with sustainability.

Loans, Deposits, And Loan-To-Deposit Ratio (MarketWatch)

Cash And Investments And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of TFS Financial Corporation has been in a downtrend since the price correction in 2021. It rebounded in 4Q 2022, but the decrease remained prominent. At $11.57, the stock price is 14% lower than last year’s value. Despite this, it becomes a good bargain. The PB Ratio can show it, given the current BVPS and PB Ratio of 6.54 and 1.74x. If we use the BVPS and the average PB Ratio of 2.57x, the target price will be $16.84. It proves the high book value of the company relative to the stock price.

Moreover, it is an attractive dividend stock, given the consistent payments and reasonable increases. Its exciting yield of 9.74% is way higher than the S&P 600 and NASDAQ average of 1.69% and 1.63%. A few days ago, the company declared dividends of $0.2825 per share, keeping payouts at their current level. It also makes capital returns through share repurchases. Also, note that 81% of its common shares are still held by MHC, which already waived its receipt of dividends. Given this, dividends remain well-covered and sustainable. To assess the stock price better, we will use the DCF Model.

FCFF $91,900,000

Cash $28,470,000

Outstanding Borrowings $1,000,000,000

Perpetual Growth Rate4.8%

WACC 9.2%

Common Shares Outstanding 53,271,000

Stock Price $11.57

Derived Value $17.55

The derived value adheres to the supposition of a potential undervaluation. There may be a 51% upside in the next 12-18 months. It may not be that simple, given the market headwinds. Despite this, shares are already priced at a discount. Buying shares is a wise choice.

Bottomline

TFS Financial Corporation maintains a solid corporation amidst macroeconomic volatility. It sustains its revenue growth and realizes increasing returns. Despite my concerns about the high loan-to-deposit ratio, liquidity levels are decent. Loan quality is excellent, given the zero non-performing loans. It may also improve its asset and business management as inflation continues to decrease. Moreover, capital returns are attractive, given the consistent dividend payments with high yields. The stock price is currently at its low, making it a great bargain. The recommendation is that TFS Financial Corporation is a strong buy.

Read the full article here