While AG Mortgage Investment Trust, Inc. (NYSE:MITT) faced some economic challenges in 2022, it appears to be making a recovery in Q1 2023 based on the increase in the book value per share, return on equity, net income, investment portfolio, financing, and liquidity. The company also continued its share repurchase program in the first quarter, showing confidence in its stock value. However, the macroeconomic environment is still posing many challenges to the company.

MITT’s portfolio

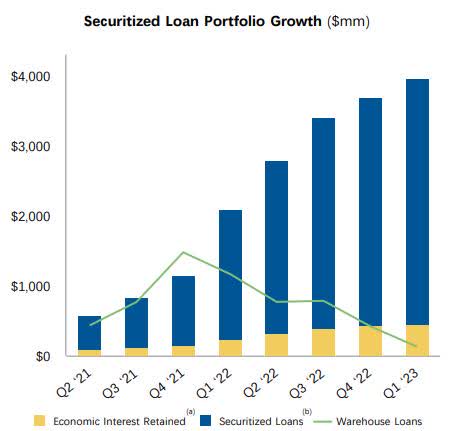

The company went through a portfolio simplification in 2021. I analyzed this a bit further in my previous article, now I only want to highlight the changes in the last 12 months. The company securitized more than $270 million in UPB loans and its total portfolio grew to $4.5 billion of which 82% are securitized loans. The remaining 18% are warehouse loans, other residential, and agency.

Securitized Loan Portfolio Growth ($mm) (Q1 2023 Earnings Presentation)

First Quarter Earnings

The book value per share decreased from $14.64 in 2021 compared to $11.39 in 2022. However, in Q1 2023, it increased from $11.39 to $11.85, showing some recovery. In 2022, the company had an annual economic return on equity of -17.3%, while in the fourth quarter of 2022, it was 5%. This positive trend continued in the first quarter of 2023 with a quarterly economic return on equity of 5.7%. The company reported a net loss of $3.12 per share in 2022, but the fourth quarter saw a net income of $0.33 per share. In the first quarter of 2023, net income further improved to $0.38 per share. The investment portfolio was $4.2 billion as of the end of 2022, which increased to $4.5 billion by the end of Q1 2023. The company had $3.9 billion in financing as of the end of 2022, and this amount increased to $4.1 billion by the end of Q1 2023. The total liquidity as of December 31, 2022, was $86.7 million, which slightly increased to $87.9 million by March 31, 2023.

2023 expectations

The management expects increased earnings power and potential growth opportunities for the rest of the year, despite the challenges that marked the beginning of the year. They highlighted recent organizational changes at Arc Home, the firm’s home captive originator, which they anticipate will lead to a return to profitability in the near term. The CEO highlighted the potential of sourcing opportunities arising from the present upheaval in regional bank balance sheets, which can result in a higher ROE on assets. This is especially worthwhile given the firm’s ample liquidity, low leverage, and strong residential mortgage pipeline. The residential home loan pipeline stood at approximately $280 million by the quarter’s end. MITT completed a securitization in February and expects increased sourcing opportunities due to disruptions in regional bank balance sheets. They also anticipate an increase in gain on sale margins in the coming quarters due to the impacts of consolidation and operational improvements at Arc Home.

“To putting this all together, we believe mixed results will produce both higher gas and EAD metrics per share looking forward. And we believe the market should recognize the hard work and solid results being delivered by the mid-team.” – T.J. Durkin – CEO

I am not that optimistic in the long term. Surely, 2023 will be much better than 2022 and the portfolio restructuring was a good decision. But the external economic challenges and the long-term high-interest rate environment could lower the company’s profit margin despite internal positive signs.

Valuation

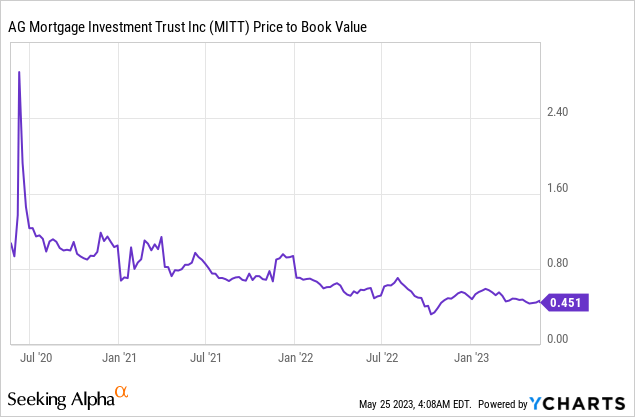

MITT is the same as any other Mortgage REIT that takes out short-term loans and invests in long-term mortgage securities. The low-interest rate environment is over and I cannot see that 1-2% interest rates will come back in the next 2-3 years, but the upcoming gradual decrease of interest rates will likely benefit as it increases the value of MITT’s mortgage-backed securities investments. MITT is trading well below its book value, at 0.45x its book value. It is among the lowest figures in the past 3 years, however, I believe this valuation is justified with the current and upcoming economic environment, its investment portfolio, and its dividend policy.

The company is trading at almost 13% dividend yield, a relatively high figure in the past years but investors should be careful looking only at the dividend yield because the management has been cutting dividends for a while.

Dividend

Surely and gradually the company has been cutting its dividend since 2013. The quarterly dividend per share was $2.4 per share in 2013 and by 2023 this figure was a disappointing $0.18 per share. All of these figures are adjusted to reflect the 1:3 reverse stock split in mid-2021. The company paid a dividend of $0.81 per common share in 2022 and $0.18 per common share in Q4 2022. The same amount, $0.18 per common share, was also paid in Q1 2023 and I expect this trend to continue in the rest of 2023. As usual, the reverse stock split rarely helps companies, MITT was no different. The price has plummeted since and although the external economic factors are changing in favor of the company, I doubt that the long-term trend can be reversed.

In 2022, the company repurchased a total of 2.7 million shares of common stock for $18.2 million. In the first quarter of 2023, it repurchased 0.9 million shares for $5.2 million. As of the end of Q1 2023, $1.7 million of capacity remained authorized under their 2022 Repurchase Program, and an additional $15 million common stock repurchase program was approved. MITT repurchased 923,000 shares at an average price of $5.68, leading to a 2% accretion for shareholders. As I see it now, the management is committed to share buybacks and the average number of shares outstanding has started to come down from almost 23 million to slightly more than 22 million by the end of the first quarter of 2023.

Summary

Despite challenges faced during the quarter, the company is optimistic about the future earnings power due to new organizational changes, expected higher ROEs on assets, and opportunities arising from the disruption among regional bank balance sheets. I am however quite cautious about MITT and my Hold rating has not changed since my last article.

Read the full article here