Medtronic (NYSE:MDT) reported its Q4 fiscal year 2023 earnings on Thursday. The numbers looked strong at first glance, with both earnings and revenues topping expectations. Despite that, MDT stock sold off meaningfully following the earnings release.

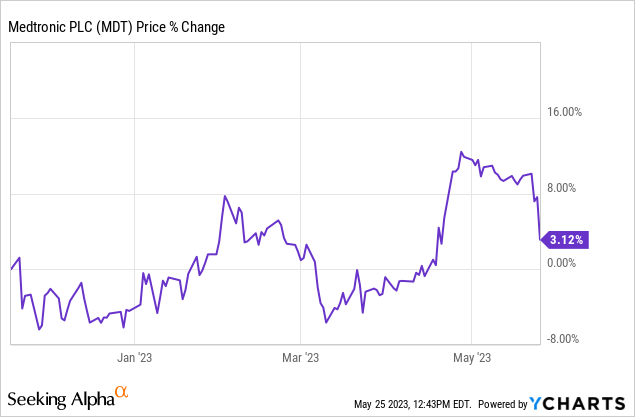

This continues Medtronic’s recent track record of incremental operational improvements but a stock price that has failed to react. Shares are only up a few percent since I last covered the company six months ago:

While it is taking longer for sentiment to improve than I had expected, I still see more positives than negatives for Medtronic, and as such, I remain bullish following the most recent earnings release.

Q4 Earnings

Medtronic reported earnings per share of $1.57 for its fiscal Q4, which slightly exceeded expectations of $1.55 per share. Revenues of $8.5 billion came in well ahead of the analyst consensus for $8.25 billion. This represented 5.6% year-over-year growth and was an acceleration in the company’s growth from prior quarters. This came in spite of unfavorable foreign exchange movements which cost the company a few points of topline revenue growth.

Previously, Medtronic had seen a slowdown in business due to people delaying surgeries due to COVID-19 and related matters. This lull lasted well into 2022, causing Medtronic (and other medical device industry participants) to have a poor year. However, it appears that Medtronic is now turning the corner. From the conference call, Medtronic’s CEO Geoffrey Martha indicated that business was robust across multiple product categories:

Our accelerating organic revenue growth was broad-based with mid-single digit organic growth in cardiovascular, neuroscience and Medical Surgical and double-digit growth in our Diabetes business in Western Europe, where we’re selling our latest generation of products.”

Following up on that last point, Medtronic got its next-generation diabetes system into commercial channels in Europe a while ago. However, it’d been held up in the U.S. with the FDA taking their time on giving a decision on Medtronic’s application. This isn’t too surprising, given the product quality issues Medtronic has had in recent years with previous generations of its pumps. This had led to a 17% decline in Medtronic’s U.S. diabetes revenues in 2022 and another significant decline in 2023.

However, the FDA came through with approval for the new MiniMed 780G system in April, which should give Medtronic a boost in coming quarters as that long-awaited new launch comes to fruition. As Medtronic regains lost revenues and potentially expands its market share, this should drive significant top and bottom line momentum for Medtronic heading into 2024.

And yet, despite the positives, Medtronic shares fell more than 4% on this earnings report Thursday. So what happened?

Soft Guidance

While Medtronic topped expectations and pointed to accelerating organic activity in its product lines, it surprisingly offered up below-consensus guidance for fiscal year 2024. The market didn’t like this one bit and sold shares off on the news. However, there’s more to the story.

An article from Barron’s offers some interesting perspective on Medtronic’s weak fiscal year 2024 outlook:

We were really focused on starting the year with guidance that set us up for success,” Medtronic CFO Karen Parkhill told Barron’s. “We had some misses last year, and we wanted to make sure that we set guidance that we feel incredibly confident that we will [meet].”

After Medtronic came up well short of its previous guidance for fiscal year 2023, it appears that the company has decided to offer more conservative guidance in order to set a lower bar. By putting expectations at a more modest level, it should be easier for Medtronic to please investors with subsequent earnings releases in future quarters.

Even with the downbeat guidance, Medtronic projected earnings of $5.10 to $5.15 for the forthcoming year, which is only a hair short of the prior analyst consensus of $5.19. I’d argue that the market might be overreacting to this guidance, particularly with the CFO’s comment around setting guidance that the company felt “incredibly confident” in achieving.

Reading between the lines here, I don’t see anything in this guidance that should concern Medtronic investors.

Medtronic’s Performance Versus Peers

Another key consideration is Medtronic’s relative performance against the other large diversified medical device companies. Over the past few years, Medtronic has been the worst performer in its peer group, and often by a wide margin.

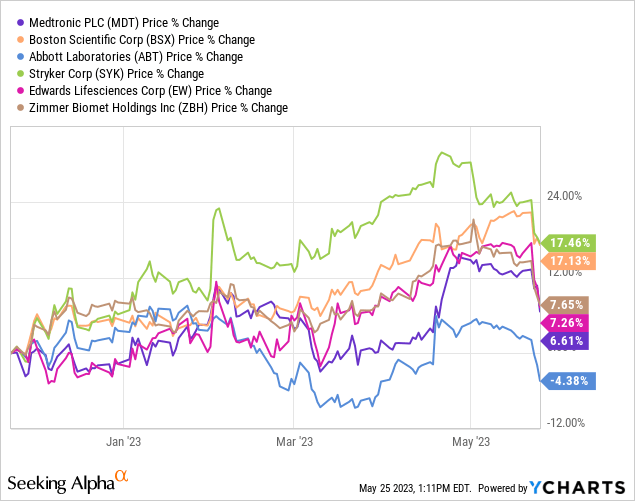

Over the past six months, however, Medtronic has seemingly turned the corner, and is now much more in-line with its direct peers:

While Medtronic hasn’t kept up with Stryker (SYK) or Boston Scientific (BSX), it is equal to Zimmer Biomet (ZBH) and Edwards Lifesciences (EW) over the past six months and Medtronic has outperformed Abbott Labs (ABT).

This isn’t tremendous performance by any means, but Medtronic has stopped being the industry laggard. That’s a subtle but sure sign that Medtronic is starting to get out of the penalty box and can enjoy better sentiment in coming quarters.

Medtronic Stock’s Bottom Line

It’s been a rough couple of years for Medtronic. Management is understandably taking a conservative approach to setting guidance and expectations going forward after previously disappointing the market.

That said, the Q4 earnings were solid and things are trending in the right direction. The FDA approval for the new diabetes pumps is another favorable development.

Medtronic also continues to invest heavily in R&D and related acquisitions, such as its newly announced $738 million deal to buy wearable insulin patch maker EOFlow.

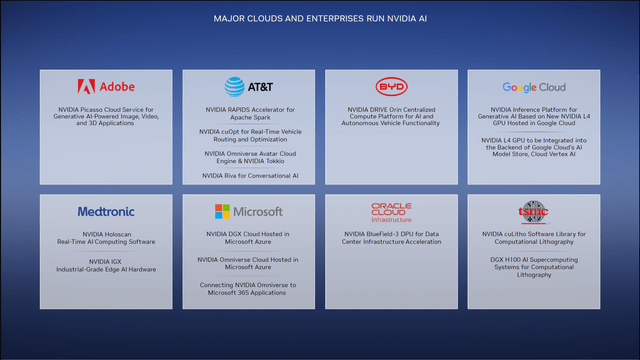

I’d also point out the Nvidia (NVDA) named Medtronic as a major enterprise leading the way in adopting Nvidia AI solutions in a recent corporate presentation:

Nvidia AI adopters (Corporate Presentation)

While I personally don’t assign all that much value to a company for using an AI solution, in present market conditions, people might give Medtronic credit for being an early adopter of these technologies.

In any case, Medtronic shares remain attractively priced at around 17x this year’s projected earnings. That moves to 15x and 14x earnings estimates for next year and the following, respectively. With Medtronic returning to significant top-line growth this quarter, we appear to be past the worst of the pandemic-related business slowdown.

The company also gave shareholders a dividend raise on Thursday. Many will complain that the 1.5% increase is not very generous. But given the industry slowdown, it’s nice that Medtronic kept its streak alive, even with a most modest of hikes. This marks the 46th consecutive year of dividend increases for Medtronic and shares yield 3.3%.

By all accounts, Q4 was a perfectly fine one for Medtronic and speaks to a company that is gradually getting back on track. The guidance for next year was admittedly soft, but it appears the company is intentionally setting a low bar. I wouldn’t read too much into it. Overall, at this valuation, Medtronic remains a buy.

Read the full article here