Introduction

As an investor in dividend growth companies, I always seek new investment opportunities in income-producing assets. I usually add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The industrial sector is attractive during these volatile times, as industrial companies tend to be more cyclical. Long-term investors may benefit from the volatility and acquire shares in high-quality companies. Short-term volatility may be harsh, but the long-term reward may be worth it. Caterpillar (NYSE:CAT) is one of my oldest holdings, and I endured its volatility in the past. I will revisit the company.

I will analyze Caterpillar using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if CAT stock is a good investment.

Seeking Alpha’s company overview shows that:

Caterpillar manufactures and sells construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. The company’s Financial Products segment provides operating and finance leases, installment sale contracts, working capital loans, wholesale financing, and insurance and risk management products. The company was formerly known as Caterpillar Tractor Co. and changed its name to Caterpillar Inc. in 1986. Caterpillar Inc. was founded in 1925 and is headquartered in Irving, Texas.

Fundamentals

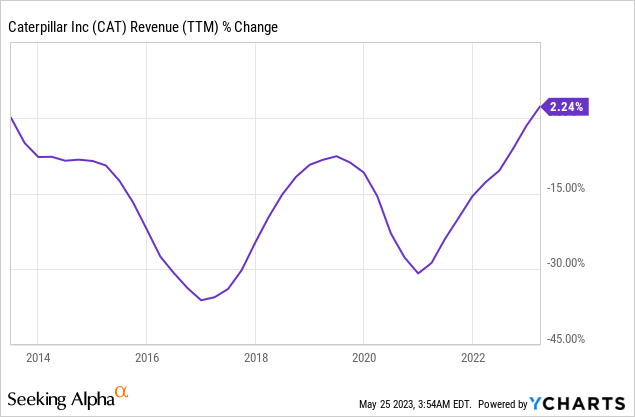

The revenues of Caterpillar have increased by only 2% over the last decade. This results from the high cyclicality we see in the sales of this blue chip. It is also the result of the company’s changes and restructuring. It divests less profitable businesses and units to focus its efforts and sales on the more lucrative part of the business. In the future, as seen on Seeking Alpha, the analyst consensus expects Caterpillar to keep growing sales at an annual rate of ~4% in the medium term.

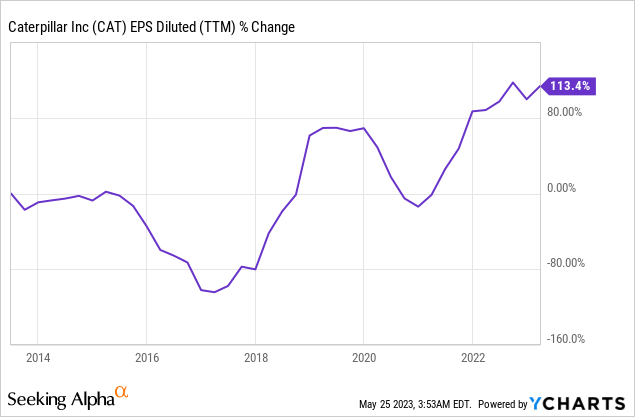

As the strategy above stated, the company benefits from focusing on its lucrative businesses. The EPS (earnings per share) has more than doubled during the same decade. This results from higher sales of more profitable products and cost-cutting as part of the company’s constant restructuring efforts. In the future, as seen on Seeking Alpha, the analyst consensus expects Caterpillar to keep growing EPS at an annual rate of ~13% in the medium term.

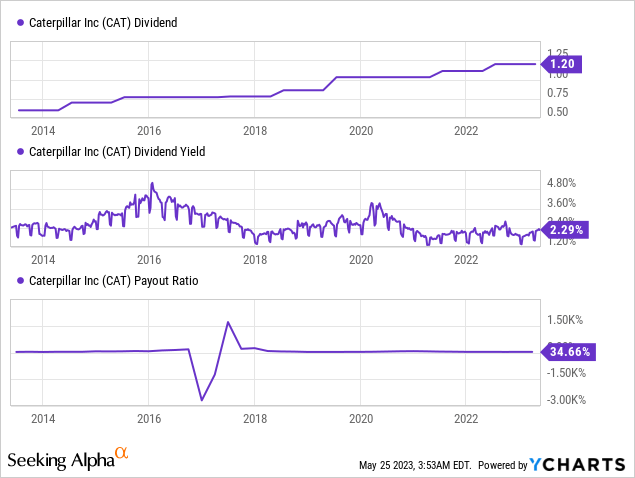

The dividend is one of Caterpillar’s crown jewels. The company is a dividend aristocrat that has increased the dividend yearly for 29 years. The future increase in June will probably be in the mid to high single digits as the company maintains a manageable payout ratio of 35%. On the other hand, the dividend yield may not look extremely attractive, yet it will grow in time significantly faster than the inflation rate.

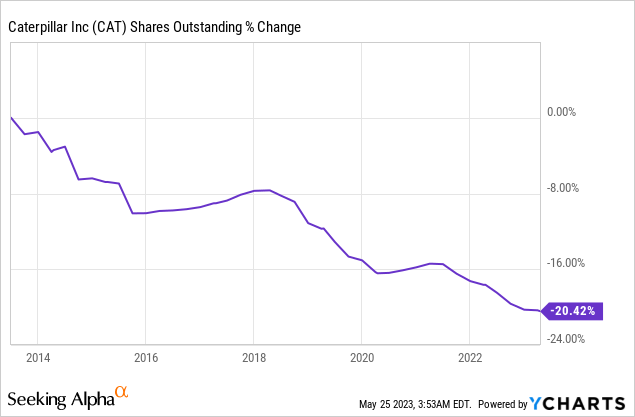

In addition to dividends, the company also returns capital to shareholders via buybacks. Buybacks support EPS growth by lowering the number of outstanding shares while the net income remains unchanged. Over the last decade, the number of shares outstanding has decreased by 20%, supporting Caterpillar’s EPS growth. The company may use the current attractive valuation to buy back more shares and make repurchases efficient.

Valuation

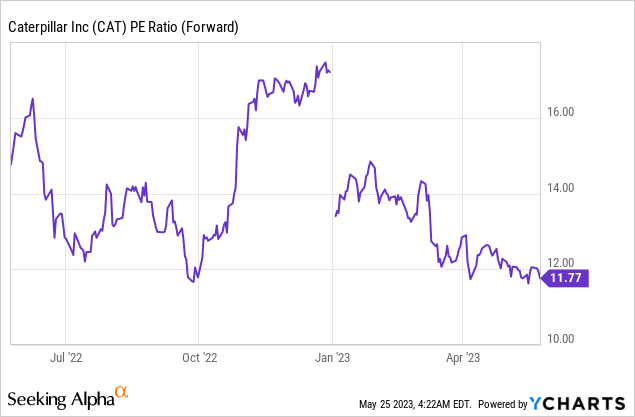

Caterpillar’s P/E (price to earnings) ratio is 11.77 when using the 2023 EPS forecasts. Paying less than 12 times the earnings of a company that grows at a double digits rate seems attractive to me. It also means that investors have some fears regarding the company’s ability to execute that well, and continue to grow, probably due to the cyclical nature of the business.

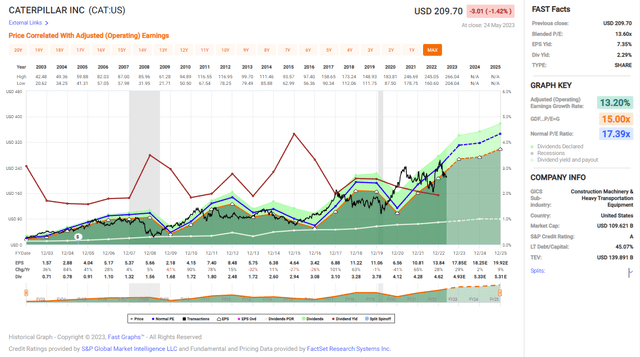

The graph below from Fast Graphs emphasizes that shares of Caterpillar are attractively valued. The average P/E of Caterpillar stands at 17.39 over the last two decades, with an average growth rate of 13.2%. Analysts believe that Caterpillar will continue to grow at the same pace as it did historically, yet the current valuation is significantly lower. It means that investors are concerned that this is the cycle’s peak. While that may be true, long-term investors should avoid that short-term noise.

Fast Graphs

Opportunities

Real estate prices are still increasing in the United States. The increase in housing prices incentivizes more companies to build more houses that will be sold to millions of Americans looking for new homes. Caterpillar is well-positioned to benefit from the trend as it sells the heavy machinery used for construction. It has a well-known brand and a strong business position.

U.S. house prices rose in February, up 0.5 percent from January, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI®). House prices rose 4.0 percent from February 2022 to February 2023. The previously reported 0.2 percent price increase for January 2023 was revised downward to a 0.1 percent increase.

(U.S. House Price Index – April 2023)

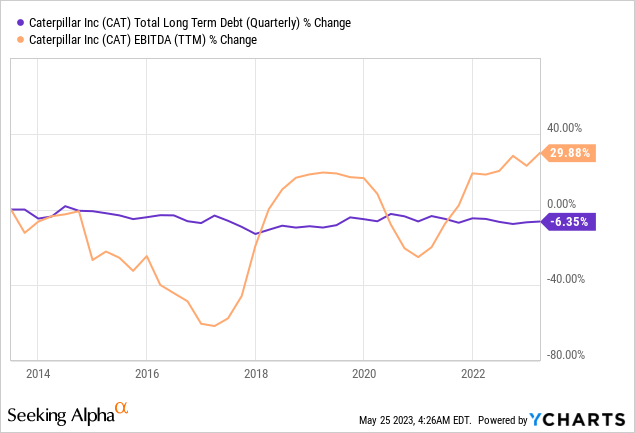

Another opportunity for Caterpillar is its solid balance sheet. The company’s net debt to EBITDA stands at around one due to the company’s significant cash position. Over the past decade, the company has seen its EBITDA increase by 30% while the long-term debt declined by 6%. This balance sheet flexibility means the dividend is safer during cyclical times, and the company may acquire quality assets and brands to grow.

Another opportunity for the company is its restructuring. In 2023 Caterpillar plans to spend $700M on restructuring. Restructuring supports growth by lowering costs as the company divests less successful units, and it also promotes growth by creating a business structure that focuses on the most prestigious assets and units and allows the entire organization to focus on them to achieve high growth in highly profitable segments.

Risks

Competition is a significant risk for Caterpillar. The company has to deal with competition from the United States, China, Japan, and Europe. While companies like John Deere (DE) are local competitors, companies like Japanese Mitsubishi are also leading brands. The challenge is not only the incumbents but also the relatively low barriers to entry into this market, which pose a possible threat to Caterpillar.

Another risk for the company is the risk of recession. A recession will see home prices decline and consumers with less purchasing power. It will negatively affect the demand for new houses and, therefore, the need for new equipment to build them. The higher interest rate is already making it harder for companies to finance the machinery. If we see a significant drop in demand, construction companies will buy less from Caterpillar.

The risks are emphasized for Caterpillar due to the cyclicality of the business. Construction companies will stop buying heavy machinery first when the business environment is harsh. They will use their existing machinery without replacing it for several more years. They will avoid expansion, which is how a revenue dip looks for Caterpillar. Therefore, the combination of higher rates, a recession, and the business Caterpillar is in, turns into a tremendous short-term risk.

Conclusions

To conclude, the shares of Caterpillar have performed well over the past several years. It happened since the company performed well with solid fundamentals that led to dividend and buyback growth. Moreover, the company has shown significant growth opportunities and is ready to deal with future risks.

The company’s current valuation is attractive, leaving investors with enough margin of safety. However, in such a volatile market, I understand why some investors would prefer an even higher margin of safety. Therefore, while I rate Caterpillar as a BUY, more conservative investors may seek to acquire it at a lower price, around $180, or when the business environment becomes more apparent.

Read the full article here