Article Thesis

Icahn Enterprises L.P. (NASDAQ:IEP) stock remains under pressure following the Hindenburg short report. Shares have now pulled back 60% from the level shares have been at over the last couple of months. Bill Ackman from Pershing Square Holdings (OTCPK:PSHZF) has added to the selling pressure seen in IEP via comments he made this week. IEP’s dividend yield has soared to an extremely high level – but the dividend is still not covered by profits, which is why income investors should not blindly rush into this stock.

What Happened?

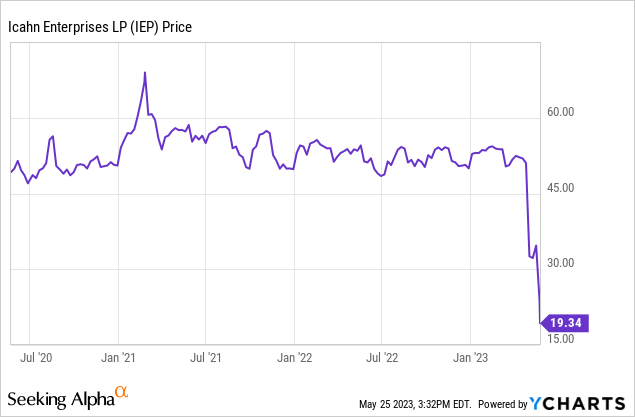

Icahn Enterprises L.P. is the main investment vehicle for Carl Icahn, one of Wall Street’s most famous investors. Icahn Enterprises has been trading way ahead of the company’s reported net asset value for a long period of time. This can be explained by the fact that outside (or retail) investors mainly bought IEP due to its high dividend yield, while they didn’t care too much about the company’s net asset value per share. Carl Icahn is the main investor in IEP, holding the vast majority of shares. Since he has been receiving dividends in the form of new shares, the high dividend payout could be maintained, as the vast majority of dividend payments did not require any cash outflow. On the other hand, the fact that Carl Icahn received, like some retail investors, dividends in the form of new shares, caused a steady increase in the company’s share count. This, in turn, has resulted in further net asset value per share pressure due to dilution. Nevertheless, IEP’s share price has been pretty stable for quite some time – until Hindenburg came out with a short report that received a lot of attention:

It’s remarkable to see how stable IEP has been up to a couple of weeks ago – shares seemingly always traded around $50 to $60, no matter what the broad market’s performance looked like. It’s also pretty easy to see when Hindenburg’s short report dropped – IEP suddenly fell off a cliff. Shares are down around 60% from recent levels, and they’re down around 20% this day alone. This has made the dividend yield soar to an incredibly high level of 41% – but be careful, this alone is not a reason to buy.

The steep drop seen over the last two days was largely fueled by comments made by Bill Ackman, another Wall Street titan. Bill Ackman and Carl Icahn had a bit of a duel about Herbalife Ltd. (HLF) around a decade ago, which might explain why Bill Ackman commented on IEP’s steep share price decline. You can read more about Ackman’s comments here on Seeking Alpha, but here are some excerpts:

“Its performance history and governance structure do not justify a premium; rather they suggest that a large discount to NAV would be appropriate.”

“All it takes is for one lender to break ranks and liquidate shares or attempt to hedge, before the house comes falling down.”

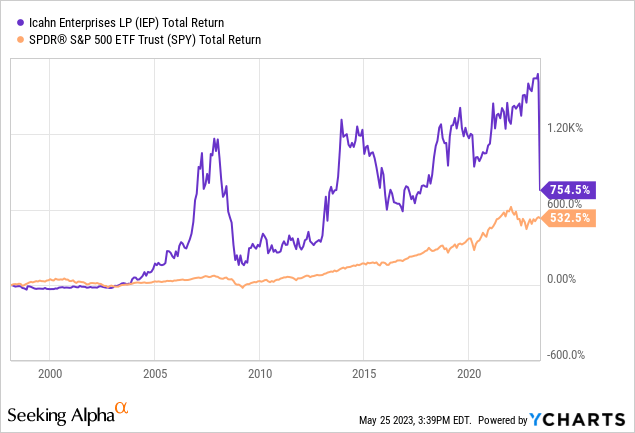

Are these comments justified? Let’s take a closer look. Over more than two decades, Icahn Enterprises has substantially outperformed the broad market:

This even holds true when we account for the hefty share price drop over the last couple of weeks. Historically, IEP shareholders have thus done better than those that bought the broad market, which is quite a feat. I thus believe that Ackman’s comment about IEP’s performance history being questionable is not very fair – IEP’s performance history is good, at least for those that bought early on. Ackman’s comment that IEP should trade at a huge discount to net asset value due to its performance history is thus something I don’t agree with – due to an above-average performance, one could argue that a premium to net asset value is justified. That does, of course, not mean that the net asset value premium should be as high as it was prior to the recent share price crash.

On the other hand, Ackman’s comment about the governance structure is correct – LP investors don’t have a lot of power when buying IEP. Due to the fact that IEP is largely owned by Carl Icahn himself, his interests are aligned with those of retail investors, however, which is why the little power of outside investors in IEP is not necessarily a problem. That would be a way larger problem if Icahn’s interests and those of minority holders were not aligned. But since Carl Icahn himself benefits from a strong total return from IEP just the way minority investors do, the governance structure is not too much of an issue, I believe.

Bill Ackman also talked about potential issues with lenders, an issue that was brought up by Hindenburg as well. If Hindenburg and Bill Ackman are correct, Carl Icahn’s personal loans are a risk. They hinted at a potential risk from margin calls if the collateral for these loans – Carl Icahn’s stake in IEP – declines too much. Then, presumably, a margin call could force Carl Icahn to sell, etc. We don’t know about this situation for sure, but Carl Icahn has made statements that indicate that his personal loans are not a risk for IEP and its shareholders. Seeking Alpha reported: “Icahn Enterprises said in the response on Wednesday that Icahn has advised that he and his affiliates are current and in full compliance with all personal loans.” While Icahn’s personal loans thus might turn out to be a risk eventually, it does not look like they are a major risk right now – at least that’s how I interpret Carl Icahn’s statement.

IEP’s Underlying Performance

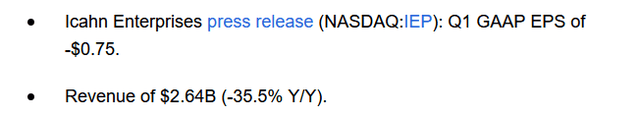

Icahn Enterprises L.P. issued its first-quarter earnings report shortly following Hindenburg Research’s report. The headline numbers can be seen here:

Seeking Alpha

This doesn’t look great at first sight, of course, as IEP logged a major net loss. Then again, this is a GAAP result, and due to many moving parts and the complicated structure of IEP and its different holdings, net profit is not necessarily telling a lot about IEP’s underlying performance.

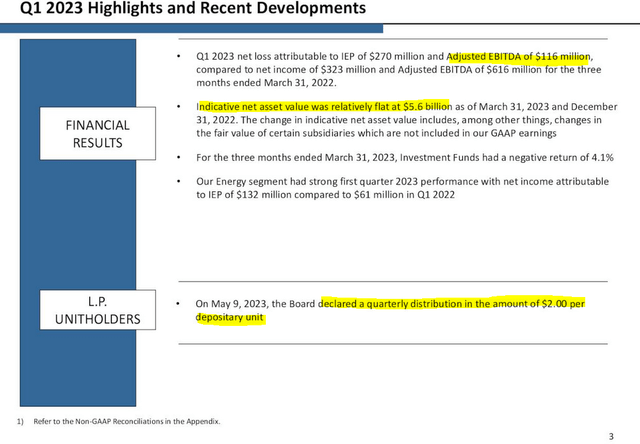

Some of the highlights in the earnings slides include the following:

IEP presentation

EBITDA was positive, which is good, although considerably lower compared to one year earlier. The cyclical nature of some of the businesses IEP invests in, such as energy, refining, etc. explains some of the move in EBITDA seen over the last year. When we get more into the details, we see that EBITDA at IEP’s operating businesses has gone up nicely, from $160 million in Q1 of 2022 to $270 million in Q1 of 2023. Unfortunately, this was more than offset by weaker EBITDA from IEP’s investment business. Since the performance of the investment business is more dependent on broad market movements, one could argue that the EBITDA decline in this segment isn’t very telling about the long-term outlook, but the fact remains that EBITDA did decline over the last year.

Net asset value was flat, which seems like a reasonable result, although it’s not great when we consider that IEP’s share count has increased over the last year – net asset value per share has thus gone down to some degree.

The dividend has been maintained at the level seen over the last couple of years, which made some bulls very happy. That being said, the fact that Carl Icahn receives dividends in the form of new shares means that IEP’s share count has continued to climb, which could further pressure the company’s net asset value per share, all else equal. Overall, IEP’s results for the first quarter did not seem great, but not disastrous, either.

IEP: Dividend And Valuation

IEP does not earn the $2 per share per quarter that it pays out. It never has. And yet, the company continues to make this payment. As long as most dividends aren’t paid out in the form of cash, but in the form of new shares, the company is theoretically able to maintain the dividend at the current level. But with a large number of new shares being issued every quarter, dilution will be massive going forward – which will cause net asset value per share to drop lower and lower. It’s hard to say whether Carl Icahn believes that this is good for him and other shareholders in the long run. A dividend cut could thus definitely happen, and even if there is none, investors should know that the net asset value of their shares will drop considerably.

Today, IEP has a net asset value per share of roughly $15. That’s still below the current share price, but the premium to NAV is not very large right here, at around 30%. Compared to the 200%-plus premium seen not too long ago, that’s very reasonable. One can argue whether a premium to NAV is justified, but based on the fact that IEP has historically outperformed the broad market, I believe that this could indeed be the case.

Final Thoughts

I have no position in IEP. NAV performance has been uneven in the past, and when the dividend is maintained, investors will have to accept massive dilution in turn for an incredibly high 40%-plus dividend yield. Whether that works out well in the long run is not known today – but at least in the past, long-term investors holding onto IEP have done well. I give IEP a neutral rating and will stay on the sidelines for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here