Investment Thesis

While I used to think of streaming services as a commodity, I’ve become increasingly confident about Spotify’s (NYSE:SPOT) future. Spotify’s preeminence as a DSP (Digital Service Provider), as evidenced by its best-in-class product (design, exclusive content, personalization, etc.), ubiquity, per user engagement, and continued evolution as a business, has placed it in a position to demand a significantly higher share of the (ever-increasing) pie it helped create. The closer I look and the longer my timeframe, the more bullish I become.

Scale

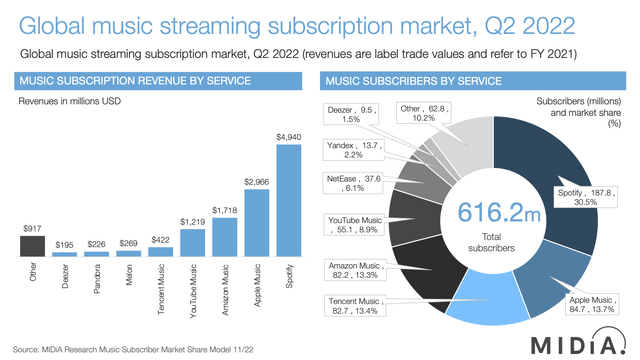

Spotify controls about ~30.5% of the global music streaming market:

MIDiA Research

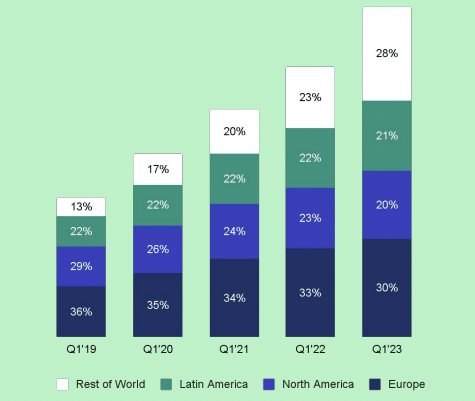

Q1 2023 results reported Spotify adding 250,000 net new MAUs (monthly active users) per day, on average, over the past year. This equates to ~96 million net new MAUs over the past 12 months, by far the highest rate of net adds in its history. Spotify now has 515 million MAUs which are fairly evenly divided across each of its 4 reported geographies:

Q1 2023 Presentation

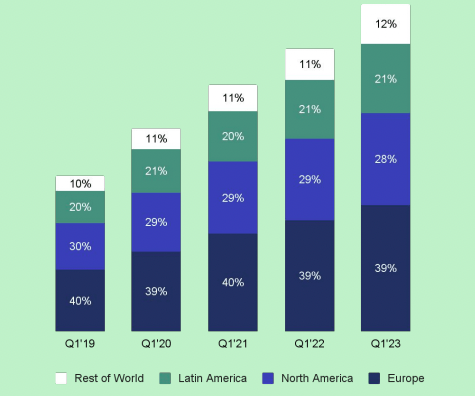

You’ll see a similar trajectory for Premium subscribers, which totaled 210 million at the end of Q1, though RoW premium penetration is lagging. Here’s the split:

Q1 2023 Presentation

The number of annual streaming hours on the platform has increased from ~55 billion in 2018 to ~132 billion in 2022, at a ~24% CAGR.

The 4 Untapped Tailwinds

1. Better Terms

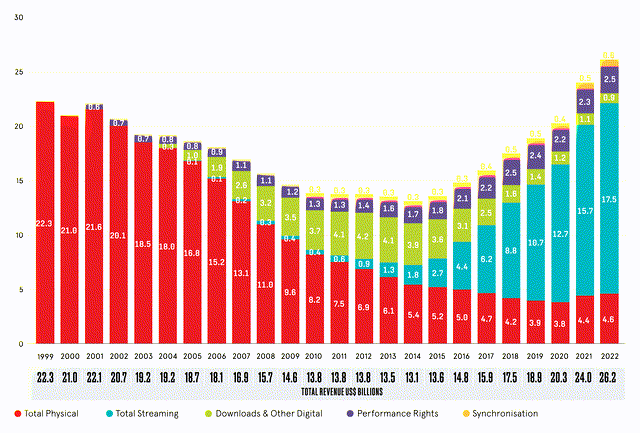

While they’re often pitted as enemies, the record labels and DSPs have aligned interests: Get more people listening, make more money. Unsurprisingly, the vast majority of the revenue in the recorded music industry is now coming from streaming:

IFPI 2023 Global Music Report

If Spotify can negotiate better terms (a higher take rate) it would be a major tailwind to gross profits. Recent commentary from the labels suggests this outcome may be coming. UMG (OTCPK:UMGNF) CEO Lucian Grange, in response to a question about whether they’d cede any more economics to the DSPs in exchange for future price increases, said:

Our entire goal is to achieve the best economics and the best outcomes for everybody – the artists, ourselves, and the platforms. I’m obsessed with growth. I like ‘2 + 2 = 7’ scenarios. And in the spirit of our partnership with the platforms and everyone we’ve ever done a deal with, I like win – win.

A “win-win” relationship would be a huge step in the right direction.

2. Pricing Power

The base (Individual) plan price for each of the major DSPs has been ~$9.99 per month for the past decade in the U.S., but Spotify’s Premium monthly ARPU in Q1 2023 was less than $5 per month. This reflects multiple factors such as geographic mix (the Individual plan in India costs ~$1.45 per month, for example) and plan mix (Individual, Duo, Family, Student).

Spotify’s Family plan in the U.S. allows 6 users for $15.99. If fully utilized, that results in a monthly ARPU of ~$2.70 per user. Given that the average Premium user listens to more than an hour of content per day, I believe there’s significantly untapped pricing power (data suggests Family plans accounted for 20-25% of Premium subscribers in 2018). (Anecdotally, my family has 5 members on a Family plan, and I would be more than fine paying $2-3 more per month.)

Why hold the line on price increases?

I see 2 plausible explanations:

- It’s experiencing an outsized benefit to MAU and Premium subscriber growth by keeping prices low.

- It’s using lower prices as a negotiating tactic.

I’m not sure how to prove/disprove #1, but #2 is a likely theory given the statement Mr. Grange made above.

Given Spotify currently generates ~$1.40 in gross profits per Premium subscriber, it’s easy to see how higher ARPUs, better splits with the labels, and (especially) a combination of the two would have a meaningful impact on revenues and gross profits.

3. Operating Expenses

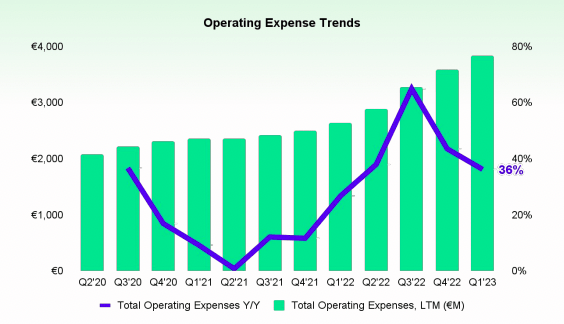

Spotify has grown its headcount by more than 4x since 2016. As a result, the company has failed to generated OpEx leverage despite significant revenue growth. Revenue is also up ~4x from 2016, but operating expenses now make up ~31% of revenues compared to ~25% in 2016. This is the most disappointing metric I’ve come across, especially considering Spotify’s business model’s significant leverage (software, distribution). While it’s still high, I’m glad to see it trending in the right direction:

Q1 2023 Presentation

I’m hopeful that the CEO Daniel Ek is taking notes from Zuckerberg’s “Year of Efficiency.” I believe there is ample opportunity to reduce headcount when management decides to do so.

4. Marketplace

Now more than ever, Spotify is at the intersection of artists and listeners.

Outside of the core business, Spotify’s Marketplace gives it an indirect way to improve economics. Marketplace gives artists the ability to sell merchandise to their fans, and generated ~€210 million in gross profit contribution in 2022, up ~5x from 2019.

While I don’t see selling t-shirts as a large potential revenue source, it’s not hard to imagine a future where Spotify is targeting local audiences with concert tickets to their favorite artists. In turn, this would deepen artists’ relationship with Spotify and tilt even more power away from the labels into the platform’s hands.

Risks

Despite its unprecedented user growth, the mechanisms for effectively monetizing those users (in terms of revenue and profitability) remain a work in progress.

As mentioned above, operating expenses have risen sharply, mainly due to headcount and other R&D expenses. This, however, aligns with management’s goal:

Our priority is to grow revenue as fast as we possibly can. When we look at a market, there’s generally two strategies to do that. One is to grow the number of people we attract to our platform. And the second is to increase the [APRU] of the users we already have on the platform. Generally, our approach when we’re early in a market is to try to grow the number of participants on the platform… Then, as the market matures, it will shift more so that most of the revenue growth comes from price increases… We will always look at what’s net beneficial to our business in growing the revenue and the profitability of each market that we’re in.

And as I’ve already covered, negotiations with the labels are a work in progress. At this point, the low take rate is making it hard for Spotify to reach robust profitability. But if that ever changes (I think it will), Spotify’s business will change almost overnight.

In both instances, I would argue Spotify is almost in the driver’s seat – I don’t see operating expenses becoming unexpectedly worse and the current take rate is as low as it ever will be.

Valuation

Spotify currently has an enterprise value of $28.85 billion. Management set clear targets on margin and profitability at Spotify’s June 2022 Investor Day. If the company can deliver on its 30%+ gross margin target (which will happen with the growth of Marketplace and a slowdown in OpEx), then FY22 revenues would translate to ~$1.5 billion of operating income (assuming ~12% margins).

Based on that figure, Spotify is trading at just 19.2x EV/EBIT. As of January 2023, the total U.S. market was trading at 18.7x EV/EBIT. I realize it hasn’t yet reached positive operating income, but I’m happy to pay 19.2x given my confidence in it reaching profitability, plus the massive tailwinds that could surprise to the upside.

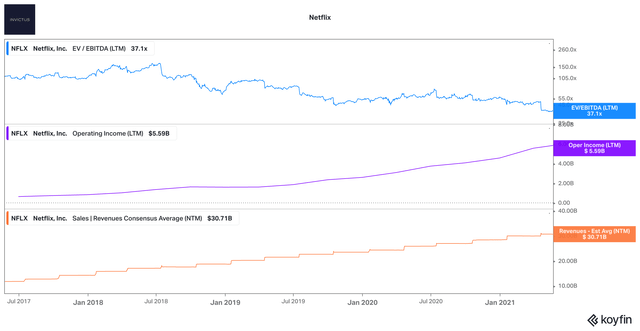

And while it’s far from an apples-to-apples comparison, Netflix (NFLX) was 1 year away from $1.5 billion in operating income in September 2017, when it was generating ~$12.5 billion in revenue. It was trading for 117x EV/EBITDA and had a market capitalization of ~$81 billion:

Koyfin

At this stage in its lifecycle, Netflix was not producing new content – it was only a distributor (although there was less competition than Spotify currently faces). Admittedly, this isn’t a great comparison – Netflix was already profitable and had higher growth expectations than Spotify currently has (not by much, though). Plus, we’re in a different economic climate than in 2017.

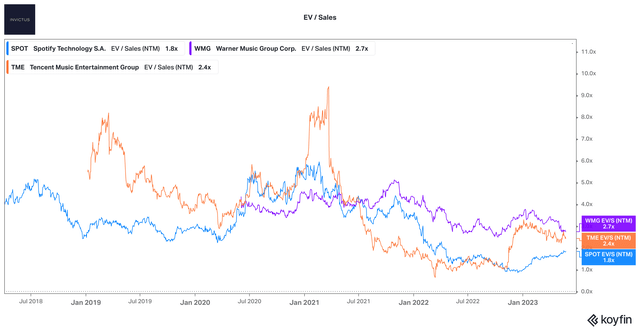

Still, there’s evidence Spotify looks relatively cheap here (if you can say that about an unprofitable company valued at ~$29 billion). Plus, here’s how Spotify stacks up against Warner Music Group (WMG) and Tencent Music Entertainment Group (TME) on a forward EV / Sales basis:

Koyfin

Again, it’s not a perfect comparison (I’d rather compare it to Apple Music or Amazon Music, but would have to make many assumptions to come up with a fair value for each of those sub-businesses) but it does add shed some light on how the market is valuing Spotify. As is the case for most of my investments, my 5+ year investment time horizon does not require me to speculate about short-term price targets (or create DCF analyses based on multiple estimated variables).

Conclusion

I’ve been a user of Spotify since 2015, but didn’t buy the stock until this year. The stock price has been all over the map since its IPO in 2018, which is reasonable given the uncertainty about the end state of the business. While there are no doubt risks (as is the case with every investment), I’m starting to see more and more pieces fall into place that could lead to Spotify being a much better business in 5 years than where it stands today.

If the company is able to execute against the significant opportunities it’s created for itself, I believe shareholders will receive ample rewards over the next 5-10 years.

Read the full article here