I have discussed for the past two years the factors behind the broad decline in biopharmaceutical stocks in 2021, and the bottom that I felt was put in last year. 2021 was the greed portion of “fear and greed” at its utmost – there were no returns from fixed income investments, the risk on strategy was prevalent and the supply of IPOs was significant. Most of the companies that went public were in very early stages, i.e., pre-clinical or Phase 1, and valuations approximated $750 million. This was in stark contrast to the recent past, when companies were at least in Phase 2 clinical study and the valuations were around $250 million. The implication was that the current companies would not have a commercial product before 2027 and would therefore have to raise additional funds. There was little margin for error-any negative news would adversely impact the stock, and as the investment outlook soured, raising money became very dilutive. The correction was so severe that the enterprise valuations in many cases became negative.

There have been several bankruptcies, and many companies are stuck with an inability to raise cash. Most of these companies should never have gone public – they were research lab ideas – but that is seen through the retrospectoscope. At this time, the companies left standing, in many instances, have demonstrated progress, yet the stocks still sell at a tremendous discount to the inappropriate 2021 levels, and, more importantly, to expected value. Hence, there has been recent merger activity, which WILL continue, and several small-cap biopharma stocks have risen dramatically, in part driven by short covering. In two weeks, there will be the closely watched ASCO conference; in favorable investment periods, one would see stocks rise ahead of the meeting.

It is important to realize that the patent expiration cycle of 2023-2028 will result in generic or biosimilar competition to many of the largest-selling drugs in the United States, including Humira, Eliquis, and Keytruda. Therefore, large-cap pharmaceutical companies will need to replenish their pipelines, and this will necessitate acquisitions.

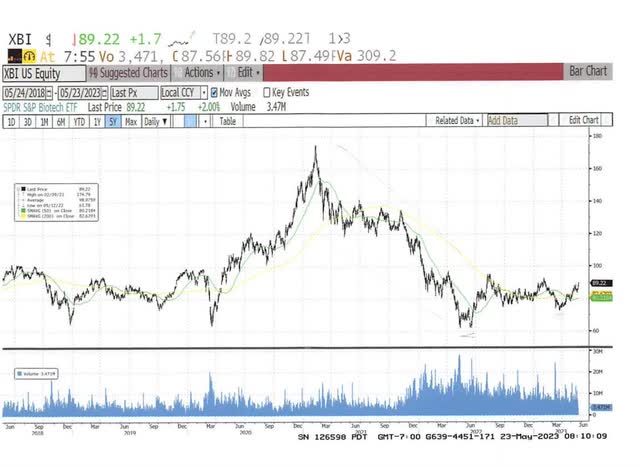

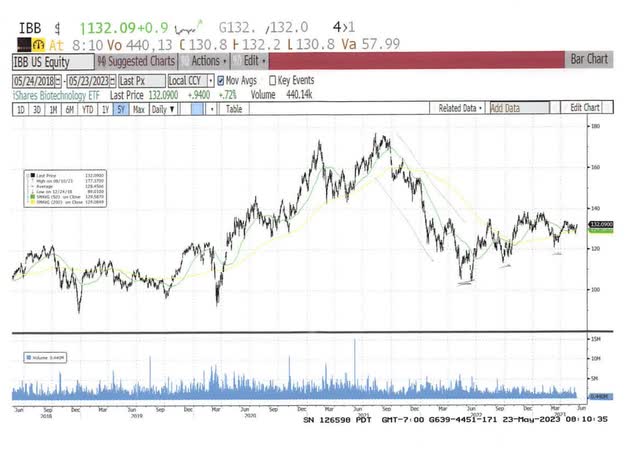

My focus remains on disease states in which major advances are being made, although I also believe that one could simply consider buying ETFs, including the XBI or IBB. Much attention has been given to the GLP-1 drugs to treat Type 2 Diabetes and obesity, and I highlighted this in a recent article. GLP-1 drugs from Novo (NVO) and Lilly (LLY) have demonstrated remarkable weight loss, and, unlike earlier weight loss agents, they act by delaying gastric emptying and by suppressing the desire for food intake in the brain. With over 70 million adults in the US classified as obese, at the ICER current suggested pricing range of $7500-$9800 per year, one can readily arrive at a domestic market size in excess of $100 million, even with modest penetration. I continue to recommend Eli Lilly.

With the ASCO meeting in early June, there will be presentations on many promising compounds, including POINT Biopharma’s (PNT) radioligand, Regeneron’s (REGN) linvoseltamab (BCMAxCD3 bispecific antibody), Moderna’s (MRNA) personalized cancer vaccine and Geron’s (GERN) Imetelstat. Investor interest approaching the conference has been subdued, which, in my opinion, contrasts with the impressive gains being made in both solid tumors and hematology.

Finally, the very favorable tailwind of age demographics will exist for the remainder of the decade. According to the NHE, people over age 65 spend three times the healthcare dollars as compared with the working-age population, and this age cohort is projected to increase from 54 million Americans in 2020 to 80 million in 2040.

In conclusion, I strongly maintain that biopharmaceutical stocks have bottomed. Furthermore, there are impressive advances in obesity (yes, the GLP-1 class will be the largest drug class in history once positive outcomes data is available), NASH, immuno-oncology, gene editing, RNA-based therapeutics, and immunology, yet investor interest is subdued. I cannot think of a better time to invest in the sector.

Reuters Reuters

Read the full article here