Investment Thesis

In a rare occurrence, Splunk Inc. (NASDAQ:SPLK) reported very impressive Q1 earnings results. Not only was its revenue in the quarter very strong, but its guidance for the quarter ahead, as well as its full-year revenues were upwards revised.

But the real icing on the cake has to be the fact that the business is expected to massively ramp up its profitability in fiscal H2 2024.

I believe that Splunk will be annualizing $1 billion in free cash flows in a few quarters’ time. This would leave the stock priced at approximately 17x forward free cash flow. A very attractive entry point for investors.

Splunk Near-Term Prospects

Splunk specializes in producing software for monitoring and analyzing machine-generated machine data.

Machine data is data that is generated by apps and computers, and provides interesting and valuable data that can be used to drive business insights.

As a machine data platform, Splunk competes with the likes of Datadog, Inc. (DDOG).

Splunk focuses on operational intelligence and log management, specializing in analyzing machine-generated data. Its primary use cases include IT operations and business analytics.

While there’s tremendous demand for log management and operational intelligence platforms, there’s also intense competition. I suspect readers will know of Datadog and Elastic N.V. (ESTC), but there are many others too, both big competitors including Amazon’s (AMZN) AWS and International Business Machines Corporation (IBM), as well as, smaller peers such as the recently taken private Sumo Logic, Inc. (SUMO).

Indeed, that’s the point I’m driving at. There’s a lot of demand for Splunk’s operations, but I’m not sure that Splunk is retaining its market share.

Expectations Had Been Reduced Already

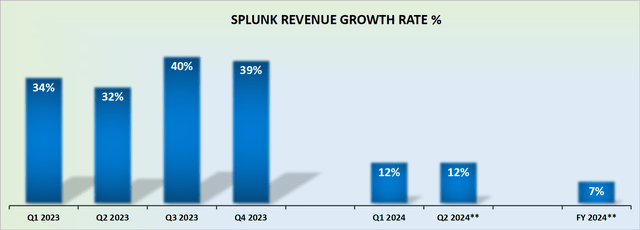

SPLK revenue growth rates

As you can see above, Splunk’s fiscal Q2 2024 guidance points to 12% y/y growth rates. For investors, this was a markedly positive surprise.

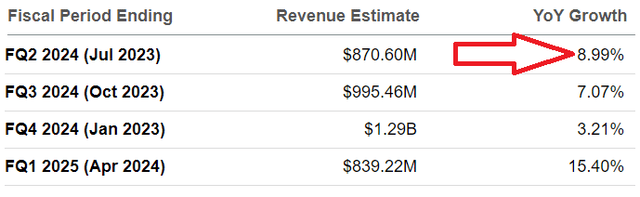

After all, as we headed into the print, Splunk was presumed to be growing in fiscal Q2 2023 by single digits:

SA Premium

What’s more, I suspect that it’s now likely, given Splunk’s recently found momentum, that it may in fact end up upwards revising its full-year fiscal 2024 outlook at some point in the coming quarters.

After all, despite the challenging comparables with fiscal H2 2023, it appears possible that analysts may be too bearish on Splunk’s H2 prospects.

However, the good news has not stopped there.

Profitability Profile Delights Investors

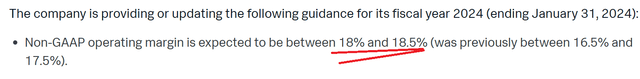

SPLK Q1 2024

Splunk upwards revised its non-GAAP operating margin by 100 basis points at the high.

This is particularly noteworthy given that Splunk’s non-GAAP operating margin in the most recently reported quarter, fiscal Q1 2024 was 3.3%. This compares with its previously guided fiscal Q1 2024 negative 3% non-GAAP operating margin.

While I won’t make any comments with regard to Splunk’s bloated stock-based compensation (“SBC”), the fact remains that at some point, investors will demand even more aggressive reductions on Splunk’s SBC expenses.

On the other hand, it’s worthwhile to note that Splunk’s SBC expense in the same quarter last year amounted to approximately 33% of its total revenues, while this time around SBC now accounts for 25% of total revenues.

In conclusion, there’s no question that Splunk’s profitability profile is indeed moving in the right direction. And the recently upgraded non-GAAP profitability implies a dramatic ramp-up in profitability in H2 2024.

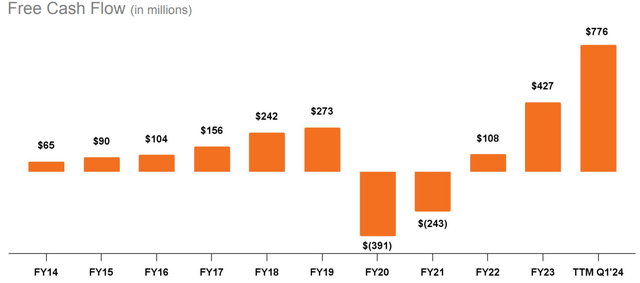

Furthermore, on a free cash flow basis, Splunk is seeing a very rapid increase.

SPLK Q1 2024

More specifically, during fiscal Q1 2024, free cash flow was up 253% y/y. Management stated on the call:

Q1 is annually our largest free cash flow quarter driven by the seasonally high bookings in Q4, which are mostly collected in Q1. For that reason, we recommend that investors evaluate free cash flow on a trailing 12-month basis which totaled $776 million at the end of Q1, more than quadruple the $179 million generated over the 12 months ending April 30, 2022.

With this consideration in mind, I believe that within a few quarters’ time, Splunk will be on a $1 billion free cash flow annualized run rate. This leaves the stock priced at around 17x forward free cash flow.

The Bottom Line

Splunk Inc.’s newly updated guidance shows that there’s still a growth engine in the company. Furthermore, given Splunk’s upwards revising profitability profile, it looks very likely that in a few quarters’ time, Splunk will be on a run rate of $1 billion in free cash flow.

This would put the big data company at around 17x forward free cash flow. A fraction of the price of Datadog.

Read the full article here