Investment Summary

Shares of Collegium Pharmaceutical, Inc. (NASDAQ:COLL) underperformed the last quarter in-line with my neutral rating on the company back in January. Rolling forward 1 period, I am turning more constructive on the company. I am thus recommending an early buy of the stock at ultra-compressed multiples of 4.4x forward earnings for reasons discussed in this report.

There is plenty to like about COLL, its operations are of the healthy type – record Q1 product revenues, strong returns on capital, and plenty of cash flow to throw off to shareholders. One pullback, is that management haven’t reinvested persistently back into the business at these rates of return, suggesting there may be a lack of opportunities to do so. Subsequently, it has been difficult for COLL to catch a long-term bid in my opinion over recent years.

Its market valuation has been buoyant in FY’22-’23, as the firm remains diligently profitable, and growing its balance sheet. In my opinion, it comes back to the opportunities to reinvest capital to grow. For now, the undeniable strengths in the company’s business, combined with strengthening core product trends, make COLL investment grade at this point in time. I revise my rating on COLL to a buy.

Figure. 1

- Chart turning very constructive, with red line indicating time of last publication.

- Now, we have the price line basing up, and could potentially curl higher from here.

- Volume drying up, 5-weeks of tight closes, 200DMA still trending higher to support this.

Data: Updata

Q1 results in fine detail

I’d commend COLL on its Q1 numbers especially at the product/sales level. It came in with record revenues and is pushing capital towards growth, as evidenced by the adjustments it made to non-GAAP OpEx. My key insights underpinning the buy thesis follow.

I. Insights

1. Top-line Revenues, Capital Budgeting

Turning to the quarter, COLL made significant strides in pursuing its strategic objectives. This has me bullish for key reasons. Why?

One, quarterly performance from the firm’s BELBUCA and Xtampza ER products were top-shelf, generating record quarterly revenue in both divisions. The BELBUCA business achieved record quarterly revenue of $44.2mm, backed by 52% YoY growth in Xtampza ER sales to $47.9mm. The Nucynta segment was resilient, clipping 100bps upside in revenue to $49mm. Growth was spurred by contract renegotiations the company executed last year, so were largely expected, but critical nonetheless. Moreover, the focus on optimizing revenue streams is welcomed in my opinion. You can see this directly evidenced in the decreased Q1 gross to net ratio of 55% for Xtampza ER. In total, net product revenues clipped $144.8mm, a tremendous 73% YoY increase.

Two, COLL’s capital and cost management initiatives have me quite interested on what is in store next for the firm. Just on the face value, on one side, you can see the 10% decrease in quarterly OpEx, contracting to $52.8mm. On the other hand, adj. OpEx (that includes additional SG&A) increased 52% YoY to $38.2mm, as COLL front-loads investments toward its growth initiatives for FY’23. This is a one-off (in terms of historical averages), but could pull through to earnings growth down the line if successful.

Three, COLL retired another $25mm in debt in Q1 strengthening its current position and freeing up cash flow. It then completed a $241.5mm convertible note offering, maturity February 2029. This is a good move in the current rates climate in my opinion. Consider that:

- The convertible provides a cheap form of financing for COLL, and if converted, the liability will be wiped from the balance sheet.

- Investors enjoy equity and debt-like features and obtain a cheap form of equity if COLL’s stock price hits the conversion price.

- Hence, it is a mutually beneficial partnership that gives COLL access to that lower tier of interest rate risk.

It used $140.1mm of the proceeds to repurchase portion of its convertible senior notes due in 2026, with the remainder set to be used for general expenditures.

2. General Productivity

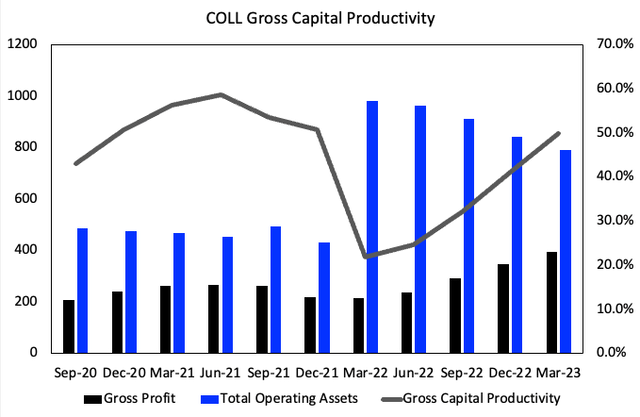

In analyzing the business economics of COLL, it becomes evident that the company is effectively ramping up its productivity. The growth in gross profit generated by total operating assets, which represent the income-producing assets on COLL’s balance sheet at book value, are particularly noteworthy [Figure 2]. Here, cash is shown at 4% of sales, serving as an operating asset.

The recent improvement in gross capital productivity has brought it back to long-term range, indicating the company’s ability to generate long-term investment returns. In fact, for every $1 invested in capital, COLL’s operating assets are producing an impressive 50% gross profit. This, alongside a pullback in capital density from its two-year highs.

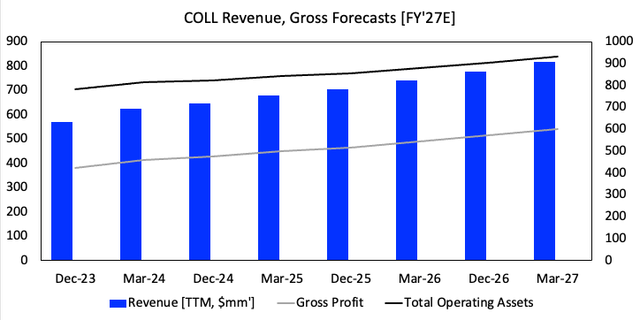

Looking forward, my analysis and projections indicate that COLL has the potential to achieve $600mm in gross revenue by FY’27 [see: Appendix 1], suggesting an 11% compound annual growth rate. I anticipate net working capital density will further increase on this, complemented by additional capital expenditures aimed at supporting the growth trajectory.

Figure 2.

Data: Author, COLL SEC Filings

Figure 3.

Data: Author Estimates

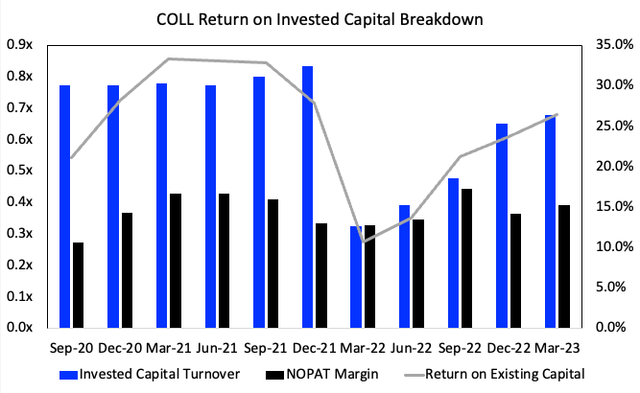

II. Business Economics

1. Returns on investment

When evaluating investments, it is crucial to delve beyond surface-level financial results, to conduct a thoughtful analysis of the business’s economic characteristics. In my view, that means capital should be more valuable in the company’s hands than my own, for one. That means, my capital (the business’ operating capital) should be generating rates of return on capital above the hurdle rate.

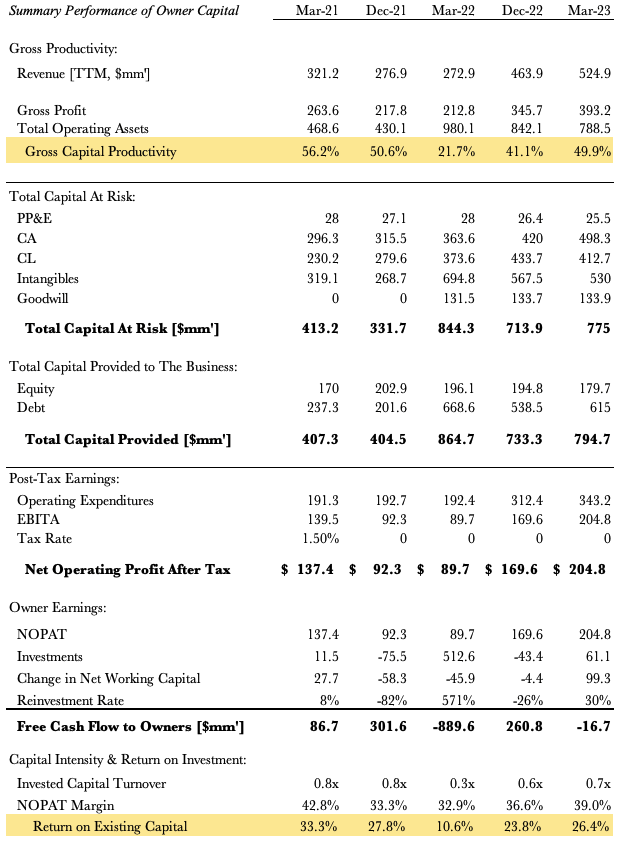

COLL stands out in terms of profitability and returns on capital in my opinion, mirroring trends observed in the broad pharmaceutical industry. As the industry is intangible-asset heavy, ROI’s are quite substantial given the scalability and extended usage effects of intangible assets. With respect to COLL’s numbers:

- Looking back to FY’21 on a rolling TTM basis, COLL persistently drove attractive returns on existing capital ranging from 25%-30%. Additionally, it has generated substantial cash flow for shareholders over that time, with post-tax earnings growing from $137mm-$204mm (TTM figures).

- This exceptional performance stems from a combination of strong operating profitability, more so than capital efficiency, as evidenced by a trailing NOPAT margin of 40% vs. invested capital turnover of 0.7x in Q1 [Figure 4].

- These findings align with my investment thesis, suggesting COLL’s strengths are on the consumer side, and that there’s potential to drive operating margin growth in the future.

Notably, the company’s capital budgeting strategy aims to reduce debt by approximately $160mm, aiming to bring net leverage down to 1x adj. EBITDA by FY’23.

There are two things to consider with the decision to divert capital towards the liabilities side of the balance sheet. First, is that capital towards growth will decelerate to ease the debt burden. Yet, at the same time, interest costs will drift lower, leading to earnings growth. Usually, you’d argue paying down debt is a good thing anyway.

Figure 4.

Data: Author, COLL SEC Filings

Figure 5.

Data: Author, COLL SEC Filings

2. Economic Earnings

To contextualize the firm’s return on investments, it is essential to compare the return on capital provided to the company (by investors) with the return on capital that’s been invested into productive assets. Companies that demonstrate the value of capital in their hands tend to be rewarded by the market with higher valuations in the long-run. Further, as mentioned, as a conduit for assets and equity, COLL should generate a return on the capital it invests (owner’s capital) higher than the market return, commonly referred to as the hurdle rate. In this case, I’d consider the hurdle rate to be 12%. With that in mind, consider these points:

- Reviewing the performance from 2021 to the present, you observe double-digit economic profits from COLL throughout the testing period, with the exception of Q1 FY’22.

- However, despite these compounding earnings, COLL’s market valuation has remained relatively flat over the past three years. The primary reason behind this disparity lies in the company’s decision not to reinvest at the high rates of return for growth in my opinion.

- In addition, operational expenses have surged from $191mm in Q1 FY’21 to $343mm in the last quarter on a TTM basis.

- Further, you can see in Figure 7 that capital requirements have increased drastically since 2022, producing more operating profit.

- However, at the same time, costs on capital required to produce the profits (OpEx) have increased substantially.

- Hence, capital is being diverted to other means, such as paying down debt for example.

- In that vein, COLL must be commended for its financial performance and returns on capital. Its profitability and ability to generate cash flow for shareholders have been equally as commendable. However, the company faces challenges in translating its economic earnings into market valuation growth, primarily due to the limited reinvestment of capital into business expansion.

I will be closely monitoring COLL’s capital allocation going forward, and hoping it finds that balance between profitability and reinvestment because the market is looking for the latter in my opinion. In my eyes, it would achieve this in operating/NOPAT margin, to increase the overall profit reinvested back in the business.

Figure 6.

Data: Author, COLL SEC Filings

Figure 7.

Data: Author, COLL SEC Filings

III. Valuation

My numbers have COLL to do $571mm in top-line revenues this year, in-line with management’s range [see: Appendix 1]. On that, I’d be looking for $420mm in gross, for 54% gross profitability (gross profit/total operating assets).

It wouldn’t be unreasonable to expect the firm to have $780-$790mm in capital at risk this year ($72mm YoY investment) and see it generate $180-$210mm in post-tax earnings and see another 25-26% ROIC. Again though, my estimates have the firm to reinvest just 6% of earnings into growth this year. The rest, will be diverted towards retiring debt, as mentioned.

Market implied valuation

The discussion turns to what the market expects at the firm’s current enterprise valuation of $1.34Bn and market cap of $804mm (at the time of writing). If there’s differences in the market’s expectations to my own, there could be an alpha opportunity:

- Carrying the same 12% discount rate, the market expects c.$160mm in post-tax earnings from the firm, getting you to the $1.34Bn ($161/0.12 = $1,240).

- Therein lies an interesting set of arithmetic in this valuation calculus. At the firm’s TTM EBITA of $204mm, adjusting this for 18% tax gets you to $167mm ($204 x (1-0.18) = $167). That’s puzzling, because you’d expect upside on this if the market was to rate COLL higher.

- My numbers have it to do $180mm in NOPAT this year in the base case, calling for $1.5Bn enterprise valuation (180/0.12 = $1,500). Recalibrating for equity value I get to $963mm on this ($27.50/share). Hence, there’s disconnect there.

These numbers assume no growth, however. Looking to the cash COLL can throw off to its shareholders (free cash flow to shareholders) into FY’27, a 4-year horizon, discounting these at 12% to the present values the firm at $899 (upside on the current market cap, not enterprise valuation).

Market Multiples

You’ve got COLL at an absolute steal at just 4.4x forward earnings. This is very attractive, on face value at least. Consider that multiple in this light:

- You’re paying just $4.40 for every $1 in COLL’s future earnings;

- But you’re getting no major earnings growth and the company isn’t investing to achieve this.

- Instead, earnings are consistent on a cumulative and incremental basis – great for the business, not so for the investor.

- Hence, the flat equity line in COLL’s stock price these past 5-years.

My numbers have the firm potentially fairly valued at 8x forward P/E (1,500/180 = 8.3), which is a potentially pleasing investment. There is certainly merit in buying the stock at 4.4x P/E and aiming for a sell at 8x (100% return on multiple). As such, for those investors looking for more resilient exposure healthcare, COLL might be the name.

In short

In summary, COLL satisfies key investment metrics and offers the investor exposure to the resilient end of healthcare. It is tremendously profitable and generating strong returns on capital, but not rotating this into market value. My estimate is this is due to quite low reinvestment rates to fuel future growth. Part of this is due to capital allocations in paying down debt, not a bad thing.

However, there’s been a lack of incremental investment return and this may be one reason the market overlooked COLL to date. Nevertheless, you’ve got the stock priced at 4.4x and that alone is potentially attractive. In my estimation, there is scope on the tactical side for COLL to re-rate to 8x forward P/E. Based on the factors discussed here, I am revising my rating on COLL to a tactical buy.

Appendix 1. COLL FY’23-’27 Forecasts

Data: Author Estimates

Read the full article here