Investment thesis

I recommended buying Arthur J. Gallagher (NYSE:AJG) in late March, as I believed the market would have a more optimistic view of FY23’s growth and margin outlook, which would lead to a positive valuation rerating in FY23. That has played out nicely, with the stock climbing consistently from $180+ to a high of ~$220. My thesis was further reinforced after the 1Q23 earnings results in late April. AJG’s adjusted EPS of $3.03 in 1Q23 was higher than the $3.01 expected by consensus. Improved organic growth and an enhanced adjusted EBITDAC margin were the primary contributors to the outperformance. I continue to be optimistic about the future of the company because management has stated repeatedly that the insurance brokerage industry is healthy, with renewal premium change increasing by 9% in 1Q23 and remaining strong through April. This gives me confidence about 2Q23 performance, as I don’t see any hard catalysts that might slow growth in the near term. Importantly, management stated that they have not seen any signs of a recession from their middle market client base and that they anticipate the firm’s P&C pricing market to persist through at least 2023, if not 2024. All in all, I reiterate my buy rating, as I believe AJG remains well-positioned to continue growing this year given the steady outlook.

Growth

Management reaffirmed their guidance for FY23, anticipating 7-9% organic growth in its Brokerage segment and 12-13% organic growth in the Risk Management segment.

Given that Brokerage segment performance in 1Q23 (which has carried through to April) is already at 9.1%, I think the guided organic growth is likely achievable. Renewal premium change was 9%, 100 bps higher than the 8% anticipated during March Investor Day, indicating that growth was widespread across products (which suggests the growth was not isolated and one-off) and geographies. Given management’s optimism that pricing levels will remain strong through FY23 and likely into FY24, I believe the organic growth target may be overly conservative. As a result, I have a great deal of faith in FY23’s growth, and I anticipate an uptick in organic growth in 2Q23 as a result of a slightly larger proportion of property businesses renewing at rates that increased by double digits.

Given the solid 14.3% organic growth in 1Q23 for the Risk Management segment, I am confident that AJG can meet this guidance. In addition to new business wins, revenue from floods and cyclones in New Zealand has contributed to the division’s continued better-than-expected organic growth. AJG is also very active in the M&A space, with 10 acquisitions done in the past quarter, driving more than $69 million in annualized revenue. Aside from revenue, these acquisitions enhance AJG’s competitive advantage as well, by increasing its scale (better negotiating power in policy wordings), and also extending its distribution. More tuck-in acquisitions would be the swing factor that would push AJG’s growth much more than expected, but I find it hard to gain conviction in this scenario in light of management comments that the M&A market is continuing to slow. The lack of a material decline in multiples is a major concern for management because it reduces the value-adding potential of an acquisition. That said, management mentioned that they have nearly 40 term sheets signed or being prepared in their pipeline (worth more than $350 million of annualized revenue). As such, I will not be surprised to see AJG tap into this pool of revenue to juice growth. Overall, without putting a convicted view on where rates might go, if rates were to go up, it would be a bigger tailwind for AJG as targets multiple would further compress, making it more accretive for AJG.

Valuation

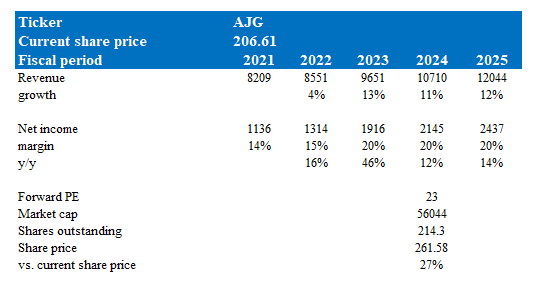

I still see a 27% increase in AJG share price in FY24, with a target price of $261. My assumptions are roughly in line with the consensus, but I would point out that the variant perception is that multiples can remain elevated for a longer period of time than expected in the near term if momentum continues. As long as interest rates remain at this level, or even higher, I believe AJG will be a “favoured” stock due to its correlated relationship with interest rates (high rates are good for AJG in terms of premium renewals and acquisitions).

Own model

Risks

While high rates are a good thing for AJG, they are a double-edged sword that will eventually flip and hurt AJG on both the business and valuation fronts. On the business side of things, a flip in rate direction will hurt premium growth, which carries very high incremental margins; as such, it also means that the decremental margins will be painful (lower rates = lower top line = huge impact on earnings given the fixed cost structure). While volume might increase, I don’t think it will be sufficient to offset the decline in pricing. Next, for valuation, it is unlikely for AJG to stay at this elevated multiple given the slowdown in growth (due to later rates).

Conclusion

In conclusion, my thesis for AJG remains intact. The company has shown consistent growth and outperformed expectations in the first quarter of 2023. Management’s statements about the health of the insurance brokerage industry and the expected persistence of favorable pricing conditions give me confidence that the guidance for organic growth in both the Brokerage and Risk Management segments is achievable. That said, a risk would be a reversal in rates, which could pose risks to premium growth and valuation.

Read the full article here