Huntington Bancshares Incorporated (NASDAQ:HBAN) is one of the largest regional banks in America – specifically operating across twelve states from its headquarters based in Columbus Ohio. This bank holding company operates through its subsidiary known as The Huntington National Bank that offers individuals alongside businesses with an array of banking services. As of March 31st of this year the company had amassed assets totaling $189 billion with deposits amounting to $145 billion whilst having provided loans worth $119 billion – rendering it as an impactful player within the industry.

I will evaluate Huntington’s stock based on its valuation, growth, profitability, and risk. I will also compare it to some of its peers in the regional banking sector. My main thesis is that Huntington is a buy recommendation, as it is trading at a discount to its intrinsic value, solid profitability, and a manageable risk profile. I will also discuss the best-in-class dividend and as always take a look at the challenges that could affect Huntington’s performance and outlook in the near and long term.

Investment Strategy

For starters, Huntington is right where I like it trading at just about 15% above its 52-week low. I added this to my investment strategy a number of years ago with great success. I’ll let famed investor Michael Burry explain its value:

“As for when to buy, I mix some barebones technical analysis into my strategy — a tool held over from my days as a commodities trader. Nothing fancy. But I prefer to buy within 10% to 15% of a 52-week low that has shown itself to offer some price support. That’s the contrarian part of me. And if a stock… breaks to a new low, in most cases I cut the loss. That’s the practical part. I balance the fact that I am fundamentally turning my back on potentially greater value with the fact that since implementing this rule, I haven’t had a single misfortune blow up my entire portfolio.”

What does this mean?

Now is the time to buy, as the stock trades at $10.53 at present.

Second, this is a volatile holding heavily subject to economic conditions, the upcoming debt ceiling matter, and more.

So what?

An investment in Huntington should be a relatively small holding if you don’t plan to hold for a decade– and I don’t.

Finally, I plan to hold onto this until it hits $15 per share.

No more rhetorical questions. I will sell my shares when the company reaches my price target of $15. Got it?

To think they told me I couldn’t be a comedian.

Dividend Monster

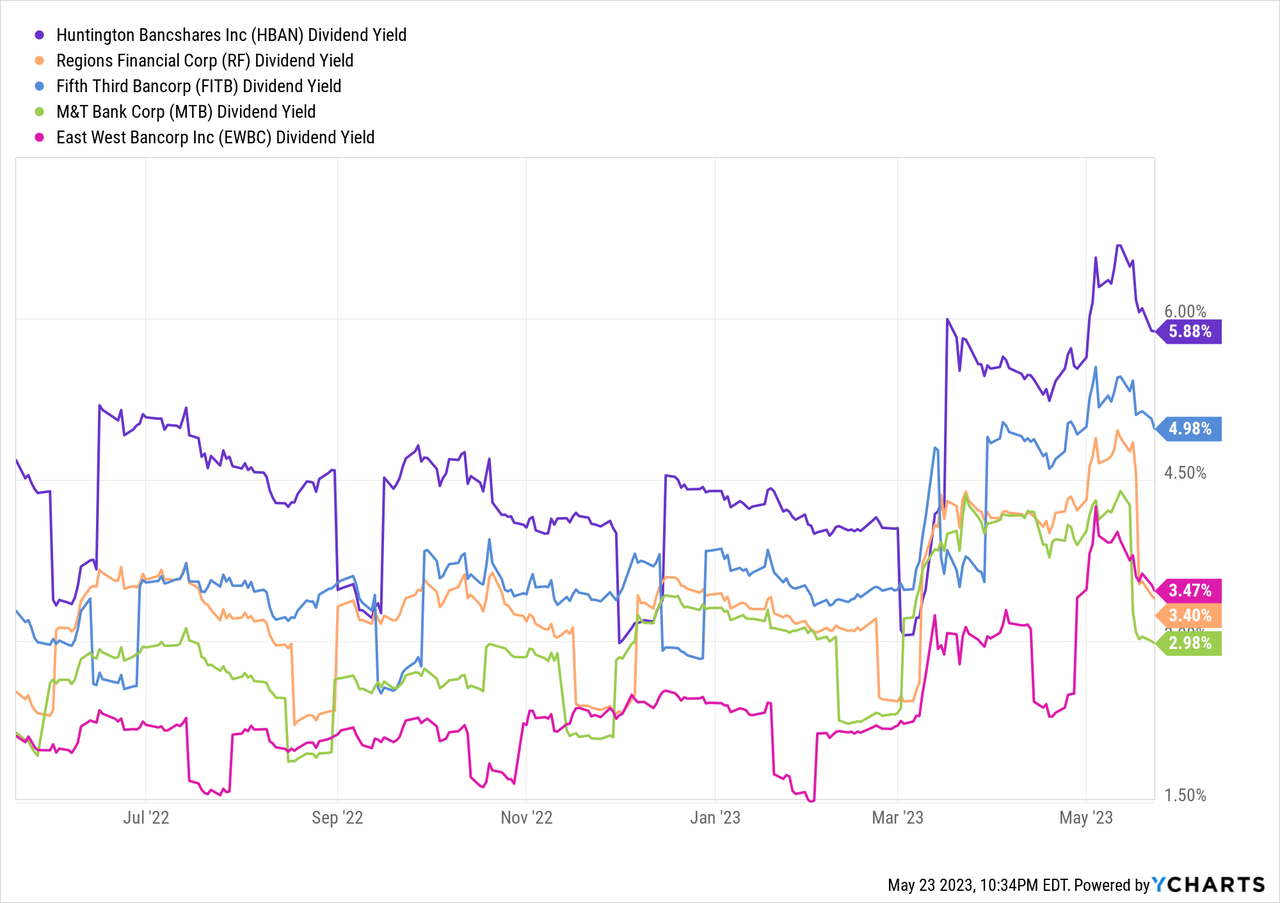

One of the most appealing aspects of Huntington’s stock is its generous dividend policy. The bank has been paying dividends consistently since 1990. The current annual dividend is $0.64 per share, which translates to a yield of 5.88% based on the current stock price of $10.53. This is well above the average yield of 2.9% for the regional banking sector and 1.66% for the S&P 500 index.

Not only is Huntington’s dividend high, but it is also sustainable and growing. The bank’s payout ratio, which shows how much of its earnings are distributed to shareholders, is 40%, which is above the industry average of 34% and within its own target range of 40% to 60%. This means that the bank retains enough earnings to reinvest in its business and support its future growth. The bank’s free cash flow yield, which shows how much cash it generates relative to its market value, is 3.39% and indicates that the bank has more than enough cash to cover its dividend and other obligations.

Huntington’s dividend has also been growing at a remarkable pace over the years. The bank has increased its dividend at a compound annual rate of 10% over the past five years and 15% over the past 10 years. While I don’t expect Huntington to maintain such a high dividend growth rate in the future, given the challenges posed by the low interest rate environment and the integration of TCF Financial Corporation, which it acquired in December 2022, I still believe that Huntington will continue to reward its shareholders with above-average dividend growth and returns.

Profitability

| Profitability Metrics | HBAN | Industry |

|---|---|---|

| Return on assets (ROA) | 1.26% | 0.98% |

| Return on average equity (ROE) | 13.92% | 10% |

| Net interest margin (NIM) | 3.65% | 2.97% |

| Loan/Deposit Ratio | 82% | 62% |

To briefly explain the significance here:

Return on assets (ROA) measures how efficiently a bank uses its assets to generate earnings. A higher ROA indicates that a bank is more profitable and productive. Huntington’s ROA of 1.26% is well above the industry average of 0.98%, which means that Huntington is able to earn more income from its assets than its competitors. This reflects Huntington’s ability to optimize its asset mix, maintain high asset quality, and control its operating expenses.

Return on average equity (ROE) measures how effectively a bank uses its shareholders’ equity to generate earnings. A higher ROE indicates that a bank is more profitable and rewarding to its shareholders. Huntington’s ROE of 13.92% is significantly higher than the industry average of 10%, which means that Huntington is able to earn more income from its equity than its competitors. This reflects Huntington’s ability to leverage its capital, grow its earnings, and pay attractive dividends.

Net interest margin (NIM) measures the difference between the interest income a bank earns from its loans and investments and the interest expense it pays on its deposits and borrowings. A higher NIM indicates that a bank is more profitable and efficient in managing its interest income and expense. Huntington’s NIM of 3.65% is much higher than the industry average of 2.97%, which means that Huntington is able to earn more interest income from its loans and investments than its competitors. This reflects Huntington’s ability to offer competitive loan rates, diversify its loan portfolio, and manage its interest rate risk.

Loan/Deposit Ratio measures the percentage of a bank’s loans that are funded by its deposits. A higher loan/deposit ratio indicates that a bank is more profitable and aggressive in lending out its deposits. Huntington’s loan/deposit ratio of 82% is higher than the industry average of 62%, which means that Huntington is able to lend out more of its deposits than its competitors. This reflects Huntington’s ability to attract and retain deposit customers, generate loan demand, and maintain liquidity.

Valuation

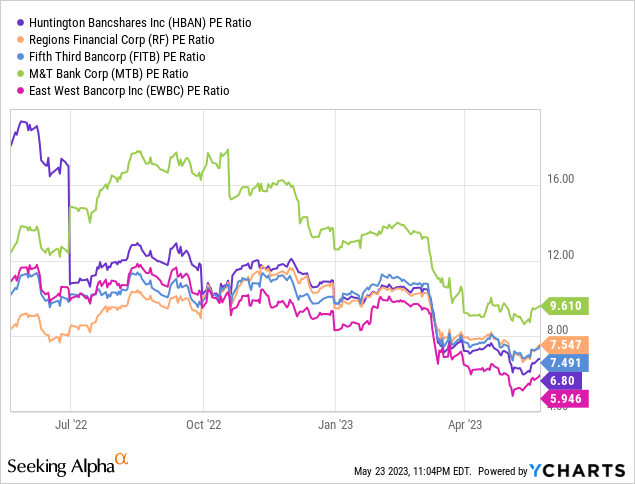

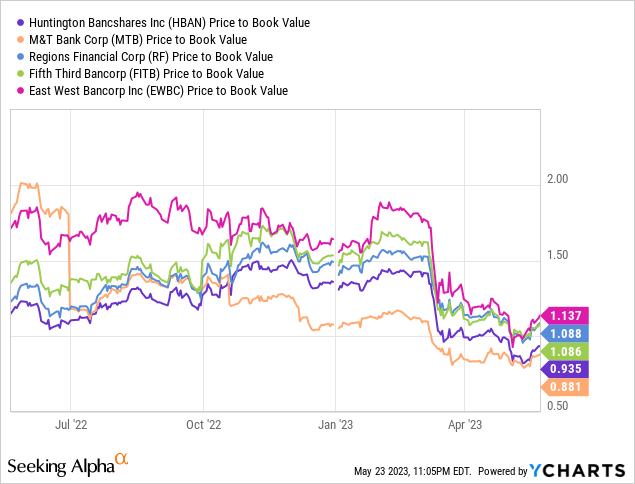

It’s not hard to see that Huntington is cheap. All we have to do is do a little peer analysis. I usually perform an excess returns model for bank valuation, but for Huntington, I believe a peer analysis is much more relevant and illuminating. I compared with Regions Financial Corp. (RF), Fifth Third Bancorp (FITB), M&T Bank Corp. (MTB), and East West Bancorp (EWBC).

Author, YCharts

Huntington is trading at the second lowest P/E among its peers, second only to East West Bancorp. Coincidentally, I am very bullish on East West Bancorp, and you can find my article about why Li Lu, The “Warren Buffett of China” invested in it here.

Author, YCharts

Book value is another very important metric for us to take a look at. I’m happy to report that Huntington is again second only to one as the cheapest trading on BV. I calculate the Book Value Per Share to be about $11.27, meaning you can buy this great bank at or below book value. The real story here is that the bank trades at the cheapest or near the cheapest among its peers in nearly every relevant valuation metric.

My valuation is quite simple, really.

Huntington Trades at a P/E of 6.80, its historical median is 12.84. Assuming conservatively that Huntington somehow does not return to this median and falls short at 10-11, we can expect an appreciation to at least $15 per share, providing somewhere in the range of a 50% return. Comparing my valuation to my colleague Leo Nelissen who reached a target of $16, and the Wall St consensus of around $13 my valuation is the colloquial happy medium. This bank has no reason to be trading at such low multiples, but I have created a conservative estimate for these trying times.

Risks

Huntington Bank is not without its risks and challenges, as it operates in a highly competitive and regulated industry that is exposed to various economic and market factors. I will provide what I consider to be the two main risks that Huntington faces or may face in the future:

Credit risk: This is the risk of loss due to borrowers or counterparties failing to repay their loans or obligations. Credit risk is inherent in any lending business and can be affected by changes in economic conditions, customer behavior, industry trends, or credit quality. Huntington has a diversified loan portfolio across various segments, such as consumer, commercial, and real estate. However, some of these segments may be more vulnerable to credit deterioration than others, especially during recessions or downturns. For example, Huntington has a significant exposure to the auto lending segment, which accounted for 17% of its total loans. Auto loans tend to have higher default rates and lower recovery rates than other types of loans, and may also be subject to regulatory scrutiny or litigation. Huntington also has a sizable exposure to the energy sector, which accounted for 4% of its total loans. Energy loans are subject to volatility in oil and gas prices and demand, as well as environmental and social risks.

Huntington has been proactive in managing its credit risk by maintaining high underwriting standards, enhancing its credit monitoring and risk rating systems, increasing its loan loss reserves and provisions, and reducing its exposure to certain segments or geographies. However, credit risk remains a significant risk factor that could affect Huntington’s earnings, asset quality, capital adequacy, and reputation.

Interest rate risk: This is the risk of loss due to changes in interest rates that affect the bank’s net interest income and margin. Interest rate risk is inherent in any banking business and can be affected by changes in monetary policy, market conditions, customer behavior, or competition. Huntington has a large deposit base that provides a low-cost source of funding for its lending activities. However, some of these deposits are sensitive to interest rate changes and may reprice faster than the bank’s assets. This could result in a compression of the bank’s net interest margin and income if interest rates rise rapidly or unexpectedly.

Huntington has been active in managing its interest rate risk by adjusting its asset-liability mix, hedging its interest rate exposure, diversifying its fee income sources, and optimizing its deposit pricing strategy. However, interest rate risk remains a significant risk factor that could affect Huntington’s earnings, profitability, growth potential, and valuation.

The Michael Burry Bonus

Famed Investor Michael Burry initiated a position in Huntington, accounting for about 2% of his portfolio– in line with my recommendation. Burry is an admittedly hard investor to follow into trades, but of note is that Huntington is at or below where he purchased it based on the time of his 13F filing. Burry has an outstanding return (a 3-year performance of 356%), and as you likely guessed, it isn’t because he picks a bunch of losers.

Burry tends to buy out-of-favor businesses and sell them when they’ve been “polished up a bit.” That’s precisely the opportunity we have here, leaving me with little to no uncertainty about his investment thesis. Michael Burry’s vote of confidence is not reason enough to invest in Huntington. However, alongside its growing dividend, well-managed profitability, and its cheap valuation, it’s hard not to grab a few shares.

Love him or hate him. He outperforms your favorite analysts year after year. So either grab some popcorn and watch or call up your broker and make a move.

Takeaway

Huntington trades at a discount to its intrinsic value and has solid profitability and a manageable risk profile. The bank also pays a generous and growing dividend that provides a steady income stream and a margin of safety. I believe the bank has a potential upside of 42% from present levels on a conservative valuation. What’s more is that while you wait for that share price appreciation, you can collect your fat 5.88% dividend. I assign a buy rating to Huntington stock at its current price of $10.53 and maintain a buy until $12, at which point I will issue a hold rating as price supports diminish.

Read the full article here