By Carrie King

First-quarter earnings largely surprised to the upside, but expectations also had been guided down. What does the latest earnings news mean for stock investors? Carrie King, Global Deputy CIO of BlackRock Fundamental Equities, offers three observations.

Sentiment #1: Surprise. But a low bar is easier to clear

Exceeding expectations isn’t as hard when they’re set (or reset) low. That was a big part of what we saw in the first-quarter earnings season. While nearly 80% of S&P 500 companies beat analyst estimates on earnings, it was in the context of expectations that had been downgraded from the start of the quarter. Importantly, the earnings beats were met with muted share price appreciation, perhaps an investor acknowledgement of the low bar. Meanwhile, companies that missed their earnings estimates suffered greater price punishment than is typical.

Overall, the level of the S&P 500 was little changed over the reporting season, despite the relatively larger frequency of positive earnings surprises. And year-to-date, it’s been the top-five stocks in the index that have carried the day. Index performance would otherwise be negative for the year. Our read on this: The market is rewarding quality, and this presents an opportunity for active stock pickers.

While the market is assigning additional value based on generative artificial intelligence (AI) prospects, these ultra-cap companies possess all-important quality characteristics like strong cash flows, fortress balance sheets, and diversified revenue streams. We expect companies with similar attributes to outperform as investors key in on potential margin compression in the coming quarters.

Sentiment #2: Gratitude. Thank you, consumer

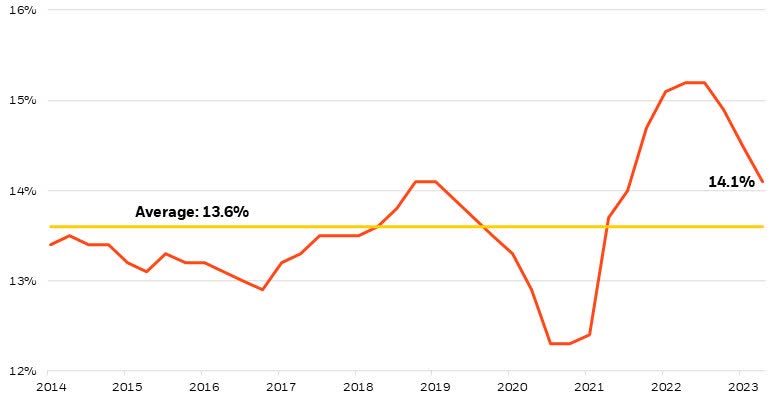

In large part, companies have consumers to thank for their good Q1 fortune. All sectors exceeded their sales growth expectations. While the top line (sales) looked good, the bottom line (profits after subtracting costs) showed that margins may be coming under pressure. Certainly, they are retreating from their post-pandemic highs, as shown in the chart below.

Profit margins retreating from historic highs

S&P 500 Index aggregate operating (EBIT) margins, 2014-2023

BlackRock Fundamental Equities, with data from Refinitiv, April 30, 2023

Aggregate EBIT (earnings before interest and taxes) margins are shown for the trailing 12-month period for the S&P 500 Index of large-cap U.S. stocks. Indexes are unmanaged. It is not possible to invest directly in an index.

Inflation pressures notwithstanding, Q1 results for some consumer-oriented companies showed that customers are not necessarily trading down in their purchases. Consumer packaged goods had a strong quarter, with name-brand beverages solidly holding their ground. And the hotels, restaurants, and leisure industry saw year-over-year earnings growth of nearly 160%. While consumers’ financial health is generally strong, the household saving rate has been on the decline along with consumer confidence. This could potentially eat into buying power, again underpinning our preference for quality companies.

Medical device companies also surprised to the upside, with a confluence of events providing support: For one, people are finally getting past their COVID-related hospital fears and scheduling long-delayed hip and knee replacements. At the same time, hospital staffing shortages are easing, allowing for the greater patient demand to be fulfilled. We would also posit that recession and related job-loss concerns may have people looking to schedule surgeries before a potential loss of employer-sponsored health benefits. New technologies coupled with remaining pent-up demand reinforce our continued favorable view.

Sentiment #3: Prudence. Stock selection matters, with a focus on quality

Our biggest takeaway from this earnings season is that stock selection matters. Companies are being rewarded for their strong fundamentals and quality characteristics. We see this trend sticking in coming quarters, particularly if the turmoil in the regional banking system spurs further regulation and tighter credit conditions, creating headwinds for economic growth.

Across our global Fundamental Equities platform, we maintain our preference for healthcare, both as a defensive and quality exposure. The sector has not been priced for its recession resilience and long-term prospects, in our view, and this quarter saw a high frequency of both top- and bottom-line beats, at 82% and 80%, respectively. We are cautious about financials amid the recent bank closures and takeovers. While we don’t see a systemic crisis, consumers are leary, as evidenced by flows out of bank deposits and into money market funds. Earnings may be challenged in the quarters ahead if regulatory conditions constrain their business models.

Overall, companies with strong brands, technological advantages, and a strong financial foundation have an edge, in our estimation, as these characteristics reinforce pricing power while also providing the financial flexibility to respond to changing consumer tastes and evolving macroeconomic conditions.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here