Investment Thesis

Concentrix Corporation (NASDAQ:CNXC) is well below its all-time highs and with a very good merger with WebHelp, the company is positioned for success in the long run if more investors/analysts start to pay attention to it. With strong financial health, solid prospects, and conservative estimates, the company is a buy at these levels.

The Company

CNXC is a provider of tech-infused customer experience solutions. It operates many call centers around the world, and it drives customer engagement and business performance solutions for many big companies around the world in the form of marketing, design services, digitization services, automation and optimization technology, analytics, and consulting services. It does a lot. It made its IPO debut in November 2020 after its spin-off from Synnex.

Outlook- Very Bright Future Ahead After the Merger

At the end of March ’23, the company announced its intentions to merge with a French multinational company WebHelp. The transaction should be completed at the end of this year. This was a very smart move in my opinion, and from reading the transcripts there will be many synergies coming out of the merger and the company’s global footprint will finally become serious, because WebHelp has a strong footing in Europe, Africa, and Latina America. CNXC was lacking in those regions, but that won’t be the case any longer. The company has wanted to expand its footprint for a while now and it finally found a very good way of doing that. The company is aiming to become a leader in the three mentioned markets, and I believe they will succeed now that they are finally going to achieve scale.

The management has also said they see cost reductions from the synergies of the merger with WebHelp of up to 120m in the next 3 years after the merger.

Tech Advancements Will Improve Margins

The company is already jumping on the hype train of AI and I’m all for it. Generative AI chatbots will help with the simplest tasks that a customer may have, which will enable real employees to focus on clients’ more sophisticated problems. AI will not replace employees any time soon, I think it will enhance the experience of the employee and the client. Efficiencies will start to come through.

Financials

The charts below will be as of FY22 which ended in November. This will give me a clearer picture of the company’s overall trend, and where it might be headed in the future. I will include some relevant numbers from the latest quarter also for more color.

As of Q1 ’23, the company had $178m in cash and $2.2B in long-term debt. After the merger with WebHelp, the company will have around $5.1B in debt outstanding, which is quite a big amount, however, is it dangerous? Let’s have a look. The company’s current interest coverage ratio as of FY22 stood at 9x. That means that the company can cover annual interest expenses 9 times over. Assuming double the outstanding debt will double the company’s interest expenses, and even if we consider not adding WebHelp’s EBIT into the financials, which would make no sense, the company is still very liquid and can cover interest expenses 4.5 times over. WebHelp is going to contribute around $500m in adjusted EBITDA in ’23, which means the extra leverage that Concentrix is taking on is not going to matter too much.

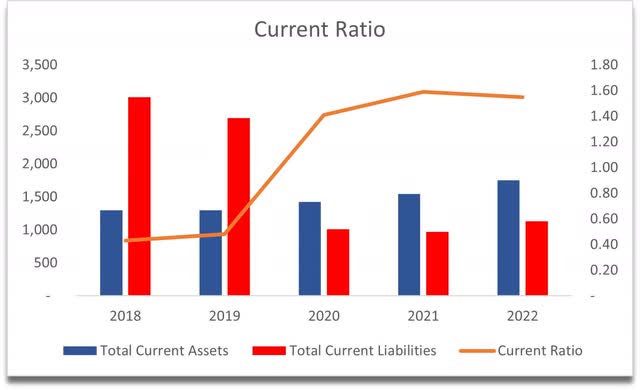

While we’re on the liquidity side of things, the company has a decent current ratio, that has improved quite a bit in the last three years. The company can easily cover its short-term obligations and has no liquidity issues.

Current Ratio (Own Calculations)

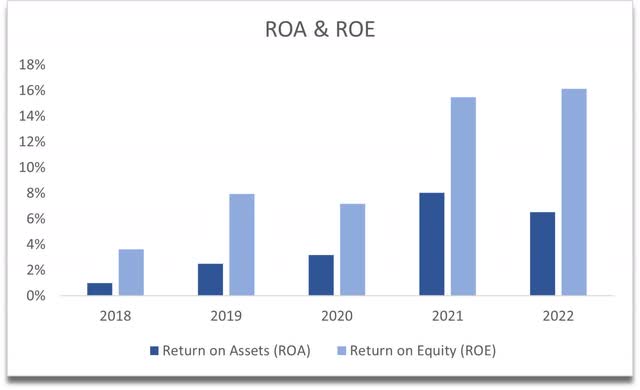

In terms of profitability and efficiency, the ROA and ROE of the company are acceptable. It can put its assets to good use, convert them to good returns, and efficiently use shareholders’ capital. It will be interesting to see how this will change once the merger is finalized.

ROA and ROE (Own Calculations)

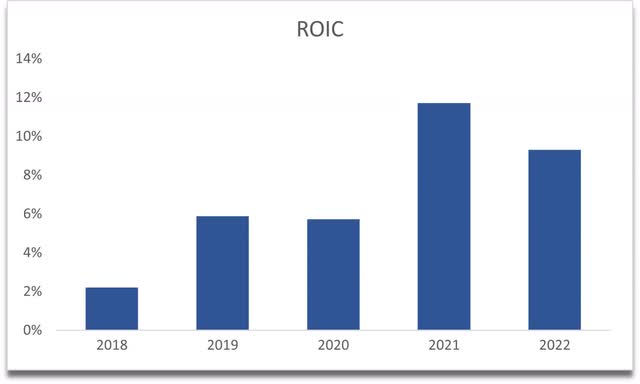

The company’s ROIC is also decent, with a slight dip in the last year, which is not concerning yet, but will have to be monitored for the next while to see if it develops a downtrend or not. Right now, the company seems to have a decent competitive advantage and a good moat.

ROIC (Own Calculations)

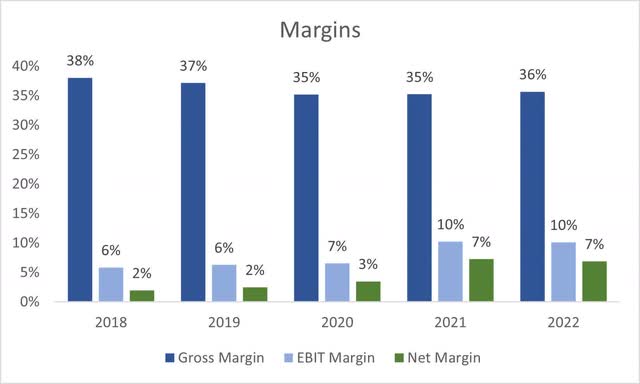

In terms of margins, the company could do a little better, and I think with all the future synergies and savings, we will see margins improve, especially in the long run.

Margins (Own Calculations)

Overall, these are decent numbers. I don’t see any red flags that would suggest the company is not going to weather the upcoming supposed economic downturn.

Valuation

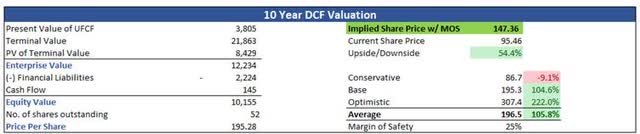

I decided to go with a simple DCF valuation that is on the conservative side. For the base case, I can see the company growing quite strongly with the extra presence across the pond and I settled on an 11.75% CAGR over the next decade. In the optimistic case, I went with around 14% CAGR, while in the conservative case, I went with 9.75%. All three scenarios seem to be reasonable to me, but everyone will have different opinions.

On the margins side of things, I went with some margin expansion on the base case. Gross and operating margins will improve by 200bps, or 2% in the next decade, while on the optimistic case, these will improve by 275bps, and on the conservative case these will remain as seen last in FY22.

On top of these assumptions, I will add a 25% margin of safety, to be even on the safer side. With that said, the company seems to be very undervalued with an upside of 54.4% from current valuations as implied share price suggests intrinsic value to be $147.36 a share.

Intrinsic Value (Own Calculations)

Closing Comments

I will be very interested to see once WebHelp is integrated into the company, what kind of revenue growth it will start to see over the next couple of years and what kind of efficiencies it’ll be able to achieve. I have a good feeling that in the long run, it will do very well. It may seem like my intrinsic value calculation is too positive, but the company has seen a very ugly selloff since February, which I think is not warranted and may present a good opportunity to get in on it for the long haul as back in February the share price was at about the intrinsic value I have calculated here.

It may not reach the potential I see that it has because it is not heavily covered stock. Currently, I see that there are 3 Wall Street analysts covering it so I would expect a lot of volatility and huge swings in share price due to low-volume trades, but I do think the merger with WebHelp has a lot of potential to reward its shareholders in the long run.

Read the full article here