The iShares Global Energy ETF (NYSEARCA:IXC) is a large-cap ETF that becomes dominated by exposures to some of the seven sisters and other companies that are substantially levered to the price of the oil commodity. We think that the situation where OPEC keeps supply tight is likely a secular phenomenon and comes with the fact that the Ukraine war could go on for a while, and that sanctions against Russia are likely to be even more secular. Dislocation in oil supply and also the consequent struggle of economies to shift away from oil remind producers of its importance, and that viable alternatives are still far off. We believe stranded asset risks are much less a concern for oil producers, and that is why they are comfortable with price over volume despite industrial economics.

IXC Breakdown

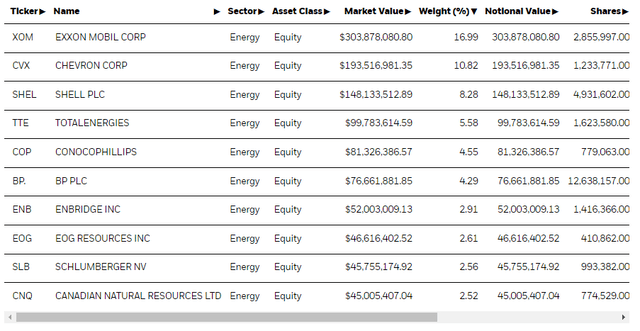

IXC contains many major oil exposures. While many contain some midstream assets, the majority are directly levered to the oil price.

Top Holdings IXC (iShares.com)

The skew is pretty meaningful to the top 3 holdings of Chevron (CVX), Shell (SHEL) and Exxon Mobil (XOM).

The only thing we take immediate issue with is the high expense ratio, which we think is odd considering the simplicity of building a large cap portfolio and its theme. 0.4% is above average for an iShares ETF, especially a simple one like this. This may be a result of geography, and including a fair bit of stocks from the Canadian and UK markets as well, where despite the UK not being a major energy producer anymore, is where quite a lot of energy names are listed. Since there’s so much skew to the top, large cap and hyper-liquid holdings, ETF investors may prefer to go solo and just buy the top three stocks in their appropriate ratio.

Nonetheless, the exposure to a lot of commodity driven stocks has kept the PE low below 8x, where markets are pricing commodity levered ideas like IXC according to the assumption that we are late in the cycle for oil prices.

Bottom Line

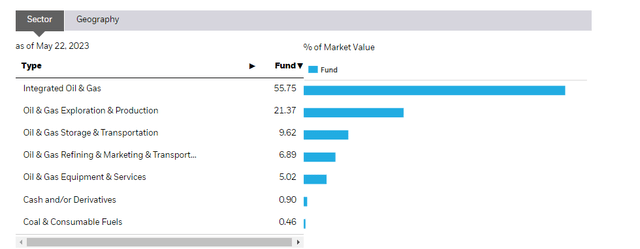

The thing is, as far as oil price goes, we do not believe we are late in the cycle. Volumes are coming down, and that is indeed being driven by demand, but it’s also being driven by exogenous supply cuts by OPEC, which these companies in IXC are not beholden to. We think markets can continue to depend on supply cuts by OPEC countries to keep prices high, primarily because the energy scarcity situation we are seeing highlights the fact that oil is not going to be substituted anytime soon. Stranded asset risk has dictated many of the decisions of producers, including not increasing capacity over the last decade. Things have changed substantially with more engineering activity in order to exploit reserves. Norway has gone as far as giving major tax incentives to oil producers to do so, and in general EPC engagements have gone up meaningfully in non-OPEC countries despite the fact that oil was seen for a long time as a secularly declining sector. OPEC countries are comfortable with slowing their reserve depletion because they are confident that the volumes they are saving for later will be better marketed in a more demand-robust environment, which the current environment is not due to tougher economic conditions. Non-OPEC countries, which aren’t even reneging on supply cuts because they were never part of OPEC, get to benefit, albeit at lower margins since no one can stand up to the margins of the Gulf countries. Nonetheless, companies in IXC will benefit in their dominating E&P businesses, where IXC is over 76% E&P or integrated large-cap oil.

Sectors IXC (iShares.com)

There’s nothing special about IXC compared to other oil ETFs out there, or a portfolio of several of the top IXC holdings. Perhaps alternatives are out there that follow a pretty vanilla energy theme but at a lower expense ratio, but we are overweight the sector and ETFs that would capture it.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here