Back in February, I was warning that Intel Corporation (NASDAQ:INTC) is likely to cut its dividends as the company has been burning cash and generating negative free cash flow (“FCF”) to execute a much-needed turnaround that could take time and additional resources. That’s exactly what happened shortly after my latest article on the company was published, as Intel announced that it would cut its quarterly dividends by a record 66% to 12.5 cents per share to save more cash in these turbulent times.

While the market has already calmed down after that decision, I believe that there’s a high possibility that it will likely take a couple of years for Intel to fully execute its transformation strategy and be able to fully unlock the business’s value. As such, it’s unlikely that Intel investors would be able to generate meaningful returns in the following months by holding Intel’s shares in their portfolios.

Despite this, I continue to rate Intel as a “buy” since the company’s stock trades close to its fair value and various federal subsidies could likely help the business accelerate the pace of the turnaround. Intel’s strategic importance to the Western governments alone makes the company too big to fail, and it’s one of the main reasons why the business won’t go under despite burning cash each quarter. That’s why patience is required when it comes to investing in Intel at the current price, as only long-term investors should have an opportunity to yield meaningful returns since the turnaround is expected to take years before the business would be able to unlock value.

All Eyes On Opportunities

After announcing a dividend cut that would save Intel ~$4 billion in payments to shareholders annually, the company revealed its mixed Q1 earnings results last month. During the March quarter, Intel’s revenues decreased by 36.4% Y/Y to $11.7 billion, but they were still above the street estimates by $570 million. At the same time, the company’s non-GAAP EPS was -$0.04, also above expectations by $0.10.

While those mixed results won’t be able to fully restore investors’ confidence, there are nevertheless reasons to believe that things are going to improve in the coming quarters and that management will be able to put the company in the best position to create long-term value by executing the IDM 2.0 strategy.

One of the goals of Intel’s current strategy is to optimize the company’s overall business, and management noted during the latest earnings call that they’re already on track to achieve $8 billion to $10 billion in annualized savings by late 2025. On top of that, Intel is in the middle of establishing an internal foundry model which should revamp its foundry business, fix its current structural inefficiencies, and ensure that the company can fully capitalize on the future growth of the overall semiconductor industry.

Considering that the PC downturn that negatively affected Intel’s performance in recent quarters is coming to an end, the company has all the chances to regain momentum in the second half of the year, exceed expectations, and deliver on its promises. Add to this the fact that Intel is also likely to become one of the biggest beneficiaries of the American and European semiconductor subsidy programs, while its entrance into the AI market could expand its total addressable market, and it becomes obvious that there’s more than enough opportunities to create value in the long run.

Is There An Upside To Intel’s Shares?

The main issue with Intel at this stage is that it needs additional time and resources to properly capitalize on those long-term opportunities. As a result, the upside in owning its shares is likely to be limited for now.

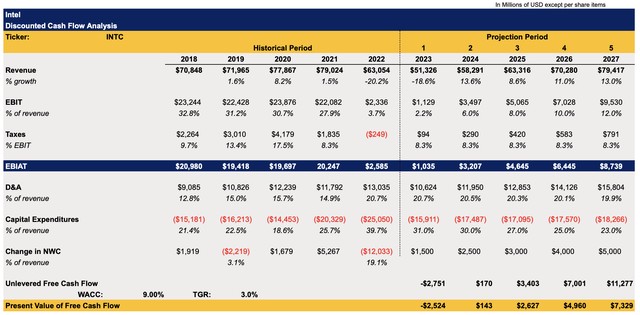

My latest article on the company, which was published in February, included a discounted cash flow (“DCF”) model which showed Intel’s fair value to be $26.13 per share, which is already close to the current market price. However, the latest earnings results prompted me to change some of the assumptions to better reflect the reality.

Due to the mixed performance in Q1 as a result of a downturn in the PC market, the updated DCF model below assumes that the revenue and earnings growth would be weaker than previously expected. The updated top-line growth rate expectations for the following years are also mostly in-line with the street forecasts. The assumptions for taxes, D&A, and the change in NWC remain unchanged from the previous model. The only major change has been made for the CapEx assumptions, which were slightly decreased due to the expected capital offsets that the management expects to mostly take place in the second half of 2023.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

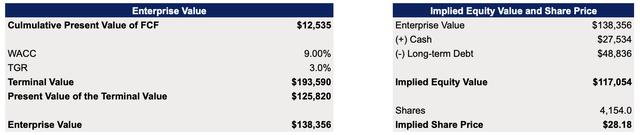

The updated model shows that Intel’s enterprise value is $138 billion while its fair value is $28.18 per share, above the previous expectations and close to the current market price.

Intel’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

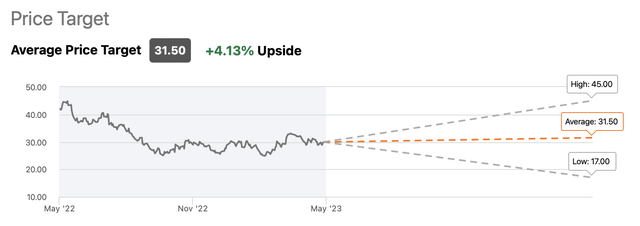

Considering that the street consensus is that Intel’s fair value is $31.50 per share, which is slightly above my calculations, it’s safe to assume that the upside in owning Intel’s shares is fairly limited at this stage. However, there’s always a possibility that the company could exceed expectations thanks to the improvement of the macro environment, the forecasted recovery of the PC market, and the faster execution of the turnaround plans, since more resources now could be reinvested back into the business after the dividends were cut. All of those things make me stick with my “buy” rating for Intel’s shares, as all of those developments would lead to the upward revision of my assumptions in the model and would result in greater fair value.

Intel’s Consensus Price Target (Seeking Alpha)

One Major Risk To Consider

The only major risk to Intel’s bullish thesis is the potential inability of the company’s management to deliver on its promises on time and fail to execute a much-needed turnaround. While the realization of the IDM 2.0 strategy is expected to take years before meaningful results would be achieved, Intel is already slowly losing market share in the data CPU market and could lose its leadership spot there if it continues to delay product launches.

At the same time, Intel’s decision not to use EUV lithography systems in its foundry business in the past made it possible for its direct rival Taiwan Semiconductor Manufacturing Company Limited (TSM) to become the most technologically advanced manufacturer of chips in the world which continues to extend its lead each year. While Intel is now fixing its past mistakes by building new fabs that are designed specifically for the needs of the EUV lithography systems, it’ll still take years until it reaches TSMC’s current capabilities.

Considering this, it would be safe to assume that if Intel’s management fails to deliver on its promises and doesn’t properly execute the IDM 2.0 strategy, then there would be no upside whatsoever to the company’s shares in such a scenario.

The Bottom Line

Intel Corporation had problems with execution in the past that have led to the destruction of shareholder value. If the same happens now, then more value would be destroyed as well. However, there are nevertheless reasons for optimism, as Intel has been actively engaged in decreasing its expenses and reinvesting the available resources back into the business.

In addition, the expected improvement of the PC market along with other growth opportunities highlighted in this article above make it possible for the company to achieve its goals and reward its shareholders. The only issue is that it could take years until investors see some meaningful returns since it would likely take years to fully revamp Intel’s business model and implement IDM 2.0 strategy. That’s why only patient investors are likely to be rewarded by Intel Corporation stock in the future.

Read the full article here