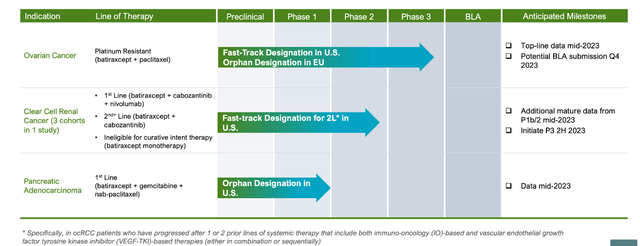

I was recently asked about Aravive (NASDAQ:ARAV), a surprisingly small company with a late stage asset in ovarian cancer, by a TPT member. The pipeline looks like this:

ARAV PIPELINE (ARAV WEBSITE)

Lead asset Batiraxcept is “an ultra-high affinity decoy protein that binds to GAS6 and thereby prevents AXL signaling to inhibit metastasis and tumor growth and restore sensitivity to anti-cancer agents.” It is targeting platinum-resistant ovarian cancer and clear cell renal cell carcinoma where it has Fast Track Designations, and pancreatic ductal adenocarcinoma where it has Orphan Drug Designation. It also has Orphan Drug Designation by the European Commission for platinum resistant recurrent ovarian cancer.

Batiraxcept is the only pipeline molecule targeting the Gas6/Axl signaling pathway, which is implicated in cancer progression, metastasis, immune evasion, and therapeutic resistance. Axl is a receptor tyrosine kinase (RTK), and Gas6 is the growth arrest specific 6 ligand. An important aspect of Gas6 is that while it is an important survival switch in tumor cells, it is not essential in normal tissues, thus it can be selectively targeted, reducing the potential for side effects. AXL is overexpressed in over 70% of ovarian, pancreatic, breast, kidney, and uterine cancers, and Gas6 and Axl expression is associated with poor prognosis and survival.

In preclinical studies, Batiraxcept has demonstrated its ability to combine with other molecules with a variety of mechanisms of action. Chemotherapies, targeted therapies and IO therapies all potentially increase Axl/Gas6 signaling, increasing the chance of resistance. Thus, Batiraxcept used with these other therapies can make them work better. Batiraxcept acts by mimicking Axl receptors, sequestering the Gas6 ligand, thus inhibiting Axl/Gas6 signaling. In fact, it binds more tightly to GAS6 than does the wild type AXL receptor, at around 200 fold greater affinity.

In a phase 1a single ascending dose in 43 healthy volunteers, Batiraxcept was well-tolerated with no dose-limiting toxicities up to 20mg/kg, with no SAEs, no anti-drug antibodies, and 10mg/kg IV dose given every other week was seen to suppress serum GAS6 levels for 2 weeks.

In a phase 1b ascending dose study in 52 Platinum-Resistant Ovarian Cancer (PROC’) patients, a similar safety profile was observed. The efficacy data from the 10mg/kg and 15mg/kg (this is the RP2D, the recommended phase 2 dose selected) cohorts were as follows:

10 mg/kg cohort, 37 out of 40 patients evaluable:

31% ORR (5/16) among those treated with AVB-500 in combination with PAC, with 1 complete response (CR). Patients given AVB-500 plus PAC who achieved MEC of AVB-500 demonstrated improved ORR of 50% (4/8), with 1 CR.

The PFS among those who achieved MEC of AVB-500 was 7.5 months versus 2.28 months with those below MEC (p=0.0062).

21.6% ORR (8/37) in all evaluable patients, regardless of their MEC or use of PAC or PLD.

All responses have been confirmed.

15 mg/kg cohort, 5 out of 6 patients evaluable:

All 5 patients in this cohort experienced clinical benefit, with 1 CR (continuing to show CR 3 months after discontinuing chemotherapy while on AVB-500 as single agent), 2 partial responses (PR), and 2 stable disease (SD).

All responses have been confirmed.

These were patients between 1st and 3rd line – the company says that “96% were on 3rd+ Line of Therapy,” and that “ Literature Demonstrates 85% of Patients on their 3rd Line of Therapy have Progressive Disease by their First CT Scan.” The 100% CBR in the RP2D cohort is, therefore, impressive, although the n was small. Also, patients who achieved a minimal efficacious concentration or MEC had better results.

The phase 3 trial will have 350 patients where PFS will be the primary endpoint. Patients will be from 1st to 4th line. Readout is expected in mid-2023. If successful, it will lead to a BLA by year-end.

Comparison with ImmunoGen

Aravive and ImmunoGen (IMGN) both have ovarian cancer programs, so it may appear, on a first look, that these are competing drugs. ImmunoGen’s drug is called mirvetuximab soravtansine, or mirve, branded Elahere, a folate receptor alpha directed antibody that targets FRα-high ovarian cancer. Batiraxcept is an Axl/Gas9 pathway inhibitor targeting platinum-resistant later line ovarian cancer, with the phase 3 population having between 1 and 4 lines of therapy. 96% of phase 1b patients had 3rd line therapy. Thus, by enrollment if not by design, the molecule is treating patients with multiple lines of therapy. Batiraxcept has shown good results in a small trial population, and has been generally safe and well-tolerated, with injection-site issues and fatigue being the major AEs.

Mirve is approved for adult patients with folate receptor alpha (FRα) positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer, who have received one to three prior systemic treatment regimens. It comes with a boxed warning of severe ocular toxicity:

|

IMGN spent 40 years in the lab to commercialize its first self-owned drug (blockbuster Kadcyla was developed by IMGN, but rights were sold to Roche), but the stock didn’t do too well at approval. As I wrote in February:

In the registrational phase 3 trial, mirve showed a 32.4% ORR with 5 CRs, where historically, ORR has been only 12% in similar patient populations. This trial, SORAYA, however was not a randomized trial. It just had a single drug arm, so the data could not be compared with anything else. That, and a few safety scares kept the stock from attaining its full potential on the data. Perhaps these are the same reasons behind the stock’s lackluster performance even after approval.

Another reason for the poor show might have been the unimpressive PFS, as I also noted, in the trial backing the accelerated approval. However, in May, the stock more than doubled overnight as a confirmatory trial showed survival benefit, with a median PFS in the Elahere group was 5.62 months, compared to 3.98 months for the chemo group. The median OS was 16.46 months in the Elahere group, compared to 12.75 months for the chemotherapy group.

Now, a few points to note:

- FRα positive ovarian cancer represents 80% of the patient population

- Mirve was given as a single agent versus Batiraxcept which can combine well with chemo, in fact, its MoA supports such combos

- There was no ocular toxicity in Batiraxcept; indeed, the company highlighted the strong tox profile of the molecule, given its propensity to avoid side effects by targeting the Gas9 ligand which is “not essential” in normal cells

About the mirve ocular toxicity:

Ocular adverse reactions occurred in 61% of patients with ovarian cancer treated with mirvetuximab soravtansine-gynx. Nine percent (9%) of patients experienced Grade 3 ocular adverse reactions, including visual impairment, keratopathy/keratitis (corneal disorders), dry eye, photophobia, and eye pain; and one patient (0.2%) experienced Grade 4 keratopathy. The most common (≥5%) ocular adverse reactions were visual impairment (49%), keratopathy (36%), dry eye (26%), cataract (15%), photophobia (13%), and eye pain (12%).

Thus, it is not exactly a non-issue, as someone commented in my article. It exists, it is there, it may not happen to everybody, and given loss of an eye or death from cancer, it is not a difficult choice. However, ocular toxicity creates an opportunity for a better drug. Right now, there is no other option. But if any of the other ovarian cancer drugs gets approved, and has a better tox profile, that drug will be my drug of choice, all else being equal.

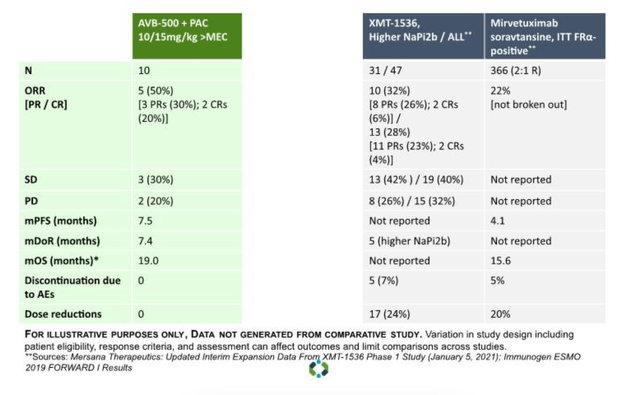

I see from an Aravive publication two years ago that they compared their data with mirve’s then-available data:

Comparative data (ARAV website)

Given the differences in patient population, and the fact that mirve has been approved, mirve has won this battle for now (lets ignore one abject trial failure, and one so-so result). All I wish to say is that it is not the perfect solution, and it leaves scope for a molecule with better safety (and even efficacy) profile to enter the market.

Financials

ARAV has a market cap of $97mn (it was above $100mn just two days ago) and a cash balance of $36mn. Research and development expenses for the three months ended March 31, 2023 were $15.9 million, while G&A were $3.5mn. The company earned $1.5mn in collaboration revenue. At this rate, the company has cash for just about two more quarters.

The company has composition of matter patents covering GAS6 inhibition till 2033, and method of use patents covering 2042.

Risks

ARAV is a microcap with low trading volume and very low cash position. I only covered this stock because a TPT subscriber asked about it. I do not cover such microcap stocks, and do not recommend buying such stocks. This article is only to illustrate the science behind Batiraxcept and its competitive differences with mirvetuximab.

Bottomline

The patient populations are slightly different for ARAV and IMGN. IMGN is also approved, while ARAV is about a year away. ARAV is a small stock with no market interest; IMGN went up 2x in May on good data. This article doesn’t aim to recommend one over the other. My intention is simply to present the data as I understand it, which is that mirve leaves room for a similar or better drug with a better tox profile to compete with it.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here