The Company

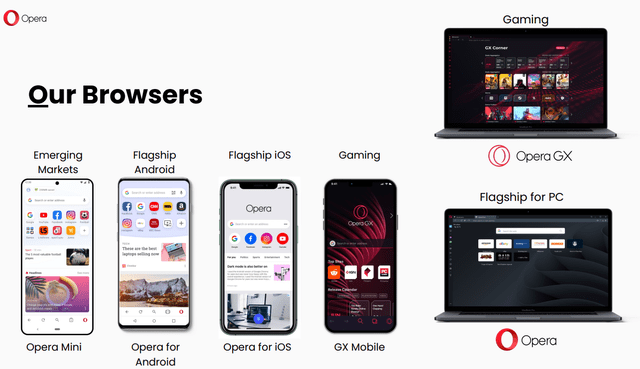

Opera Limited (NASDAQ:OPRA) and its subsidiaries offer web browsers for mobile and PC devices. Based on the most recent 20-F, they have 2 main segments: Browser and News [99.2% of total revenue], and Other [0.8%]. The company provides various mobile browser products like Opera Mini, Opera for Android and iOS, Opera GX Mobile, and Opera Touch. They also offer PC browsers such as Opera for Computers and Opera GX. Additionally, Opera Limited has Apex Football, Opera VPN Pro, and Opera News, which is a personalized news discovery and aggregation service powered by artificial intelligence. They also have Opera Crypto Browser for PCs and mobile devices, a browser-based cashback rewards program, and their own GameMaker Studio, a platform for developing 2D games. Opera Limited operates the gaming portal GXC and the online advertising platform Opera Ads. They have operations in several countries including Nigeria, Ireland, France, Germany, Spain, England, South Africa, and Kenya, as well as internationally. The company was founded in 1995 and is headquartered in Oslo, Norway. Opera Limited is a subsidiary of Kunlun Tech Limited.

Opera’s IR materials, May 2023

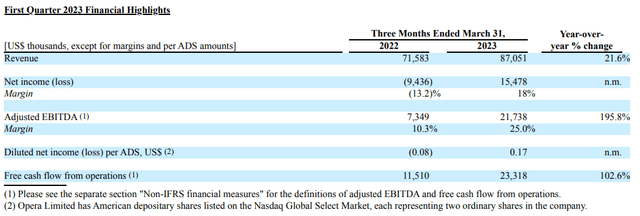

In Q1 FY2023, Opera had a strong first quarter, exceeding its internal revenue and profitability targets, according to the latest earnings call. Their revenue reached $87.1 million, a 22% increase compared to the previous year, and their adjusted EBITDA was $21.7 million with a 25% margin. Free cash flow from operations reached ~$23.3 million – that’s more than double Q1 FY2022.

Opera’s 6-K

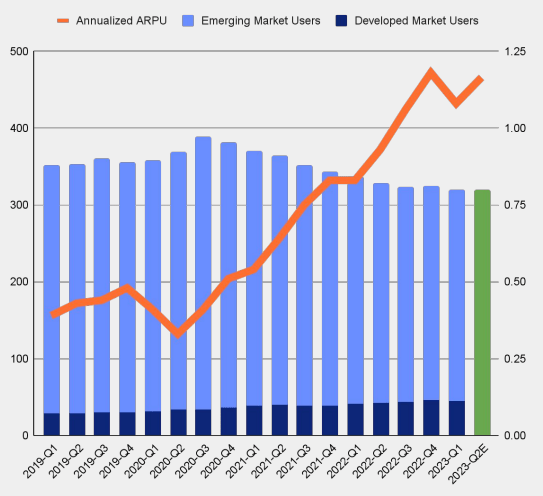

Opera’s focus on high-value users and the growth of its Opera Ads business contributed to the overall solid financial results. They experienced a doubling of ARPU (Average Revenue Per User) over the past two years, reaching $1.08 in the first quarter, a 30% increase from the previous year.

Opera’s IR materials

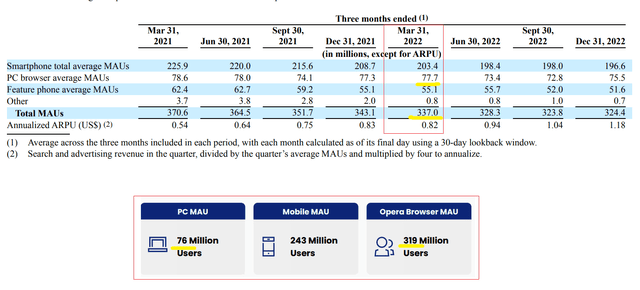

Despite the ARPU increase, the number of MAUs [Monthly Active Users] fell 5.34% year-over-year in the first quarter of FY2023, when we compare the 20-F and the recent IR presentation – which is why Opera’s stock plunged nearly 14% after the earnings release.

Opera’s 20-F and IR materials, author’s notes

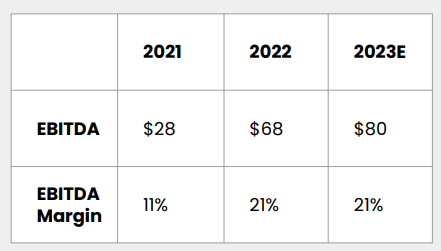

However, the very next day, the quotes rose by >22% and made up for the entire decline – I suspect that strong fundamentals that couldn’t be ignored were responsible for this. Opera’s advertising revenue grew by 26% and accounted for 56% of its total revenue. They also highlighted their initiatives in AI integration, introducing AI services in their browsers to enhance user experience. Opera GX, their gaming browser, experienced significant growth, with a user base increase of 80% sequentially to 22 million users. The management provided updated guidance for 2023, raising the revenue and adjusting EBITDA projections:

For the second quarter, we guide revenue to 92 million to 94 million, which is 19% growth at the midpoint. We guide adjusted EBITDA to be 18 million to 20 million, translating to a 20% margin at the midpoints.

Source: Q1 FY2023, Earnings Call

Opera’s IR materials

They emphasized their strong financial position and promising outlook for the future. Opera has $85 million in cash and no corporate debt, with receivables standing at $57 million from the sale of Star X and a valued stake of 9.5% in OPay, which is worth $163 million. Altogether, these assets total $305 million of liquidity, which is a significant amount compared to the company’s market cap of $1.37 billion [~22.3%].

During the first quarter, Opera bought back 370,162 of its ADSs on the open market, spending a total of $2.5 million at an average price of $6.66 per ADS – this leaves $30.2 million or 60% of their authorized buyback amount available for future repurchases. As of March 31, 2023, 89,842,247 ADS equivalents were outstanding. Additionally, in January 2023, Opera announced a special dividend of $0.80 per ADS, totaling $71 million, which was distributed in February 2023. In my view, these actions indicate that Opera is taking steps to be shareholder-friendly.

The Valuation & Expectations

Before I get into the valuation, I want to talk about the phenomenal growth of the stock in recent months and explain why it happened. In its recent open letter to shareholders [Q1 FY2023], Fairlight Capital draws a parallel between Opera’s stock price movements and earthquakes. Just as friction determines the movement of physical objects, stock prices can be understood in terms of static and dynamic forces. Static anchoring occurs when the market perceives the current stock price as stable and an expression of the underlying value. At this stage, changes in the stock’s fundamentals may not immediately affect the price. However, when the accumulated information reaches a tipping point, dynamic anchoring takes effect. This transition is similar to the dynamic friction that occurs when an object is already in motion. The market recognizes the value of the new information and adjusts the stock price accordingly. The sudden change from static to dynamic anchoring is comparable to an earthquake in the financial market. Stock prices may remain anchored for a while before the accumulated information triggers a significant price movement, much like tectonic plates building up before an earthquake. This sudden movement often results in a rapid and significant adjustment in the stock price, much like the release of energy in an earthquake. Once the stock is in motion, news can trigger even larger price movements, and the stock may exhibit greater volatility than before.

A new collaboration with OpenAI, which Opera announced in its first-quarter earnings release, spurred interest in this stock because of its already successful financial performance – as opposed to high-growth stories with no actual success and generous promises of a turnaround thanks to AI.

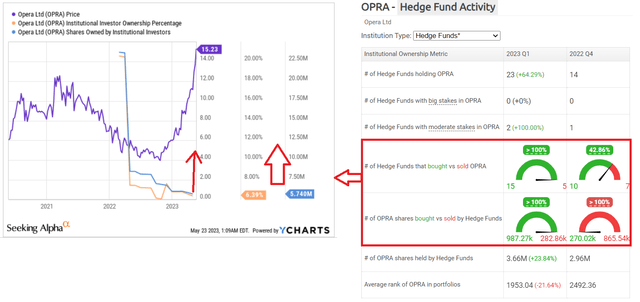

I suspect that this information was quickly absorbed by the market, which led to an immediate reaction – in the last 6 months, OPRA’s share price has tripled. The culprit in all this is the activity of hedge funds, which have greatly increased their positions in this company – even Ken Griffin and Jim Simons couldn’t pass by, judging by the data from Hedgefollow.com. And what is most surprising – Opera’s stock can hardly be called overcrowded. Even if we assume that the data from Ycharts is somewhat lagging, the share of institutional investors in this company is still very small.

Author’s work, based on Hedgefollow and YCharts

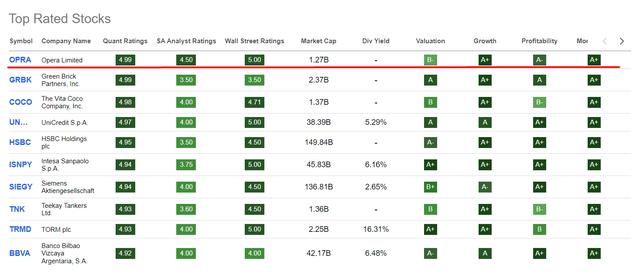

Meanwhile, OPRA is on everyone’s radar [stock scrreeners] and getting more and more attention. Even here on Seeking Alpha, OPRA has again been rated as the Top stock:

Seeking Alpha’s Quant Ranking System, author’s notes

Therefore, I expect the stock to continue to rise in the foreseeable future as interest in Opera Limited by large institutional investors continues and as, in the meantime, reduces the supply of its stocks on the market through buybacks.

In parallel with this process, I expect Opera to continue to beat its revenue and EPS forecasts, as it has done for the past 2 quarters, as the market is still pretty thin on the company’s coverage – its Q2 FY2023 consensus revenue estimate, based on forecasts from only 2 analysts, is sitting at $90.61 million, although management raised the guidance 1 month ago to $93 million in the mid-range [~2.6% difference].

Opera raised its revenue guidance for the full year 2023 to a range of $373 million to $390 million, representing 15% revenue growth at the midpoint. With a guided 21% adj. EBITDA margin at the midpoint, OPRA should generate ~$80.12 million in adj. EBITDA for FY2023 – that’s around 15x in forwarding EV/EBITDA, based on my calculations.

This is a growth story – since 2018, the EV/EBITDA multiple has been in the 8x to 32x range, according to YCharts. At the same time, the projected growth has also been highly variable. If we assume that the company follows consensus from a projected EBITDA of $80.12M and grows that to $113.12M by the end of FY2025, that represents a 41.2% year-over-year [2024-25] increase and a multiple contraction to ~10.5x, which I think is too low to be true. I assume that with this growth, the company should keep its multiple at least at 15-20x for the next 2 years [the median of the IT sector’s FWD EV/EBITDA is 13.84x with an FWD EBITDA growth of 9.09%]. Then the implied market capitalization, adjusted for the total liquidity on the balance sheet, will be in the range of $1,984-2,078 million in 1-2 years, 45-52% higher than today’s market capitalization. So I assign a Buy rating today.

The Bottom Line

Currently, the stock is undergoing a crucial test of its supply zone on the weekly chart, representing a decisive moment that will impact future price movement. From a technical analysis perspective, this situation suggests heightened volatility ahead, aligning with the description of price movement in Fairlight Capital’s letter.

TrendSpider Software, OPRA, author’s notes

One of the risks is high competition and too much hype around AI trends. Although it looks to me like OPRA stock is far from “overcrowdedness” at this point, I expect a period of increased volatility as many early investors take the profit. I’m also a little concerned about the decline in MAUs – perhaps ARPU growth in the future won’t be enough to offset the potential shift of users to Chrome and Edge. Also, my calculations on valuation multiples may be wrong – OPRA should have some sort of discount to valuation due to its small company size risk, which could be higher than I assume when calculating OPRA’s fair share price.

However, be that as it may, I recommend buying OPRA on share price pullbacks, which are very likely at current levels. My buy recommendation comes with the expectation that the stock will rise 45-51% over the next 1-2 years.

Thanks for reading!

Read the full article here