Investment Summary

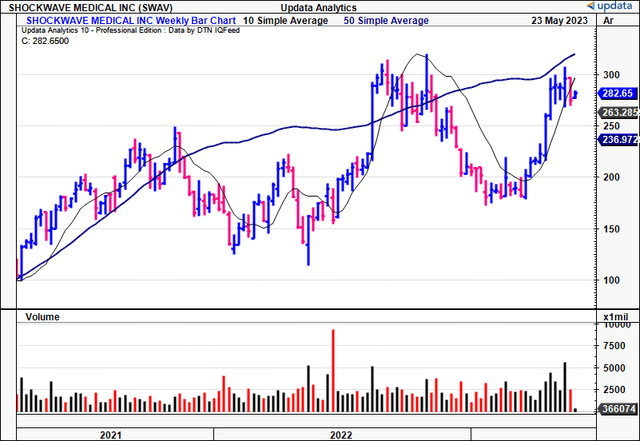

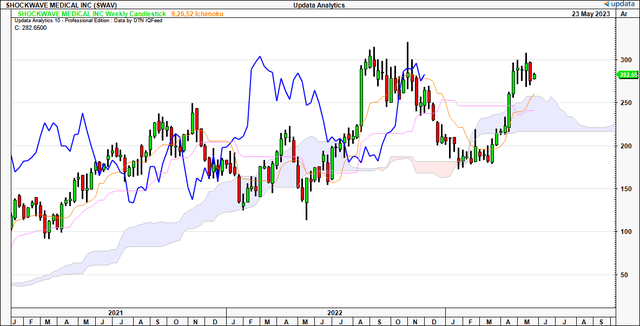

There is tremendous value to be recognized in owning Shockwave Medical, Inc. (NASDAQ:SWAV) in my informed opinion. For one, the firm has grown revenues exponentially on a rolling basis, eclipsing an accelerated growth period that would even rival the take off of SpaceX’s rockets. Investor expectations have revised higher for the company, as evidenced by the thrust in SWAV equity from 6-month lows. We’re now looking at a classic cup and handle forming on the chart [Figure 1] and a break above the 200DMA would really demonstrate an influx of demand in my view.

Underneath the recent market gains is takeover rumours from Boston Scientific (BSX), and exceptional fundamentals to make your investment worth it, even at the eye-scarring multiples of 69x forward earnings and 56x forward EBIT you’d pay today. Even at nearly 15x book value, to me this suggests the market expects enormous things from SWAV looking ahead. In this report you will see the ramp SWAV is on, what expectations are and aren’t baked into its market price.

Net-net, I reiterate SWAV stock is a buy, with exceptional business economics, generating high returns on capital and throwing off cash to shareholders, whilst reinvesting wisely. I am very bullish and looking to a $472 target, and prepared to pay a premium to get this. Not that I’d have a choice anyways, given the SWAV’s current market multiples. In that vein, any pullback towards $250 would be a delicious entry point in my best estimation. In short, reiterate buy.

Figure 1. SWAV almighty surge leading into 2023, continuation in Q2

Data: Updata

Q1 earnings dissection

Before we unpack SWAV’s first quarter, it’s important to realize the trajectory we are on here. Despite some disconnect in market price to fundamentals at times, (to the downside, where SWAV was undervalued in my opinion), the top-line has accelerated at almighty pace.

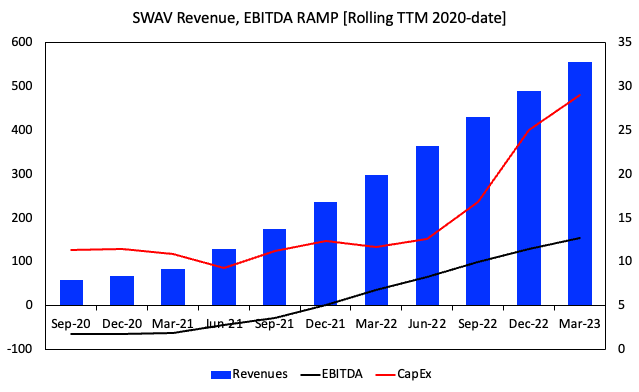

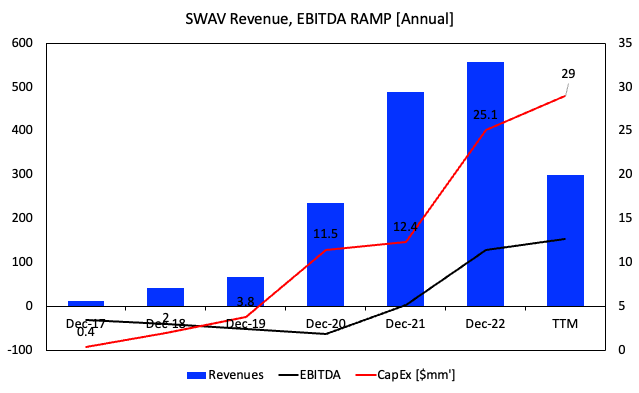

1). Revenue, earnings ramp

You can see the ramp on this in Figure 2 and Figure 3. The former shows SWAV’s operating performance on a rolling TTM basis from Q3 2020-Q1 2023. Revenues have increased from $59mm to $484mm in that time, 720% total increase, whereas EBITDA from negative $63mm to $154mm. Figure 3 shows the same on an annual basis from 2017-2022, including the TTM adjusted for Q1. You’re looking at a growth of $12mm in 2018 to $557mm over this period.

What’s most impressive is the capital reinvestment that’s been required to produce this growth. It is small, in relative terms. In the last 2 years alone, the trailing CapEx increased from $11.4mm to $29mm, inventory from $28mm to $83mm and no intangible investments. That’s a tremendous ROI as will be discussed later. Nevertheless, the context of SWAV’s earnings growth is important to know.

Figure 2.

Data: Author, SWAV SEC Filings

Figure 3.

Data: Author, SWAV SEC Filings

Looking to the quarter, there were numerous talking points. My analysis alludes to 4 key takeouts that are key in shaping SWAV’s medium-term. These include:

-

Speculation on Deal Interest with BSX: The Elephant in the room. No firm mention on this from the CEO on the call, given policy reasons to keep things quiet. No news could also be good news, however. The hush-hush suggests there might be ongoing discussions between the pair, but it could also mean the opposite.

-

Guidance upgrade, Indicating Momentum for H2 FY’23: I’d note the $40mm in additional guidance on top of previous estimates. The increase was attributed to the strong start in sales, but there’s plenty more underpinning the decision. Language used on the call also tells me that investments made in its U.S. market [educational programs and expanding the clinical specialist team] will start to show as returns on incremental capital. Additionally, look at its international markets, they are performing well particularly Japan and Germany, as discussed later. Japan is an exciting market in my opinion – dense population with low capital requirements. Already the firm has seen uptake in its IVL usage in Japan, a good sign for me. There’s plenty of horsepower to pull through just yet.

-

Reimbursement and Regulatory Updates: You’d want to factor in the potential tailwinds from the Inpatient Prospective Payment System document (“IPPS”) in Q4 covering coronary procedures. Management are fairly confident on a smooth transition, but there’s no telling on the actual sensitivity in the back end of the year. Something to think about for sure.

-

Upsides from the Neovasc Strategy: The firm will divert additional capital to support its Neovasc operations. There’s still some debate on the best market strategy for its product, so I’d be watching this segment tightly over the coming 2-3 quarters to see the outcome. For now, it is centred on procedure creation and driving sales where reimbursement exists.

2). Q1 Revenue Growth and Market Expansion

Turning to the numbers, as expected, SWAV bolted on another exceptional growth period. Quarterly top-line revenues were up 72% to $161mm, underlined by a 57% increase in coronary turnover ($91mm). No seasonality in coronary either – up 11% on Q4 last year, illustrating the momentum SWAV has brought into the new year. Looking at this further:

- Average daily sales also experienced 11% sequential growth, and 54% on Q1 last year, mostly from existing accounts;

- Nearly 99% of the first-quarter coronary revenue came from accounts launched before 2023, illustrating the tail of returns on these once launched.

- International turnover lifted 95% YoY as the firm completed investments into geographic expansion, customer demand, and the growth of the direct sales force. You see this in the growth of markets like Japan, Germany and China, as mentioned.

- The introduction of peripheral products, including Shockwave M5, Shockwave M5+, Shockwave S4, and Shockwave L6, generated substantial revenue – securing 102% increase compared to the previous year.

- Similarly, Shockwave C2 and Shockwave C2+ [coronary products], were up 62% in sales as well.

One simply cannot ignore these tremendous growth percentages. It is no wonder that BSX is/was potentially interested in acquiring, and it is no wonder the market has such high expectations for the stock with its sharp repricing in 2023.

Deeper look into Financials, Outlook

Looking down the P&L, gross came to $140mm, a 73% surge from the previous year. Another factor driving success here is gross margin – 87% in Q1, driven by an advantageous product mix, enhanced productivity, and efficiency.

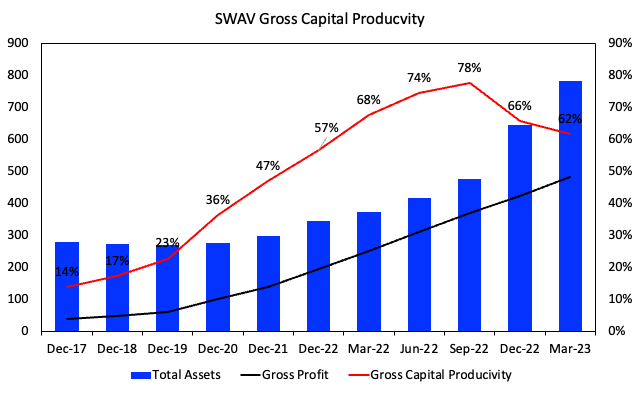

Take a look at Figure 4, that shows gross profit scaled against total assets. Here, you can see the gross productivity of the firm’s assets have shot from $0.23 on the dollar to $0.63 at the time of writing, whilst the asset base is 1.8x larger. Hence, this is one major factor driving growth for SWAV in my opinion. Looking further down, OpEx rose by 53%, reaching $100.2mm, reflecting the company’s investment in growth and market expansion.

Figure 4.

Data: Author, SWAV SEC Filings

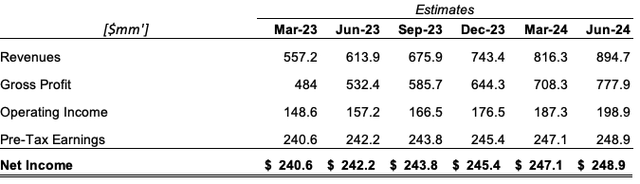

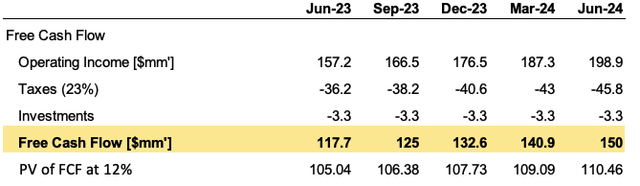

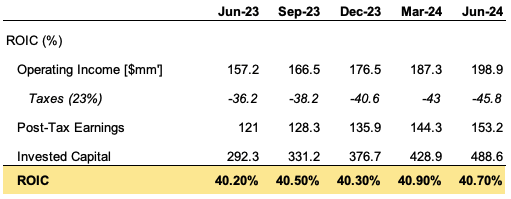

The question turns to what’s next for SWAV, as there’s already been such forward growth percentages priced in. Figures 5 through 7 show forward estimates on SWAV’s income, free cash flow and returns on capital on a rolling TTM basis into Q3 2024. Forecasts were obtained using a Monte Carlo simulation on 5-years of historical data (quarterly, annual) and plotting 1,000 pathways to obtain the line of estimates.

As noted in Figure 5, showing the consolidated forward earnings projections, my numbers have SWAV to do $743mm in FY’23 turnover, ahead of management’s $720mm. This would represent a pleasant surprise. All going well, I believe it could pull this to $245mm in earnings when considering all operating and non-operating income.

I’d also call for $132mm in free cash flow to shareholders on this, after considering an additional $9mm in net investment (CapEx + change in NWC). In fact, it’s important to note most of the firm’s capital is tied up in working capital vs. fixed assets, so should pull through to cash fairly smoothly.

Figure 5.

Data: Author Estimates

Figure 6.

Note: Trailing 12-month numbers are shown. (Data; Author)

- These estimates call for SWAV to have $488mm in capital at risk by 2024, and generating a consistent 40% trailing return on this. This might seem farfetched, but consider a few points here:

- To date you’ve got SWAV generating 35-40% trailing returns on existing capital since turned an operating profit in 2021. This is a tremendous rate of return and directly implies the company’s competitive advantage that is driving sales, and ultimately, intrinsic valuation.

- The CAGR in post-tax earnings since this point in 2021 has been 35% per quarter (rolling TTM basis).

- Alas, this isn’t farfetched at all, and, given the momentum SWAV is building on a sequential basis, is actually appropriate in my opinion. I’d call for the company to compound its intrinsic valuation at 12-15% over the coming 5 periods, factoring in a 30-38% earnings reinvestment rate and 40% average ROIC (0.3×0.4 = 0.12; 0.38×0.4 = 0.15). This would call for SWAV at $18.2Bn in market cap by 2024 if the market is efficient and recognizes this.

Figure 7.

Note: Trailing 12-month numbers are shown. (Data: Author)

Market Generated data

The charts immediately visualize the current sentiment and what the market expectations are for SWAV. Note the deep cup formed across 2022-’23, where the equity line is now basing up. The next few weeks of trade are crucial. You need SWAV to drive up above the high seen 3-weeks ago in order to create a pivot point and suggest it will break higher. Notably, SWAV is trading above the cloud, in bullish territory on the long-term time frame (looking months out). I’d accept a pull back to c.$250 and still be bullish. The lagging line is also well above the cloud, and needs to cross $250 by September in order to be more cautious on the bullish trend.

Figure 8.

Data: Updata

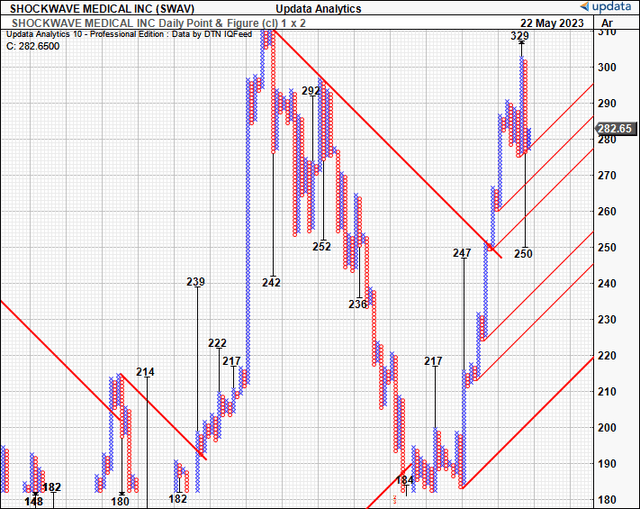

Looking to the available price targets, the point and figure studies show an upside target to $329 on the daily chart. There is a downside target to $250 and this shouldn’t be ignored. If SWAV breaks lower you’d be looking to this number, but if it manages to curl up again $329 is the next number. This would be a sizeable re-rating if it tracked to this mark. To me this is further confirmation of a buy thesis, given the risk reward ($30 downside to $47 upside potential).

Figure 9.

Data: Updata

Valuation

You’re only getting SWAV today by paying a premium and a hefty one at that. The stock trades at 70x forward earnings, 160% above the sector’s 27x multiple. Has the market gone bananas? Or do the expectations justify this? Consider a 12% discount rate, and 5-year time horizon:

- At the current market valuation of $10.35Bn, the market expects SWAV to generate $1.25Bn in future cash flows, getting you to the $10.4Bn range ($1,250/0.12=$10,400).

- With the 5-year horizon in mind, from the TTM pre-tax earnings of $148mm, the market expects SWAV to compound earnings at 53% into FY’28, getting you to the current market cap ($148×1.53^5/0.12 = $10,340).

My numbers have SWAV to do $245mm in pre-tax earnings calling for 65% growth, and thus I believe the market may be underestimating the company’s market value. My expectations point to SWAV compounding earnings at 40% ROIC, and a growth of 12-15% in intrinsic value going forward.

This gets me to the $17.5-$18Bn market value range, compounding the market’s valuation of $10,350 forward into 2024. To me this suggests there’s a mispricing, even with the market’s generous expectations, supporting a buy rating at $17. 5Bn market valuation or $472 per share. That is quite the valuation, but not out the realms of reality in my opinion.

In short

There are multiple inflection points to consider for SWAV going forward. The major questions are a). what expectations does the market have priced in, and b). is there reason to expect differently from the market. Findings presented in this analysis suggest the market has tremendous growth priced in, and yes, there’s reason to believe SWAV could rate higher. In particular, growth in its overseas markets, and the jet engine powering the coronary segment, are key levers driving upsides to the top-line. In summation, I reiterate SWAV as a buy, looking to a sharp re-rating up to $427 per share over the coming 2-years.

Read the full article here