Rocky Brands Inc (NASDAQ:RCKY) is off to a rough start in 2023 following poor Q1 earnings which missed expectations while management also revised lower full-year guidance.

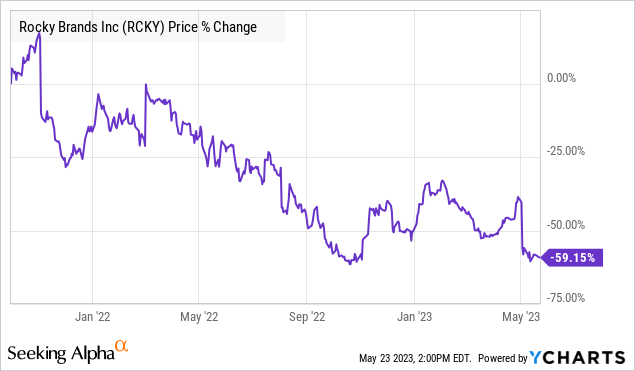

The company recognized as a leader in specialty footwear covering outdoor, western, work, and military markets is simply selling a lot less of its famous boots compared to the sales bonanza at the height of the pandemic. Indeed, the stock is down more than 70% from its high in 2021 in what has been a disappointing reset of expectations for investors.

Our take is that Rocky Brands maintains a stable financial position with some strong points in its fundamental profile, but its main issue is the weak growth outlook. We expect RCKY stock to remain volatile with risks likely tilted toward more downside, until there is evidence of sales trends materially improving.

RCKY Earnings Recap

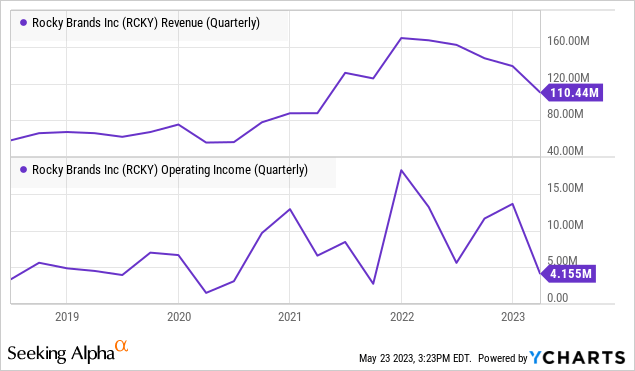

RCKY reported a Q1 net loss of -$0.12 per share, which was a big miss compared to the EPS consensus estimate of a positive $0.05. Revenue of $110 million, a decline of 33.9% and falling short of the $125 million forecast.

The gross margin climbed by 200 basis points to 39.6%, considering some lower inflationary cost pressures, although it wasn’t enough to balance the top-line weakness. Q1 operating income for Rocky Brands at $4.2 million on an adjusted basis fell from $14.2 million in the period last year.

The weak performance this quarter to poor wholesale trends, which have been hit with weaker demand while retail partners still work through elevated inventory levels. The concern here is that retailers may push back on bookings and re-orders for the year-end holiday season.

While the management was expecting some softness against strong comparables at the start of 2022, the current operating environment has been “much more difficult” than anticipated. Cost-cutting initiatives announced include the sale of the “Servus” brand with proceeds used in part to pay down debt.

Maybe the biggest development from the Q1 earnings report was the updated forward guidance. Management now sees full-year revenues at just $500 million compared to a previous midpoint outlook of $545 million, excluding the Servus brand impact. At the same time, the company sees some room to support the gross margin of around 40% based on higher pricing.

The company ended the quarter with $4.9 million in cash against $219 million in total debt. Considering approximately $47 million in EBITDA over the past year, the leverage ratio of around 5x is elevated. Comments during the earnings conference call suggest an effort to sell down inventory to raise cash for further deleveraging.

source: company IR

What’s Next For RCKY?

We know that Rocky Brands has a solid portfolio of footwear with a legion of fans based on the reputation of quality. At the same time, the question is if the company will manage to expand that addressable market pie with a return to growth. Management believes conditions can improve into the second half of the year, but this is a case where we’ll believe it when we see it.

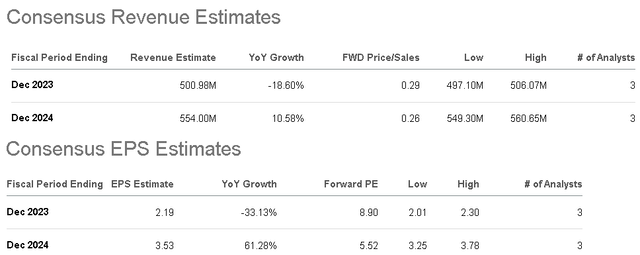

According to the consensus estimates, the market is taking the company’s guidance for $500 million in revenue this year as a given, representing a decline of 19% from 2022. From there, the forecast is for revenue to rebound by 11% in 2024 to $554 million.

Within that amount, Rocky Brands is preparing to start fulfilling orders from a three-year $45 million Department of Defense contract awarded last year to develop specialty combat boots.

If we allocate that amount evenly across the contract period, the $15 million contribution implies a 3% impact to the annual revenues. By this measure, the expected revenue rebound in 2024 appears less impressive considering just single-digit momentum in the core consumer brands.

In terms of valuation, while a 1-year forward P/E of 5.5x based on the consensus 2024 EPS may appear enticing, we’ll take that forward earnings outlook with a grain of salt. Given the underwhelming Q1 results, it’s fair to be skeptical of a looming turnaround. In our opinion, the stock’s dividend yield of 3.2% isn’t wide enough to cover the underlying risk that Rocky Brands continues to underperform.

Seeking Alpha

Final Thoughts

We’re looking at shares of RCKY which are trading under $20.00, but still above the 2022 low when it briefly traded at $18.00. There’s a case to be made that the outlook for Rocky Brands is weaker today than the baseline last year.

Compared to what the company looked like, before the pandemic, a big difference now is the higher debt level that we believe works as an overhand that will keep shares under pressure. Until there is a clear indication the top-line momentum is recovering, we don’t see a catalyst for the stock to rebound significantly.

Seeking Alpha

Read the full article here