Vestas Wind Systems A/S (OTCPK:VWSYF) has exemplified recovery in profitability in recent earnings along with strong growth. I believe that Vestas is a hold due to its geographic expansion and overvaluation assuming my DCF figures.

Business Overview

Vestas Wind Systems A/S is a global company that specializes in the design, manufacturing, installation, and servicing of wind turbines. Its operations span across various countries including the United States, the United Kingdom, Denmark, and other international markets. The company operates through two main segments: Power Solutions and Services.

Under the Power Solutions segment, Vestas offers a comprehensive range of solutions for onshore and offshore wind power plants. This includes the development, construction, and installation of wind turbines, as well as providing development sites for wind energy projects. Vestas leverages its expertise in the industry to deliver efficient and sustainable wind power solutions to meet the growing demand for renewable energy.

In addition to its power solutions, Vestas also has a strong focus on providing high-quality service to its customers. The Service segment of the company is dedicated to offering service contracts, spare parts, and related activities to ensure the optimal performance and maintenance of wind turbines. By providing reliable and responsive services, Vestas aims to maximize the uptime and longevity of its wind power installations, enhancing the overall value proposition for its customers.

Vestas Wind Systems A/S, with a market capitalization of $30.31 billion, has experienced a 52-week high of $31.61 and a low of $17.08. Currently trading at $30.06, the stock is showing strong momentum, slightly below its 52-week highs.

While Vestas Wind Systems A/S does not currently offer a dividend, I believe the company’s emphasis on growth is a strategic move to utilize its free cash flow for expanding its business. This approach is particularly important in the renewable energy sector, where capturing market share before regulatory changes or the entry of established firms is crucial. By prioritizing growth, Vestas aims to solidify its position and capitalize on market opportunities.

Seeking Alpha

Vestas Wind Systems A/S has showcased strong performance in Q1 2023, surpassing expectations both in terms of earnings and revenue. With a remarkable beat of 144.14% on earnings per share (-€0.04 compared to €0.02) and a solid 10.92% beat on revenue (€2.55 billion compared to €2.83 billion) which is up 13.7% Y/Y, the company has demonstrated its ability to outperform in a period of moderate economic challenges. This achievement signifies Vestas’ successful return to profitability and its rapid revenue growth. It also highlights the company’s capacity to expand its operations and establish a sustainable business model for the future.

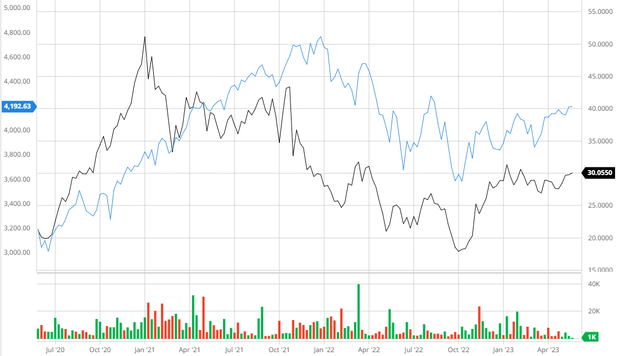

Underperforming in Comparison to the Broader Market

During the past three years, Vestas has shown relative underperformance compared to the broader market when considering dividend adjustments. This underperformance can be attributed to the company’s challenges in recent times. However, with the company’s strong recovery, as demonstrated by its recent earnings, I believe Vestas is poised to outperform in the future. The positive momentum generated by the recent earnings results indicates that Vestas is on track to overcome its previous struggles and position itself for future success.

Vestas Compared to the S&P 500 3Y (Created by author using Barchart)

Global Market Expansion Fostering Long-Term Growth

Vestas has successfully increased its market presence over time and strengthened its position by expanding into new geographic areas in an effort to increase market share.

Vestas Wind Systems A/S’s successful debut into the Chinese wind energy sector serves as a convincing demonstration of the company’s global market expansion. Vestas intentionally positioned itself to enter this market after seeing the enormous growth potential in China, which has grown to be the largest market for wind power in the world.

Vestas received a sizable order from Longyuan Power, the biggest wind power producer in China, in 2018, marking an important milestone. This order, which at the time was Vestas’ largest in China, was for the supply and installation of 100 V120-2.2 MW wind turbines. This success demonstrated Vestas’ dedication to growing its footprint in the nation and taking advantage of the enormous market potential.

Vestas established local manufacturing capabilities to increase its presence in China. The establishment of factories in Tianjin and Xuzhou allowed the company to make wind turbine parts close to home. By lowering shipping costs and lead times, this localization strategy not only complied with Chinese government policy but also improved Vestas’ competitiveness.

Additionally, in order to promote market expansion, Vestas actively sought out strategic alliances and partnerships with nearby Chinese businesses. One noteworthy instance is the partnership with CRRC, a major Chinese train business. Through this agreement, Vestas’ V150-4.2 MW wind turbine would be modified to meet the specific requirements and constraints of the Chinese wind energy market. Vestas improved its product line and gained a competitive edge by utilizing CRRC’s experience.

Vestas has proven its capacity to recognize and seize possibilities in the global market with its successful expansion in the Chinese market. With several potential pathways for expansion, this expansion plan puts Vestas in a position for future exponential growth. The company’s expansion initiatives will be accelerated by higher free cash flows as it continues to increase profitability. Vestas can create cutting-edge products that serve a variety of geographical regions by exploiting global growth patterns and establishing collaborations, which enables it to outperform rivals and stay at the forefront of the industry.

The recent announcement of contracts secured in South America, particularly in Brazil, will serve as a litmus test for the continued success of Vestas’ expansion strategy and its potential to ignite substantial growth once more.

Microsoft Stories

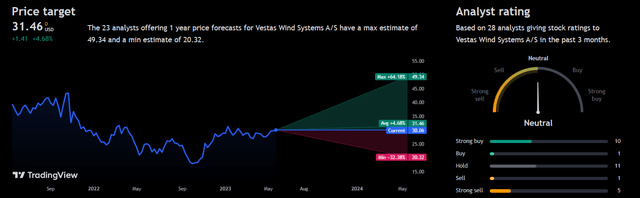

Analyst Consensus

Analyst consensus rates Vestas as a “hold”. The stock demonstrates fair potential returns with an average price target of $31.46 which presents a potential 4.68% upside.

TradingView

Valuation

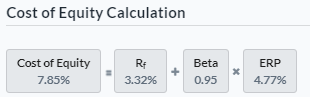

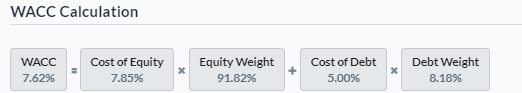

Prior to formulating my assumptions and conducting a discounted cash flow analysis, it is essential to calculate both the Cost of Equity and Weighted Average Cost of Capital for Vestas using the Capital Asset Pricing Model. Taking into account a risk-free rate of 3.32%, my calculations indicate that the Cost of Equity for Vestas is 7.85%, as demonstrated below.

Created by author using Alpha Spread

Based on the aforementioned Cost of Equity value, I have derived the Weighted Average Cost of Capital for Vestas to be 7.62%, as illustrated below. It is noteworthy that this figure is below the industry average of 8.93%.

Created by author using Alpha Spread

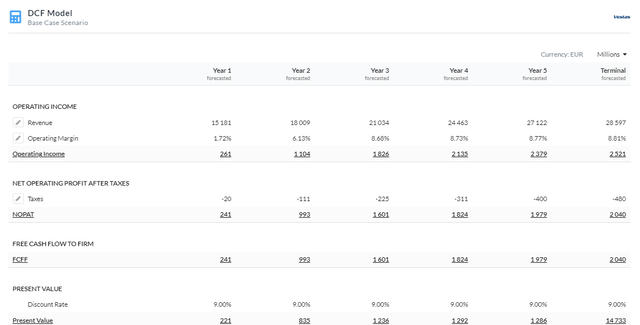

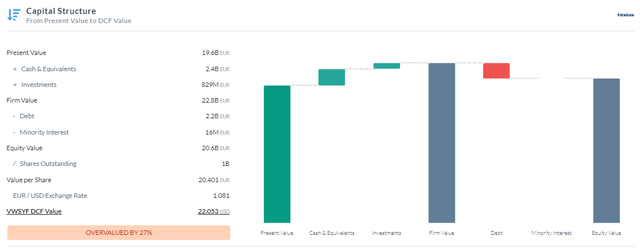

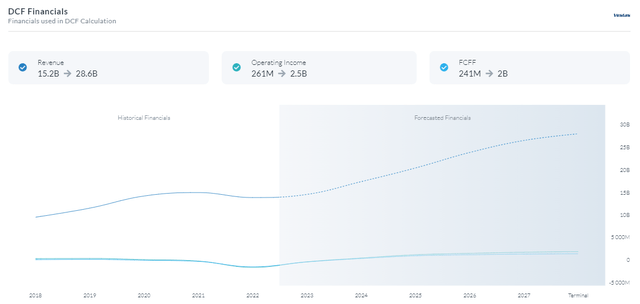

Based on my analysis utilizing a Firm Model DCF approach with a focus on Free Cash Flow to Firm, I have determined that Vestas is currently overvalued by approximately 27% with a fair value estimate of $22.05. This calculation is based on a discount rate of 9% applied over a 5-year period. To account for potential macroeconomic headwinds and the risk of cyclical downturns that may impact Vestas’ primary materials for windmill construction, I incorporated a 1.38% risk premium into my analysis. This adjustment aims to reflect the potential challenges and uncertainties associated with these factors.

Moreover, I projected a mid-teen revenue growth rate beyond 2023, with a gradual deceleration to low-double digits in subsequent years. This assumption considers Vestas’ expansion plans and the potential hurdles the company may encounter as it seeks to sustain its growth trajectory.

Furthermore, I anticipate that Vestas will continue to enhance its profitability and capitalize on geographic trends, which will lead to significant improvements in margins over the years. By leveraging its expertise and seizing opportunities in various regions, Vestas can drive growth and enhance its overall financial performance.

5Y Firm Model DCF Using FCFF (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Risks

Regulatory and Policy Changes:

Changes in government policies, subsidies, and rules pertaining to wind power and renewable energy sources may have a big impact on Vestas’ operations. The company’s revenues could be impacted by changes to subsidy programs or negative regulatory environments in important areas.

Market Volatility and Competition:

The wind energy sector within the renewable energy sector is vulnerable to market instability. Variations in energy costs, the state of the economy, and industry competition can have an impact on Vestas’ market share, pricing, and profitability.

Conclusion

In conclusion, my assessment of Vestas leads me to recommend a hold position. While the company shows promising signs of recovery in terms of profitability, there is evidence of overvaluation when considering the results of my DCF analysis. To gain a clearer understanding of the long-term recovery prospects, it would be prudent to monitor the company’s progress and reassess the stock at a later date.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here