Investment Summary

Here I present my latest update for STAAR Surgical Company (NASDAQ:NASDAQ:STAA) following its Q1 FY’23 numbers. The price response since posting in early May has been flat, suggesting no revised expectations in the medium term. Since my last STAA publication in September, the company hasn’t been rewarded by the market despite a strong reversal in the S&P 500 index.

The “low-beta, high quality offering” that is STAA continues churning out reasonable growth percentages over time. It is without question STAA’s core offering is attractive and its financial performance speaks volumes to this. As you’ll see here today, the business is churning out strong profits, and its China market is a key growth lever that could drive revenue upsides this year.

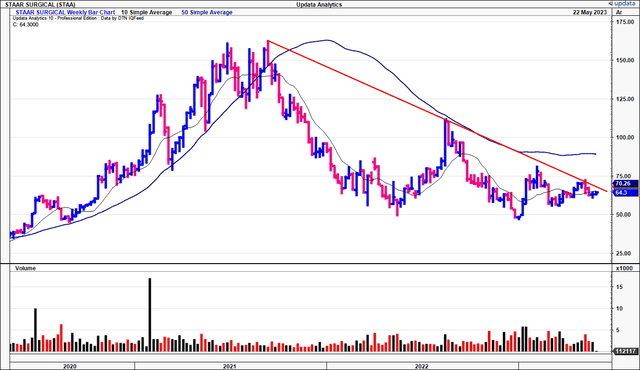

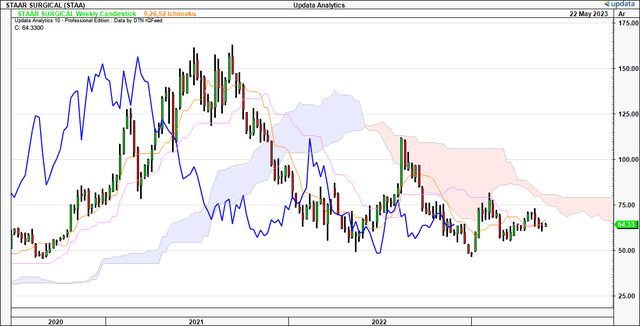

Problem is the market’s expectations continue to revise STAA lower, and there’s been no chance of a recovery towards 2021 highs [Figure 1]. Moreover, as core portfolio needs evolve over the medium-term, STAA no longer will be handsomely rewarded by the market going forward in my opinion. For one, starting multiples are 61x forward earnings at the time of writing, borderline offensive to ask with just $38mm in FCF projected this year. Number two, its stipulated growth rates aren’t overwhelmingly valuable to offset this.

Net-net, whilst I remain constructive on STAA stock’s long-term prospects, at the current valuations, and lack of technical support, I cannot advocate it as a buy at this point in time. I am paring back the rating to hold in response.

Figure 1. STAA price evolution, 2020-date

Data: Updata

Q1 numbers in detail

STAA’s first quarter was underlined by the strong global performance of its EVO Implantable Collamer Lens (“ICL”) division. Global ICL pulled in a 20% growth rate, driven by both sales (price) and units (demand), with broad-based success across APAC, EMEA, and the U.S.. As you will see today, the firm’s China market experienced a resurgent quarter, injecting ICL unit growth of 20%, affirming its strong comeback.

Looking closer at the successful marketing and surgeon collaboration in China:

- Most of it involved hosting surgeon training events, academic conferences, and advanced practice development, each with outstanding outcomes.

- This played a pivotal role in driving growth in Q1, exemplified by the remarkable attendance of over 1,800 doctors and clinical staff in a live stream surgery training.

These growth prospects extend even to the U.S.. Despite a decline in industry volumes reported by the Refractive Surgery Council (“RSC”), growth in ICL units amounted to 78% for the quarter, leapfrogging the broad market’s performance. This tells me there are good quality assets underpinning growth in the domestic segment as well. For example, the investments made in its U.S. commercial organization ( into personnel, infrastructure, R&D, etc.) are poised to drive further growth, for one. Second, the firm’s investment into the productive fixed capital base has increased 2.5x since 2020 to $85mm, adding another 2 cylinders to STAA’s money engine. Plus, the direct-to-consumer (“DTC”) marketing strategy saw tremendous ROI in Q1 – visits to STAA’s doctor finder increased by 402% YoY.

Insights:

-

China – The Land of ICL Restoration. Saying it again, the remarkable insight from Q1 FY’23 is the restorative performance of ICL procedures in China. Commencing in mid-January, these procedures have continued unabated, leading to ~20% increase in ICL unit growth for STAA in the first quarter. Management playfully emphasized on the call that “China indeed is back,” highlighting the positive outlook of ICL procedures in the region looking ahead.

-

APAC’s Solid Performance. As a region, Asia-Pacific (“APAC”) was a growth lever and deserves a round of applause. It came in with a 19% increase in units and a corresponding 20% increase in sales. This growth further substantiates the company’s success in APAC markets, and highlights the importance of this region in STAA’s global strategy in my estimation.

-

Surgeon and Customer Testimonials. Management spoke of the feedback from a surgeon CEO at a multicenter U.S. clinic, and a young surgeon based in California,, on the earnings call as well. This language underscores the growing acceptance of EVO ICL. Surgeons report increased patient conversion rates, reduced patient anxiety, and expectations of significant accelerated uptake for ICL in the coming year, per management. These testimonials are evidence that STAA is building momentum in this segment, in my view.

-

European Hybrid Markets. This is a key differentiator for the company in my informed opinion. STAA’s investment in hybrid markets, such as the Benelux, Italy, and France, has yielded exceptional growth results compared to pure distributor markets. In the first quarter of 2023, ICL unit growth in the Benelux, France, and Italy reached impressive levels of 34%, 20%, and 45%, respectively, just to illustrate this point. .

I’d submit these double-digit growth rates exemplify the significance of STAA’s targeted investments in hybrid markets, that could potentially drive superior performance. In addition to the China market, definitely keep a close eye on these points going forward.

Financial results

Looking to the financial performance during the quarter, it was a steady period of growth from the company’s broad offerings in Q1. Net sales reached $72.5mm, representing a 16% YoY increase. The dominance of ICL sales remains in situ, accounting for $70.6mm or 96% of turnover, reflecting a 20% increase YoY.

It pulled this down to 78.3% gross ($57mm), which is 40bps of margin upside on the previous year. This is a good sign given the bulk of players incurring cost challenges, to see STAA lifting at the margin. It expects 80% gross this year as another clear tailwind.

There were many key financial details from the quarter, related to the discussion thus far. To name a few:

-

Strategic Shift to ICL Sales Focus:

- STAA’s transition toward a stronger emphasis on ICL sales is evident, with ICL sales accounting for 96% of total net sales in Q1, up from 93%. This is a strategic shift and we should welcome further ICL contributions. Management expect other product sales will represent a decreasing contribution margin in FY’23. Further, the company’s commitment to the ICL business indicates a keen awareness of underlying market demand in my opinion.

-

Scaling up R&D:

- STAA’s R&D investment totalled $10.3mm in Q1, another $2mm incrementally. A chunk of this can be tied to increased compensation and growth investments from the U.S. EVO clinical trial. You can see the firm’s long-term vision on display in that regard.

-

Liquidity backing the and sales outlook:

- The firm had $217.3mm in cash on the balance sheet by the end of the quarter, and expects to be cash flow positive this year. That would be welcomed, given the $150mm outflow from the year prior. In that vein, management increased the FY’23 sales outlook from $340mm to ~$348mm , and that’s likely been a key driver to the price activity seen in 2023.

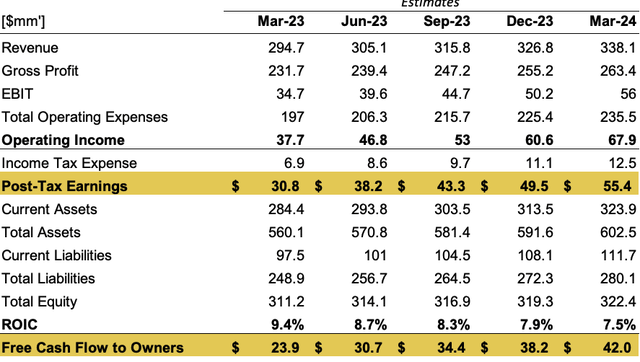

STAA could very well do $340mm if all goes well at the back end of FY’23, but my numbers have a slightly tighter revenue clip of $326mm [Figure 2]. This is also a down-step from estimates of $ 374mm provided in the September publication. The differences are in the YoY run-rate I’ve baked into sales growth. Consensus also expects $347mm this year, so I am behind both the company and the Street in my top-line outlook for STAA.

Economic Earnings & Guidance

Despite this, my estimates have the company to do $49mm in post-tax earnings this year, jumping to $55mm in FY’24. This would be a sizeable gain and could see STAA throw off ~$38mm to shareholders net-net. This is a 58% YoY increase that could inflect positively on the market’s valuation of the company.

Figure 2. STAA Forward Estimates

Data: Author’s Estimates

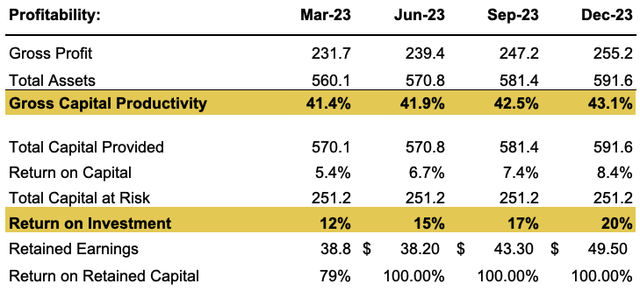

Underlining these results are the firm’s economic profits generated in Q1, matching the cost of capital with the return on capital investments. Looking forward, my estimates have the firm to be doing 15–17% trailing ROIC, which could represent value should the financials come in to support.

Figure 3.

Data: Author, STAA SEC Filings

Growth levers

The company anticipates equally strong performance in Q2 and Q3, where it could benefit from seasonal revenues. Moreover, I’m calling for strong growth in bottom-line fundamentals, and I’d estimate STAA to pull these growth levers to get there:

Growth lever 1: Market Potential in China

As I’ve discussed at lengths in this report, the firm’s China market represents a strong growth curve looking ahead by all estimations. Despite the challenges of entering a mature market dominated by the LASIK procedure, in my view, the company has made significant progress in China. You’re looking at STAA having sold ~2mm implants worldwide cumulatively by Q1, capturing a market share of ~20%. Should it continue with the above-market growth rates, it will steal further market share in my estimation. Further, the company’s EVO ICL technology has demonstrated its safety and efficacy. I’d really be looking to contributions from the China market looking forward, and I believe there’s even scope for an upside surprise here, so stay very closely tuned for evidence on the same.

Growth lever 2: U.S. Growth Strategy

The firm’s U.S. market also represents a substantial growth opportunity. While the approval for EVO ICL was obtained a roughly year ago, the company’s launch efforts only began ~6-7 months ago. Despite the relatively short launch curve, there’s been reasonable investment in practice development, expanding the sales team, and clinical support. These could pull through into later periods.

Growth lever 3: Surgeon Engagement and Education

Key to getting people on board with EVO ICL procedures is in the actual engagement and demonstration. STAA is engaging key opinion leaders (“KOLs”) to train surgeons on EVO ICL procedures. The number of trained surgeons is already accelerating toward the 700 mark, so there’s early evidence of this success.

From here it will be a function of obtaining new surgeons, retaining existing ones, and adding value for both. The firm can then add in ancillary products/services for additional value drivers. Each surgeon on the EVO train provides a lengthy tail of returns from the revenue model, so the more surgeons STAA gets on its book in these early days, the more it will snowball further down the line.

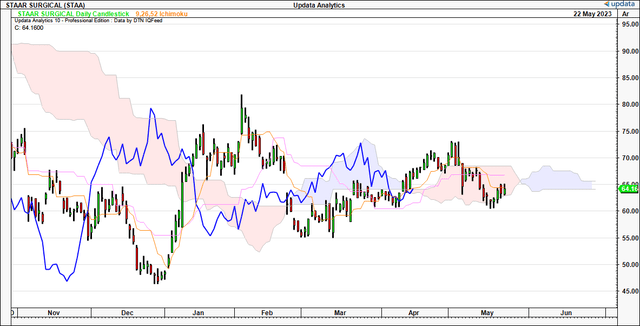

Market Generated Data

Looking to the market generated data reveals some interesting findings. The daily cloud chart below demonstrates the in-depth view of the medium term (coming weeks) price trend. Shares are testing the base of the cloud along with the price line and are gaining some support at this mark. This looks to be a critical zone for STAA and you’d need to have the stock riding to the $67-68 region to be immediately constructive.

On the weekly cloud chart, that looks to the coming months, the trend is more distinctly bearish. The lagging line and price line are beneath the cloud and pushing into congestion. You’d need $75–$78 by June to suggest investors are bullish based on this setup, in my view.

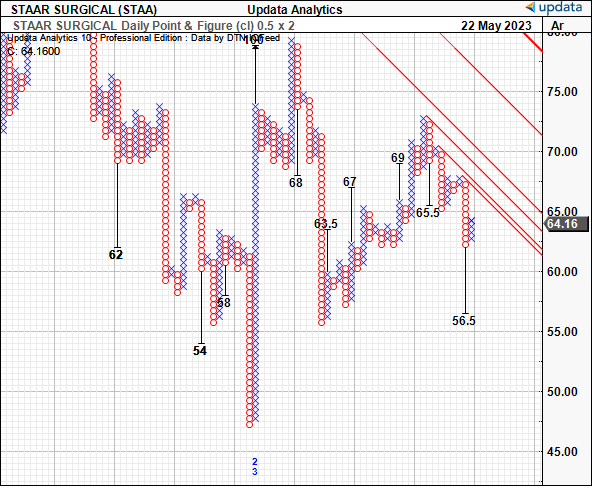

Figure 4.

Data: Updata

Figure 5.

Data: Updata

We have downside targets to $56 following the latest price action. Note, there was tremendous convergence around the $64-$67 previously, as shown. STAA has since taken out these levels with conviction, giving some confidence in using these to guide price visibility. The $56 seems like it could be a reality with a push lower. A break below $62 you’d be looking to this as the next short-term target in my opinion. In any sense, it appears the bullishness has left the STAA party for the time being.

Figure 6.

Data: Updata

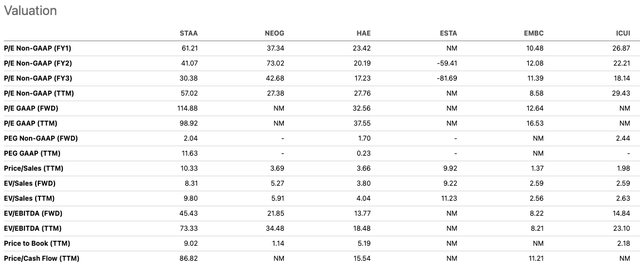

Valuation

For all the company’s glory the valuation debate is where the sane-ness begins to unravel in STAA’s case in my opinion. You’re asked to pay $61 for every $1 in earnings, or $85 for every $1 in pre-tax income at the time of writing. For this to be fair, you just can’t get to those numbers without some spectacular, awe-inspiring, triple-digit growth range, which I don’t foresee for STAA going forward, even though I do not possess a crystal ball.

Moreover, the sector is priced at 19x forward earnings and 13x EBIT, far more attractive in the eyes of any intelligent investor. STAA’s place relative to comps is seen in Figure 7, where you can note the premium across most multiples. Consensus also expects $1.03 in FY’23 EPS and you get to $62 at 61x that multiple, fair value. On the other and, my numbers have $50mm in EBIT this year, and at the 85x multiple, that gets you to $88. Nevertheless, I do believe this is a very steep ask.

Even prescribing the generous sector multiples to my FY’23 estimates gets back to the $17 range. Hence, there is wide variance, and therefore low confidence, around accurately estimating a fair valuation for STAA, and the strata throws off unattractive valuations for the most part anyways.

Figure 7.

Data: Seeking Alpha

In short

There is no doubt STAAR Surgical Company remains a great company. Stepping into the investment colosseum, not so much in my opinion, at the moment anyways. There will be a time to enter STAA once more I am sure, however, the key mid-term catalyst remains the company’s China market in my opinion. I’d encourage investors to pay close attention to growth trends here, which could see a repricing as I don’t believe the market has this expected in STAA’s current market price. I am trigger ready on this name but have sized down and freed up capital to allocate to better performing names for the time being. Net-net, I am revising down to a hold for now, but remain constructive on the long-term prospects.

Read the full article here