Those who know me best are aware of the fact that, among my many odious personality traits, is my tendency to brag. This may go some way toward explaining the current state of my social life. Anyway, it’s with this in mind that I want to write once again about Everbridge Inc. (NASDAQ:EVBG). Since I wrote a cautious note about the company about 1 ½ months ago, the shares have lost about 22% of their value, against a small gain of about 2% for the S&P 500. Since a large part of investing well involves not losing capital, I’ll call this a win. The company has reported earnings again since, and I want to review those. Additionally, a stock trading at $25 is definitionally less risky an investment than the same stock when it’s trading at $32. Given this, I might take a speculative long position here, depending on the current valuation, and what the most recent financials look like.

We’re all busy people on this site. I imagine some of you are trying to work out which supermodel to spend the weekend with. Some of you might be putting the finishing touches on your submission to the journal “Nature.” Some others may be planning a dive expedition to explore the sea floor below the North Atlantic. I’m busy, too, given all of these cat videos and “Young and the Restless” to catch up on. Whatever our particular “bag”, we’re pressed for time. Given that I’m absolutely obsessed with making your reading lives as pleasant as possible, I want to try to save you some time by offering you the “gist” of my thinking about a given topic in a summary thesis statement paragraph somewhere near the beginning of each of my articles. No thanks are necessary. I’m just happy that you’re happy. I am actually impressed with the latest financial results. The losses have been slowed dramatically, in spite of a more modest uptick in revenue over this time last year. Additionally, The shares are trading near multi-year low valuations. This combination is enough for me to spend some of my recent winnings on a speculative position here. We’re told to be greedy when others are fearful, and the market seems to have reached multi-year levels of fear here. That is compelling in my view. I’m taking a small, speculative position here. There you have the thesis statement in a nutshell. I should warn you that there’s even more bragging below, specifically, about another recent call. If you can’t stomach such things or don’t like the fact that I spell words like “flavour” properly, I’d recommend getting out now, now that you’ve got the gist of my argument. Now that you’ve been warned, I don’t want to read any complaints in the comments section about all the egoism and proper spelling.

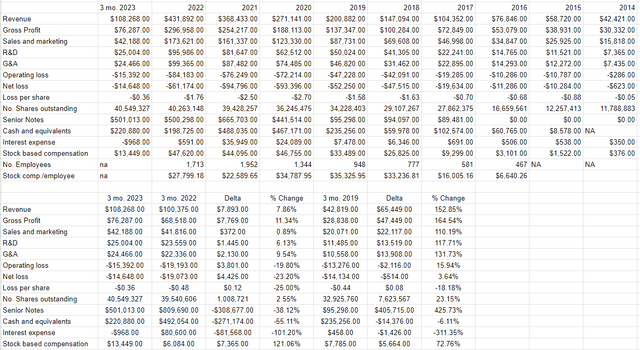

Financial Snapshot

For some time now, I’ve been whining about the negative relationship between revenue and net income. It seemed that the more the company sold, the greater were its losses. This posed a very obvious question to me: if growing revenues doesn’t result in profits, what does? This is important, because it’s profits, and not revenue, that drives sustainable investor returns. Investors are paid after employees, landlords, suppliers, and various other inputs. Additionally, of course, the government needs to wet their beak. I mean, they need a taste of any business that happens in their territory. Given that, we owners get what’s left over. So, rising sales are only relevant if they lead to rising profits. For the longest time, there was a strong negative relationship between the top and bottom lines at Everbridge. That seems to have changed over the past quarter.

As usual, revenue this year was higher than it was last year. Specifically, revenue for the first quarter of 2023 was about 7.8% higher than it was this time last year. At the same time, net loss before tax, and net loss dropped by about 31.5%, and 23.2% respectively. The company managed to shrink the loss relative to the same time last year, in spite of a 6% uptick in R&D expenses, and a 9.5% uptick in General and Administrative. Additionally, the company generated about $1.74 million in interest and investment income, which dwarfed last year’s $62 thousand figure. I’ve not been a fan of this company for a while, but I must admit that the financial results were relatively impressive. Similar to my recent purchase of 8×8, I may be willing to purchase some shares if the valuation is compelling enough. I don’t expect the 15% in 5 days return I’m sitting on from 8×8, but if things that are improving are cheap enough, they’re relatively decent investments in my view. In short, I’m willing to buy some of this business if the valuation is compelling enough.

Everbridge Financials (Everbridge investor relations)

The Stock

If you’re one of my regulars, I can understand that you might be rolling your eyes at the phrase ‘if the valuation is compelling enough”, because you know that I’ve talked myself out of some great buys in the past with all of this financial fastidiousness. Sometimes I eschew a stock because it’s not cheap enough, and it goes on to perform well. In response, I’d remind my readers, yet again, that I’m of the view that it’s better to miss out on some gains than lose capital. So my fastidiousness not only causes me to miss out on some gains, but also some losses.

Additionally, if you read my stuff regularly, you know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product or service. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for critical events software, future margins, and so on. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. I really hate to sound as though I’m “going on” about it, but a reasonable-sounding, if counterfactual, the argument can be made to suggest that shares of Everbridge would have declined even more had the market itself not posted a reasonably decent return since I recommended avoiding these shares. If the demand for “stocks” as an asset class hadn’t held up well, these shares may well have fallen further in price. Of course, it’s impossible to prove this point definitively, but it’s worth considering. In any case, the stock is affected by a host of variables that may be only peripherally related to the health of the business, and that can be frustrating.

This stock price volatility driven by all these factors is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: By determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

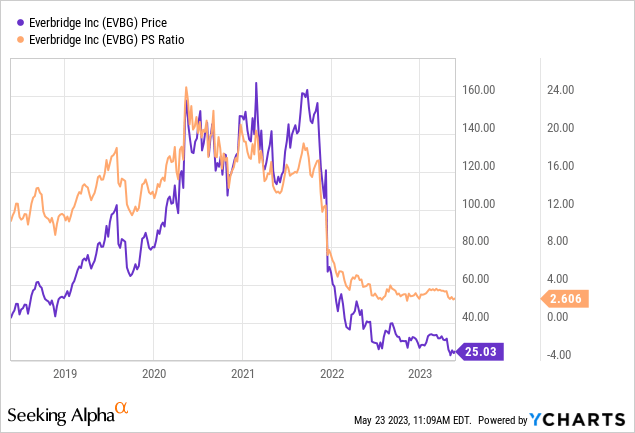

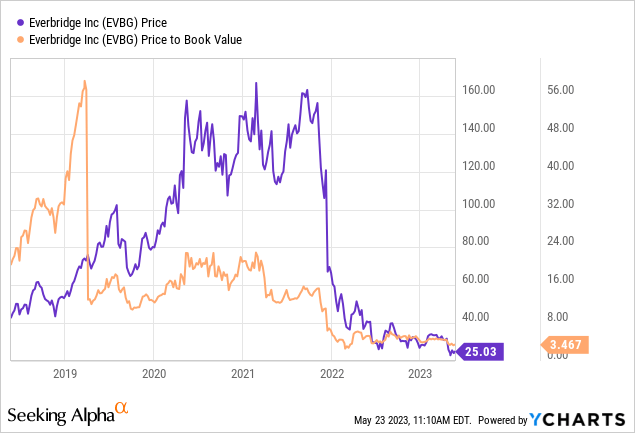

As my regulars know, I measure the relative cheapness of a stock in a few ways, ranging from the simple to the more complex. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. When I last reviewed Everbridge, I was put off by the fact that the market was still paying $3.36 for $1 of sales, and that the shares were trading at 4.4 times book. Given what was going on with the financials, I considered this to be a wildly optimistic forecast back then. Fast forward to the present, and here’s the lay of the land.

Source: YCharts

Source: YCharts

The shares are about 22% cheaper than they were previously, which a reasonable person might expect given the decline in the stock price. Given that the shares are cheaper, and given that the financials have become “less bad”, I admit to being somewhat intrigued.

Being intrigued by something isn’t enough to “pull the trigger”, as the young people say. I want to flavour the ratios with a different type of analysis. I think ratios can be instructive, but I also want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future. Applying this approach to Everbridge at the moment suggests the market is assuming that this company will grow earnings at a rate of ~5% in perpetuity. While I consider that to be somewhat optimistic, it’s not so egregious as to disqualify this stock from consideration. Given the above, I’ll take a small, speculative position in this stock today.

Read the full article here